Social Security and Child Support * Together Helping Families

advertisement

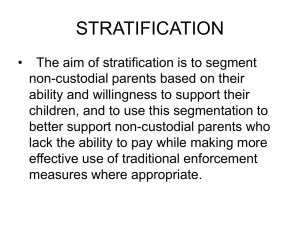

Social Security and Child Support – Together Helping Families Lara Fors Dee Price-Sanders SSA and CSE Overview of information sent by SSA Issues, concerns State case law Results SSA Match State Verification and Exchange System (SVES) o Title II, Title XVI, Prisoner SVES for children Proactive SVES match Pending Title II claims SVES Prisoner Over 6,500 correctional institutions Cost recovery program Data reported at time of incarceration Release date-not updated Prison/facility address Contact name and phone number SVES Title XVI Recipient name, address and date of birth Date of benefit or denial Current payment status and amount Benefit payee information Historical payment information Verified death information Proactive SVES Title XVI Monthly match for NCPS new or ended Title XVI benefits Indicator on MSFIDM matches SVES Title II – Type of Benefits Retirement Disability Auxiliary/Survivors Disability Defined A medical condition preventing substantial work for at least 12 months, or expected to result in death. The determination also considers age, education, and work experience. SVES Title II Recipient name, address, and date of birth Claim Number and Beneficiary ID Code Date and amount of entitlement Current pay status Historical record of benefits Denial, suspension and termination dates Verified death information SVES Title II Railroad retirement indicator o Send IWO to: Railroad Retirement Board 844 North Rush St Chicago, IL 60611-20922 Proactive SVES Title II Returns SVES match data for person added or changed on the FCR Return SVES on children when locate requested on an adult Survivor/Auxiliary Benefits If a wage earner receives a benefit, his/her eligible children, spouse and divorced spouse(s) may also be eligible for benefits If the wage earner is deceased but was injured at the time of death, his/her surviving children, spouse and divorced spouse(s) can be eligible for survivor’s benefits. Eligible Children Natural Adopted Illegitimate Step Grand Disabled adult Student child Title II Pending Claims Sent Proactively for new applications Send IWO to SSA address provided SSA will hold IWO until benefits approved SSA will apply to initial lump sum payment SSA - Kansas Retirement Benefits . Children receive an insurance benefit off of an NCP’s Social Security Retirement. Does that apply towards the child support? Yes… In re Marriage of Martin, 32 Kan. App.2d 1141 (2004) held that a child’s insurance benefits based on NCP’s Social Security retirement benefits are a credit against the parent’s child support obligation. SSA - Kansas SSDI - Establishment SSDI benefits are not public assistance and count as income in calculating child support. In re Marriage of Callaghan, 19 Kan. App.2d 335 (1994) Kansas would input actual NCP SSDI benefit amount as the income amount on the child support worksheet. SSA - Kansas SSDI - Enforcement Social Security Disability payments are subject to income withholding/garnishment to satisfy past due child support payments. Mariche v. Mariche, 243 Kan. 547 (1988). A child’s SSDI benefit payments may be credited against current child support accruing that same month, but cannot be credited against past due support. In re Marriage of Williams, 21 Kan. App.2d (1995) Child’s SSDI benefit amount satisfies the entire child support obligation if greater than child support ordered amount. Andler v. Andler, 217 Kan. 538 (1975) SSA - Kansas SSDI - Enforcement In re marriage of Hohmann, 47 Kan. App.2d 117 (2012) the Court gave the NCP credit towards his child support arrears that accrued during the months covered by the child’s auxiliary lump sum benefit. In re Stephenson and Papineau, 2013 WL 5014230 (9/13/2013) NCP not entitled to reimbursement for child support payments made during time when minor child ultimately received retroactive lump-sum payment of obligors SSD benefits. The excess benefit is a gift that inures to the benefit of the children. SSA - Kansas SSDI - Enforcement Practical considerations for impact of Hohmann and Papineau: • When does the child’s auxiliary benefit get paid out? • How and when does the IV-D agency find out the child’s lump sum benefit amount and period covered? • Incentive to not pay current support. • Impact on family • Impact on incentive measure • Contempt, really? • Papineau: “Papineau argues that he would have been better off not making timely child support payments while his Social Security case was pending. While that may be true, his children certainly would not have been better off if Papineau had defaulted on his child support obligation, and such a default could have subjected Papineau to a judgment for accrued/pastdue child support or a finding of contempt by the district court.” SSA - Kansas SSI SSI benefits are not income under the Kansas Child Support Guidelines. Thus, an NCP receiving SSI as sole source of income owes $0 for continuing child support obligation. State v. Moses, 39 Kan. App.2d 1054 (2008) As a result of Moses, all cases that are found to have an NCP on SSI have a modification review conducted and child support modified to $0. Establishment of support for NCPs on SSI results in a $0 order so the case counts as a case under order for incentive purposes. SSA Child’s Benefits If child is getting SSI due to his/her own disabilities, the NCP does not get any reduction in the child support obligation. In re Marriage of Emerson, 18 Kan. App.2d 277 (1993) Adoptive father gets no credit for child’s survivors’ benefits from biological father and the CP doesn’t count it as income to determine child support. The benefits the child receives are not attributable to adoptive father. In re Marriage of Beacham, 19 Kan. App.2d 271 (1994) Referrals to the CSE Attorney There are three sets of questions the attorney needs to answer before proceeding: Is the NCP already receiving benefits or has the NCP allegedly applied for benefits/will apply? If the NCP is receiving benefits already, are they Title II benefits (SS), or are they Title XVI benefits (SSI)? Is this in an Establishment action or is this in an Enforcement Action? When the NCP is already receiving benefits … Determine whether the benefit is SS or SSI Request that NCP to provide written verification by SSA of benefit amount or check your automated system If the benefits are SS, determine whether child(ren) are receiving the auxiliary (dependent) benefit and verify the amount and the number of children that are covered When the NCP has allegedly applied for SSA benefits… Determine where NCP is in the process to give yourself a timeline Verify that NCP has an application with SSA by checking your automated system or request a copy of application from NCP Verify that NCP listed the child in your action on the application as a “child” for benefit purposes Request a copy of NCP’s “Social Security Statement” o Find yearly gross reported income o Find amount of benefit if successful When the NCP is “going to” apply for benefits… Give NCP directions to SSA office or online at www.ssa.gov Tell NCP to keep a copy of application for you Tell NCP to put all of his children on the application Tell NCP to apply for Medicaid o Medicaid application automatically files for Social Security Benefits; workers in that office may help you monitor NCP’S compliance with process Establishment with SSA application In addition to tips listed previously, contact NCP’s disability attorney for time frames for a decision Request a copy of medical records or have NCP sign a Medical Release form Monitor that NCP is keeping doctor appointments for SSD determination Send IWO to SSA; SSA will put in their COGS system Check automated system for new hire and quarterly wage information to see if NCP has other (potential) income If NCP has private attorney, do discovery for income and assets If you confirms that NCP is receiving Medicaid and Food Stamps, may want to close referral / end action Establishment Cases and SSD If NCP is receiving SS benefits, all of NCP’S benefit is included in income; the child’s benefit from NCP’S SS is not included on the calculation anywhere If there is an auxiliary (dependent) benefit, that amount is credited against the child support calculation amount before an amount is ordered CS order may be zero Bonus question: What if the CP is receiving SS and receives an auxiliary benefit for the child. Where does that child’s benefit go on the calculation? that’s right……no where Enforcement Cases with SSD Benefits SSD benefits are subject to IWO’s Even if the child’s auxiliary benefit exceeds the amount of current child support due in a month, if there are arrears, send IWO to SSA for the arrearage payment o See Missouri’s Weaks v. Weaks, 821 SW2d 503 (NCP’s credit is limited by the amount of current due) o See Massachusetts's Rosenberg v. Merida, 697 N.E.2d 987 (NCP’s credit is equal to the benefit) o See Arkansas’s Grays v. AR Office of CSE, 289 S.W.3d 12 (no bright-line rule; discretion with trial court for equitable consideration) Enforcement Cases with SS Benefits Disability determinations are reviewed at different intervals NCP may be working and still receive some disability payment, so you may have multiple sources of income to attach Establishment Cases and SSI If NCP is receiving SSI, the benefit is not included on the child support calculation as income No auxiliary benefit is available to dependents If no part of benefit is SS, report to the child support agency that NCP is on SSI only and be prepared to get Court to order paternity and state debt only; other factors may make you argue for some support Enforcement Cases and SSI Not subject to IWO’s If NCP is receiving SSI only and no other verifiable form of income, may close the referral, especially for civil contempt cases because you have to prove the present ability to pay Contact Dee Price-Sanders dee.pricesanders@ngc.com Lara Fors lfors@greenecountymo.org