Fiscal Federalism and Fiscal Decentralization in Nepal

Fiscal Federalism and

Fiscal Decentralization in Nepal

Mahesh Banskota

Fiscal decentralization

• Long history of decentralization measures in Nepal

• Mainly from Centre to Districts and From

Districts to Village Development

Committees

• Local Self Governance Act 1999 – most comprehensive measure to decentralize both fiscal and administrative powers

Decentralization – Lip Service

• Centre line agencies too heavily entrenched, unwilling to give up many incumbent resources

• Much conflict in provision between Centre and local government

• Post 2006 Political Change – main Issue has been Federal Structure with all its implications including fiscal dynamics

Post 2006 Political Change

• Strong move to Ethnic and Fiscal

Federalism

• Political movement founded on ethnic tension, ethnic autonomy and ethnic federation in Nepal

• Main Thrust of Maoist Party and eventually

Ethnic paradigm has dominated political debate forcing all political parties to accept ethnicity as a basis for federalism

How to manage ethnic tension ?

• Great deal of inter district and inter region inequality !

• Poverty increases as one moves west ward and northwards – although there are exceptions here and there

Main arguments for making non-ethnic based province/state

Demographic lens (migration and deconstruction of ethnic territory):

Cultural territory has been rapidly eroded by internal migration

1. There are only 12 districts having absolute majority of particular caste/ethnic groups (Cheetri in 7, Gurung in 2, and each of Tamang,

Tharu and Newar in 1 district) in total population of respective districts.

2. The people considering Nepali as their mother tongue constitute majority or largest group in 54 out of 75 districts.

3. Non-Hindus are in the position of majority or as the largest population group in only 5 (Kirat in Taplejung and Panchather, and

Buddhist in Rasuwa, Manag and Mustang) out of 75 districts of the country.

4000

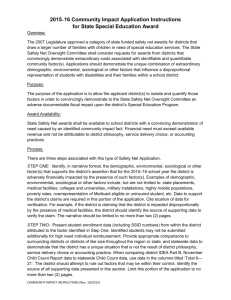

Figure 1.2 National Road Distribution by Road Network

3500

3000

2500

2000

1500

1000

500

0

National Highways

Feeder Roads

District Roads

Urban Roads

Eastern Central Western Mid Western Far Western

Administrative Regions

Partitioning Government revenue-

Vertical Fiscal Imbalance

• 2004/05 – 80 % of government revenue from four areas – Kathmandu, Parsa, Morang and

Rupandehi

• Characteristics of these – most developed, industrial concentration, large urban areas, important custom points, well connected to rest of the country

• 12 district make up 94 % of the revenue

• 63 districts only 6 % of revenue

• How to Balance? Where are the G potentials?

Local Development Expenditure

• LDE Share in GDP 1.15 % - 1.4 %

• LDE share in Government Budget -< 5% > 8%

• Major sources of local revenue – natural resources tax, sales tax, revenue sharing, 25 % of land tax , DDC Grant, VDC Grant

• Most taxes on basic activities

• Terai districts generally richer than the hills and mountain ones

• Richer areas as one moves east and south

Federalism Agenda

• Looks like we will end up with somewhere between 10 and 15 states in a federal Nepal.

• all major parties have finally ditched the idea of geographic north-south vertical states.

• All of Terai will likely not end up as one state,

• the only disagreement now is if the Terai will have two or four or five states

Proposed

Recent CA Committee

Recommendations

• customs duty, value added tax (VAT), corporate income tax and personal income tax will be under the central government

• The provincial governments have been given the power to collect transport tax, land revenue, property tax and business

• Excise duty has been proposed to be shared between the provincial and central government while service charges, royalty from natural resources and penalties are proposed to be shared among all three levels of government

• entertainment tax and land and building registration charges are to be shared between provincial and local governments

Fiscal Federalism Issues

• Local government structure

• Expenditure responsibilities , capacities

• Revenue assignments, autonomy, sharing, accountability

• Fiscal Transfers and bailouts

• Special Grants, Borrowing and Budgeting

• Donor relations

• Thank You For Your Attention