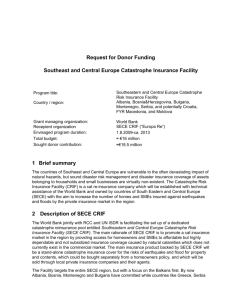

Insurance & Disaster Mitigation

advertisement

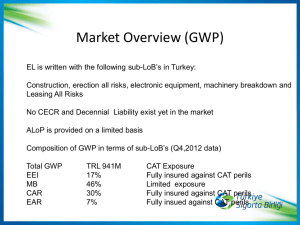

SEMINAR ON DISASTER MANAGEMENT ROLE OF INSURERS & REINSURERS IN ACHIEVING THE OBJECTIVES OF NATIONAL POLICY ON DISASTER MANAGEMENT FICCI IRDA NDMA 11TH AUGUST 2010, NEW DELHI PRESENTATION BY SHRI M RAMADOSS CHAIRMAN CUM MANAGING DIRECTOR NEW INDIA ASSURANCE 1 DEFINITION OF CASTASTROPHE / DISASTER DEFINITION “GREAT NATURAL CATASTROPHES” (IN KEEPING WITH UNITED NATIONS DEFINITION CRITERIA) THE AFFECTED REGION'S ABILITY TO HELP ITSELF IS DISTINCTLY OVERTAXED INTERREGIONAL OR INTERNATIONAL ASSISTANCE NECESSARY THOUSANDS ARE KILLED HUNDREDS OF THOUSANDS ARE MADE HOMELESS SUBSTANTIAL ECONOMIC LOSSES CONSIDERABLE INSURED LOSSES 2 DEFINITION OF CASTASTROPHE / DISASTER DISASTERS – MAY BE ACTS OF GOD MAN MADE (TERRORISM) ACCIDENTS (CONFLAGRATION, OILS SPILLS, AIR CRASHES, ETC..) THIS PRESENTATION PROPOSES TO DEAL WITH ACTS OF GOD CAT EVENTS. 3 HISTORY OF EARTHQUAKES IN INDIA YEAR REGION YEAR REGION 1897 ASSAM 1997 JABALPUR 1905 KANGRA 1998 BIHAR 1934 BIHAR 1999 CHAMOLI 1950 MEDOG 2001 GUJARAT 1967 KOYNA 2004 TSUNAMI – OCEAN EARTHQUAKE 1975 KUNOOR 2005 KASHMIR 1991 UTTRAKASHI 2009 ANDAMANS 1993 LATUR 2010 NICOBAR ALLAHABUND FAULT RUNNING THROUGH GUJARAT INDIAN METEOROLOGICAL DEPARTMENT BELIEVES THAT THE 2001 BHUJ EARTHQUAKE IS DUE TO RE-AWAKENING OF ALLAHABUND FAULT. EARLIEST REVEALED EARTHQUAKE IN GUJARAT IN 1819 WAS DUE TO THIS FAULT, MEASURED 8 ON THE RITCHER SCALE – FLATTENED ENTIRE VILLAGES INCLUDING SINDREE FORT AND CRUSHED 3,500 PEOPLE, RIPPED EARTH APART AND CREATED 140 KM LONG SCARP IN 4 HISTORY OF FLOODS IN INDIA REGION STATUS BIHAR MOST PRONE TO FLOODS. 16.5% OF FLOOD AFFECTED AREA AND 22.1% OF FLOOD AFFECTED PEOPLE LIE IN BIHAR. ALMOST EVERY YEAR, FROM 1979, FLOODS HAVE HAPPENED IN BIHAR. 1979-2006, AROUND 5,900 PEOPLE AND 19,000 ANIMALS DIED DUE TO FLOODS IN BIHAR 2005 GUJARAT/MAHARASHTRA FAMOUS MUMBAI FLOODS OF 26TH JULY, 2005 1,074 PEOPLE DIED 2008 ASSAM, MAHARASHTRA, ANDHRA PRADESH, WEST BENGAL, ORISSA & UTTAR PRADESH 2009 KARNATAKA, ORISSA & KERALA THE ABOVE DEPICTS THAT FLOODS ARE HAPPENING IN ALMOST ALL PARTS OF INDIA. 5 HISTORY OF LANDSLIDES IN INDIA YEAR REGION 1998 MALPA VILLAGE IN UTTARAKAND. ENTIRE VILLAGE WASHED OUT. 60 PILGRIMS TO KAILASH MANSAROVER WASHED AWAY, INCLUDING THE FAMOUS MS.PROTIMA BEDI 2000 MUMBAI LANDSLIDE 2003 VAIBHAVWADI IN SINDUDURGH DISTRICT, MAHARASHTRA 2004 KARAYA VILLAGE IN MAHARASHTRA SUCH SUDDEN LANDSLIDES HAD CAUSED TRAIN DISRUPTION, ACCIDENTS AND LOSS TO HUMAN LIFE. 6 HISTORY OF CYCLONES IN INDIA YEAR REGION YEAR REGION 1942 BENGAL 1976 BENGAL 1946 ANDHRA PRADESH 1977-1980 ANDHRA PRADESH 1956 SALLALAH 1959-1960 SALLALAH 1979 TAMIL NADU 1965 BENGAL 1999 ORISSA 1967-1971 ORISSA 2001 WESTERN INDIA & PARTS OF NORTHERN INDIA 1972 TAMIL NADU 2009 CYCLONE BIJLI IN EASTERN INDIA, BANGLADESH, MYANNMAR CYCLONE AAILA IN EASTERN INDIA CYCLONE PHYAN IN MAHARASHTRA & GUJARAT CYCLONES AFFECT ALMOST ALL PARTS OF INDIA. 7 WHY CAT INSURANCE PENETRATION IN INDIA IS LOW • POOR AND CANNOT PAY PREMIUM - MOSTLY AFFECTED • LOW OR MODERATE INCOME GROUP – CAN PAY PARTIALLY • UPPER SEGMENT – CAN PAY FULLY - A COMMERCIAL PROPOSITION FOR INSURANCE SECTOR. • ABSENCE OF SPREAD OF RISKS – CAT EVENTS OCCUR ONLY IN THOSE AREAS PRONE TO SUCH PERILS. • SELECTION AGAINST INSURERS – PEOPLE RESIDING OUTSIDE CAT ZONES DO NOT NORMALLY BUY INSURANCE. • AT PRESENT PENETRATION OF CAT INSURANCE IN INDIA IS < 0.5% AS COMPARED TO TURKEY AT 17%. 8 DISASTER MANAGEMENT • EX-ANTE: BUDGETARY ALLOCATION FOR MITIGATION BUYING INSURANCE OR OTHER FINANCIAL PROTECTION • EX-POST: DECISION STAGE AFTER A DISASTER WHEN RECOVERY, RECONSTRUCTION AND OTHER FINANCIAL DECISIONS EG. TAX INCREASE, LOANS ETC. MADE • SCOPE OF POSSIBLE ACTIONS AT STAGE TWO INFLUENCES DECISIONS AT STAGE ONE 9 EX-POST V/S EX-ANTE SOLUTIONS • SOME COUNTRIES PROVIDE COMPENSATION TO PROPERTY OWNERS BY STRUCTURAL ARRANGEMENTS – COMPENSATION FUNDS OR ADHOC DISBURSEMENTS AFTER EVENTS. • OTHER COUNTRIES LEAVE PROTECTION OF PRIVATE PROPERTIES TO INSURANCE COMPANIES. EX-POST APPROACHES HAVE SEVERAL LIMITATIONS VIZ. SLOW COMPENSATION, UNBEARABLE FISCAL BURDEN ON STATE, DIVERSION OF RESOURCES FROM TARGETTED BENEFICIARIES / DIVERSION FROM OTHER PROJECTS. • THEREFORE, EX-ANTE (PREVENTION AND MITIGATION) MEASURES MAY BE THE BETTER OPTION. 10 WHO CAN ASSIST : BOTH EX – ANTE & EX - POST PUBLIC AUTHORITIES (CENTRAL & STATE GOVTS.) NGOs CAPITAL MARKETS INSURANCE THE MAGNITUDES INVOLVED REQUIRE A PARTNERSHIP APPROACH AND INSURANCE CAN PLAY A VITAL ROLE. 11 ROLE OF INSURANCE / REINSURANCE RISK ASSESSMENT AND UNDERWRITING (MANDATORY MEASURES): • ENSURING EXISTING AND UPCOMING INDUSTRIAL ASSETS AND INFRASTRUCTURE ARE DISASTER RESISTANT. • MAKING INDUSTRIAL PROCESSES AND PROCEDURES INHERENTLY SAFE. • ENSURING THAT TRANSPORTATION, STORAGE, HANDLING AND USAGE OF CHEMICALS AND OTHER HAZARDOUS RAW MATERIALS DOES NOT POSE A THREAT TO NEARBY AREAS AND ENVIRONMENT. 12 ROLE OF INSURANCE / REINSURANCE…. RISK ASSESSMENT AND UNDERWRITING (MANDATORY MEASURES)…. • CONDUCTING MOCK DRILLS PERIODICALLY TO TEST THE EFFICACY OF THE DM PLANS. • DEVELOPMENT OF ON-SITE AND OFF-SITE DISASTER MANAGEMENT PLANS BY INDUSTRIES IN ASSOCIATION WITH THE DISTRICT ADMINISTRATION. • MOVE AWAY FROM A RELIEF CENTRIC APPROACH TO A PRO-ACTIVE METHODOLOGY THROUGH RISK MANAGEMENT MEASURES AND CAPACITY BUILDING OF INDUSTRIAL PERSONNEL • NETWORKING KNOWLEDGE ON BEST PRACTICES AND TOOLS FOR EFFECTIVE DM. 13 ROLE OF INSURANCE / REINSURANCE…. • EFFECTIVE RISK ASSESSMENT INVOLVES – BUILDING CODES STRUCTURAL PARAMETERS CONSTRUCTION OF EMBANKMENTS ETC. ONCE DONE, BEST MANAGED RISKS TO GET COMPREHENSIVE CAT INSURANCE AT DISCOUNTED PRICE. • MEASURES HAVE TO BE SUPPORTED BY CENTRAL & STATE GOVT. BY WAY OF CERTAIN MANDATORY REQUIREMENTS LIKE PERIODICAL OVERHAUL OF DRAINAGE SYSTEM EARTHQUAKE PROOF CONSTRUCTION ETC 14 ROLE OF INSURANCE / REINSURANCE…. CATASTROPHE INSURANCE – MANDATORY? SOME COUNTRIES SUCH AS TURKEY (EQ), ICELAND & SWITZERLAND INSURANCE COMPANIES HAVE TO MAKE CAT INSURANCE AVAILABLE BY MANDATORY OFFER OF COVERAGE THAT CAN BE DECLINED BY POLICY HOLDER. OTHER COUNTRIES – INSURANCE COMPANIES ARE REQUIRED BY LAW TO INCLUDE CAT RISK – AUSTRALIA (TERRORISM), BELGIUM & FRANCE (NAT CAT, TERRORISM), NEWZEALAND (EQ), NORWAY & SPAIN. INDIA – FLOOD COVER AVAILABLE AS PART OF PROPERTY INSURANCE BUT CAN BE OPTED OUT. TERRORISM CAN BE TAKEN AS ADDITIONAL COVER. 15 ROLE OF INSURANCE / REINSURANCE…. PRICING – DISASTER INSURANCE • RISK BASED – FLAT : DEPENDING ON VOLUMES, FINANCIAL CAPACITY OF INSURER, POTENTIAL TO RETAIN ON NET AND RI PROTECTIONS. • EXPOSURE ANALYSIS – PART OF PRICING – THIS INVOLVES CONCENTRATION OF RISKS / VALUES. EQ AND FLOOD AGGREGATES – REGIONWISE /PINCODE WISE. 16 ROLE OF INSURANCE / REINSURANCE…. PRICING: • UNFORTUNATELY ACCURATE DATA OF CAT PERIL PREMIUMS ARE NOT AVAILABLE AS EQ COVERS ARE OPTIONAL AND RATES VARY ZONE WISE. FLOOD RISKS CAN BE EXCLUDED IF THE INSURED SO DESIRES. ONE THEREFORE, NEEDS TO WORKOUT THE CAPACITY AVAILABLE BY LOOKING AT THE RATIO OF PAST LOSS EXPERIENCE TO GDPI. BASED ON THE GUJARAT CYCLONE OR THE MUMBAI FLOODS AS A % OF THE GROSS PREMIUM (GUJARAT CYCLONE- 12%, MUMBAI FLOODS - 11%), ONE COULD ASSUME APPROXIMATELY 18% BEING THE STRAIN OF ANY ONE CAT EVENT ON THE INSURANCE PREMIUM OF THE MARKET. 17 ROLE OF INSURANCE / REINSURANCE…. CAT MODELLING : • A TYPICAL CAT MODELLING SOFTWARE PACKAGE CONTAINS INFORMATION ON THE PROPERTIES BEING ANALYSED CALLED ‘EXPOSURE DATA’ WHICH CAN BE BROKEN INTO THREE GROUPS – SITE (STREETS / PINCODE / CRESTA ZONES) PHYSICAL CHARACTERISTICS OF THE STRUCTURE (CONSTRUCTION, OCCUPANCY, AGE, HEIGHT ETC.) FINANCIAL TERMS OF THE INSURANCE COVERAGE, (VALUES, LIMITS, DEDUCTIBLES ETC.) 18 ROLE OF INSURANCE / REINSURANCE…. • BASED ON THE ABOVE INPUTS, THE MODEL ESTIMATES THE MAXIMUM LOSS ASSOCIATED WITH AN EVENT OR SET OF EVENTS AND THE PROBABILITY OF REPETITION OF SUCH EVENTS (RETURN PERIOD). • THE MODEL HELPS INSURER’S UNDERWRITING STRATEGY AND HOW MUCH REINSURANCE TO PURCHASE. • INTERNATIONAL RATING AGENCIES – AM BEST AND S&P USE CAT. MODELLING TO ASSESS THE FINANCIAL STRENGTH OF INSURERS WHO UNDERWRITE CAT RISKS. • SUCH EXPOSURE ANALYSIS BY ALL INSURERS IN THE MARKET WOULD PROVIDE AN ACCURATE PERSPECTIVE OF AGGREGATES IN THE COUNTRY AND THE QUANTUM OF INSURANCE REQUIRED TO BE PURCHASED AS WELL AS THE RATE AT WHICH THE PRODUCT SHOULD BE PRICED. 19 ROLE OF INSURANCE / REINSURANCE…. CAN CAT RISKS BE COVERED BY INSURANCE COMPANIES ON THEIR OWN ? DOES THE INDIAN MARKET HAVE SUFFICIENT CAPACITY TO PAY FOR SUCH EVENTS? • IF THE MUMBAI FLOODS OF 2005 ARE TO BE CONSIDERED AS A BENCHMARK WITH A MARKET LOSS IN EXCESS OF RS. 3000 CRS., THE INDIAN MARKET CAPACITY (RETENTIONS OF INSURERS) IS CERTAINLY NOT ADEQUATE, AND HERE REINSURANCE PLAYS A VITAL ROLE IN SUPPORTING THE MARKET. • MODELLING TECHNIQUES THEREFORE ARE AN ESSENTIAL TOOL FOR ESTIMATION OF EXPOSURES. • INSURANCE COMPANIES, DEPENDING ON THEIR FINANCIAL STRENGTH AND RETENTION CAPACITIES PURCHASE SPECIFIC CAT EXCESS OF LOSS PROTECTION FROM REINSURERS. 20 ROLE OF INSURANCE / REINSURANCE…. • INSURANCE COs, APART FROM PURCHASING THEIR SPECIFIC CAT XL REINSURANCE PROTECTIONS CAN ALSO CONTRIBUTE THEIR CAPACITIES TO FORM A CAT INSURANCE POOL, THE BROAD FRAMEWORK OF WHICH WOULD BE: All AOG CAT PERILS MANDATORY COVER UNDER PROPERTY INSURANCE AGREED PREMIUM RATES COMPULSORY PARTICIPATION BY THE ENTIRE MARKET GIC RE AS THE MANAGER WOULD SUBSEQUENTLY PROCURE XL PROTECTION IN EXCESS OF THEIR OWN RETENTION. 21 THE ROAD AHEAD--• DISASTER MANAGEMENT, BOTH EX-ANTE AND EX-POST COLLECTIVE RESPONSIBILITY OF VARIOUS STAKEHOLDERS DEMANDS • A GOVT. INSURANCE SCHEME UNDER WHICH PAYMENTS ARE TRIGERRED BY PARAMETRIC CRITERIA WHERE NO NEGOTIATIONS ARE REQUIRED, COULD PROVIDE FOR MORE RAPID DISBURSEMENT OF FUNDS FOR RECONSTRUCTION. IN SUCH SCHEMES INSURERS WOULD ENFORCE MITIGATION MEASURES SUCH AS COMPLIANCE WITH BUILDING CODES, REGULAR DRAINAGE OVERHAULS, CONSTRUCTION OF EMBANKMENTS, PRESERVATION OF MANGROVES, ETC. • INCORPORATING AN INBUILT PA COVER INTO THE POLICY, AS NAT CATs IN THIS PART OF THE WORLD INVOLVE CONSIDERABLE BODILY INJURIES AND FATALITIES. 22 THE ROAD AHEAD--• KEY CONSIDERATIONS – SHOULD CRITICAL UTILITIES SUCH AS POWER LINES BE PLACED UNDERGROUND? CAN MUTUAL SUPPORT AGREEMENTS BE REACHED WITH NEIGHBOURING COUNTRIES TO PROVIDE HUMAN AND MATERIAL SUPPORT NEEDED TO REBUILD CRUCIAL INFRASTRUCTURE SUCH AS POWERLINES, TELEPHONE LINES & CELLULAR TOWERS, ROADS ETC. ? CAN WE EMBARK ON A PARTNERSHIP PROGRAMME WITH THE GOVERNMENT TO MAKE CAT INSURANCE COMPULSORY WITH STRICT MANDATORY REQUIREMENTS (BUILDING CODES, ETC..) MENTIONED EARLIER, TO ALSO INCLUDE THE “CANNOT PAY INSURANCE” SEGMENT INTO THE BROAD SOCIAL OBJECTIVES OF THE COUNTRY? 23 THE ROAD AHEAD--• KEY CONSIDERATIONS – CAN WE INTRODUCE A “DISASTER CESS” ON THE “UPPER SEGMENT – CAN PAY” SECTOR OF THE ECONOMY, TO BUILD UP A CAT FUND FOR EMERGENCIES? THIS COULD FORM PART OF A PROPERTY TAX ON ALL PRIVATE OWNED PROPERTIES. BUT FOR LOSS OF LIFE OF THE POOR SEGMENT, THEIR FIELDS, CATTLE, HUTS AND CONTENTS, THE GOVERNMENT COULD CREATE AN INSURANCE FUND FROM ALL STATES AND COMPENSATE A FEW UNFORTUNATE STATES. CAN WE INTRODUCE “DISASTER MANAGEMENT SKILLS” FOR BOTH AOG AS WELL AS MAN MADE CATASTROPHES AS A SUBJECT IN EDUCATION AND IN EXECUTIVE TRAINING PROGRAMMES OF CORPORATES? 24 THE ROAD AHEAD--• KEY CONSIDERATIONS – CAN WE LOOK FORWARD TO DIGITALISED MAPPING OF THE ENTIRE COUNTRY IN THE NEAR FUTURE THAT COULD ENSURE MORE ACCURATE ESTIMATION OF EXPOSURES? SUCH MAPPING APPARENTLY IS BEING DONE TODAY IN COUNTRIES LIKE FRANCE, UK, GERMANY, SINGAPORE ETC.. • OVER TIME, THE ABOVE WOULD ALLOW THE COUNTRY TO REDUCE THE REQUIRED QUANTUM OF DISASTER INSURANCE COVERAGE AND ASSOCIATED PREMIUM COSTS AS THE INFRASTRUCTURE AND RELATED BUSINESS ACTIVITIES BECOME ROBUST AND LESS AT RISK OF LOSS FROM A NATURAL DISASTER. 25 26