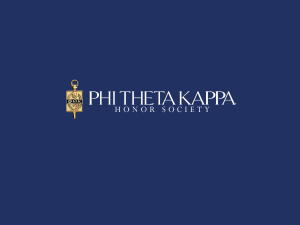

Eligibility to public health insurance

advertisement

Insurance Function in Health System Shahid Beheshti University of Medical Sciences School of Medical Education Strategic Policy Sessions: 28 Relations between functions and objectives of a health system Functions the system performs Stewardship (oversight) Creating resources (investment And training) Financing (collecting, pooling And purchasing) Objectives of the system Responsiveness (to non-medical expectations) Delivering services (provision) Health Fair (financial) contribution Pooling to redistribute risk, cross-subsidy for greater equity Contribution Pooling across equal incomes Subsidy across equal risks Low Risk High Risk Low Income High Income Net Transfer Utilization Classification of health insurance models • Public health insurance: – Tax-based public health insurance. – Social security schemes. • Private health insurance: – Private mandatory health insurance. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Classification of health insurance models • Public health insurance: – Tax-based public health insurance. Social security schemes. An– example of Tax-based public health insurance is the Canadian Medicare instituted by the Canada • Health Private Act health insurance: – Private mandatory health insurance. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Classification of health insurance models • Public health insurance: – Tax-based public health insurance. – Social security schemes. example of Social security schemes is French • •An Private health insurance: ‘Securité Sociale’. •Public healthmandatory insurance ishealth usuallyinsurance. mandatory. The – Private mandate can apply to the entire population (universal/national public health insurance) – Private employment group health or to groups within it (e.g., individuals with income below a insurance. threshold). • Possible exceptions are portionshealth of Medicare – Private community-rated insurance. coverage and Medicaid in the USA, where eligible individuals to applyhealth to public insurance agencies – Privateneed risk-rated insurance. to receive health cover. Classification of health insurance models An example of private mandatory health insurance is: • Basic Public health social health insurance: insurance in Switzerland, which has been mandated for the Swiss population with the 1996 – Tax-based Health Insurancepublic Law. health insurance. – Social security schemes. • Private health insurance: – Private mandatory health insurance. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Classification of health insurance models An example of private employer group health • Public health insurance: insurance is: employer-based health insurance in the United States. public health insurance. – Tax-based – Social security schemes. • Private health insurance: – Private mandatory health insurance. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Classification of health insurance models • Public health insurance: Examples of private community-rated individual health – Tax-based public health insurance. insurance include: Voluntary health insurance in Ireland – Social security schemes. and Australia, and voluntary health insurance in the Netherlands provided under the WTZ Act, which is open to • above-65 Privateindividuals health insurance: not eligible to the sickness fund scheme for curative services (ZFW). – Private mandatory health insurance. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Classification of health insurance models • Public health insurance: – Tax-based public health insurance. – Social security schemes. • Private health insurance: An examplesmandatory of private risk-related individual health – Private health insurance. insurance is: Individual health insurance in the UK. – Private employment group health insurance. – Private community-rated health insurance. – Private risk-rated health insurance. Defective Insurance Coverage • Population Coverage • Service Coverage Un-insured • Cost Coverage – Lack- of- coverage for catastrophic expenses – Insurance deductibles and co-payments • Time Coverage – Exclusion of coverage for preexisting illnesses • Quality Coverage Under-insured – Services not covered – Lack of coverage for long-term care Non-financial barriers to health care • Distances between patients and health care facilities • Language and cultural incompatibilities between patients and health care givers • Gender • Race Functional classification of private health insurance schemes A Health services covered by PHI scheme Eligibility to public health insurance Individuals have public cover Individuals do not have public cover PHI covers medically necessary curative services typically covered under the public system Duplicate PHI PHI covers cost sharing applicable to public coverage systems Complementary Primary PHI: - Substitute - Principal PHI covers top-up health services not included in public systems or primary PHI Supplementary Functional classification of private health insurance schemes A Health services covered by PHI scheme Eligibility to public health insurance Individuals have public cover Individuals do not have public cover PHI covers medically necessary curative services typically covered under the public system Duplicate PHI PHI covers cost sharing applicable to public coverage systems Complementary Primary PHI: - Substitute - Principal PHI covers top-up health services not included in public systems or primary PHI Supplementary Functional classification of private health insurance schemes A Health services covered by PHI scheme Eligibility to public health insurance Individuals have public cover Individuals do not have public cover PHI covers medically necessary curative services typically covered under the public system Duplicate PHI PHI covers cost sharing applicable to public coverage systems Complementary Primary PHI: - Substitute - Principal PHI covers top-up health services not included in public systems or primary PHI Supplementary Functional classification of private health insurance schemes A Health services covered by PHI scheme Eligibility to public health insurance Individuals have public cover Individuals do not have public cover PHI covers medically necessary curative services typically covered under the public system Duplicate PHI PHI covers cost sharing applicable to public coverage systems Complementary Primary PHI: - Substitute - Principal PHI covers top-up health services not included in public systems or primary PHI Supplementary Functional classification of private health insurance schemes A Health services covered by PHI scheme Eligibility to public health insurance Individuals have public cover Individuals do not have public cover PHI covers medically necessary curative services typically covered under the public system Duplicate PHI PHI covers cost sharing applicable to public coverage systems Complementary Primary PHI: - Substitute - Principal PHI covers top-up health services not included in public systems or primary PHI Supplementary Cost Sharing Policies • Service benefit policies use three costsharing features, sometimes in concert: the deductible, the coinsurance rate, cost caps and the stop loss amount Deductible • The deductible is the amount that an individual must pay before the insurance company pays anything. • The deductible is usually set annually; the typical deductible in 1991 was about $200 for an individual and $500 for a family. • Consumers pay the full price for care consumed under the deductible. Coinsurance rate • The coinsurance rate is the percentage of the total bill above the deductible that a patient pays. • Nearly all indemnity plans had a coinsurance rate of 20 percent. Stop loss • The coinsurance is paid until the patient reaches the stop loss - the maximum out-of-pocket payment by the person in a year. • A typical stop loss in an indemnity policy was about $1,000 to $1,500 in a year. Caps • In addition to these features, many policies impose further cost sharing through caps on various types of expenditures. • For example, policies may permit 8 mental health visits per year, or have a $1 million lifetime limit on overall medical expenditures. • Such provisions discourage use Cumulative Individual Payments Patients Cost Total Payment Insurer Payment Insurer Payment Stop-loss Individual Payment Coinsurance Deductible Medical Expenditure Risk-sharing features of indemnity insurance policies, 1991 Characteristic Deductible Coinsurance rate Stop loss Maximum lifetime benefit individual Average/percent Individual $205 Family $475 <20 percent 13% 20 percent 78% >20 percent 4% <$500 21% $500 - $1000 30% $1000 - $2000 32% >$2000 17% <$250,000 9% $250,000 - $1,000,000 6% >$1,000,000 85% Optimal insurance given moral hazard Author Optimal policy Feldstein and Friedman (1977) 58 percent coinsurance rate Buchanan, Keeler et al. (1991) $200 deductible; 25 percent coinsurance rate Newhouse et al. (1993) $200 to $300 deductible; 25 percent coinsurance rate; $1,000 stop loss (assumed) Manning and Marquis (1996) 25 percent coinsurance rate; >$25,000 stop loss Blomqvist (1997) Cost sharing declines from 27% at roughly $1,000 of spending to 5% above roughly $30,000 Thank You ! Any Question ?