Chapter 14 - Health, Disability, and Life Insurance

advertisement

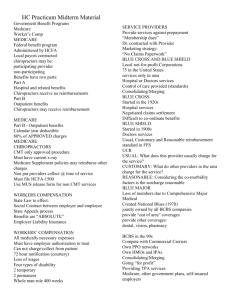

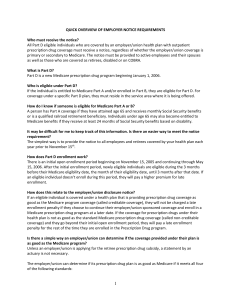

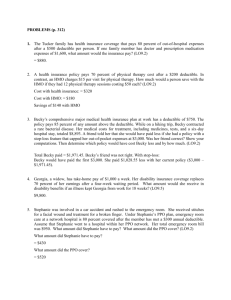

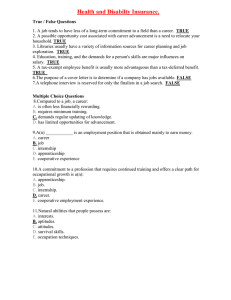

Health, Disability, and Life Insurance Chapter 14 Health Insurance and Financial Planning Section 14.1 What is Health Insurance Protection from illness or injury Includes both medical expense insurance and disability income insurance Medical expense insurance pays actual medical costs Disability income insurance covers income person lost from illness and injury Group Health Insurance Most people who have insurance are covered under this type of plan Usually employer sponsored, or by labor unions or professional associations They cover most or all of cost Cost is fairly low because so many people are insured under the same policy Coordination of Benefits Allows you to combine benefits from more than one insurance plan Benefits are limited to 100% Individual Health Insurance Buy from the company of your choice Individual or family plans available COBRA Allows those who lose job to keep former employer’s group coverage for a set time Have to work for a private company or state or local govt. to be eligible Basic Health Insurance Coverage Hospital Expense Surgical Expense Some or all of daily cost of room and board Routine nursing, minor medical supplies, use of other hospital facilities as well Pays all or part of surgeon’s fees Physician Expense Meets some or all of the costs that do not involve surgery Routine visits, x-rays, lab tests Major Medical Expense Insurance Covers long hospital stays and multiple surgeries Coinsurance Stop-Loss Provisions Set % of medical expenses you must pay in addition to deductible amount 20 to 25% of expenses Policyholder must pay all costs up to a certain amount then insurance will pay rest $3,000 to $5,000 Comprehensive Major Medical Pays hospital, surgical, medical, and other bills Limits on what they will pay on expenses Dread Disease Policies Policies sold through the mail, newspapers, magazines For dread disease, trip accident, death insurance, cancer Play upon people’s fear and are illegal in many states Usually only cover very specific conditions which are normally already covered under major medical plans Dental Expense Insurance Encourages preventative dental care and pays for maintenance care Oral examinations, x-rays, cleanings, fillings, extractions, oral surgery, dentures, and braces May have a deductible and coinsurance Vision Care Insurance May be part of group plan Covers eye examinations, glasses, contact lenses, eye surgery, treatment of eye diseases Long-Term Care Insurance Provides expense for daily help you may need if you become seriously ill or disabled and cannot care for yourself Nursing homes Dressing, bathing, household chores Premiums are $900 to $15,000 depending on age and amount of coverage Major Provisions Eligibility – defines those covered under a policy (usually spouse and children to a certain age) Internal Limits – specific levels of repayment for certain services (hospital room could cost $400 a day but internal limit only pays $250) Co-Payment – flat fee you pay every time you receive a covered service Preexisting Conditions – conditions diagnosed before the insurance plan took effect; often not covered along with cosmetic surgery Health Insurance Plans Should…. Offer basic coverage for hospital and doctor bills Provide at least 120 days hospital room and board in full Provide at least $1 million lifetime maximum for each family member Pay at least 80% for out-of-hospital expenses after a yearly deductible of $500 per person or $1000 per family Impose no unreasonable exclusions Limit your out-of-pocket expenses to no more than $3000 to $5000 a year, excluding dental, vision care, and prescription costs Private and Govt. Plans Section 14.2 Private Health Care Plans Private Insurance Companies Hospital and Medical Service Plans Managed Care Health Maintenance Organizations (HMO) Preferred Provider Organizations (PPO) Point of Service Plan (POS) Private Insurance Companies Provide group health plans to employers Premiums may be fully or partially paid for by employers Employees pay remainder of cost Hospital and Medical Service Plans Blue Cross/Blue Shield are statewide organizations similar to private companies Each state has a Blue Cross/Blue Shield Blue Cross provides hospital care Blue Shield provides surgical and medical services Managed Care Prepaid health plans that provide comprehensive health care to their members Designed to control cost of health care services by controlling how they are used HMO’s, PPO’s, and Point of Service Plans Health Maintenance Organizations (HMOs) Preapproved doctors to provide care in exchange for fixed, prepaid premiums Give preventative care like immunizations, screening, diagnostic tests with the idea they will minimize future medical problems Coverage for surgery, hospital care, and emergency care Usually pay small co-payment for each service Vision coverage and prescription services are extra Any treatment from doctors not on approved list you have to pay cost yourself Exception is if there is an emergency that would threaten your life Tips on Choosing HMO Make sure doctors are near your home You should be able to change doctors if you don’t like your first choice Second opinions should always be available at HMO’s expense Should be able to appeal any case in which HMO denies care Preferred Provider Organizations (PPO) Group of doctors and hospitals agree to provide specified medical service at prearranged fees PPO plan members pay no deductibles, but may have small co-payments PPO plan members can go to doctors not on pre-approved list, but may pay larger deductibles and co-payments Government Health Care Programs Medicare Medicaid Medicare Federally funded to those over 65 or those with certain disabilities Part A – hospital insurance Social Security tax Inpatient hospital and nursing facility care, home health, and hospice Part B – medical insurance Doctor’s services and other services not covered by Part A Deductible and 20% coinsurance Supplemental, meaning additional coverage for those who don’t feel fully covered Medicare Finances In danger Health care costs growing Population of senior citizens growing Projections from 2004 say it will be bankrupt by 2019 if no changes made What is not covered by Medicare? Skilled or long-term nursing care Out of hospital prescription drugs Routine checkups Dental care Most immunizations If doctor does not accept Medicare’s approved payment in full, patient must pay themselves Medigap Eligible people are those who receive Medicare Supplements the gap between Medicare payments and medical costs nto covered by Medicare Medicaid Low income individuals and families Financed by state and federal funds Benefits include: Physician services Inpatient hospital services Outpatient hospital services Lab services Skilled nursing and home health services Prescription drugs Eyeglasses Preventative care for people under 21 The US market-based health care system relies heavily on private and not-forprofit health insurance, which is the primary source of coverage for most Americans. According to the United States Census Bureau, approximately 84% of Americans have health insurance; some 60% obtain it through an employer, while about 9% purchase it directly. Various government agencies provide coverage to about 27% of Americans (there is some overlap in these figures). Public programs provide the primary source of coverage for most seniors and for low-income children and families who meet certain eligibility requirements. The primary public programs are Medicare, a federal social insurance program for seniors and certain disabled individuals, Medicaid, funded jointly by the federal government and states but administered at the state level, which covers certain very low income children and their families, and SCHIP, also a federalstate partnership that serves certain children and families who do not qualify for Medicaid but who cannot afford private coverage. Other public programs include military health benefits provided through TRICARE and the Veterans Health Administration and benefits provided through the Indian Health Service. Some states have additional programs for low-income individuals. In 2006, there were 47 million people in the United States (16% of the population) who were without health insurance for at least part of that year. About 37% of the uninsured live in households with an income over $50,000. Lifestyle Choices: 7 in 10 Americans do not exercise regularly 4 in 10 Americans are not physically active 60 percent of all Americans are overweight Prescription Drug Costs: • 23 prescription drugs account for 50 percent of prescription sales • $1 billion in sales attributed to 30 drugs • 17 percent increase in cost from 2000 to 2001 or $22.6 billion Cost Shifting: 43 Million Americans do not have health insurance or are underinsured Medical Technology: Up to 1/3 of the projected increase in health care in the US during the next five years will be the result of new technology Disability Insurance Section 14.3 Disability Insurance Cash income when unable to work due to pregnancy, non-work related accident, or an illness Very common Word disability can vary from insurer to insurer Sources of Disability Income Worker’s Compensation Employer Social Security Private Income Insurance Programs Worker’s Compensation Result of accident or illness that occurred on the job Benefits depend on salary and work history Employer Provided through group insurance plans Employer pays part or all of cost Could be continued wages for several months or for long-term Social Security Eligible if you paid into Social Security system Depends on salary and number of years you’ve been working Dependents may qualify for some benefits Strict rules Physical or mental condition that prevents work for at least 12 months Or, have a condition that may result in death Starts paying 6 months after person is disabled Private Income Insurance Programs Weekly or monthly cash payments to those who cannot work from accident or illness Pays 40 to 60% of normal income, although some may pay up to 75% Disability Insurance Trade-Offs Waiting or Elimination Period – one to six months, longer the wait the less the cost Duration of Benefits – look for those that last throughout life Amount of Benefits – look for benefit that will equal 70 to 80% when added to other sources of income Accident and Sickness Coverage – look for those that also pay for sickness in addition to accidents Guaranteed Renewability – make sure that they will not cancel coverage when you fall ill Life Insurance Section 14.4 What is Life Insurance? Contract in which you pay a certain premium periodically Stated money amount paid upon your death Paid to your beneficiary – person named to receive your benefits Purpose of Life Insurance Pay off mortgage or other debt Money for children when they reach certain age Education or income for children, survivors Charitable donations Retirement income Accumulate savings Set up an estate plan Pay estate and death taxes Principle of Life Insurance Estimate how long people will live Set the price of life insurance on tables Higher premiums for those who will die sooner Types of Life Insurance Policies Term Insurance Pays out only if you die during the term it covers May only get covered for the time you have children Renewable Term allows to renew after original term is up Multiyear Level Term – Guarantees you pay the same premium for the duration of policy Conversion Term – Allows you to change from term to permanent, with a higher premium Decreasing Term – Pays less to beneficiary as time passes Whole Life Insurance Pay a set amount for the rest of your life Also serves as an investment