SSI - Poverty Law

advertisement

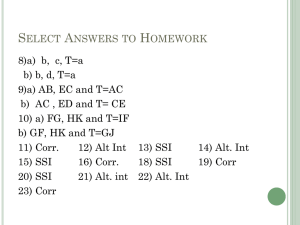

Government Benefits for Non-Citizens October 2013 Laura Melnick SMRLS 651-894-6932 laura.melnick@smrls.org Government Benefits for Non-Citizens 1. Welfare reform 2. Definitions: qualified and unqualified immigrants, “battered immigrants” 3. Sponsor-deeming 4. “SAVE” 5. Reporting to Immigration 6. Public charge considerations 7. 5-year Bar 8. Federal cash and food benefits: a. SSI b. SNAP (food stamps) 9. State and federal/state cash & food benefits a. cash and food: TANF – families (i) FSS (Family Stabilization Services) (ii) DWP (Diversionary Work) (iii) MFIP (MN Family Investment Program) (iv) WB (Work Participation Cash Benes.) b. cash: GA (General Assistance) c. cash: MSA (Minnesota Supplemental Assistance) d. emergencies: EA (Emergency Assistance), and EGA (Emergency GA) e. non-need-based: UI (Unemployment Insurance) f. food MFAP (MN Food Assistance Program) g. health care (i) MA (Medical Assistance) (ii) EMA (Emergency MA) (iii) MinnesotaCare 10. other benefits 11. considerations for mixed-status households 12. scenarios 1. Welfare reform enacted August 22, 1996 replaced AFDC (family cash program) with “TANF” block grants to states imposed lifetime limits on, and work requirements for, family cash assistance eliminated SSI & food stamp eligibility for many non-citizens (“Restricting Welfare and Public Benefits for Aliens” provision) required certain agencies to file reports with Immigration Post-1996 federal law changes (all good!) IIRIRA - ILLEGAL IMMIGRATION REFORM & IMMIGRANT RESPONSIBILITY ACT OF 1996 • amended definition of “Qualified Alien” to include battered non-citizen. • (BUT – clarified that SSDI & retirement benefits could not be paid to anyone not “lawfully present” in US) BBA - BALANCED BUDGET ACT OF 1997 • broadened eligibility for SSI based on disability; • extended SSI window for refugees, asylees to 7 years; • treated Amerasian immigrants as refugees; • broadened “qualified” definition to include certain Indians born in Canada; & • added surviving spouses to US vet exception. 1998 AGRICULTURAL RESEARCH ACT restored food stamp eligibility to certain groups of legal immigrants (those receiving disability benefits, elderly, under 18, Hmong/Laotian); also extended window for refugees, asylees to 7 years (from 5). FARM BILL OF 2002 significantly broadened eligibility for food stamps for non-citizens beginning 2003 (allowed all “qualified” non-citizens to get food stamps 5 years after arrival; eliminated 5-year wait for certain groups). SSI EXTENSION FOR ELDERLY AND DISABLED REFUGEES ACT OF 2008 allowed certain humanitarian immigrants an additional 2-3 years of SSI past their “window.” 2. Definitions for eligibility for FEDERAL benefits. “QUALIFIED” NON-CITIZEN lawfully admitted for permanent residence under the Immigration & Nationality Act (INA) “refugee,” including Haitian, Cuban, & Amerasian granted asylum or parol granted conditional entry before 4/1/80 deportation withheld or removal cancelled granted T-Visa “battered immigrant” “UNQUALIFIED” NON-CITIZENS expired or no documentation pending application for adjustment, asylum, suspension of deportation, or cancellation of removal lawful temporary resident under amnesty program non-immigrant (temporary protected status, or student, visitor, or temporary worker visa) U-visa (crime victim) Deferred Action for Childhood Arrival (DACA) “BATTERED IMMIGRANTS” can qualify for range of federal & state-funded benefits but must wait 5 years for SNAP, SSI, MA: o must have been battered or subjected to extreme cruelty in U.S. by U.S. citizen or LPR parent, spouse, or relative in same household, AND o must no longer live with abuser, AND o need for benefits must be “substantially connected” to abuse, AND applicant must either: • be spouse or child of U.S. citizen AND have petitioned for adjustment of status under Violence against Women Act (VAWA); OR • be spouse or child of U.S. citizen OR LPR AND have petitioned for cancellation of removal under Immigration and Nationality Act (INA). 3. Sponsor-deeming attribution of income from sponsor to immigrant can make certain immigrants COMPLETELY INELIGIBLE for almost all types of public assistance! Requirement imposed by 1996 welfare reform law. Began December 19, 1997 with implementation of “Affidavit of Support” form (form I-864). Applies only to family-based immigrants (immigrants arriving through petition from family member) & immigrants who come to US to work in family-owned business). Deeming does NOT apply to: refugees, asylees, parolees diversity visa (visa lottery) recipients Cuban/Haitian entrants people granted Temporary Protected Status children under 18 (for SNAP and MA only) pregnant women (MA & MinnesotaCare only) How deeming works • 100% of income & assets of sponsor AND sponsor’s spouse are considered fully available to immigrant. (Less harsh deeming for SNAP). • Sponsor’s family size & fixed debts are irrelevant. • Burden of proving sponsor has little income on immigrant applying for public assistance. • Income and assets deemed until: immigrant becomes U.S. citizen, works 10 years, or dies; OR sponsor dies. • Divorce from sponsor has no effect on deeming. • Whether deeming will affect people other than sponsored immigrant varies by type of assistance program. • In MFIP & other family cash programs, & for MinnesotaCare, income is deemed to all members of “assistance unit.” • In MA, income & assets are deemed only to sponsored immigrant. 2 exceptions to deeming: A. Indigence exception: Sponsor-deeming will NOT apply if welfare agency determines that, as result of sponsor’s failure to support, immigrant is without food and shelter. 12-month renewals available. Govt. can sue sponsor for reimbursement. (Immigrant can sue sponsor, too, for nonsupport). B. Battered spouse/child exception Deeming will NOT apply if immigrant or child is battered or subjected to extreme cruelty by spouse or parent, or by relative of spouse or parent in same household. Immigrant can’t have participated in abuse of child. Immigrant must show that battery or cruelty is substantially connected to need for benefits. Exception ends after 12 months, UNLESS battery was perpetrated by sponsor AND is recognized in court order (OFP, etc.) or USCIS determination. Government can sue for reimbursement; immigrant can sue for non-support. Deeming applies to: cash programs: SSI, MSA, GA, MFIP, EA food programs: SNAP for adults; MFAP health care programs: MA, MinnesotaCare Deeming does NOT apply to: o EMA (Emergency Medical Assistance) o MA & MinnesotaCare for pregnant women & children o SNAP for children o Basic Sliding Fee child care o SSDI o UI Special 3-year deeming for MFIP • 3-year deeming in state law for MFIP only. • Applies only to those who came to U.S. through means other than relative petition (such as diversity visa). • Does not affect refugees or asylees. • Takes into account sponsor’s family size & support obligations. 4. “SAVE” Systematic Alien Verification for Entitlements o Inter-agency governmental informationsharing program o Used to verify immigration status for public assistance & public housing o NOT used for reporting immigration status (or lack thereof) to Immigration 5. Reporting to Immigration requirement stems from 1996 welfare reform law WHO IS REQUIRED TO REPORT? Only: agencies receiving “TANF” funds (in MN, that means county agencies administering MFIP & DWP benefits) Social Security Administration public housing agencies contracting with HUD WHAT MUST BE REPORTED? names, addresses, & other “identifying information” ON anyone worker “knows” is unlawfully in U.S. Reporting in Minnesota protocols require that agencies: report to MDHS rather than to Immigration not verify status if not relevant to benefit being sought stop inquiring about status when applicants are unwilling/unable to verify interpret “knowledge” very narrowly comply strictly with data privacy laws 6. “Public charge” Receiving/having dependents receive certain benefits may affect ability to adjust to LPR status. Benefits considered are: cash benefits: MFIP, DWP, SSI, MSA, GA long-term medical care (nursing home care) Benefits not considered include health care, WIC, housing & energy assistance, & benefits not intended for income maintenance. Receipt of SNAP or state-funded food support not a factor for public charge determinations. 7. “5-year bar” 5-year “bar” prevents immigrants from receiving federal benefits during first 5 years in “qualified” status. Benefits affected are SSI, SNAP, MA, & federally-funded MFIP. During 5-year wait period, immigrants may receive state-funded benefits if eligible for them (& such benefits exist). BENEFITS! 8. Federal cash & food benefits: a. Supplemental Security Income (SSI) Social Security administers 2 types of disability benefits: SSI, for low-income, low-asset individuals. Recipients must be too disabled to work or 65 or older. SSDI, for people too disabled to work who meet earnings requirements by having paid into system via FICA wage deductions. To qualify for SSI, noncitizen applicants must: meet definition of “qualified” noncitizens under federal law; AND meet certain residency requirements. SSI residency issues: A. immigrants lawfully residing in U.S. before welfare reform (8/22/96) if on SSI on 8/22/96, can keep getting SSI as long as elderly or disabled. if not on SSI on 8/26/96, can get SSI now if: • “qualified” AND • disabled. Can’t get SSI based on age (over 65). B. arriving after welfare reform (coming to U.S. or adjusting to LPR status after 8/22/96) If “unqualified,” can’t get SSI. Even if “qualified,” probably can’t get SSI. There are 3 exceptions. Exceptions to SSI ineligibiity: 1) refugees, asylees, & those granted withholding: 7 year window of eligibility (from date of grant of status). 2) U.S. veterans, active-duty members of U.S. armed forces, & spouses or minor children of vets & active duty members: no time limits, not subject to 5-year bar. Hmong soldiers who fought with the CIA in Vietnam War not considered “U.S. veterans.” 3) workers (or those credited with at least 40 work quarters): no time limits, but 5-year bar applies. Note about work exception: o Only work where FICA taxes deducted from pay counts toward 40-quarter requirement. o Quarters can be attributed from spouse to spouse & from parent to minor child. Minor children can carry parents’ quarters into adulthood. o Any quarters worked after December 31, 1996 in which hh received federal “need-based” benefits (AFDC, MFIP, SNAP, SSI, MA) do not count as quarters. Sponsor-deeming and Social Security o Because SSI is need-based program, sponsor-deeming may preclude eligibility. o Because SSDI is not needbased, sponsor-deeming does not apply. b. SNAP Except when sponsor-deeming applies, all “qualified” non-citizens are potentially eligible for SNAP. Applicants may have to wait 5 years to get SNAP benefits. SNAP exemptions from 5-year bar refugees, asylees, & those granted withholding of deportation U.S. veterans & active-duty members of U.S. armed forces (& their spouses & unmarried dependents) elderly immigrants who were “lawfully residing” in U.S. AND at least 65 on 8/22/96 disabled (certified by State or SSA) under age 18 Hmong or Highland Lao 9. State (and federal/state) cash & food benefits requirement for all state cash & food benefits: “steps” toward citizenship Most recipients of state-funded assistance must take “steps” toward obtaining citizenship. They don’t have to take such steps if: legally residing in U.S. fewer than 4 years; are age 70 or older; OR living in nursing home, group home, or similar facility. “Steps” toward citizenship “steps” = o o o o taking citizenship, literacy, or ESL class being on wait list for ESL or literacy class having application for citizenship on file applying for waiver of citizenship test requirements o having failed citizenship test at least twice or being unable to understand rights & responsibilities of citizenship. “Lawfully residing people” Some non-citizens not eligible for federal benefits may get state-funded benefits: Lawful Temporary Residents Temporary Protected Status (TPS) recipients applicants for asylum or withholding who have employment authorization spouses or children of U.S. citizens with approved visa petition or pending application for adjustment to LPR Others permitted to stay in US for humanitarian or public policy reasons. (Category includes Deferred Enforced Departure [DED], deferred action, voluntary departure) Victims of Trafficking: T Visas o Victims of trafficking who have “T” visas are eligible for both federal and state-funded benefits to extent that refugees are eligible. o To qualify, T visa holders must get certification from the Office of Refugee Resettlement (ORR). Crime Victims: U Visas • Crime victim recipients of “U” Visas are not eligible for federally-funded benefits; U Visa is “nonimmigrant” visa. • U Visa holders are not eligible for state-funded cash benefits. • They are eligible for MinnesotaCare. • They are eligible for state-funded food benefits (MFAP) if they meet categorical eligibility requirements. DACA recipients o Those granted Deferred Action for Childhood Arrivals (DACA) are not considered “lawfully residing” for MA (according to HHS). o DACA recipients should qualify for MinnesotaCare. a. cash & food: TANF (i) FSS – Family Support Services (ii) DWP – Diversionary Work Program (iii) MFIP – Minnesota Family Investment Prog. (iv) WB – Work Participation Cash Benefits MFIP, DWP, FSS & WB = programs that have replaced AFDC. They provide cash assistance to families with minor children. Cash grants for MFIP, DWP & FSS are very low: $437 for a household of 2, $532 for 3, $621 for 4, $697 for 5, etc. Adults without minor children are not eligible for FSS, DWP, MFIP or WB. FSS, DWP, MFIP & WB Most non-citizens here lawfully & permanently can get family cash benefits if categorically eligible, whether “qualified” or “unqualified” under federal law. Certain non-citizens can only get state-funded benefits. (Eligibility depends on date of arrival in U.S. & immigration category). Newly-arrived (here < 1 year) are exempt from DWP. State-funded benefit recipients must take “steps” toward citizenship. Sponsor-deeming may preclude eligibility. MFIP & DWP work plans & ESL Most MFIP recipients have to work, unless exempted. o Counties may allow non-English speakers to include ESL in job search & work plans if spoken language proficiency level low enough on standardized testing. o MFIP recipients may fulfill only half of work participation requirements through ESL, unless taking intensive functional work literacy. o MFIP & DWP recipients may include ESL in work plans for total of only 24 months (out of 60). b. cash: General Assistance (GA) GA is state-funded program for low-income, low-asset individuals not living with minor children. GA is also for minor children whose adult caregivers don’t qualify for MFIP due to relationship status. GA pays $203 per month for individual & $260 for married couple. Legal immigrants residing in U.S. permanently (or with pending application for adjustment) may get GA if meet other eligibility criteria. If under 70 & here at least 4 years, must take steps toward citizenship. Sponsor-deeming may preclude eligibility. c. Cash: Minnesota Supplemental Assistance (MSA) MSA is state supplement for recipients of SSI (or those who would receive SSI but for excess income). MSA serves to ameliorate high housing costs. SSI recipients living in “shared households” usually ineligible for MSA. Average MSA supplement = $81. Non-citizens must take “steps” toward citizenship, & sponsor-deeming may preclude eligibility. d. cash: EA and EGA Emergency Assistance (EA) & Emergency GA (EGA) designed to prevent destitution, providing cash grants to resolve crises. Both EA & EGA are funded through block grants from State, so individual counties have great deal of discretion in administering benefits. Legal, permanent residents are eligible for EA & EGA to same extent (& subject to same limitations) as U.S. citizens. Sponsor-deeming may preclude eligibility, but applicants may qualify for indigence exception. e. non-need-based cash: Unemployment Insurance (UI) UI benefits can be paid if worker was: • lawfully admitted for permanent residence at time of employment; • lawfully present for purposes of employment; OR • permanently residing in U.S. under color of law at time of employment. Work done before attaining legal status does not count toward earnings requirements. UI benefits not need-based; therefore not subject to sponsor-deeming. f. Food MFAP – MN Food Assistance Program Legal, permanent non-citizens not on MFIP here < 5 years (who may be subject to 5-year bar on SNAP) may get food assistance through MFAP. MFAP benefits available only to those age 50 & up. MFAP program follows federal SNAP regulations. MFAP recipients may be subject to sponsordeeming. g. health care (i) Medical Assistance (MA) MA available to immigrants who: are low-income & low-asset; are “qualified” under federal law; AND meet categorical requirements, meaning they’re: • • • • • • pregnant; living with minor children or in MFIP household; <21; >64; certified disabled by State or SSA; OR >20, without kids, & living <76% FPG. Sponsor-deeming may preclude eligibility. In 2011, Minnesota legislature eliminated state-funded MA statutorily, effective 1/1/12, for non-citizens lawfully residing in the U.S. who were not eligible for federallyfunded assistance. Implementation of change took place 3/1/12. No longer eligible MA, since 3/1/12, are: o people considered “otherwise lawfully residing” who don’t meet definition of “qualified” under federal law; AND o LPRs subject to 5-year bar. (All in this group should qualify for MinnesotaCare during 5-year wait, except those on Medicare). NOTE: Pregnant women & children remain eligible for MA (funded by SCHIP, State Children’s Health Insurance Program). No 5year bar. Special rule for torture survivors Those receiving “care and rehabilitation” services from Center for Victims of Torture (CVT) do NOT have to meet MA guidelines in terms of: o categorical eligibility; o income and asset restrictions; OR o immigration requirements. (ii) Emergency Medical Assistance (EMA) Basic safety net health care program. Can provide health care services to “medically needy” people who are undocumented, who have lapsed documentation, or who otherwise would be ineligible due to sponsor-deeming. Does NOT cover organ transplants or “related procedures.” EMA is available only to those categorically eligible for MA (i.e., living in household with minor children, pregnant, elderly, certified disabled, <21, or >20 and living <76% FPG). EMA is for “Emergency Medical Services”: required for medical conditions manifested by acute symptoms of such severity that absence of immediate medical attention reasonably could be expected to result in: o Placement of patient’s health in serious jeopardy; o Serious impairment to bodily functions; OR o Serious dysfunction of any bodily organ or part. EMA no longer available for chronic conditions since 1/8/12: o MN legislature eliminated EMA eligibility for those with chronic conditions in 2011. o Exceptions were made for those who would have respiratory or cardiac failure within 48 hours but for treatment. o In 2012 legislature allowed EMA for kidney dialysis & for treatment (including chemotherapy & radiation) for cancer. o Law limits EMA to care delivered in hospital emergency rooms or ambulances; on in-patient basis following ER care; & as follow-up care directly related to ER treatment. Medical coverage for pregnant women Pregnant women qualify without regard to immigration status or sponsor income for: labor & delivery AND pre- & post-natal care for 60 days after birth (iii) MinnesotaCare Need-based program with higher income allowances than MA. Available to those ineligible for MA because of categorical or income restrictions. Available to those who meet income guidelines AND: are “qualified” non-citizens OR effective 3/1/12, meet definition of “lawfully present” under federal regulations. DACA grantees & U Visa recipients should qualify. Sponsor-deeming may preclude eligibility. 10. Other benefits Some benefits available without regard to immigration status include: • • • • • • • WIC (Women, Infants & Children) benefits school breakfast & lunch benefits benefits through Head Start K-12 free public education public health immunizations & testing soup kitchens, short-term shelter, etc. child care assistance for U.S. citizen children 11. Considerations for mixed-status households To avoid getting reported to Immigration, those without proper documentation should be advised to: Tell agency they are not eligible for benefits for themselves due to immigration status. Tell agency they are applying only for eligible household member. Not provide details about their status to agency. Not provide Social Security number (unless necessary for income verification). Verify earned income, from whatever source. Verify pregnancy if seeking health coverage. SCENARIOS A. Battered immigrants: Natasha o Natasha is 36 & came to US without papers. She left o o o o o U.S. citizen husband after he assaulted her with baseball bat, causing traumatic brain injury. Friend is letting Natasha stay in her condo & has stocked it with food. Natasha filed a VAWA petition & received notice last month she’d made prima facie case for VAWA relief. Natasha’s main concern is medical coverage. Cognitive functioning is significantly impaired due to injury, & she needs some home health care to remain in community (& out of nursing home). MA covers home health services; MinnesotaCare does not. Natasha would also like cash assistance, since she can’t work. She doesn’t have SSDI eligibility. A. Natasha quiz Natasha: 1. is not currently eligible for any cash or health care because she is undocumented. 2. is eligible for GA & MinnesotaCare, but not for SSI or MA; therefore, she can’t get home care. 3. is eligible for SSI & MA since, she is now a “qualified” non-citizen under federal law. B. Sponsor-Deeming: Ralph & Mai Lia o Mai Lia moved to US with minor daughter, Bee (now 8), 6 years ago, via relative petition signed by Mai Lia’s mom. Mom lives in California with stepdad, who earns $200,000 a year. o 11 months ago, Mai Lia married widower Ralph, US citizen & MFIP recipient with 6 kids. Mai Lia’s mom & stepdad stopped talking to her after marriage. Ralph added new wife to MFIP grant, then added couple’s new baby, Jethro, 2 months ago (he gets only food portion & MA). o County just notified Ralph it made mistake by not counting Mai Lia’s deemed income. County has determined that whole household is ineligible for MFIP. County has terminated household’s MFIP benefits & assessed it huge overpayment. o Ralph & Mai Lia were just served with eviction notice from landlord. o County says: Ralph and all 8 kids remain eligible for MA. Kids can get SNAP. No one else is eligible for anything. B. Ralph & Mai Lia quiz. Mai Lia should: 1. Appeal the MFIP termination & overpayment; she has not had any contact with mom & stepdad, so their income should not be imputed to household (and, particularly, to 8 U.S. citizen members of household, including child born after signing of I-864 affidavit). 2. Encourage Ralph to appeal imposition of sponsordeeming, as he & all his children are US citizens & therefore can’t be subject to sponsor-deeming. 3. Reapply for MFIP & SNAP and start working on citizenship application. C. Reporting and Public Charge: Tamara & Mustafa o Tamara is U.S. citizen, married to Mustafa. Mustafa’s student visa expired; he hopes to adjust to LPR status sometime. o Tamara is unemployed. Mustafa works part-time using SSN he obtained on black market. Neither is eligible for UI. Mustafa isn’t earning enough to make ends meet. o The couple has 2 minor children born in U.S. Household needs food, medical & cash. Tamara is worried that applying for benefits will: cause County to report Mustafa’s lapsed status to Immigration; get Mustafa in legal trouble because of false SSN; & harm Mustafa’s chances of adjusting to LPR status. C. Tamara & Mustafa quiz Tamara should: 1. apply only for medical & food benefits, reporting Mustafa’s wages to County as part of application process. 2. Apply only for medical and food benefits, but not report Mustafa’s wages to County because he used false SSN & he could get charged criminally. 3. Not apply for any benefits. County would have to report Mustafa to Immigration, & he could face removal (deportation). 4. Apply for all benefits. She has nothing to fear; she’s merely being worry-wart. D. SSI: Tang o Tang is 52, from Laos. She came to U.S. as refugee little over 7 years ago. o Tang doesn’t speak English. She suffered trauma in her youth & can’t work. She likes to keep to herself. She started getting SSI couple years ago due to PTSD. She also got state MSA grant. o Because she had over $700 in monthly income, Tang could afford her own apartment. o Recently, Tang’s SSI & MSA terminated because she is not U.S. citizen. Tang applied for GA but doesn’t know how she’ll pay her rent. County says she can’t get GA until she signs up for ESL, literacy, or citizenship classes. o Tang wants her SSI benefits back. D. Tang quiz Tang should: 1. ask Social Security to reinstate her SSI benefits; as Hmong refugee, she is not subject to 7-year limitation. 2. file new application for SSI since she hasn’t used her 7 years of benefits yet. 3. apply for subsidized housing, sign up for citizenship classes, file citizenship application, & ask doctor to complete medical waiver form for it. 4. appeal County’s termination of her MSA benefits. She’s a “qualified” non-citizen. 5. move to Nebraska, as she’ll automatically get SSI there.