Seth Freedman

advertisement

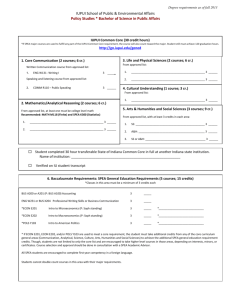

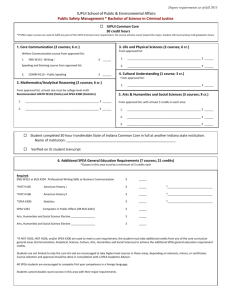

Effects of Provider Consolidation in Healthcare: The Latest Research Seth Freedman Assistant Professor, IU SPEA November 21, 2014 Recent Trends in Consolidation • New wave of hospital mergers − 50-60 per year during 2000s − 90-100 per year since 2011 • ~15% increase in # of hospitals in systems since 2002 • Increasing prevalence of hospital owned physician practices Seth Freedman, IU SPEA April 9, 2015 Outline • Recent trends in consolidation • Conceptual effects of consolidation • Empirical evidence of effects • Some implications moving forward Seth Freedman, IU SPEA April 9, 2015 Effects of Consolidation on: 1. Provider Costs 2. Price 3. Quality 4. “Medical Arms Race” Seth Freedman, IU SPEA April 9, 2015 Varying Types of Consolidation Mergers System acquisitions Physician Integration Merging ownership only Systems with local presence Physicians joining large group practices National systems with no local presence Hospital/hospital systems purchasing physician practices Merging operations Seth Freedman, IU SPEA April 9, 2015 Focus of Today’s Talk • Hospital market competition and mergers − Most well developed research area • Two main types of studies − Comparing more and less competitive markets − Before and after studies of mergers Seth Freedman, IU SPEA April 9, 2015 Focus of Today’s Talk • Will mention some early work on − System acquisitions − Hospital/physician integration Important areas for future research Seth Freedman, IU SPEA April 9, 2015 RECENT TRENDS IN PROVIDER CONSOLIDATION Seth Freedman, IU SPEA April 9, 2015 Chart 2.9: Announced Hospital Mergers and Acquisitions, 1998 – 2013 (1) Source: Irving Levin Associates, Inc., The Health Care Acquisition Report, Twentieth Edition, 2014. (1) In 2006, the privatization of HCA, Inc. affected 176 acute-care hospitals. The acquisition was the largest health care transaction ever announced. Chart 2.4: Number of Hospitals in Health Systems,(1) 2002 – 2012 3,200 3,100 Hospitals 3,000 2,900 2,800 2,700 2,600 2,500 2,400 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Avalere Health analysis of American Hospital Association Annual Survey data, 2012, for community hospitals. (1) Hospitals that are part of a corporate body that may own and/or manage health provider facilities or health-related subsidiaries, as well as non-health-related facilities including freestanding and/or subsidiary corporations. medec.com/medicinemonopoly Seth Freedman, IU SPEA April 9, 2015 CONCEPTUAL EFFECTS OF CONSOLIDATION Seth Freedman, IU SPEA April 9, 2015 Conceptual Effects • Typical antitrust concerns: lack of competition increases prices • The health care sector is different! Patients Insurers Seth Freedman, IU SPEA Providers April 9, 2015 Consolidation and Cost • • • • Economies of scale Facilitate investment in EMRs Improved access to capital Eliminating duplicative services or excess capacity • Effects likely to depend on extent to which merging hospitals combine facilities or not Seth Freedman, IU SPEA April 9, 2015 Consolidation and Prices Insurer Bargaining Power Provider Bargaining Power Seth Freedman, IU SPEA April 9, 2015 Consolidation and Prices Increased provider bargaining power Increased prices paid by insurers to providers Increased premiums, lower benefits, and/or lower wages for consumers Seth Freedman, IU SPEA April 9, 2015 Consolidation and Quality Gov. Determined Prices (e.g. Medicare) Seth Freedman, IU SPEA Market Determined Prices (e.g. Private Insurance) Can’t compete for patients through prices Can compete for patients through prices or quality Level of competition likely to raise quality Quality effects ambiguous April 9, 2015 Adding MCOs Compete by enhancing attractiveness to MCO Lower treatment costs More competition quality Seth Freedman, IU SPEA More competition quality Attract more patients More competition quality April 9, 2015 Medical Arms Race • True clinical “quality” is difficult for patients to observe • Hospitals may compete by investing in flashy things that attract patients, but may not improve care − Amenities − Medical technology with little or uncertain benefit Seth Freedman, IU SPEA April 9, 2015 EMPIRICAL EVIDENCE Seth Freedman, IU SPEA April 9, 2015 Challenges to empirical research • Lag time to obtaining data • Defining markets − Arbitrary geographic classifications − Patient flows • Measuring actual transaction prices • Hospitals sell many “products” • Correlation vs. causation Seth Freedman, IU SPEA April 9, 2015 Correlation vs. Causation Seth Freedman, IU SPEA April 9, 2015 Provider Costs • Some evidence of general economies of scale in hospitals • Few direct studies of consolidation on costs Seth Freedman, IU SPEA April 9, 2015 Provider Costs • One high-quality, direct study: Dranove and Lindrooth (2003) − Studied 122 mergers between 1989 and 1996 • 81 of these mergers combine licenses − Find 14% cost savings in licensecombining mergers − No savings in others Seth Freedman, IU SPEA April 9, 2015 Prices • One of the most well developed areas of research • Consistent evidence that level of market concentration raises prices − Much early evidence from CA − Newer work examines FL, MA, and full US − Must studies based on data through mid-2000s Seth Freedman, IU SPEA April 9, 2015 Prices Seth Freedman, IU SPEA April 9, 2015 Prices • Consistent evidence that mergers raise prices • Variety of methods to ensure appropriate “control” hospitals Seth Freedman, IU SPEA April 9, 2015 Prices Example: Dafny (2009) • Do hospitals raise prices when rivals merge? • Leverages “co-located” rivals Seth Freedman, IU SPEA April 9, 2015 Prices Example: Dafny (2009) • Find that mergers lead to 40% higher prices • National coverage • Most “event studies” find effects upwards of 20%, especially when markets are already relatively concentrated Seth Freedman, IU SPEA April 9, 2015 Quality • Large literature on effects of competition on quality under both pricing schemes • Administered pricing − Older studies on Medicare find competition improves quality − Newer studies of GB policy change find consistent results • Market-based pricing − Results mixed, but lean towards quality improving with more competition Seth Freedman, IU SPEA April 9, 2015 Quality • Much of this literature based on mortality outcomes • Especially AMI patients • May be incomplete picture of overall “quality” Seth Freedman, IU SPEA April 9, 2015 Medical Arms Race • Little direct research on the MAR hypothesis • Some indirect evidence from pre-1991 − Kessler & McLellan (2000): “Is Hospital Competition Socially Wasteful?” − Competition increased costs without clear impacts on health outcomes for elderly heart disease patients − After 1991, competition unambiguously beneficial Seth Freedman, IU SPEA April 9, 2015 Medical Arms Race • “the medical arms race is slowed by insurers with market power in markets with sufficient competition among hospitals. As hospitals continue to consolidate and integrate with other providers (e.g., as encouraged by the ACO movement), I wonder if the medical arms race will return.” ~Austin Frakt, http://theincidentaleconomist.com/wordpress/th e-medical-arms-race/ Seth Freedman, IU SPEA April 9, 2015 Medical Arms Race • Some evidence patients value “amenities” • Goldman & Romley (2008): “Hospitals as Hotels” − Medicare pneumonia patients in LA value amenities − Patients actually more responsive to amenities than clinical quality in choosing hospital • Need more direct evidence on competition and tech/amenities investment Seth Freedman, IU SPEA April 9, 2015 Physician Integration • Major data limitations • Researchers currently working on competition in physician markets − Preliminary evidence: consolidation of physician offices raises prices • Also evidence that physician/hospital integration raises prices • Need to know more about quality outcomes! Seth Freedman, IU SPEA April 9, 2015 Effect Of Hospital Integration And Market Competitiveness On Hospital Prices. Baker L C et al. Health Aff 2014;33:756-763 ©2014 by Project HOPE - The People-to-People Health Foundation, Inc. Hospital Systems • Hospitals in multi-hospital systems increased prices more between 1999 and 2003 (Melnick & Keller 2007) − 34% more for large systems − 17% more for small systems − Results not confined to hospitals with other system members in local market − Suggestive of important bargaining power Seth Freedman, IU SPEA April 9, 2015 Hospital Systems & Physician Integration • Know very little about other potential effects − Efficiency − Financial stability − Care coordination − Quality Seth Freedman, IU SPEA April 9, 2015 Summary of Research Findings: Effects of consolidation Costs Prices Quality MAR Potential for cost savings Generally price increases Generally quality decreases Indirect evidence of MAR when insurers were weaker Especially when services consolidated Mergers in concentrated markets increase prices by >20% Results more mixed when prices market determined Could become important again Seth Freedman, IU SPEA April 9, 2015 Implications Moving Forward • Much of our knowledge based on 1990s merger wave • Will consolidation continue to accelerate? • Will current mergers and acquisitions have similar or different effects? Seth Freedman, IU SPEA April 9, 2015 ACOs, Physician Integration, and Multi-Hospital Systems • New models of care delivery becoming increasingly important • Clear scope for price effects • How will this be balanced with potential benefits? • How will regulators respond? Balancing act between FTC and ACA Seth Freedman, IU SPEA April 9, 2015