HRA* example year 1

advertisement

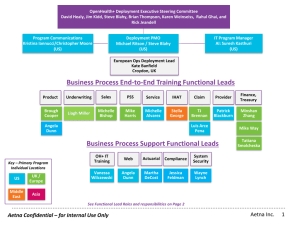

Ready today for the future of consumer-directed health plan solutions 32.25.102.1 (3/09) Aetna HealthFund® Health Reimbursement Arrangement (HRA) 2 3 Support member engagement Help members become better health care consumers Educate members on the process Enable behavior change Support doctor-patient relationships Provide personalized information Make connections for optimal health ©2009 Aetna 4 Aetna HealthFund® High deductible health plan, Health Reimbursement Arrangement( HRA)*, Health Savings Account (HSA)*, Aetna performance networks Decision tools for value-based purchasing Health incentives Health care transparency Integrated care management Effective communications and education *HRAs and HSAs are currently not available to HMO members in Illinois ©2009 Aetna 5 Health benefits - current environment Health care costs continue to rise Employers looking for solutions and savings New competitive options emerging Legislative and political impact Consumer’s role changing Result – CDHP (Consumer-Directed Health Plans) ©2009 Aetna 6 An industry transformation Greater member responsibility Promotes consumer engagement Can improve employee satisfaction Saves employers money Drives cost down ©2009 Aetna 7 ® The Aetna HealthFund Health Reimbursement Arrangement (HRA)* Fully integrated systems, including Pharmacy Full product and funding spectrum Actuarial modeling capabilities Plan design flexibility Full medical management services Personalized Aetna Navigator® consumer decision support tools Favorable network discounts Monthly member statements *HRAs are currently not available to HMO members in Illinois ©2009 Aetna 8 Aetna HealthFund HRA* Fund integrated with deductible-based medical plan – Fund • • • • • – Medical plan • • • • Established by employer Notional account / unfunded liability Pays eligible out-of-pocket expenses Balances roll over, option to cap Fund reduces deductible (standard model) Deductible Coinsurance and/or copayments 100% preventive care, not subject to fund or deductible Out-of-pocket maximum Consumer tools and information *HRAs are currently not available to HMO members in Illinois ©2009 Aetna 9 * *HRAs are currently not available to HMO members in Illinois. 10 * Helps you pay for eligible out-of-pocket expenses ………………………. Employer funded each plan year *HRAs are currently not available to HMO members in Illinois. 11 * You pay this amount before your health plan begins to pay for eligible expenses Helps you pay for eligible out-of-pocket expenses ………………………. Employer funded each plan year *HRAs are currently not available to HMO members in Illinois. 12 * You pay this amount before your health plan begins to pay for eligible expenses Once you meet your deductible, your health plan pays a larger % of eligible costs while you pay a smaller % Helps you pay for eligible out-of-pocket expenses ………………………. Employer funded each plan year *HRAs are currently not available to HMO members in Illinois. 13 Employer-established fund Various fund amounts available Generally half deductible amount Fund rollover options Fund typically forfeited at termination of employment or termination of plan Health fund can be limited to: – – ©2009 Aetna Traditionally covered PPO expenses IRS Section 213 deductible health expenses (ASC) Rollover maximum One fund per family, not member Fund-tiering available 14 HRA* common plan designs Underlying Plan deductible ranges – – – – ($1,000 / $1,500 / $2,000) ($2,000 / $2,500 / $3,000) Individual range: Family range: $2,000 - $4,000 $4,000 - $8,000 Fund ranges – $500 - $3,000 $1,500 - $9,000 Out-of-Pocket maximum – Individual range: Family range: Individual range: Family range: $350 - $1,000 $750 - $3,000 ($500 / $750 / $1,000) ($1,000 / $1,500 / $2,000) Underlying plan coinsurance levels: 80/60, 90/70 or 100/70 100% preventive care Tiering – – Standard is 2-tier (Individual or Family) Each tier has one deductible to meet for the entire group Note: Effective member responsibility is a result of utilizing many of the plan design components as opposed to each component individually. * HRAs are currently not available to HMO members in Illinois. ©2009 Aetna 15 Preventive care coverage Generally 100% covered for each individual – ©2009 Aetna Does not apply to fund or deductible Preventive care schedule on Aetna Navigator® Covers medical services such as routine physicals, immunizations, screening, well-woman exams, well-child visits Encourages employee to obtain preventive care 16 HRA* medical plan Fund – – – – Fund pays member responsibility (deductible and member coinsurance) Fund pays until exhausted (may or may not reduce deductible) Before-fund deductible fund coinsurance (ASC only) Deductible fund deductible coinsurance PPO, Aetna Choice® POS II, Open Access Aetna SelectSM Fully insured plans – coinsurance options Self-funded plans (ASC) – deductible PPO, Open Access Managed Choice® (POS) and Aetna Choice POS (HMO) Optional standalone or integrated pharmacy and dental Flexible plan designs *HRAs are currently not available to HMO members in Illinois ©2009 Aetna 17 Additional options & features Dental integration Long Term Care premium reimbursement Chronic & preventive medications Incentives Hybrid funding arrangement (insured plan, ASC fund) Simple Steps To A Healthier Life® Informed Health® Line Medical management programs Aexcel® ©2009 Aetna 18 Pharmacy integration Real-time claim adjudication Discounted cost of prescriptions applied to fund and/or deductible depending upon fund model Once fund exhausted and deductible met, pharmacy plan can be: – – Same or lower coinsurance level as medical, or Copay plan Participating pharmacy knows whether to collect anything from member – handled at point of sale with no balance billing Price-A-DrugSM tool available to assist members ©2009 Aetna 19 Comparing HRA*, HSA*, FSA Feature Health Reimbursement Arrangement (HRA* or RRA) Health Savings Account (HSA*) Flexible Spending Account (FSA) Eligibility All eligible employees Individual covered by high deductible health plan (HDHP) All eligible employees Contributor Employer only Employer, individual or both Employer, associate or both Roll-Over Usually yes, but at employer discretion Yes No Tax Advantaged Yes Yes Yes Portability No, forfeit upon termination Employer has option to roll to RRA on retirement Yes No Ability to Earn Investment Income No Yes No Rx Integration for HDHP Available Required N/A Note: HSAs can be purchased with a “limited purpose” HRA/FSA, post deductible HRA/FSA, suspended HRA, retirement HRA *HRAs and HSAs are currently not available to HMO members in Illinois 20 Aetna HealthFund® HRA* / HSA* High-Deductible Health Plan/HSA Health Reimbursement Arrangement 819 customers • 133 National • 123 Key • 290 Select • 68 Small Group 9,712 customers • 131 National • 146 Key • 350 Select • 9,085 Small Group 51 full replacement plans* 52 full replacement plans* ~401K members HDHP/HSA ~ 882K members ~75K members HDHP only * >1,000 lives Aetna’s HRA/HSA growth 1/02 – ~482 1/03 – ~39K 1/04 – ~160K 1/05 – ~359K 1/06 – ~463K 1/07 – ~826K 1/08 – ~1.29M As of 12/2008 *HRAs and HSAs are currently not available to HMO members in Illinois 21 Plan sponsor tools Cost modeling Pricing tool Reporting ©2009 Aetna 22 Consumer tools Aetna Navigator® Plan Selection & Cost Estimator Tool ©2009 Aetna 23 Consumer tools DocFind® Hospital Comparison Tool Plan Selection & Cost Estimator Transparency Suite of Tools – Price and Clinical Quality Cost of Care Tool Healthwise® Knowledgebase Informed Health® Line Aetna InteliHealth® Simple Steps To A Healthier Life® ©2009 Aetna 24 Keys to success Set a strategy Appropriate benefit structure, information and tools A business culture actively communicating health care engagement concepts Member responsibility $750 - $1000 bridge between deductible and employer fund/account contribution with appropriate coinsurance Update benefit offerings regularly to stay in-sync with the overall strategy Engagement Multi-year, cost controlling strategies that engage employees in managing their health Provide information and tools for decisions about health, spending and overall wellness ©2009 Aetna 25 Keys to success Wellness Preventive care covered at 100% In-depth education and communication including completion of Health Assessments Steerage to CDHP CDHP as the lowest cost option Lowering the required employee premium contribution and/or offer higher fund/account contribution ©2009 Aetna 26 Engaging your employees and enabling behavior Four phases to an effective communications strategy 1 2 3 4 Pre-Enrollment Enrollment Post-Enrollment Ongoing support Engage Management Contribution strategy Reinforce Motivate employees Advantages/Features Educate Remind Keep them engaged Employee role Emphasize accountability Update Reintroduce resources ©2009 Aetna 27 Why Aetna? Experience Innovation Consumer communication and education Integration Plan design Analysis and reporting ©2009 Aetna 28 Join the Change Healthier employees + + = Higher levels of engagement Innovative, client-centered solutions Lifelong optimal health Lower medical costs Higher productivity Ready today for the future of health care 29 This material is for information only. Providers are independent contractors and are not agents of Aetna. Provider participation may change without notice. Aetna does not provide care or guarantee access to health services. Aetna HealthFund HRAs are subject to employer-defined use and forfeiture rules, and are unfunded liabilities of your employer. Fund balances are not vested benefits. Investment services are independently offered through JPMorgan Institutional Investors, Inc., a subsidiary of JPMorgan Chase Bank. Health information programs provide general health information and are not a substitute for diagnosis or treatment by a physician or other health care professional. Information is believed to be accurate as of the production date; however, it is subject to change. For more information about Aetna plans, refer to www.aetna.com. Policy forms issued in OK include: HMO OK COC-5 09/07, HMO/OK GA-3 11/01, HMO OK POS RIDER 08/07, GR-23 and/or GR-29/GR-29N. Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies, including Aetna Health Inc., Aetna Health of California Inc., Aetna Health of the Carolinas Inc., Aetna Health of Illinois Inc., Aetna Health Insurance Company of New York, Aetna Health Insurance Company and/or Aetna Life Insurance Company (Aetna). In Maryland, by Aetna Health Inc., 151 Farmington Avenue, Hartford, CT 06156. Each insurer has sole financial responsibility for its own products. ©2009 Aetna Inc. 32.25.102.1 (3/09) 30 Appendix ©2009 Aetna 31 HRA* Workflow (Medical HRA* pays first) Member sees Provider - presents ID card (no copay) - Member pays $0 Is there enough money in the HRA Fund to cover the Member responsibility? No Provider bills Aetna. Aetna pays Provider whatever it can, if anything, from the Fund and tells the Provider the exact amount to bill the Member. Yes Provider bills Member. HRA$ Member pays Provider. Aetna pays Provider directly from the Fund. Member owes $0. *HRAs are currently not available to HMO members in Illinois. 32 Aetna adjudicates claim and determines what the Member owes. HRA* – how it works The Plan Pays 10% *HRAs are currently not available to HMO members in Illinois. 33 30% HRA* – how it works Member Responsibility 10% *HRAs are currently not available to HMO members in Illinois. 34 30% HRA* – how it works The Plan Pays Fund Member Responsibility 10% *HRAs are currently not available to HMO members in Illinois. 35 30% HRA* – how it works The Plan Pays Fund Member Responsibility Fund Helps Pay 10% *HRAs are currently not available to HMO members in Illinois. 36 30% HRA* example year 1 ** 10% *HRAs are currently not available to HMO members in Illinois. ** For illustrative purposes only. Does not reflect events experienced by an actual participant. 37 30% HRA* example year 1 ** 10% *HRAs are currently not available to HMO members in Illinois. ** For illustrative purposes only. Does not reflect events experienced by an actual participant. 38 30% HRA* example year 1 ** 10% *HRAs are currently not available to HMO members in Illinois. ** For illustrative purposes only. Does not reflect events experienced by an actual participant. 39 30% HRA* example year 2 ** 10% *HRAs are currently not available to HMO members in Illinois. ** For illustrative purposes only. Does not reflect events experienced by an actual participant. 40 30%