GS-98-437 A RANDOMIZED, DOUBLE-BLIND, PLACEBO

advertisement

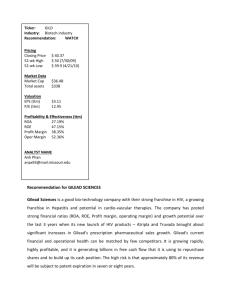

AAAS Science and Human Rights Coalition July 26, 2010 Gregg Alton Executive Vice President Corporate and Medical Affairs About Gilead Sciences Worldwide presence – 4,000 employees – 25 offices on 4 continents 13 marketed drugs – Primary therapeutic focus in HIV/AIDS, liver disease and serious cardiovascular and respiratory conditions Eight successful acquisitions – Expanding company’s therapeutic reach Strong Geographical Presence Norway Edmonton, Alberta Mississauga, ON Ireland U.K. The Netherlands Germany Austria Belgium Branford, CT France Durham, NC Finland Denmark Turkey Italy Greece Portugal San Dimas, CA Sweden China Switzerland Spain Foster City, CA Palo Alto, CA Australia Seattle, WA New Zealand LEGEND Gilead Locations Research and Development Locations Manufacturing Operations Sales and Marketing Operations Regional Partners to Support Registrations, Product Distribution and Medical Education Delta Medicopharmacia Puerto Rico Pharma IDS Quadri Nicholas Piramal Stendhal Traphaco Aspen* Anspec Gador 11 Distributors and 48 Sub-Distributors Reaching 130 Countries *Manufacturing and Distribution for Africa, in Africa Our Therapeutic Areas HIV/AIDS Atripla Truvada Viread Emtriva Truvada/rilpivirine FDR (Ph III) Quad (Ph III) Elvitegravir (Ph III) Cobicistat (Ph III) Liver Disease Cardiovascular Respiratory HBV Heart Disease Influenza Hepsera Viread Ranexa Lexiscan Regadenoson (filed with EMEA) Ranolazine (Ph II) Tamiflu HCV GS 9190 (Ph II) GS 9256/GS 9190 (Ph I) CF Cayston Aztreonam (Ph III) PAH Letairis Cicletanine (Ph II) Bronchiectasis Aztreonam (Ph II) NASH Metabolic GS 9450 (Ph II) GS 9667 (Ph I) IPF Ambrisentan (Ph III) Pulmonary GS 6201 (Ph I) Evolution of Fixed-Dose Combinations GlaxoSmithKline Zidovudine (AZT; 1987) Combivir® (AZT/3TC;1997) Trizivir® (ABC/AZT/3TC; 2000) Lamivudine (3TC; 1995) Abacavir (ABC; 1998) Epzicom® (3TC/ABC; 2004) Gilead / Bristol-Myers Squibb / Merck Tenofovir (TDF; 2001) Emtricitabine (FTC; 2003) Efavirenz (EFV; 1998) Truvada® (FTC/TDF; 2004) Atripla® (EFV/FTC/TDF; 2006) 2006: Single Tablet Regimen Approved 1996 2006 30+ Pills a day Introduction of Atripla® HIV Pipeline – Addressing Unmet Needs Truvada/rilpivirine fixed-dose regimen – Would be only second single-tablet regimen for HIV – Safer for use in pregnant women – Fewer CNS side effects Cobicistat (novel PK enhancer) – No HIV activity – Good chemical stability (heat stable) – Enabling once-daily dosing of elvitegravir (integrase inhibitor) – Broader role with protease inhibitors for tolerable and safe combination therapy HIV Research – New Targets Active early-stage, preclinical research program identifying compounds that may inhibit HIV at newer targets in the virus’ life cycle – LEDGF Inhibitors – Capsid Assembly Inhibitors Exploring strategies and compounds to eradicate HIV in latently infected cells – Eliminate cells actively replicating HIV – Infection by newly produced virus particles blocked by ARVs D. D. Richman et al., Science 323, 1304 -1307 (2009) Worldwide Impact of HIV/AIDS UNITED STATES DEVELOPING WORLD ~1 million infected ~33 million infected 56,300 new infections per year 2.7 million new infections per year 3 million years of human life saved Life expectancy in sub-Saharan Africa: 51 Life expectancy upon entering care: 24+ Without AIDS, life expectancy would be 62 Gilead Access Program Particular focus on countries hardest hit by the HIV/AIDS epidemic – 130 countries – Including all of Africa Pricing tiers – Based on a country’s economic status and HIV prevalence Support for: – – – – Regional distributors Supply chain tools Medical education Product registrations Access Initiatives – Generic Partnerships Goal: Achieve the lowest price for least developed countries Rationale: Indian manufacturers have proven track record in delivering high volume/low margin quality products Parameters: – Full technology transfer to speed production and ensure quality – Develop any tenofovir-based FDC or pediatric formulation – Free to sell API within India with no royalty payment to Gilead – Free to set own price for finished product – Distribute within India and 94 other countries, pay 5% royalty to Gilead – Seek WHO or tentative FDA approval Expanding Access to HIV Treatment: Lower Prices, More Patients 800,000 702,911 $17.00 700,000 $16 600,000 $14 508,103 $12.42 500,000 $12.00 $12 400,000 $10 300,000 $8.25 $8 $7.25 $6 31,000 200,000 100,000 129,279 $4 0 2006 2007 2008 2009 2010 # patients reached Lowest generic price/month $18 Price Patients Case Study: Matrix 55 Countries covered by Matrix – 58% of licensed territory The Cost of Viread COST OF VIREAD TABLET (PER DAY) $0.57 $1.00 $1.75 $4.00 15% Dist. Margin Cost of manufacturing, pre-distribution, pharmacovigilance, medical education + 5% royalty $17.13 Intellectual Property Return on investment, incentive for innovation $21.43 Model is Financially Self-Sustaining FY 2009 FY 2008 Total Revenue (in $,000) 33,117 19,365 Total COGS (in $,000) 25,959 16,809 Operating Expenses (in $,000) 3,556 4,243 Total Contribution Margin (in $,000) 3,601 (1,688) Total Contribution Margin (as % of Total Revenue) 10.9% -8.7% Full Year 2010 Guidance ($ in millions, except percentages and per share amounts) Provided on 4/20/10 Net Product Sales $ 7,400 – 7,500 Updated on 7/20/10 $ 7,300 – 7,400^ 75% – 77% 75% – 77% R & D* $ 850 – 870 $ 850 – 870 S G & A* $ 900 – 920 $ 900 – 920 Non-GAAP Product Gross Margin* Non-GAAP Expenses Effective Tax Rate Diluted EPS Impact of Acquisition, Restructuring and Stock-Based Compensation Expenses 25% – 26% 26.5% – 27.5%^^ $ 0.27 – 0.30 $ 0.25 – 0.28^^^ ^ Reduction in net product sales guidance for full year 2010 was driven by the impact of foreign currency fluctuations. ^^ Increase in effective tax rate for full year 2010 was driven by higher U.S. revenue growth and lower revenues in Europe. ^^^ Decreases in diluted EPS impact of acquisition, restructuring and stock-based compensation expenses for full year 2010 was driven by lower projections of stock-based compensation expenses, partially offset by higher restructuring expenses related to our decision to close operations in Durham, North Carolina. * Non-GAAP product gross margin and expenses are non-GAAP and exclude the impact of acquisition, restructuring and stock-based compensation expenses, where applicable. Management believes this non-GAAP information is useful for investors, taken in conjunction with Gilead’s GAAP financial statements, because management currently uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under U.S. GAAP. Looking Ahead Continued commitment to R&D – new targets, new treatments for HIV Expand Gilead Access Program – Build on existing generic partnerships – As approved, introduce new products into program (e.g., TMC278 fixed-dose regimen) UNITAID Patent Pool – Gilead is actively participating in discussions to move this important initiative forward – Like partnerships with generic manufacturers, a patent pool could increase access by lowering prices, while respecting IP Evaluate participation in new efforts for expanding access while encouraging innovation Thank You