Click to add title - Kapnick Insurance Group

advertisement

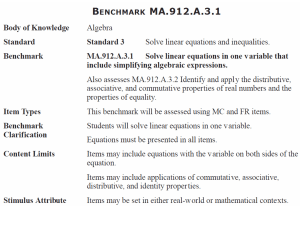

Simplifying Insurance Surviving a Department of Labor (DOL) Audit Insurance | Employee Benefits | Risk Management | Financial Strategies simplifying Insurance | Background The Employee Retirement Income Security Act of 1974 (ERISA) establishes reporting provisions and participant requirements for all private employer health & welfare benefit plans. Expanded several times to include other health laws. COBRA, HIPAA DOL enforces ERISA simplifying Insurance | General ERISA Requirements Plan Document A Plan Document is the written document(s) describing plan terms and conditions, including some general ERISA-required provisions Includes insurance contracts, policies, riders and third party administrator (TPA) service agreements Must be distributed upon request (within 30 days after written request, to avoid penalties). simplifying Insurance | General ERISA Requirements Summary Plan Description (SPD) A SPD is the written document(s) summarizing the plan (WRAP is the common format as most benefit books do not contain all the required items) Time frames for distribution: upon plan enrollment; and every 5 years (plan has been modified) or every 10 years (no plan modifications) Must be distributed to participants and any beneficiaries entitled to benefits simplifying Insurance | General ERISA Requirements Summary of Material Modifications (SMM) A SMM is the written document summarizing the changes to the SPD Must be distributed within 210 days after the end of the plan year If an updated SPD is distributed, no SMM is required Must be distributed to participants and any beneficiaries entitled to benefits simplifying Insurance | General ERISA Requirements Summary of Material Reduction in Covered Services/ Benefits (SMR) A SMR is the written document summarizing the reductions to the health (medical) plan Must be distributed within 60 days Must be distributed to participants and any beneficiaries entitled to benefits simplifying Insurance | General ERISA Requirements Annual Report An Annual report is the 5500 filed with the DOL and Internal Revenue Service (IRS) disclosing financial aspects of the plan Exemption for small plans with less than 100 participants at the beginning of the plan year Must be filed annually within 7 months of the end of the plan year; and Must be distributed to participants upon request simplifying Insurance | General ERISA Requirements Summary Annual Report (SAR) A SAR is the written document summarizing the Annual Report (5500) Must be distributed within 60 days of the 5500 filing Must be distributed to participants and any beneficiaries entitled to benefits simplifying Insurance | General ERISA Requirements Internal and External Claims and Appeal Procedures These are the written document(s) describing the procedures for claims and appeals Generally distributed by the insurer or TPA Recommendation: Include PPACA amended language in all WRAP documents Must be distributed to participants and any beneficiaries entitled to benefits simplifying Insurance | General ERISA Requirements COBRA Requirements Initial COBRA notice COBRA election notice Notice of unavailability of COBRA Notice of COBRA early termination Exemption for Government & Church plans and small plans (less than 20 employees) Specific timing and distribution requirements for bullets 1-4 simplifying Insurance | General ERISA Requirements HIPAA Portability Requirements Certificate of Creditable Coverage This is the document that certifies the time the participant was covered under another group health plan Must be distributed upon loss of coverage (generally distributed by the insurer or TPA) Must be distributed to participants and beneficiaries who lose coverage simplifying Insurance | General ERISA Requirements HIPAA Portability Requirements cont. Notice of Preexisting Condition Exclusion Must be distributed with enrollment materials Must be distributed to participants Individual notice must be distributed to participants who present a certificate of creditable coverage Notice of Special Enrollment Rights This is the document that describes all of the special enrollment rules (marriage, birth, etc.) Must be distributed prior to or during enrollment to all covered employees simplifying Insurance | General ERISA Requirements Misc. Notices Women’s Health and Cancer Rights Act Must be distributed with initial enrollment materials (all covered employees) and annually (participants) Newborns’ and Mothers’ Health Protection Act Must be distributed with initial enrollment materials (all covered employees) and annually (participants) simplifying Insurance | General ERISA Requirements Misc. Notices cont. CHIPRA Must be distributed annually to all employees Michelle’s Law Must be distributed at the time that a plan requires certification of student status to any applicable participants HIPAA Wellness Program Must be distributed if there is a reward based on outcome annually to all employees simplifying Insurance | General ERISA Requirements Misc. Notices cont. Medical Child Support Order Must be distributed upon receipt and qualification to the applicable participant USERRA Needs to be posted in the workplace (no distribution requirement if posted) FMLA Notice and Written Guidance Needs to be posted in the workplace (no general distribution requirement if posted) Must be distributed to any applicable participants simplifying Insurance | General ERISA Requirements Misc. Notices cont. HIPAA Privacy and Security Notice of Privacy Practices Notice of Breach of unsecured PHI Specific timing and distribution requirements for the above items PPACA Grandfather Status If any part of the plan is grandfathered, this must be distributed whenever plan information is provided Must be distributed to all participants simplifying Insurance | General ERISA Requirements Misc. Notices cont. GINA Needs to be posted in the workplace (no general distribution requirement if posted) W-2 Reporting of Health Insurance Aggregate cost of coverage must be disclosed Effective beginning January 2013 for 2012 coverage Summary of Benefits Coverage (SBC) and Advance Notice of Mid-Year Changes Look for an update on this soon! simplifying Insurance | Penalties Generally $110/ day per participant who requests the document (SPD, SAR, all notices, etc.) Penalties can be increased if the issue is brought before the court Special Exceptions: 5500- Up to $1,100/ day per return HIPAA Breach- Specific (significant) penalties simplifying Insurance | Conclusion Questions?