2.1

advertisement

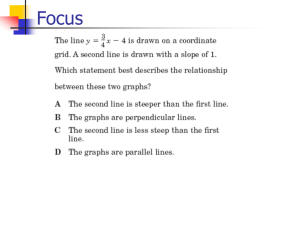

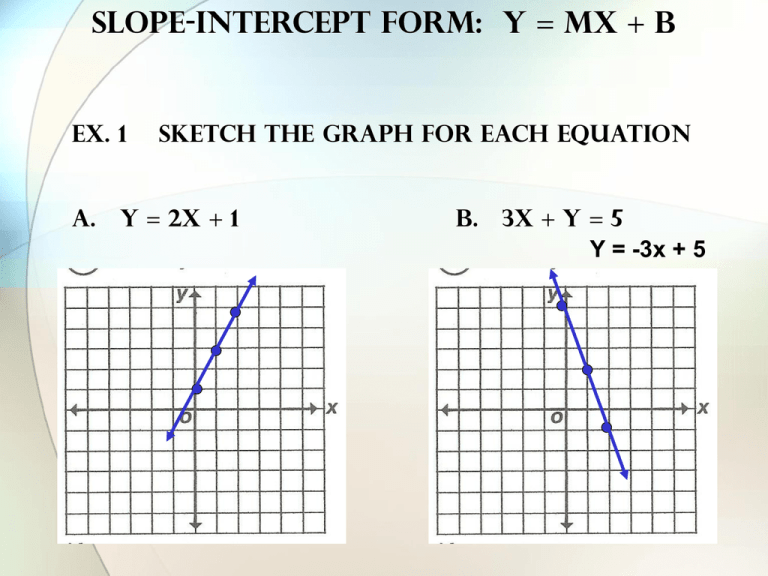

Slope-intercept form: y = mx + b Ex. 1 a. Sketch THE graph for each equation Y = 2x + 1 b. 3x + y = 5 Y = -3x + 5 Slope of horizontal line: 0 Slope of vertical line: undefined Slope of a line: yy xx Ex. 2 find the slope of the line passing through each pair of points a. (-2, 0) and (3, 1) 1 0 3 2 b. (3, 4) and (3, 1) 4 1 33 1 5 3 0 undefined Point-slope form: y – y1 = m(x – x1) Ex. 3 find the lope-intercept form of the equation of the line that has slope of 5 and goes through (4, -7) Y – –7 = 5(x – 4) Y + 7 = 5x – 20 Y = 5x – 27 Slope of parallel lines: same Slope of perpendicular lines: neg. reciprocal Ex. 4 Find the slope-intercept forms of the equations of the lines that pass through the point (3, -5) and are (a) parallel and (b) perpendicular to the line 2x – 3y = 5 2x – 3y = 5 – 3y = –2x + 5 y = 2/3x + 5/3 (B) Perpendicular y – – 5 = –3/2(x – 3) (A) Parallel y – – 5 = 2/3(x – 3) y + 5 = 2/3x – 2 y = 2/3x – 7 y + 5 = –3/2x + 9/2 y = –3/2x – 1/2 Ex. 5 The maximum recommended slope of a wheelchair ramp is 1/12. A business is installing a wheelchair ramp that rises 22 inches over a horizontal length of 24 feet. Is the ramp steeper than recommended? Ramp is not steeper 1/12 = 0.0833 slope vertical change horizontal change 22 in 0.076 288 in Ex. 7 A college purchased exercise equipment worth $12,000 for the new campus fitness center. The equipment has a useful life of 8 years. The salvage value at the end of 8 years is $2000. Write a linear equation that describes the book value of the equipment each year. (0, 12000) and (8, 2000) slope 12000 2000 08 10000 8 $1250 V – 12000 = –1250(t – 0) V = –1250t + 12000 Ex. 8 The sales per share for Starbucks Corporation were $6.97 in 2001 and $8.47 in 2002. Using only this information, write a linear equation that gives the sales per share in terms of the year. The predict the sales per share for 2003. y – 6.97 = 1.5(x – 1) y = 1.5x + 5.47 (1, 6.97) and (2, 8.47) slope 8.47 6.97 2 1 1.5 1.5 1 y = 1.5(3) + 5.47 y = 9.97 $ 9.97 per share in 2003 (estimate based on our equation) $ 10.35 per share in 2003 (actual)