Chapter4 Collection

advertisement

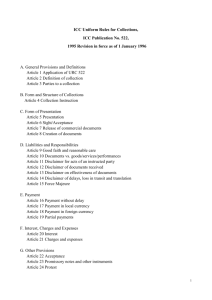

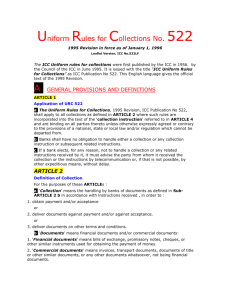

International Settlement L/O/G/O Chapter four Collection • • • • • • • • The concept of collection Basic parties to a collection Procedures of a collection Documents in collection Types of collection Terms of releasing documents Risks involved and protection URC522 The concept of collection • URC522 Art.2 collections means the handling by banks, on instructions received, of documents, in order to: 1)obtain acceptance and/or payment; 2)deliver commercial documents against acceptance or payment; 3)deliver documents on other terms and conditions. 指由接到委托指示的银行处理金融单据和/或商业单据以便取得付 款/承兑,或凭付款/承兑交出商业单据,或凭其它条件交出单据。 • Collection is an arrangement whereby the seller draws a draft on the buyer , and /or shipping documents are forwarded to his bank, authorizing it to collect the money from the buyer through its correspondent bank . 指债权人(出口人)出具债权凭证(汇票等)委托银行向债务人 (进口人)收取货款。 • 银行参与仅是利用其资金划拨渠道,提供完善服务,并无收妥保 证,商业信用基础。 Basic parties to a collection • 委托人 principal--seller(drawer) collection application • 托收行 remitting bank/寄单行 collection instruction • 代收行 collecting bank • 提示行 presenting bank • 付款人 payer - buyer (drawee) • 需要时的代理 principal’s representative in case of need Collection application • It serves as the contract between the principal and the remitting bank,and should expressly indicate the intention and requirement of the principal. • Content: details of the principal and drawee a list of documents Amount and currency to be collected terms of releasing documents 交单条件 disposal of proceeds upon collection票款收妥后代收行汇交 托收款的方式 store and insure clause when documents are not taken up on arrival of goods 仓储&保险 bank and other charges银行费用 about protest in the event of dishonor designating collecting bank 指定代收行 托收行在缮制托收指示书时,应将交款指示明确、清楚地表达 出来。交款指示是托收行对代收行在款项收妥后如何汇交的指示。 如果托收行在代收行设有账户 collection instruction:upon collection,please credit the proceeds to our account with you under airmail/cable advice to us. 如果代收行在托收行设有账户 collection instruction:Please collect proceeds and authorize us by airmail/cable to debit your account with us. 托收行与代收行之间没有帐户,托收行在国外X银行开立帐户 请代收行将收妥款项汇至X银行,贷记本行帐户,并请该行以电 报或航邮通知我行。 please collect and remit the proceeds to x Bank for credit of our account with them under their cable/airmail advice to us. Procedures of a collection Documents in collection • Collection draft Payee: Blank endorsement Special endorsement 1)drawer/principal remitting bank collecting bank 2)remitting bank collecting bank pay to the order of remitting bank Endorsement: for collection pay to the order of collecting bank, for remitting bank,signature 3)collecting bank Drawn clause: Drawn against shipment of *** from *** to*** for collection for payment on demand, draft is not necessary • Bill of lading consignee:to order/to order of shipper Types of collection • 光票托收(clean collection) Collection on financial instruments only,sometimes accompanied by invoice,etc. Documents are sent directly by the exporter to the importer. The exporter is in fact shipping on open-account terms. Payment instrument: a draft, a check or a money order, the tenor of which can be at sight or a future time. • 跟单托收(documentary collection) Collection on financial documents being accompanied by commercial documents or collection on commercial documents without financial documents. Only the draft drawn is paid or accepted, will the documents be released to the importer. • 直接托收(direct collection) an arrangement whereby the seller obtains his bank’s prenumbered direct collection letter, thus enabling him to sent his documents directly to his bank’s correspondent bank for collection. 是委托人以从托收行获取的托收表格为基础,直接将托收单据 和托收表格寄给代收行, 代收行将委托人直接寄送的单据视同由托收行寄出。 Terms of releasing documents • 付款交单(documents against payment, D/P) 即期付款交单(D/P at sight) 远期付款交单(D/P at … days after sight) • 承兑交单(documents against acceptance, D/A) • 凭其他条件交单(documents against other terms and conditions) Documents against payment the collecting bank is allowed to release the documents to the drawee only against full and immediate payment • D/P at sight sight draft; pay on presentation for documents “upon first presentation the buyers shall pay against documentary draft drawn by the sellers at sight. The shipping documents are to be delivered against payment only.” • D/P at a fixed time after sight time draft; first presenting for acceptance;when the accepted draft matures, presenting it for payment, then releasing document to buyer. 一般是为避免在运输途中买方资金的占压,远期期限以货物 运输的在途时间为宜。 Procedures contract Drawer 1)Documents, draft and application 7)payment Remitting bank Drawee 3)Presenting draft 2)Documents,draft and Collection instruction 6)payment 4)pay/ accept pay Presenting for payment Collecting bank Red letter stands for D/P at a fixed time after sight 5)release documents Documents against acceptance The collecting bank is allowed to release the documents to the drawee only against the acceptance of a draft. the exporter extends credit to the importer. Drawer 1)Documents, draft and application contract Drawee 5)docu 7)payment 3)Presenting 9)payment -ments draft 4)Accept 6)present -ing for 2)Documents,draft and payment Collection instruction Remitting bank 8)payment Collecting bank Documents against other terms • 部分凭即期付款,其余凭承兑远期汇票交单 ( Delivery of documents against partial payment) “Delivery of documents against part of collection to be paid at sight and the balance by the way of the acceptance of a separate draft payable at a future date .” • 凭本票交单(against P/N) • 凭付款承诺交单(against letter of undertaking to pay) • 凭信托收据交单(against trust receipt) • 凭保函交单(against letter of guarantee) Risks involved to an exporter • Non-acceptance or payment by the importer for a significant drop in market price of the imported goods • Operational risks of the importer • Exchange restrictions • Risks relating to insurance • Special collections customs in different countries Protection against risks • Investigate the reputation and financial standing of the importer • Market trend of exported goods in importing country • Take into account the foreign exchange regulations and the economic and political conditions in the importing country • Pay attention to the local collection customs or usages • Better conclude a deal under CIF URC522 • 《托收统一规则》(国际商会出版物第522号出版 物)是托收业务使用的国际惯例。 • 国际商会为调和托收有关当事人之间的矛盾,以 利商业和金融活动的开展,于1967年拟定《商业 单据托收统一规则》,并建议各国银行采用。此 后国际商会对该规则一再进行了修订,并改名为 《托收统一规则》。 • 其内容包括:总则与定义,托收的形式和结构, 提示的形式,义务和责任,付款,利息、手续费 和开销以及其他条款等共26个条款。 解释和说明: • 凡在托收指示书中注明按URC522行事的托收业务,本规则对有关当 事人均具有约束力。 • 除非事先已征得银行同意,货物不应直接运交银行,也不得以银行 或其指定人为收货人。否则此项货物的风险和责任由发货方承担。 • 银行必须确定所收到的单据与托收指示书所列的完全一致,除此之 外,银行没有进一步审核单据的义务。 • 托收如被拒绝付款或拒绝承兑,代收行行必须毫不延迟地向发出托 收指示书的银行通知,托收银行须在合理时间内对代收银行作出处 理有关单据的指示,如在送出拒付通知60天内仍末接到该项指示时, 可将单据退回托收银行,而不负任何责任。 • 托收不应含有凭付款交付商业单据指示的远期汇票。 • 托收指示书中明确且完整地注明需要时代理人的权限。 • 对托收费用、利息、部分付款、拒绝证明、托收情况的通知等问题 具体的规定。 • 银行免责和不可抗力的规定 案例1: 我某外贸公司与某国A商达成一项出口合同, 付款条件为D/P45天付款。当汇票及所附单据通过托 收行寄抵进口地代收行后,A商及时在汇票上履行了 承兑手续。货抵目的港时,由于用货心切,A商出具 信托收据向代收行借得单据,先行提货转售。汇票到 期时,A商因经营不善,失去偿付能力。代收行以汇 票付款人拒付为由通知托收行,并建议由我外贸公司 直接向A商索取货款。 代收行有责任,但托收行没有责任,要由我出 口方直接向代收行追索货款。 案例2 某地B公司与国外贸易公司成交一笔业务,在交易会 上口头商定即期付款L/C结算,签订合同时支付条款规定“payment by draft drawn on buyer payable at sight”。另外合同中规定 “quality certificate by CCIB at loading port to be taken as final”。B公司按合同规定备妥货物,但始终未见买方开来的L/C, 于是6月20日去电催证。但买方复电称合同规定并非L/C结算,是以 即期付款交单方式办理托收。B公司随即核对合同,发现未明确L/C 结算。双方几经交涉,但由于买方的外汇正在申请中,无法在装运 期前开立L/C,最后接受买方D/P45天托收,并由买方负担45天的利 息。 B公司按期装运货物后,与7月25日交单办理托收,并在托收指 示书中规定45天的利息与货款一并收取。9月20日接到托收行通知, 该笔托收款已收到,但付款人拒付利息。B公司随即发电向买方追究, 而买方回电说提货后发现货物有部分霉变,以未付利息弥补霉变损 失。 B公司发现买方已提取货物,说明代收行早已放单给买方,即通 过托收行欲向代收行提出责问。试问会有怎样结果和教训? 提示: 签订合同时要慎重,合同条款要完整、详细和准确; 交易行为规范化 关于货物品质的问题; 熟悉国际惯例 关于利息,URC522规定,如规定应收 取利息, 而付款人拒付时,除非托收指示书上明确规定利 息不得免除,提示行可视情况在未收取利息条件下交单。