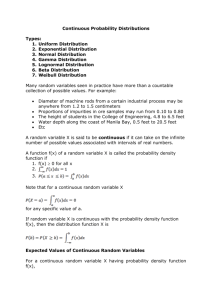

PowerPoint: More Continuous Distributions.

advertisement

More Continuous Distributions Beta Distribution • When modeling probabilities for some proportion Y, 0 < Y < 1, consider the Beta distribution: ya 1 (1 y ) b 1 ,0 y 1 f ( y ) B (a , b ) 0, otherwise for parameters a, b > 0, where (a )( b ) B(a , b ) (a b ) Beta D ens ity f unct ion, dbeta(x , 3, 4) 2 f ( x) 1 0 0 0.5 1 x 1.5 A Useful Identity • Since this is a density function, we know 1 ya 1 (1 y) b 1 dy, B(a , b ) 1 0 or equivalently, 1 0 a 1 y (1 y) b 1 (a )( b ) dy B(a , b ) (a b ) which is easy to compute when a and b are integers. Mean, Variance for Beta • If Y is a Beta random variable with parameters a and b, the expected value and variance for Y are given by E (Y ) a ab ab V (Y ) (a b )2 (a b 1) Cumulative? • For the special case when a and b are integers, it can be shown that the cumulative probabilities can be determined using binomial coefficients. n F ( y) Cn,i ( y)i (1 y) ni , i a where n a b 1. Beta and the Binomial • Show that the following density function is for a Beta distribution. Determine a and b. 12 y 2 (1 y), 0 y 1 f ( y) 0, otherwise • Show that F (0.4) 0.1792 …using integration or using the binomial probabilities. The Lognormal Distribution • Unlike the normal curve, it’s not symmetric. • May be appropriate for modeling “insurance claim severity or investment returns”. • If Y is lognormal, then ln(Y) has the normal distribution. Lognorm al Dens it y f unc tion, dlnorm(x, 4, 1.1) f ( x) 0.01 0 0 100 x 200 Lognormal Mean, Variance • If ln(Y) is a normal random variable with mean m and variance s 2, then Y is lognormal with mean and variance given by: E (Y ) e V (Y ) e m (s 2 / 2) 2 m s 2 e s2 1 Lognormal Probabilities • Suppose Y is lognormal and ln(Y) = X where X ~ N(m,s). Then the cumulative probability F (Y ) P(Y c) P( X ln(c)) FX (ln(c)) may be computed using the z-score and the table of standard normal probabilities. If claim amounts are modeled using a lognormal random variable Y = eX, where X ~ N(7, 0.5 ). Find the probability P( Y < 1400 ). Pareto Distribution • For modeling insurance losses, consider the Pareto distribution with density function a 1 ab f ( y) b y , for a 2 and y b 0 and distribution function a b F ( y ) 1 , for a 2 and y b 0 y Suppose there is a deductible on the policy, so values of y less than b are not filed. Pareto Distribution • If Y is a Pareto random variable with parameters a and b, the mean and variance given by: ab E (Y ) a 1 2 2 ab ab V (Y ) a 2 a 1 Weibull Distribution • When there was a constant failure rate l, we often model the time between failures using an exponential distribution with mean 1/ l. • If the failure rate increases with time or age, consider using a Weibull distribution a 1 b xa f ( y) ab ( x) e , for x 0, with a 0, b 0 b xa F ( y) 1 e , for x 0. Weibull Mean, Variance • If Y is a Weibull random variable with parameters a , b 0, the mean and variance are given by: E (Y ) V (Y ) (1 a1 ) b 1/ a 1 b 2 /a (1 2 a ) (1 a ) 1 2 Weibull Distribution • Note that for a = 1, the Weibull distribution agrees with the exponential distribution. a 1 b xa f ( y) ab ( x) e = be But when a > 1, the Weibull distribution yields a higher failure rate for larger x (i.e., failure rate increases with age). b x when a 1 W eibull dens it y f unc tion, dweibull(x , 2) 1 f ( x) 0.5 0 0 2 x 4 Failure Rate • A “failure rate” function is defined by f (t ) l (t ) 1 F (t ) For a time interval t < T < t + h , we consider this as f (t )dt P(t T t h) l (t )dt 1 F (t ) P(T t ) …the probability of failing in the next h time units, given the part (or person) has survived to time t. Thus, l(t) is thought of as failures per unit time. Comparing Failure Rate • For the exponential distribution f (y) = le-ly, we note f (t ) le l (t ) lt l is constant. 1 F (t ) e lt Comparing this to the Weibull distribution, a 1 b xa f (t ) ab x e l (t ) b xa 1 F (t ) e ab x a 1 …so here the failure rate is increasing with x, if a > 1. Moment Generating • As with discrete distributions, we can define moment generating functions for continuous random variables, m(t ) E[e ] e f ( y)dy ty ty y such that the moments of Y are given by k d [m(t )] E (Y k ) dt t 0 Some common MGFs • The MGFs for some of the continuous distributions we’ve seen include: 1 l 1 exponential: m(t ) , where b 1 bt l t l gamma: m(t ) (1 b t ) a chi-square: m(t ) (1 2t ) / 2 • Note that not all distributions have a MGF that can be written in a nice and tidy, closed-form expression.