Mineral Rights

advertisement

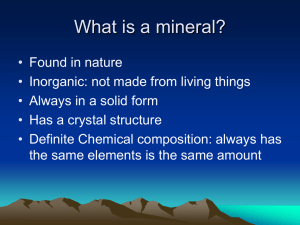

Mineral Rights Mineral Rights Valuation • Mineral rights consist of the right to extract all minerals contained in or below the surface of a property. • Mineral and surface rights can be separated creating a “mineral estate.” • The mineral estate represents the dominate tenant in most states. • The owner of the mineral estate has the right to occupy the amount of surface area necessary to extract the minerals. • However, the mineral rights holder must pay the surface owner any damages. • Minerals include: – sand and gravel – precious metals – building stone – gem stones – oil and gas • Water rights are separate to mineral rights and are not included in the mineral estate • Valuations of minerals fall into two broad categories – Operating units with delineated reserves – Prospects • Analysis of sales of similar properties is the most desirable method for valuing minerals; however, it is often difficult to perform because minerals are seldom sold apart from the surface. • Appraisers typically estimate leased fee value or the contribution to the surface estate if the minerals are being leased. Mineral Reserves • Reserves are the volume of accessible mineral material of acceptable quality that will produce a return, after operating expenses, under present economic conditions. • Reserves may be classified as: – Proven – Probable – Possible Proven Reserves • To value mineral properties several basic items are needed: – The amount and quality of the reserves – The extraction rate or production life – The net value per unit extracted – A discount rate based on investment rates • The income approach is a good method to value mineral-producing properties. • The discounted cash flow – net present value technique is generally used. Probable or Possible Reserves • Non-operating reserves are more difficult to value. • The sales comparison approach where properties with mineral interest have sold is useful in valuing probable or possible reserves.