Preventing Land Loss in Coastal Louisiana: Estimates of WTP and

advertisement

Preventing Land Loss in

Coastal Louisiana:

Estimates of WTP and WTA

Dan Petrolia & Ross Moore

Mississippi State University

Tae-goun Kim

Korea Maritime University

2010 CNREP Conference, New Orleans, May 26-28

Abstract

A dichotomous-choice contingent-valuation survey was conducted

on a sample of Louisiana households to estimate compensating

surplus (CS) and equivalent surplus (ES) welfare measures for the

prevention of future coastal wetland losses in Louisiana

Valuations were elicited using both WTP (tax) and WTA

compensation (tax refund) payment vehicles

PV of welfare estimates were very sensitive to discount rates, but

were estimated in the neighborhood of $9,000 per LA household

for CS (WTP) and $21,000 for ES (WTA)

The results of a probit model using a Box-Cox specification on

income indicate that the major factors influencing support for

land-loss prevention were:

perceived hurricane protection benefits (positive)

environmental and recreation protection (positive)

distrust of government (negative)

income

age (positive)

race (positive for whites)

Motivation

Louisiana’s 3 million acres of wetlands represent about 40% of coastal

wetlands in U.S.

Coastal LA lost 1,900 miles2 between 1932 and 2000 (USGS 2003)

Katrina and Rita eliminated an additional 217 miles2 in 2005 (Barras 2006)

Additional 700 miles2 expected to be lost over next 50 years (USGS 2003)

Several reports have been published over the last decade to heighten

awareness of these losses and to identify solutions

Ongoing restoration projects: CWPPRA & state

but account for about 80% of losses (USGS 1995).

As of 2006, an estimated 32,345 acres of coastal land had been re-established

under CWPPRA, at cost of $624.5 million

Most projects are small and independent; do not appear to be part of a

comprehensive coast-wide restoration strategy called for in reports.

Cost estimates for a comprehensive strategy:

from as low as $1.9 billion over 10 years for a scaled-down version of the Coast 2050

plan (National Research Council 2006),

to $14 billion over 30 years for the full-blown Coast 2050 plan (LCWCR Task Force 1998),

to as much as $100 billion (Winkler-Schmit 2009).

Prior work on Wetland Valuation

Brander, Florax, and Vermaat (ERE 2006)

Woodward and Wui (Ecol. Econ. 2001)

Kazmierczak (LSU Staff Paper 2001)

Research specific to Louisiana is now 14-23 years

old

Farber (Cont. Econ. Pol. 1996)

Bergstrom et al. (Ecol. Econ. 1990)

Costanza, Farber, and Maxwell (Ecol. Econ. 1989)

Farber (JEEM 1987)

Farber and Costanza (JEM 1987)

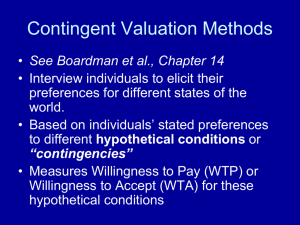

Our Approach

We address wetland valuation from the

perspective of future land-loss prevention

Similar to how one approaches damage assessment

Our referendum asks respondents to evaluate a

policy that will prevent expected future losses

rather than a policy that will restore land already lost.

The former is more readily-feasible than the latter

The scenario on which our results are based are coastwide.

our estimates are intended to reflect preferences for a

unified large-scale approach to land-loss prevention that

spans the entire Louisiana coast

The CV Scenario

The questionnaire opened with this introduction:

Coastal Louisiana has lost an average of 34 square miles of land,

primarily marsh, per year for the last 50 years. From 1932 to

2000, coastal Louisiana lost 1,900 square miles of land, roughly

an area the size of the state of Delaware.

PLEASE SEE MAP INCLUDED WITH YOUR SURVEY.

Additionally, Hurricanes Katrina and Rita eroded an additional 217

square miles in 2005 alone. (Not shown on map.)

If no action is taken, Louisiana could potentially lose an additional

700 square miles of land, about equal to the size of the greater

Washington D.C. – Baltimore area, by the year 2050.

Other scenario details

Program timing: To make the scenario appear

realistic, we specified that it would take 5 years

for the program to be fully implemented.

To make the scenario consistent with the map

included with the questionnaire, we specified that

the program, if implemented, would maintain

land area at current levels through the year 2050.

In other words, the prevention program would, at

minimum, shift projected losses as shown 35

years into the future.

WTP vs. WTA

One can conceive of at least two sets of

respondents in the LA restoration case:

WTA: perceives coastal land to be their birthright,

where WTA would be the appropriate welfare measure

WTP: perceives coastal land loss as a natural

phenomenon

This set may, perhaps, perceive any losses as the result of

human activity such as oil and gas exploration or the

building of levees

likely perceives future losses as a given, with any losses

prevented being something gained, rather than something

saved, relative to no action

Unable to identify each respondent ex ante

we split the sample in two, half receiving a WTP-style

referendum question, and the other a WTA-style question.

WTP Question: A tax

Suppose the State of Louisiana proposed a coast-wide project that

would prevent the projected future losses (as shown in yellow

on the map) from occurring.

It is expected that it would take approximately 5 years for the

project to be fully implemented, and projected land area would be

maintained at current levels until the year 2050.

If the project received a majority vote of support, it would be

implemented, and each tax-paying household in Louisiana would

be obligated to pay an additional tax of $X per year for 10

years. The tax payments would be collected on annual state

income tax returns.

How would you vote?

1- I would vote FOR the project: In other words, PREVENT

future land losses and PAY AN ADDITIONAL ANNUAL TAX OF

$X FOR 10 YEARS.

2- I would vote AGAINST the project: in other words, DO NOT

PREVENT future land losses and pay NO ADDITIONAL TAX.

WTA Question: A tax refund

If the project did not receive a majority vote of support, it

would not be implemented, and the State would

redistribute the funds such that each tax-paying household

in Louisiana would receive an additional tax refund of $X

per year for 10 years. The refunds would be distributed

on annual state income tax returns.

How would you vote?

1- I would vote FOR the project: In other words,

PREVENT future land losses and receive NO ADDITIONAL

TAX REFUND.

2- I would vote AGAINST the project: in other words, DO

NOT PREVENT future land losses and RECEIVE AN

ADDITIONAL TAX REFUND OF $X FOR 10 YEARS.

Data Collection

Questionnaire mailed to a stratified (by parish)

random sample of 3,000 Louisiana households,

obtained from Survey Sampling International, Inc.

1st mailing sent during 3rd week of May 2009

included pre-paid $1 cash incentive, shown to increase

response rates relative to either no incentive or postpaid incentives (Dillman 2007, Petrolia and

Bhattacharjee 2009).

Replacement questionnaires sent during 3rd week

of June 2009.

A total of 680 questionnaires were returned

(22.7% response rate).

Referendum Responses by Bid ($/year)

Bid

50

71

101

144

204

291

413

588

836

1189

Total

No

10

10

12

15

5

14

9

13

15

22

125

Yes

24

27

18

27

19

20

23

11

18

7

194

WTP

Total

34

37

30

42

24

34

32

24

33

29

319

% Yes

0.71

0.73

0.60

0.64

0.79

0.59

0.72

0.46

0.55

0.24

0.61

No

7

3

5

5

2

5

2

5

4

9

47

Yes

33

27

28

25

20

35

28

22

29

36

283

WTA

Total

40

30

33

30

22

40

30

27

33

45

330

% Yes

0.83

0.90

0.85

0.83

0.91

0.88

0.93

0.81

0.88

0.80

0.86

Empirical Model

Standard RUM approach

Utility of individual i is defined as Ui = U(yi , zi ; q )

where y is household income; z is a vector of individualspecific characteristics, and q is coastal land quantity

In WTP case, Individual votes Yes if Ui (yi – ti , zi ; q0) > Ui (yi,zi

; q1)

In WTA case, Individual votes Yes if Ui (yi + ti , zi ; q1) > Ui (yi,zi

; q0)

where t is the bid

q1 is the state of nature where the program is implemented

q0 is where it is not (q0 > q1)

Weighted likelihood function to mitigate sample bias (pseudolikelihood)

Ratio of population income category proportion over sample

income category proportion

Estimated (weighted) pseudo-likelihood probit model using Stata 11

Modeling Income and Bid

Because bids were relatively large, ranging from $50 to

$1,189, we did not wish to impose the commonly-made

assumption of constant marginal utility of income.

We adopted the Box-Cox Transformation, which specifies

a composite bid-income term of ( y t ) y

K

i

i

K

K

i

where λ is Box-Cox Transformation parameter with K possible

values

When λ = 0, the Box-Cox transformation converges to the loglinear specification

Following Greene (2000), estimated model for λ = {-2, 2} in

increments of 0.1.

The survey gathered household income by income categories.

To construct our composite variable, income was interpolated

as the mid-point in the category.

Our search resulted in the adoption of λ = 0.7.

Variable Descriptions

Variable Name

Type

Vote (dependent var.)

binary

continuous

Box-Cox Income-Bid Term (λ = 0.7)

Age

continuous

Age x WTA

continuous

Education ord. categor.

Male

binary

White

binary

Latitude

continuous

No Confidence in Govt

binary

Consequential ord. categor.

Climate Change

binary

Storm-Protection Priority

binary

Other Benefits Priority

binary

WTA Dummy

binary

Question Sequence

binary

Mean

0.755

-15.508

54.341

27.584

2.709

0.604

0.820

30.679

0.457

-0.278

0.418

0.558

0.306

0.508

0.506

Std. Weighted

dev.

Mean

0.018

0.727

0.670

-17.300

0.644

54.517

1.254

27.962

0.034

2.564

0.021

0.548

0.017

0.772

0.041

30.716

0.021

0.431

0.033

-0.224

0.021

0.444

0.021

0.546

0.020

0.305

0.021

0.515

0.021

0.514

Regression Results

Std.

Coef.

Err.

Box-Cox Income-Bid Term (λ = 0.7)

0.015 **

0.004

Age

0.004

0.006

Age x WTA

0.019

0.010

Education

0.086

0.094

Male

0.075

0.161

White

0.590 **

0.190

Latitude

-0.079

0.079

No Confidence in Govt

-0.427 *

0.167

Consequential

0.134

0.115

Climate Change

0.115

0.157

Storm-Protection Priority

1.514 **

0.211

Other Benefits Priority

1.190 **

0.233

WTA Dummy

-0.243

0.555

Question Sequence

-0.249

0.154

Constant

1.233

2.506

**,* Parameter estimate significant at p = 0.01, 0.05 levels, resp.

2

Marginal effect for the equivalent of a $1,000 increase in income.

# of obs = 543

Log Pseudolikelihood = -219.64

pvalue

0.000

0.496

0.056

0.359

0.640

0.002

0.314

0.010

0.245

0.463

0.000

0.000

0.661

0.105

0.623

Marginal

Effects 1

0.0012 2

0.003

0.015

0.067

0.022

0.192

-0.062

-0.128

0.105

0.034

0.446

0.282

-0.071

-0.073

Pseudo R-squared = 0.29

Nominal (Annual) Welfare Estimates

Turnbull Lower

Bound (Mean)

Box-Cox

(Median)

Mean/Median

$490

$1,116

95% CI

$484 ~ $496

$755 ~ 2,029 *

Mean/Median

$982

$2,496

WTA

95% CI

$977 ~ $986

$1,727 ~ $4,892 *

*Box-Cox confidence intervals calculated using the KrinskyRobb method.

WTP

PV(WTP)

$20,000

$18,000

$16,000

$14,000

Box-Cox WTP w/ KR Conf. Int.

NPV of WTP

$12,000

$10,000

$8,000

$6,000

$4,000

$2,000

Turnbull WTP w/ Conf. Int.

$0

0.02

0.04

0.06

0.08

0.10

0.12

Discount Rate

0.14

0.16

0.18

0.20

PV(WTA)

$45,000

$40,000

$35,000

Box-Cox WTA w/ KR Conf. Int.

NPV of WTP

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

Turnbull WTP w/ Conf. Int.

$0

0.02

0.04

0.06

0.08

0.10

0.12

Discount Rate

0.14

0.16

0.18

0.20

Summary of Results

The WTA dummy variable, included to capture any residual treatment

differences was not found to be significantly different from zero

The Box-Cox income-bid term was significant and positive

Age was significant among WTA respondents only (at the p = 0.1 level),

increasing the probability of a Yes vote by 15% for a 10-year increase in

age

Whites were 19% more likely to vote Yes

Respondents with no confidence in government to enact restoration efforts

in a timely manner were 13% less likely to vote Yes

Those citing storm protection were 45% more likely to vote Yes relative to

all others

Although it does affect welfare estimates

over half of respondents indicated storm protection as their leading concern

while voting

respondents citing some other concern (including environmental

protection, protection of recreational opportunities, and protection against

sea-level rise) were 28% more likely to vote Yes

Depending on the discount rate, our results indicate:

$1,000 < WTP < $18,000

$5,000 < WTA < $45,000

Questions and Comments

Contact: Dan Petrolia

petrolia@agecon.msstate.edu

Sponsoring Agency (NOAA):