Economic Analysis

advertisement

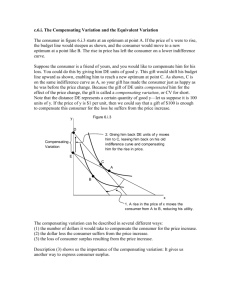

Economic Analysis Key Questions What do we mean by ‘Economic Analysis’? Why do we need ‘ Economic Analysis’? What should be considered in an ‘Economic Analysis’? What is Economic Analysis? Economic Analysis of a project is to assess the social profit by measuring the effects of the project on the fundamental objectives of the whole economy. Why do we need Economic Analysis? We adopted Economic Analysis to measure the social profit instead of money profit itself. Economic Analysis of a project provides the decision-maker to allocate their resources more efficiently and effectively. What should we consider in an Economic Analysis? Enumeration of Cost and Benefit Measurement of Cost and Benefit Thus it is called CBA. Economic Analysis: Cost-Benefit Analysis Cost-Benefit Analysis (CBA) is a set of procedures for defining and comparing benefits and costs. Decisions are made by decision makers, and benefit-cost analysis is properly regarded as an aid to decision making and not the decision itself (Zerbe/Dively 1994). Cost and Benefit Analysis Cost-Benefit Analysis involves the consideration of Social Benefits and Social Costs, so it is widely used in evaluating and assessing many government projects and decisions. In CBA, the Willingness to Pay or to Accept as measured by the Compensating and Equivalent Variations is the correct theoretical measures for welfare changes. Examples of Public Projects: using CBA Pricing non-market goods is common. Community and public goods. where “free riders” cannot be excluded. Intangible externalities, e.g noise and congestion cost, human lives saved, the pleasure derived by passers-by from flowers and trees in private gardens. THE CBA Approach Most basically, list all relevant items Value expected benefits and costs Discount the future flow of benefits and costs Appraise the project by setting off aggregate benefits against aggregate cost Willingness to Pay and to Accept Willingness to pay for a good or to avoid cost is subject to the budget. Willingness to accept payment to forego a good or to bear cost is different from willingness to pay and it could be infinite. Compensation Variation and Equivalent Variation could be adopted to measure the above two concepts. Consumer Surplus Consumer Surplus is approximately the amount one would pay for the good, over what one does pay, rather than do without the good (Zerbe/Dively 1994). P Figure 1 A P0 CS B D0 . Q0 Source : Adapted from Richard O. Zerbe. Jr. and Dwight D. Dively. 1994. Benefit-Cost Analysis In Theory And Practice. New York: Harper Collins College Publishers, pp. 84. A: Consumer Surplus B: Payment Producer Surplus Producer Surplus is an amount that can be taken from the producer or input supplier without diminishing the amount supplied. Figure 2 P S 0 P0 PS Xo X Source : Adapted from Richard O. Zerbe. Jr. and Dwight D. Dively. 1994. Benefit-Cost Analysis In Theory And Practice. New York: Harper Collins College Publishers, pp. 88. Measures of willingness to Pay, Willingness to Accept, Consumer Surplus and Producer Surplus Social benefits and costs are important to evaluate a project as well as important to the policy maker as an reference in undertaking public projects. In evaluating the Willingness to Pay and Willingness to Accept, we can adopt the Compensating and Equivalent Variations for measurement. Compensated Demand Curves and Compensating Supply Curves for facilitating our assessment. Compensating Variation It gives the maximum (minimum) amount of money that can be taken from (must be given to) a household so as to leave it just well off as it was before a fall (rise) in price. Equivalent Variation It provides the minimum (maximum) amount of money that must be given to (taken from) a household to make it as well off as it would have been after a fall (rise) in price. Summaries of Compensating Variation and Equivalent Variation Compensating Variation Money which can be taken or given to leave one as well off as before the economic change Amount he/she would be Welfare willing to pay for the change Gain (finite – limited by his (benefit) income) Amount he/she would be Welfare willing to accept as Loss compensation for the change (cost) (could be infinite) Equivalent Variation Money taken or given that leaves one as well off as after the economic change Amount he/she would be willing to accept to forego the change (could be infinite) Amount he/she would be willing to avert the change (finite – limited by his income) Source: Adapted from R. Layard and A.A. Walters, Microeconomic Theory, McGraw Hill: New York, 1978, pp.150-152 Expenditure Functions Expenditure Function is commonly adopted as expressions in much of modern welfare theory. For a price decrease P 01> P 11,, so that CV > 0 CV = C[P 01, P 02, U 0)] - C[P 11, P 02, U 0)] P Compensation Variation a P1 A CV b P2 D0 H1 (U1) X4 X3 X2 X1 H2 (U2) X Expenditure Functions (Cont’d) For a price change P 01 to P 11, EV = C[P 01, P 02, U 1)] - C[P 11, P 02, U 1)] P a P1 A Equivalent Variation C EV b P2 B X D0 H1 (U1) X4 X3 X2 X1 H2 (U2) The Rate of Discount Adopted when we have to forego current consumption presently and obtain the benefits of the project in the future. Social Opportunity Cost Applied when we are Rate of Interest (SOC) estimating the future consumption foregone by not taking the alternative investment. Social Time Preference Rate (STP) Risk and Uncertainty Adding premia to the discount rate is a widely adopted principle. However, not all phenomena exhibit the pattern of ‘riskness’. A minor technical adjustment make a possible error in estimating individual items. Economic Analysis for consideration Steps involved 1. Identify benefits and costs, and quantify 2. Include shadow pricing and opportunity cost, if necessary 3. Apply evaluation methods as in financial appraisal, e.g. - Discount Cash Flow - Net Present Value - Internal Rate of Return - Benefit-cost ratio Methods of Economic Analysis (Cont’d) 4. Apply sensitivity and risk analysis Present worth of the expected net social benefit = i=1 PiXi Where Pi = Possibility of an event,Xi = Expected net social benefit Example There is an existing old and poor single-two road running between Town A and Town B. There is a proposal to construct a new highway to relieve the increasing traffic on the road. After considering all constraints, a new route has been drawn up for constructing the highway to connect the two towns, crossing a crop field. Identify the social benefits and social costs of the proposed highway project. Example (Cont’d) Social benefits 1. 2. 3. 4. 5. Less fuel used by vehicles Less traveling Reduction of maintenance and repair costs to existing road Fewer injuries to pedestrians Benefits from greater business turnover Social costs 1. Costs of resources committed 2. Maintenance and repair costs to new highway 3. Loss of crop production Difficulties with a CBA Allowing for the distributional effects Adjusting market prices to allow for indirect taxes Estimating the ‘willingness to pay’ for intangibles which are market non-priced Choosing the appropriate discount rate Providing for risk and uncertainty Conclusion Like a private investor, the public sector is also concerned about the financial implication of its investments. Market prices do not fully reflect the true costs and benefits of an investment, largely due to market failure and imperfection. Such external effects should therefore be dealt with in economic analysis (always economists refer it to as “costbenefit analysis”. A financially viable project may not necessarily be economically feasible.