lect1

advertisement

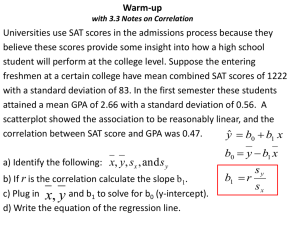

The Basics: Outline • What is a time series? What is a financial time series? • What is the purpose of our analysis? • Classification of Time Series. • Correlation – Autocorrelation – Partial Autocorrelation – Cross Correlation • Basic transformation to stationarity – Differencing Spring 2005 K. Ensor, STAT 421 1 What is a time series? • Review • Time Series – Random variable – Distribution (cdf, pdf) – Moments • • • • • • Spring 2005 Mean Variance Covariance Correlation Skewness Kurtosis – Random process – random variable is a function of time – Distribution? – Moments • • • • • • K. Ensor, STAT 421 Mean Variance Covariance Correlation Skewness Kurtosis 2 -4 -2 0 2 Stationary Time Series with 100 Future Realizations 0 Spring 2005 10 20 K. Ensor, STAT 421 30 3 10 8 6 4 percent 12 14 16 U.S. Weekly Interest Rates Red line is 1-year; Blue line is 3-year 01/05/1962 Spring 2005 07/18/1969 01/28/1977 08/10/1984 TimeSTAT in w eek s K. Ensor, 421 02/21/1992 09/03/1999 4 Further examples of a time series Spring 2005 5 earning 10 15 Quarterly Earning per shar Johnson and Johnson 0 • Anything observed sequentially (by time?) • Returns, volatility, interest rates, exchange rates, bond yields, … • Hourly temperature, hourly ozone levels • ??? Jan 60 K. Ensor, STAT 421 Jan 64 Jan 68 Jan 72 Jan 76 Jan 80 Time in quarters 5 What is different? Spring 2005 1 log earning 2 Log Quarterly Earning per share Johnson and Johnson 0 • The observations are not independent. • There is correlation from observation to observation. • Consider the log of the J&J series. • Is there correlation in the observations over time? Jan 60 K. Ensor, STAT 421 Jan 64 Jan 68 Jan 72 Jan 76 Jan 80 Time in quarters 6 What are our objectives? • Making decisions based on the observed realization requires: – Descriptive: Estimating summary measures (e.g. mean) – Inferential: Understanding / Modeling – Prediction / Forecasting – Control of the process • If correlation is present between the observations then our typical approaches are not correct (as they assume iid samples). Spring 2005 K. Ensor, STAT 421 7 Classification of a Time Series • Dimension of X • Dimension of T – Time, space, spacetime • Nature of T – Discrete • Equally • Unequally spaced • State spce – Discrete – Continuous • Memory types – Stationary – Continuous • Observed continuously • Observed by some random process Spring 2005 – Univariate – Multivariate • No memory • Short memory • Long memory – Nonstationary K. Ensor, STAT 421 8 Stationarity Strictly Stationary All finite dimensional distributions are the same. Covariance Stationary First and second moment structure does not change with time. Spring 2005 K. Ensor, STAT 421 9 Autocorrelation Spring 2005 K. Ensor, STAT 421 10 Autocorrelation Function for a CSTS • In theory… • How to estimate this quantity? Spring 2005 K. Ensor, STAT 421 11 Autocorrelation? 2 2 2 0 1 lagged 7 K. Ensor, STAT 421 2 2 0 0 1 lagged 8 2 1 2 Series 1 2 lagged 5 2 0 Series 1 Series 1 0 0 1 lagged 4 2 2 0 1 lagged 6 1 lagged 3 1 0 0 0 2 1 Series 1 2 1 Series 1 1 lagged 2 0 0 1 Series 1 1 Series 1 2 2 0 0 1 2 0 1 1 0 lagged 1 Spring 2005 1 Series 1 2 1 Series 1 0 1 Series 1 0 How would you determine or show correlation over time? 2 Lagged Scatterplots : x 0 1 lagged 9 2 0 1 lagged 10 12 2 Sample ACF and PACF • Sample ACF – sample estimate of the autocorrelation function. – Substitute sample estimates of the covariance between X(t) and X(t+h). Note: We do not have “n” pairs but “n-h” pairs. – Subsitute sample estimate of variance. • Sample PACF – correlation between observations X(t) and X(t+h) after removing the linear relationship of all observations in that fall between X(t) and X(t+h). Spring 2005 K. Ensor, STAT 421 13 Summary Plots 0 1 2 Log Quarterly Earnings for J&J J an 60 J an 64 J an 68 J an 72 J an 76 J an 80 Time in quarters PACF -1 0 1 2 Log Quarterly Earnings for J&J Spring 2005 3 0.5 0.0 ACF 0.0 -0.5 -1.0 0 -1.0 -0.5 5 ACF 10 0.5 15 1.0 ACF 1.0 Histogram 0 5 10 15 Lag K. Ensor, STAT 421 0 5 10 15 Lag 14 Cross Correlation Spring 2005 K. Ensor, STAT 421 15 Multivariate Series • How can we study the relationship between 2 or more time series? • U.S. weekly interest rate series measured in percentages • And the corresponding change series – c1(t)=(1-B)r1(t) – c2(t)=(1-B)r2(t) – Time: From 1/5/1962 to 9/10/1999. – Variables: • r1(t) = The 1-year Treasury constant maturity rate • r2(t) = The 3-year Treasury constant maturity rate Spring 2005 K. Ensor, STAT 421 16 10 4 6 8 percent 12 14 16 U.S. Weekly Interest Rates Red line is 1-year; Blue line is 3-year 01/05/1962 07/18/1969 01/28/1977 08/10/1984 02/21/1992 09/03/1999 Time in weeks Spring 2005 K. Ensor, STAT 421 17 1.0 16 14 diff(yr3) 0.0 0.5 12 Spring 2005 -1.0 4 The two series are highly correlated. 6 -0.5 yr3 10 8 Scatterplots •between series simultaneous in time •and the change in each series. Scatterplot of Change 1yr rate and 3yr rate 1.5 Scatterplot of U.S. Weekly Interest Rate 4 6 8 10 12 14 yr1 K. Ensor, STAT 421 16 -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 diff(yr1) 18 -1.5 -0.5 0.5 1.5 Change in 1-year rate 0 500 1000 1500 2000 1500 2000 Time -1.0 0.0 0.5 1.0 1.5 Change in 3-year rate 0 Spring 2005 500 1000 K. Ensor, STAT 421 19 c3 -1.0 0.0 0.5 1.0 1.5 Scatterplot of Change in 1-year and 3-year rate -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 c1 Multivariate Series : cbind(c1, c3) Spring 2005 0. 0 0. 2 0. 4 0. 6 0. 8 ACF 0. 0 0. 2 0. 4 0. 6 0. 8 1. 0 c1 and c3 0 5 10 15 20 25 30 0 5 10 20 25 30 20 25 30 0. 2 0. 2 0. 4 0. 6 ACF 0. 4 0. 6 0. 8 0. 8 15 c3 1. 0 c3 and c1 0. 0 0. 0 What is the cross-correlation between the two series? c1 -30 -25 -20 -15 Lag -10 -5 K. Ensor, STAT 421 0 0 5 10 15 Lag 20 Differencing to achieve Stationarity Spring 2005 K. Ensor, STAT 421 21 Detrending by taking first difference. First Difference Log Quarterly Earning per share J&J Z(t) is a random variable. 0.2 0.0 -0.2 -0.4 -0.6 Suppose X(t)=a+bt+Z(t) first difference of log earning What happens to the trend? 0.4 Y(t)=X(t) – X(t-1) Apr 60 Apr 64 Apr 68 Apr 72 Apr 76 Apr 80 Time in quarters Spring 2005 K. Ensor, STAT 421 22 Sumary Plots of Detrended J&J log earnings per share. -0.6 0.0 0.4 Detrended Log Quarterly Earnings for J&J Apr 60 Apr 64 Apr 68 Apr 72 Apr 76 Apr 80 Time in quarters Histogram ACF -0.6 -0.4 -0.2 0.0 0.2 0.4 Detrended Log Quarterly Earnings for J&J 0.6 0.0 ACF -0.5 -1.0 -1.0 0 -0.8 Spring 2005 0.0 -0.5 10 ACF 20 0.5 0.5 30 1.0 1.0 PACF 0 5 10 15 Lag K. Ensor, STAT 421 0 5 10 15 Lag 23 Removing Seasonal Trend – one way to proceed. • Suppose Y(t)=g(t)+W(t) where g(t)=g(t-s) where s is our “season” for all t. W(t) is again a new random variable • Form a new series U(t) by taking the “s” difference U(t)=Y(t)-Y(t-s) =g(t)-g(t-s) + W(t)-W(t-s) =W(t)-W(t-s) again a random variable Spring 2005 K. Ensor, STAT 421 24 Summary of Transformed J&J Series -0.2 -0.1 0.0 0.1 0.2 Log J&J After Removing Linear and Seasonal Trend Apr 61 J an 65 Oc t 68 J ul 72 Apr 76 J an 80 Time in quar ter s PACF -0.2 -0.1 0.0 0.1 0.2 0.3 Log J&J After Removing Linear and Seasonal Trend Spring 2005 0.5 0.0 ACF 0.0 -0.5 -1.0 0 -1.0 -0.5 5 ACF 10 0.5 15 1.0 ACF 1.0 Histogram 0 5 10 15 Lag K. Ensor, STAT 421 0 5 10 15 Lag 25 Summary of Transformations: • X(t) = log (Q(t)) • Y(t)=X(t)-X(t-1) = (1-B)X(t) • U(t)= (1-B4)Y(t) • U(t)=(1-B4) (1-B)X(t) Spring 2005 K. Ensor, STAT 421 26 An example of Forecasting Spring 2005 K. Ensor, STAT 421 27 What is the next step? • U(t) is a time series process called a moving average of order 1 (or possibly a MA(1) plus a seasonal MA(1)) – U(t)=q e(t-1) + e(t) • Proceed to estimate q and then we can estimate summary information about the earnings per share as well as predict the future earnings per share. Spring 2005 K. Ensor, STAT 421 28 Forecast of J&J series 20 10 15 Earnings 25 Two Year Forecast and 95% Bounds for Johnson and Johnson Quarterly Earnings Per Share 5 10 15 20 Quarter Time Spring 2005 K. Ensor, STAT 421 29 Wrap up • • • • Basics of distribution theory. Classification of time series. Basics of stationarity. Correlation functions – Autocorrelation – Partial autocorrelation – Cross correlation • Transformations to a stationary series – differencing Spring 2005 K. Ensor, STAT 421 30