Optimizing Risk Matr.. - Quantitative Decisions

advertisement

Optimal Design of Qualitative

Risk Matrices to Classify

Quantitative Risks

Bill Huber

Quantitative Decisions

Rosemont, PA

Tony Cox

Cox Associates

Denver, CO

Outline

Setting the Scene

•

•

•

•

Optimal Risk Matrix Design Theory and Results (Binary Case)

•

•

Result 1: Make your matrices as square as possible.

Result 2: Create the best matrix with the Zig-Zag construction.

Further Research

•

•

2

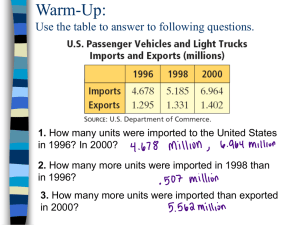

Examples: risk matrices are widely used.

Definitions and terminology: our model applies to most risk matrices.

Pros and cons of risk matrices: they have their uses, but problems lurk.

The Risk Matrix Design problem: if you must create a risk matrix,

how well can you do and is it worth the effort to do a good job?

Beyond binary: What about risk matrices with more than two decisions?

What you can do.

Quantitative Decisions/Cox Associates

Risk Matrices

Swedish

Rescue

Service

Canadian Navy

U.S. FHA

Supply

Chain

Digest

Australian Government

3

Quantitative Decisions/Cox Associates

Definitions

A risk matrix assigns a unique decision to any prospect:

•

•

•

It presents a two-dimensional table of decisions.

•

•

Rows correspond to classes (or “bins”) of a prospect attribute u (typically

consequence, severity, impact, or disutility) and columns to bins of

another attribute p (typically probability).

u and p might be computed from other prospect attributes.

Decisions could be

•

•

4

Accounts that could go bad;

Facilities that might be attacked;

Research, development, or exploration projects that might not come to

fruition; etc.

Act now, take risk mitigation countermeasures, perform a follow-on

study: typically colored red.

Do nothing, act later, assume no risk: typically colored green.

Quantitative Decisions/Cox Associates

Uncovering the Detail

(From a consultant’s

white paper)

Harvard Business Review

Pêches et

Océans

Canada

5

Quantitative Decisions/Cox Associates

Risk Matrices Are Discrete

Approximations

Their creators clearly conceive of risk matrices as discrete

representations of functional relationships.

Thus,

•

•

•

•

6

Columns bin the values of p at breakpoints x0 (the smallest possible

value of p), x1, x2, …, xn (the largest possible value).

Rows bin the values of u at breakpoints ym < ym-1 < ym-2 < … < y0.

Risk is determined by a function v(p,u): the valuation function. (Often p and

u can be expressed so that v(p,u) = pu: “risk is probability times

consequence.” However, p does not need to be probability, nor does u

have to be consequence, and our theory handles a large class of valuation

functions besides pu.)

Decisions are intervals of risk (z0,z1], (z1,z2], …, (zL-1,zL].

Quantitative Decisions/Cox Associates

column j

Notation

...

u axis

prospect (p,u)

yi -1

Bin (yi, yi-1] for u:

yi < u yi-1.

row i

a ij

yi

The decision for prospect (p,u) is

shown here as aij. We talk about it

generically as a color ranging from

green through red.

...

...

xj -1

xj

Bin (xj-1, xj] for p:

xj-1 < p xj.

7

...

p axis

Quantitative Decisions/Cox Associates

Why Use Risk Matrices?

The risk attributes p and u or the valuation function

v(p,u) might not be accurately known or precisely

measurable.

Computing v(p,u) and comparing it to the breakpoints

z1, z2, …, zL-1 may be burdensome, time consuming

error prone, or could reveal sensitive information.

•

8

When p or u change frequently, a risk matrix expedites the

response.

A risk matrix can present, simplify, and document the

information used to make a decision.

Quantitative Decisions/Cox Associates

Problems with

Risk Matrices

Binning (classifying into categories) the variables p and u almost

always loses some information that may be needed for correct

decision making.

This causes the risks of some pairs of prospects to be ranked

incorrectly.

•

An error will occur when a prospect with attributes (p,u) falls

into a cell whose color is not the correct one for the “true” risk

v(p,u). We call these the “bad” prospects for the risk matrix.

•

9

It is possible for decisions made with them to be worse than random! (LA

Cox Jr, What’s Wrong with Risk Matrices, Risk Analysis 28(2), 2008).

“Gray” cells by definition contain both good and bad prospects.

How bad can the errors get in actual use?

Quantitative Decisions/Cox Associates

The Risk Matrix

Design Problem

Given a valuation function v(p,u) and constraints (upper bounds)

on the numbers of rows and columns you want to use,

determine breakpoints x1, x2, …, xn-1; y1, y2, …, ym-1; and z1, z2,

…, zL-1 that minimize the “overall” error made by users of the

risk matrix.

•

•

10

In most cases, the set of decisions is predetermined, thereby fixing the

breakpoints z1, z2, …, zL-1.

“Overall” error can be measured in several ways, including maximum

possible error, expected error under a probability distribution of

prospects, or expected error rate.

How well can an optimal matrix perform compared to an

“intuitive” or “generic” solution?

Quantitative Decisions/Cox Associates

Theory and Results

The Case of Binary Risk Matrices

1.0

0.9

0.8

Preliminaries

0.7

0.6

u

x4

The threshold k is fixed. It determines the decision curve {(p,u) : v(p,u) = k}.

Adopt a cost function C(p,u,d). The cost is that of making decision d for

prospect (p,u). Often, C will indicate error or the size of the error.

•

When the decision is the correct one, the cost is zero.

E.g., relative risk is C(p,u,d) = |v(p,u) – k|. Indicator risk is C(p,u,d) = 1.

Optionally specify a probability (or frequency) distribution for the prospects.

•

12

0.1

This is natural: anything else probably doesn’t qualify as a valuation

x 1 xfunction.

x3

2

0.0into “green”

0.2

0.4

0.6

A binary (two-decision) problem divides prospects

ones

where

p risk.”)

v(p,u) k and “red” ones where v(p,u) > k. (k is known as “acceptable

•

y 2will be binned anyway.

There is no loss of generality: ultimately both variables

0.3

0.0

•

y3

Assume v(p,u) is strictly increasing in both arguments

iny 1the interior of its

0.2

domain (i.e., (0,1) (0,1)).

•

0.5

Re-express p and u so they both lie in the interval

[0, 1].

0.4

•

y4

E.g., the uniform distribution d = dpdu.

Quantitative Decisions/Cox Associates

0.8

Two Kinds of Problems

The minimax problem is to optimize the worst cost that can be

incurred in using the risk matrix.

The expected cost (or expected loss) problem is to optimize the

average cost incurred in using the risk matrix.

•

For either problem,

•

•

•

13

This requires one to specify the frequencies (or probabilities) with which

the prospects will occur.

Use indicator risk C(p,u,d) = 1 to measure error rates.

We use relative risk C(p,u,d) = |v(p,u) – k| to account for the degree of

error as well as its occurrence.

Generally, the cost should increase or at least stay the same as the

difference between the risk matrix’s prescription and the true decision

increases. We solve the problem in this most general setting.

Quantitative Decisions/Cox Associates

Binary Risk Matrices

Binary risk matrices have two colors only: red and

green.

Understanding them is a key step towards a general

theory of optimal risk matrix design.

Műnchener Rűck Munich Re Group

14

Quantitative Decisions/Cox Associates

0.8

0.7

y 4 Right Decisions

Choosing

the

0.6 variables, you can go cell

After binning the

by cell through the matrix to pick the

decision that minimizes the cell’s cost.

0.5

y

3

• When all prospects in the cell have the same

u

•

color, give the cell that color (obviously).

Otherwise 0.4

15

y

In the minimax problem, consider the worst

2 cell color. Choose

prospect for each possible

the color 0.3

that minimizes this worst case.

In the expected cost problem, choose the color

that minimizes the expected

1 cost over the cell.

y

0.2 of choosing

Thus, the problems

breakpoints and coloring the cells are

decoupled. 0.1

0.0

x1 x2

However we color this gray cell, the

worst costs will be incurred at the

two corner cells marked.

In solving the expected cost problem,

we have to integrate the cost over

the upper half of the cell (if it’s

colored green) or over the lower half

(if it’s colored red).

x3

x4

Quantitative Decisions/Cox Associates

Sweeping through a Strip

Focus on one column as you vary one y-breakpoint.

The cost of this

cell goes up …

We prove there is a

unique point in the

sweep where the

sum of the two costs

is smallest.

while the cost of this

cell goes down.

The colored dots mark curvilinear triangles containing bad prospects. E.g., the cell for the green dot (at the left)

will necessarily be colored red, but this prospect—lying below the decision curve—is green.

16

Quantitative Decisions/Cox Associates

config33a new.ggb

The Key Idea

17

At any critical point, the infinitesimal increase in cost

contributed by the green (left) line segment balances the

infinitesimal decrease in cost contributed by the red

(right) line segment.

Quantitative Decisions/Cox Associates

Result 1: Use Square Matrices

Make the matrix as square as possible (that is, m and n

should be equal or differ by one).

•

If not, there will be neighboring rows (or columns) that can

be combined without any increase in overall cost.

No matter how we vary y2

between y1 and y3, the row

of cells between y1 and y2

must always be colored the

same as the row of cells

between y2 and y3. Thus, y2

is unnecessary.

This situation always

happens when there are

more rows than columns+1.

18

Quantitative Decisions/Cox Associates

Result 2: The Zig-Zag Procedure

The “zig-zag” procedure always

produces a best set of breakpoints.

•

•

y1

The procedure:

•

•

•

•

•

•

19

This works for any reasonable cost

function C and valuation v.

It applies to expected cost and minimax

cost.

Start at top (or left).

Move down (or right), cross the decision

curve, and move an “equivalent”

distance beyond it.

Make a right turn.

Repeat until you move beyond the

square.

If your last step lands exactly on the

boundary, you have a good design.

This produces a set of simultaneous

equations we can solve explicitly.

y2

y3

y4

x1

x2

x3

x4

Quantitative Decisions/Cox Associates

How Good Is Best?

The graphic shows how

overall costs for relative risk

vary with breakpoints in a

binary 2 2 risk matrix.

•

20

The problem’s symmetry

(correctly) suggests the y

breakpoint should equal the x

breakpoint.

Here, poor choice of

breakpoints can increase

losses over 100% (minimax)

or almost 400% (expected

loss, uniform distribution)

relative to the best choice.

1.00

Loss

m = n = 2; k = 1/4

v(p ,u ) = pu ; c(v,k ) = |v - k |

0.10

Minimax loss

Minimax optimum

Expected loss

Expected optimum

0.01

0.0

0.2

0.4

0.6

0.8

x 1, y 1

Note the logarithmic scale for loss (overall cost).

Quantitative Decisions/Cox Associates

1.0

How Good Is Best? (2)

21

The “naïve” design divides

p and u each into n equally

spaced bins (which is often

done).

These values of k are the

worst case for v = pu: for

them, the minimax cost is

largest.

Nevertheless, the “Ratio”

column shows the best

design is typically 2.5 to 3

times better than the naïve

one.

Similar results hold for the

expected-cost problem.

Maximum Relative Risk

n

2

3

4

5

6

7

8

9

10

11

12

13

14

15

k

0.3750

0.3704

0.3691

0.3686

0.3684

0.3682

0.3682

0.3681

0.3680

0.3680

0.3680

0.3680

0.3680

0.3680

Naïve

0.1250

0.1481

0.1309

0.1114

0.0906

0.0621

0.0693

0.0718

0.0520

0.0452

0.0487

0.0462

0.0414

0.0365

Optimal

0.1250

0.0741

0.0527

0.0410

0.0335

0.0283

0.0245

0.0217

0.0194

0.0175

0.0160

0.0147

0.0136

0.0127

Ratio

1.00

2.00

2.48

2.72

2.71

2.19

2.83

3.32

2.68

2.58

3.04

3.14

3.04

2.88

n = #rows, #columns. k = decision threshold.

“Naïve” and “Optimal” are maximum relative risk errors

caused by using a risk matrix.

Quantitative Decisions/Cox Associates

Further Research

Beyond Binary Risk Matrices

What Next?

What can we say about more than two decisions?

•

•

•

What can we say about arbitrary probability distributions of

prospects?

•

Not much, unless we make strong assumptions.

Nevertheless, our results for the binary case suggest significant

improvements over intuitive or naïve designs are possible.

•

23

The strip sweep analysis still works.

The Zig-Zag procedure does not easily extend to more than two decisions

because of interactions between strips.

It is unlikely we will find any simple, clear characterization of all optimal

risk matrices.

The Zig-Zag procedure applied independently to the L-1 cutoffs for an

L-decision matrix might be a good heuristic guide in many cases.

Quantitative Decisions/Cox Associates

0.6

u

What You Can Do0.4

0.5

y3

y2

Consider using the Zig-Zag procedure

to help

0.3

y 1 risk matrices.

determine cutoffs for p and u0.2in your

More generally, evaluate the potential effects of a risk

0.1

matrix in terms of the maximum error or

x 1 expected

x2 x3

x4

0.0

error incurred by its users.

0.0

0.2

0.4

0.6

0.8

p

If your analysis suggests the error rates are

unacceptable, you can

•

•

24

Increase the numbers of rows and columns or

Provide quantitative decision procedures (formulas) or

software in place of a risk matrix.

Quantitative Decisions/Cox Associates

QD and CA

Supporting you and solving your

problems with maps, numbers, and

analyses.

www.quantdec.com

Superior business decisions through

better data analysis.

www.cox-associates.com

Loss

Finding the Best

Breakpoints

0.10

The overall cost of the design, given that we have selected the

best color for each cell, is a function of n+m–2 variables subject

to the constraints 0<x1<x2 …<xn-1<1>y1>y2>…>ym-1>0.

x (1), y (1) (vide the

For the minimax problem the cost is not differentiable

red curve) so we have to be careful about using Calculus.

Nevertheless, we can use the fundamental idea of looking for the

best design at critical points where independent small changes in

any variable no longer improve the cost.

Changing any variable causes changes in the strips of cells

through which it passes. Therefore, we study how the cost

changes as a breakpoint sweeps across one strip.

Minimax loss

Minimax optimum

Expected loss

Expected optimum

0.01

0.0

26

0.2

0.4

0.6

0.8

Quantitative Decisions/Cox Associates

1.0

Example:

Minimax relative risk for v = pu

For an n by n risk matrix with decision

threshold k, valuation function v(p,u) = pu,

and relative risk cost c(p,u,d) = |v(p,u) – k|

(when d is the wrong decision for (p,u)),

maximum loss is minimized uniquely by

choosing breakpoints in the zig-zag

construction beginning at x1 = k + e

where e is the only positive root of

(k + e)n = (k – e)n –1.

The x-breakpoints lie in geometric

progression with common ratio r =

(k+e)/(k–e), so that

xi = (k + e)r i-1 = (k + e)i / (k – e)i-1,

i = 1, 2, …, n.

The y-breakpoints are the same as the xbreakpoints. The maximum loss is e.

1.0

0.9

0.8

y1

0.7

0.6

y2

v (p ,u )=0.289

0.5

0.4

y3

v (p ,u )=0.211

0.3

y4

x1

x2

x3

x4

0.2

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

For k = 0.25 and m = n = 4, e 0.039.

Note that 0.289 = 0.25 + 0.039 and 0.211 = 0.25 – 0.039.

27

Quantitative Decisions/Cox Associates