RI Accounting for Non Proportional Treaties

advertisement

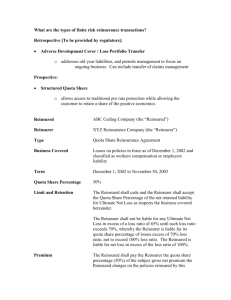

RI Accounting for Non Proportional Treaties Mrs. A. U. Nayak Director J. B. Boda & Co (S) PTE LTD Singapore Accounting for Non Proportional Under the XL treaties there are various types of Premiums. But the accounting for XL treaties is simple as there are No commissions (generally no PC also) No reserves. No portfolios Premiums are accounted separately. Losses are recovered on individual basis (assuming a Catastrophe loss is a single loss). 2 What is Non Proportional RI? Non Proportional RI is basically a method of reinsurance through which the reinsured obtains protection for his portfolio. There is no pre-decided fixed proportion in which the reinsurer and reinsured share the premiums and losses of a portfolio. Hence this is called “Non Proportional”. These methods are also called “Excess of Loss Reinsurance.” 3 Why is it called “Excess of Loss”? For a recovery under this method of reinsurance: The loss amount must exceed a fixed threshold known as deductible or priority or underlying for qualifying recovery from Reinsurers. Reinsurer’s liability is also fixed, known as the Cover Limit. 4 Why is it called “Excess of Loss”? Excess of loss recovery :Layer 300,000 XS 200,000 3rd loss 700 600 2nd loss 500 400 Recovery 1st loss 300 200 Retention 100 0 100,000 400,000 600,000 5 Advantage & Disadvantages of XOL RI Advantages: Simple, easy and inexpensive administration. Efficient and clear protection. Disadvantages: Premium cost may vary from year to year. The Sum of retentions for a per risk cover can be relatively high if the frequency of risk losses is large Risk might run out of cover if unexpected frequency exhaust the automatic reinstatements. Further reinstatements might be at high costs (back-up layers) 6 What are the main types ? Risk XOL: which protects the reinsured from large single risk losses, used for any traditional classes of business where a single risk can be defined. Catastrophe XOL: which protects the reinsured from accumulation of losses out of a single event, used for protection against traditional classes and particularly for Nat-Cat perils. Stop Loss XL: which protects the reinsured from accumulation of losses over a certain period, usually one year (e.g. Crop Insurance). Also known as Aggregate Loss Ratio XL. 7 Risk Excess of Loss Cover Generally the claims profile of an insurer shows most of the losses are small in size & few claims are large. Insurer has capacity to pay small claims but needs help to pay large claims. Hence he chooses to pay all losses up to a level he is comfortable with and beyond that threshold asks the reinsurer to pay. Typical Ris k Los s e s 120 100 80 60 40 20 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 8 Catastrophe Excess of Loss Excess of loss cover protection for accumulation of loss out of a single event. Proportional Reinsurance and Risk XL control the vertical exposure on individual risks. However the Cat XL protects an insurer from horizontal exposure, when a single loss affects a number of policies and risks. Natural events such as a flood, cyclone, earth-quake, volcanic eruption, or, or man made event such as riots / large fires in conflagration areas can cause wide-spread loss. 9 How does it work? For example: If the cover is 800,000 excess of 200,000. Which means the loss must exceed 200,000 to qualify for a recovery from the reinsurer . But at the same time, the Reinsurer’s liability is limited to 800,000. All losses up to 200,000 each are retained net. If there is a loss of 1,250,000: Reinsured retains 200,000 Recovery from Reinsurer: 800,000 Balance 250,000 falls back to reinsured’s retention – because the cover was inadequate. 10 How does it work? The above example means: Reinsured has to keep certain amount of loss retention on every loss. Reinsurer is NOT liable to pay every loss. There is a limit to how much loss the Reinsurer will pay. Since every risk is not shared in proportion, the Reinsurer is not entitled for proportional premiums. 11 How does it work? Excess of loss recovery : Layer 800,000 XS 200,000 1,600,000 1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 12 Premiums in Non Proportional GNPI = Written Premium less Return Premium, Cancellations and premium on reinsurances which reduce the exposure of the XL Reinsurers. XL Premium= GNPI x Rate of Adjustment. M & D Premium= XL Premium x 80% or 90% as may be negotiated & agreed. Adjustment Premium= Excess of XL Premium over the M & D Premium, but not vice versa. Reinstatement Premium= Proportionate premium payable to the reinsurers, in case of a loss recovery, as per predetermined terms, which will reinstate the cover limit of the XL treaty. 13 GNPI: 3 line Surplus Treaty: Max Retention 100 600 500 400 Net Retained Premium 300 200 100 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 14 XL Premium Since every loss is not shared in proportion, Reinsure is not entitled for proportionate premium. There can be years, when not a single loss is recovered from Reinsurers and Reinsured retains all losses, as they are within the deductible level. The XL premium is therefore worked out on the basis of certain rating methods such as Burning Cost, Exposure, ROL methods etc. Reinsurers use rating models for various classes and trypes of XL treaties. 15 How is Premium fixed for Non Prop? A rate of adjustment is arrived at by using vaious methods of rating and this rate is applied to the GNPI of the whole portfolio. The premium thus arrived is called the XL Premium. For example : GNPI is 20,000,000 Rate of adjustment is 2% XL Premium is 400,000 Now the GNPI it self is an estimation by the Reinsured. Depending on the market conditions and business strategies of the Reinsured, the (estimated) GNPI : may be reached, say is accounted at 20,000,000 may not be reached, may reach to 15,000,000 or may exceed the estimate and reach to 25,000,000 16 XL Premium 3 line Surplus Treaty: Max Retention 100 600 500 400 300 200 100 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 GNPI X Rate of adjustment = XL Premium 17 Minimum & Deposit Premium XL Treaty is arranged for period 12 months at 1.1.2000 Information given to Reinsurers before 31.12.1999. Hence the GNPI is estimated at say 2,000,000 But, the actual Accounted Premium will be known only at 31.12.2000 It might be more than 2 m or less than 2 m. Neither party knows. Reinsurer is selling his capacity, he is providing capital to reinsured to write large risks. Hence Reinsurer wants a minimum return on the capacity sold or capital provided. Therefore a minimum and deposit premium is charged – which is payable in advance. In the above example, if the rate is 5% - then the XL Premium would be 100,000 The MDP would be charged say at 85% or 90% of the XL Premium. 18 Adjustment Premium The Reinsurers will receive MDP during the period of cover. At the end of the cover when the actual accounted GNPI is known, the final XL Premium is to be ascertained. In above case if final GNPI is 2,500,000 Then the actual XL Premium would be 125,000 (2.5 m XS 5%) The Reinsurer has already received MDP of 90,000, hence by way of Adjustment Premium he will receive the balance 35,000 19 Accounting for Non Proportional Calculation of Premiums: Terms: GNPI 20,000,000 (Period 12 months @ 1.1.2000) XL Rate: 2.5% XL Premium: 500,000 M & D @ 85%:425,000 payable quarterly in advance. 1st installment on 1st January 2000 : 106,250 2nd installment on 1st April 2000 : 106,250 3rd installment on 1st July 2000 : 106,250 4th installment on 1st Sept. 2000 : 106,250 Actual GNPI @ 31.3.2001 is 22,000,000 XL Premium = 550,000 Adjustment Premium due to Reinsurer is 125,000 20 BC Premium Assumption: Motor /WC/EL XL 1st layer. GNPI 2,500,000. Period 1.1.99 to 31.12.99 LOD basis. Treaty : 1,000,000 XS 500,000 Rate min 4% & max 10%. XL P 100,000 (technically there should be no MDP when the rate is Min & Max) Loading factor 100/70. BC Calculation: During the year there is one loss of 700,000. Recovery from Reinsurer is 200,000 Pure BC = 200,000 / 2,500,000 X 100 = 8% Loaded BC = 8 *100/70 = 11.43% Maximum rate is 10% Hence BC adjusted Premium is 250,000. Already paid 100,000, so AP 150,000 21 Reinstatement Premium Cover : 500,000 xs 500,000 at cost of 50,000 Loss of 400,000 recovered from the cover. Hence the balance protection reduced to 100,000 for the remaining term. The Cedant would like to reinstate the cover to its original level by paying additional premium, known as the reinstatement premium. This can be @ 50% or 100% or 125% etc. of the original XL Premium or can even be free of cost e.g. in case of the Motor XL 1st layer. 22 Reinstatement Premium Reinstatement Premium 300,000 3 2 200,000 0 200,000 Loss of 700,000 recovers 200,000 from layer MDP 50,000 500,000 500,000 1 200,000 Reinstate at Additional Pro-rata Premium Of 30,000 400,000 600,000 800,000 1,000,000 1,200,000 23 Calculation of Reinstatement Premium Assumptions: Cover 500,000 XS 500,000 EEL & Premium 50,000 2 full Reinst. 1st @ 50% & 2nd @ 100% AP Pro rata as to amount only. Formula: Claim Amount X Premium X 50% 1st Cover X 100% 2nd FGU Loss Recovery MDP 50,000 Cover Reinstated Additional Reinst. 1st Reinst. @ Premium 50% AP 1st Loss 1,000,000 500,000 500,000 2nd Loss 1,000,000 500,000 500,000 3rd Loss 800,000 300,000 4th Loss 1,000,000 200,000 Total 1,700,000 1,500,000 25,000 50,000 2nd Reinst. @ 100% AP 1,000,000 75,000 24 Adjustment Premium Cover is 1,000,000 XS 500,000 EGNPI is 5,000,000 Rate is 2% E XL Premium 100,000 & MDP 90,000 GNPI Rate XL Premium Less MDP Adjusted Premium 1 6,000,000 2% 120,000 90,000 30,000 2 3,500,000 2% 70,000 90,000 Nil 25 Accounting for Non Proportional Policy attaching basis & Losses Occurring Basis. 31.12.2002 1.1.2002 Policy 1 Policy 2 U/W Yr 2002 Loss 1 Loss 2 Loss 3 Loss 4 Policy 3 Policy 4 Loss 5 •Reinsurers on a “Policy Attaching” contract will pay No.3, 4 & 5 losses. •Reinsurers on a “Losses Occurring” contract will pay No. 1,2, & 3 losses. 26 Preliminary Loss Advise ON COMPANY LETTER HEAD & DATE / REFERENCE TO BE MENTIONED We regret to advise a loss as per following particulars: 1. Cover 2. Name of Insured 3. Policy No 4. Claim No 5. Date of Loss 6. Period of Insurance 7. Sum Insured 8. Particulars of Loss 9. Description of Risk Covered 10. Est. Amount of Loss 11. Deductible 12. Est. Amount of loss affecting layer We shall keep you informed of the further development, meanwhile kindly register this claim in your books. 27 Loss Recovery Advice Assumptions: Cover 500,000 XS 500,000 EEL & Premium 50,000 2 full Reinst. 1st @ 50% & 2nd @ 100% AP Pro rata as to amount only. Formula: Claim Amount X Premium X 50% 1st Cover X 100% 2nd FGU Loss Recovery MDP 50,000 Reinstatement Premium Reinsurer Pays 1st Loss 1,000,000 500,000 25,000 475,000 2nd Loss 1,000,000 500,000 50,000 450,000 3rd Loss 800,000 300,000 300,000 4th Loss 1,000,000 200,000 200,000 Total 1,700,000 1,500,000 75,000 1,425,000 28 Chain of Non Proportional Accounting Settlement of MDP in advance Loss advise Revised Loss advise and loss survey Recovery of Claims after discounting the reinstatement premium. Advice of Losses outstanding at the end of the year. Advice of final accounted GNPI and adjustment premiums at the end of the year. This advice should sent for few years, until all risks are fully serviced. 29 Some important clauses pertaining to the Non Proportional Treaties 30 Ultimate Net Loss Clause (UNL) Defines a loss as a sum that the Ceding Company sustains following a loss, after necessary adjustments are made. Intention is that the Reinsurer is liable only when the amount including legal cost and other loss settlement expenses, actually paid by the Ceding Company less all recoveries from underlying reinsurances or other sources exceeds the loss retention or the underlying. 31 Claims reporting Clause The Ceding Co. is obliged to notify the loss to the reinsurer ASAP with the date & basic details of loss. Reinsurer may request for additional details and then set up required reserves. Any loss that may be 75% or more than the loss retention and is likely to increase further needs to be advised to the Reinsurer. 32 Claims Co-operation Clause Ceding Company’s obligation regarding liaison with the reinsurer over the conduct and negotiation of losses, thus allowing the reinsurer to be closely involved in any such negotiations. 33 Stability / Index Clause For Long Tail business there is time of several years, between the date of loss occurrence and actual date of settlement. Hence due to inflation the final settled amount might be much larger than estimated originally. Year Value of Loss Rate of Inflation Inflated Loss 1 200,000 8.5% 217,000 2 217,000 9.75% 238,158 3 238,158 10.25% 262,269 4 262,269 11.80% 293,551 Value of Loss at date of occurrence: 200,000 Value of loss if settled after 4 years : 293,551 34 Stability Clause Reasons for increased cost of Loss: Inflation. Personal injury awards related to earnings, which may increase over the years. Improvement in know-how and costs of medical treatment. Tendency of Courts to be generous towards the claimant. Under Pro-rata treaty the Cedant and Reinsurer share the loss in same proportion. However for Non Proportional Treaty the increase in cost may involve the Reinsurer, who otherwise would not have been involved in the loss. 35 Stability Clause Looking back to the example, if the cover was 300,000 XS 100,000: Value at the date of accident 200,000 Cedant’s share of loss 100,000 Reinsurer’s share of loss 100,000 Value of loss after 4 years 293,551 Cedant’s share of loss 100,000 Reinsurer’s share of loss 193,551 36 Stability Clause Purpose of Stability Clause: To spread impact of inflation equitably between the Cedant and the Reinsurer in the same proportion as if there was no influence of inflation. This is achieved by applying a particular INDEX to Cedant’s retention and measuring the variation in that INDEX between The date of inception of treaty & The date of settlement of loss Let us now see, how this will have an effect on our example. 37 Stability Clause Value of loss on day 1 200,000 Index at inception Value of loss after 4 years 293,551 Index at date of payment 100 146.77 Formula : Payment Actual Payment Value X Index at inception = Adjusted Payment Value Index at date of Payment 293,551 X 100/146.77 = 200,000 Formula: Retention Retention at inception X Actual Payment Value = Adjusted Retention Proportion of Cedant & Adjusted Payment Value Reinsurer is the same. 100,000 X 293,551/200,000 = 146,775 Value of loss after 4 years Cedant’s retention Reinsurer’s Liability With Stab. Cl 293,551 146,775 146,776 Without Stab. Cl 293,551 100,000 193,551 38 Stability Clause & Franchise A Stability Clause may provide for say 10% Franchise. For example if the Cover is 300,000 XS 100,000 Base Index is 100 Settlement Index 146.77 The increase in the Index is by 46.77 and exceeds the franchise of 10% hence Stability Clause will be applied as normal Had the increase in the base index and the settlement index been less than 10% the Stability Clause would not be applicable. The base index would normally be The date of inception or renewal of a Treaty or sometimes the date of loss occurrence. The settlement index would normally be The date of settlement of loss. 39 Hours (Definition of Loss Occurrence) Clause Applicable to treaties covering events that may last for a number of days, such as flood, Cyclone, Riots etc. Defines “Event” by putting time limit e.g. 72 hours (3 days) for Hurricane/ Riots etc. and 168 hours (7 days for Flood / Winter Storm). Continuous period to be applied Following graph indicates pattern of a flood lasting for 16 days: 500000 450000 400000 350000 300000 250000 200000 150000 100000 50000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 40 Hours (Definition of Loss Occurrence) Clause 500000 450000 400000 350000 300000 250000 200000 150000 100000 50000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 41 Hours Clause Day Loss Event 1 20,000 2 50,000 3 70,000 4 100,000 5 0 6 460,000 7 80,000 8 450,000 9 10,000 10 50,000 11 100,000 12 70,000 13 70,000 14 250,000 15 120,000 16 retains recovers 3 events means 3 retentions 780,000 350,000 430,000 1,000,000 350,000 650,000 50,000 170,000 170,000 0 1,950,000 1,950,000 870,000 1,080,000 42 Hours Clause Day Loss Loss Event 1 20,000 20,000 2 50,000 50,000 3 70,000 70,000 4 100,000 100,000 5 0 0 6 460,000 460,000 7 80,000 80,000 8 450,000 450,000 9 10,000 10,000 10 50,000 50,000 11 100,000 100,000 12 70,000 70,000 13 70,000 70,000 14 250,000 250,000 15 120,000 120,000 16 50,000 50,000 1,950,000 1,950,000 20,000 retains 20,000 recovers 0 Two Events, and two Loss retentions 1,210,000 350,000 860,000 10,000 10,000 0 710,000 350,000 360,000 1,950,000 730,000 1,220,000 43 Interlocking Clause (risks attaching) Purpose of this clause to allocate or apportion the liability If arising out of ONE Event or Cause But falling in the scope of TWO or MORE parallel treaties or TWO or MORE underwriting years of the same treaty. Effect of this clause is To proportionately scale down the limits of treaty to apportion and allocate loss to each contract. Otherwise the Cedant has to bear full retention under each of the treaties or underwriting years affected. 44 Interlocking Clause - Example Assumption: Cover 1999= 300,000 XS 200,000 Cover 2000 = 400,000 XS 100,000 Loss occurs on 15.10.2000 for 400,000 Apportionment of the loss 1999 policies 2000 policies 120,000 means 30% 280,000 means 70% Allocation of the Loss 1999 (30% of original limits) 2000 (70% of original limits) 90,000 XS 60,000 280,000 XS 70,000 Year Gross loss Cedant’s retention Reinsurer’s Liability 1999 120,000 60,000 60,000 2000 280,000 70,000 210,000 Total 400,000 130,000 270,000 Gross loss Cedant’s retention Reinsurer’s Liability 120,000 120,000 Nil 280,000 100,000 180,000 400,000 220,000 180,000 45 46