National Income - Bannerman High School

advertisement

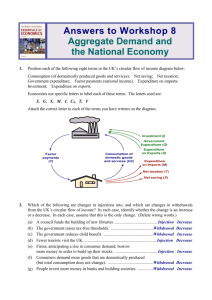

LEARNING OUTCOME 5 NATIONAL INCOME NATIONAL INCOME National Income is a measure of the value of economic activity in an economy. Nominal National Income is the money value, whereas Real National Income eliminates the effect of inflation. The basis of National Income is Aggregate Monetary Demand which comprises: Consumption Spending (C) + Investment Spending (I) + Government Spending (G) + Exports (X) In an open (trading) economy, National Income comprises: Consumption(C) + Investment(I) + Government(G) + Exports(X) – Saving(S) – Taxation(T) - Imports(M) INJECTIONS Firms Government Saving (X) Investment Exports WITHDRAWALS (I) (G) (C) (M) CIRCULAR FLOW OF INCOME (Y) Imports (T) (S) Households Taxation NATIONAL INCOME As long as - total injections Investment + Government + Exports equal = total withdrawals Saving + Taxation + Imports national income is in equilibrium. If injections are greater than withdrawals national income, output and employment will rise. If injections are lower than withdrawals national income, output and employment will fall. Similar to water in a bath, when the taps inject water into the bath faster than the plug withdraws it, then the water level rises. If the plug withdraws water faster than the taps inject it, the water level falls. THE MULTIPLIER The proportion of any rise in income which consumers save is known as the Marginal Propensity to Save. Any additional injection will be multiplied by the inverse of the Marginal Propensity to Save or 1 ie 1 MPS (T) (M) Marginal Leakages This is known as the multiplier effect and can be used as follows: If consumers choose to spend two thirds of any rise in income then they save the other one third. This means the multiplier is 1 ie 3. 1/3 When the multiplier has a value of 3 this means a Government, seeking to generate additional national income of £4.5 bn, only requires to spend an additional £1.5 bn, since a multiplier of 3 will generate the desired £4.5 bn (£1.5 X 3 = £4.5). The reason for the multiplier effect is because when 2/3 of any extra income is spent, creating increased demand. Manufacturers will employ extra resources to increase output to meet the demand. When these extra resources are paid for, extra income is earned, 2/3 of which will be spent and so the process goes on. An additional injection therefore has a ‘multiple’ rather than a ‘one-off’ effect. NATIONAL INCOME National income in an economy is important since it is the level of economic activity which creates employment for labour and all the other resources. If we plot all spending on the graph E=Y starting with Consumption spending (C), Expenditure C+I+G C+I C then add on Investment spending (I), then Government spending (G) - C+I+G represents Aggregate Monetary Demand. When AMD is insufficient to employ all resources, there is a deflationary gap. FE Income Keynesian theory would suggest that a Government could increase G and put policies into effect to stimulate C and I in order to make up the gap and create a level of national income sufficient to achieve full employment. Similarly where the level of AMD is higher than necessary for full employment there is an inflationary gap – too much demand for the capacity available. Keynesian theory would suggest a Government could decrease G and use policies to reduce C and I to eliminate the inflationary gap. 3 METHODS OF CALCULATING NATIONAL INCOME INCOME METHOD OUTPUT METHOD EXPENDITURE METHOD Gross Domestic Income Gross Domestic Product + + Net Income from Overseas + Net Income from Overseas and Exports - Net Income from Overseas Imports = = Gross National Income = Gross National Product - - Depreciation Depreciation = = Net National Income Gross Domestic Expenditure = Net National Product Gross National Expenditure = + subsidies - tax Gross National Expenditure - Depreciation = = Net National Expenditure PROBLEMS WITH NATIONAL INCOME CALCULATIONS INCOME METHOD: Only incomes which are earned from productive activity should be counted. Transfer incomes must not be included since these are paid out of the axes paid by income earners and have already been counted. Transfer incomes include pensions, benefits and disability allowances. OUTPUT METHOD: Care must be taken to avoid double counting by costing production at final value. Increase in value of stock must be due to real additions to stock and not inflation Much production is in the ’ black economy’ and therefore goes unrecorded. EXPENDITURE METHOD: Should be expressed at ‘factor cost’ by adding back subsidies given and deducting taxes taken. ALL METHODS: Depreciation must be deducted since this is value attributed to income earned from, or output produced for, or expenditure on, replacement goods (which do not increase the total stock of goods available) and not additional new goods. USING NATIONAL INCOME STATISTICS Allows comparisons of standard of living between countries provided consideration is given to: • differing populations – national income per head should be used • average personal disposable income would take differing tax rates into account • consideration is given to how national income is distributed within countries • differences in hours worked and conditions of work should be considered • social costs and benefits • exchange rate differences between countries • different countries spend different proportions of national income on capital goods and defence which do not immediately impact on standard of living Allows comparisons over time provided consideration is given to: • the rate of inflation therefore • use ‘real’ values rather than’ nominal’ values QUIZ What does AMD stand for? What makes up AMD? Name 3 injections. Name 3 withdrawals. AGGREGATE MONETARY DEMAND CONSUMPTION, INVESTMENT, GOVERNMENT SPENDING AND EXPORT INVESTMENT, GOVERNMENT SPENDING AND EXPORTS SAVING, TAXATION AND IMPORTS What is national income equilibrium? LEVEL AT WHICH INJECTIONS = WITHDRAWALS Describe the multiplier effect. EXTRA SPENDING MULTIPLIED UP GENERATING NATIONAL INCOME LARGER THAN INJECTION How is the value of the multiplier determined? INVERSE OF MARGINAL PROPENSITY TO LEAK What is an inflationary gap? SPENDING TOO HIGH FOR AVAILABLE CAPACITY What is a deflationary gap? SPENDING TOO LOW FOR AVAILABLE CAPACITY What are 3 methods of calculating national income? When using national income statistics what must be borne in mind? INCOME, OUTPUT AND EXPENDITURE DIFFERENCES IN POPULATION, INFLATION, WORK CONDITIONS, DISTRIBUTION OF WEALTH ………….