Chapter 7 Powerpoint - Agricultural & Applied Economics

advertisement

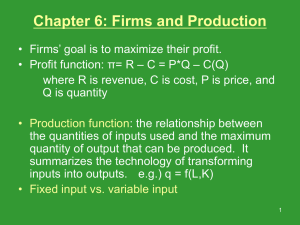

Economics of Input and Product Substitution Chapter 7 Topics of Discussion Concept of isoquant curve Concept of an iso-cost line Least-cost use of inputs Long-run expansion path of input use Economics of business expansion and contraction Production possibilities frontier Profit maximizing combination of products 2 Physical Relationships 3 Use of Multiple Inputs In Ch. 6 we finished by examining profit maximizing use of a single input Lets extend this model to where we have multiple variable inputs Labor, machinery rental, fertilizer application, pesticide application, energy use, etc. 4 Use of Multiple Inputs Our general single input production function looked like the following: Output = f(labor | capital, land, energy, etc) Variable Input Fixed Inputs Lets extend this to a two input production function Output = f(labor, capital | land, energy, etc) Variable Inputs 5 Fixed Inputs Use of Multiple Inputs Output (i.e. Corn Yield) 250 Nitrogen Fert. 6 Phos. Fert. Use of Multiple Inputs If we take a slice at a level 250 of output we obtain what is referred as an isoquant Similar to the indifference curve we covered when we reviewed consumer theory Shows collection of multiple inputs that generates the same level of output There is one isoquant for each output level 7 Isoquant means “equal quantity” Output is identical along an isoquant and different across isoquants Two inputs 8 Page 107 Slope of an Isoquant The slope of an isoquant is referred to as the Marginal Rate of Technical Substitution (MRTS) Similar in concept to the MRS we talked about in consumer theory The value of the MRTS in our example is given by: MRTS = Capital ÷ Labor Provides a quantitative measure of the changes in input use as one moves along a particular isoquant 9 Pages 106-107 Slope of an Isoquant The slope of an isoquant is Capital Q=Q* Slope of an isoquant = Slope of the line tangent at a point K* A L* the Marginal Rate of Technical Substitution (MRTS) Output remains unchanged along an isoquant The ↓ in output from decreasing labor must be identical to the ↑ in output from adding capital as you Labor move along an isoquant Pages 106-107 10 MRTSKL = ∆K/∆L MRTSKL here is –4÷1=–4 11 Page 107 What is the slope over range B? MRTS here is –1 ÷ 1 = –1 12 Page 107 What is the slope over range C? MRTS here is –.5 ÷ 1 = –.5 13 Page 107 Slope of an Isoquant Since the MRTS is the slope of the isoquant, the MRTS typically changes as you move along a particular isoquant MRTS becomes less negative as shown above as you move down an isoquant Pages 106-107 14 Slope of an Isoquant Lets derive the slope of the isoquant like we did for the indifference curve under consumer theory Q f L,K ΔQ ΔQ ΔL + ΔQ ΔK ΔL ΔK ∆Q = 0 along an isoquant → ΔQ ΔQ 0 ΔL + ΔK ΔL ΔK ΔQ ΔQ ΔK ΔQ ΔQ ΔK ΔL ΔL ΔK ΔK ΔL ΔL 15 Pages 106-107 Slope of an Isoquant MPPL ΔK ΔQ ΔQ MRTS KL ΔL ΔK ΔL MPPK Capital Q=Q* MRTSKL = –MPPL*/MPPK* K* L* 16 Labor Pages 106-107 Slope of an Isoquant Capital Q = Q* K* What is the impact on the MRTS as input combination changes from A to B? Why? A B K** L* 17 L** Labor Pages 106-107 Introducing Input Prices 18 Plotting the Iso-Cost Line Lets assume we have the following Wage Rate is $10/hour Capital Rental Rate is $100/hour What are the combinations of Labor and Capital that can be purchased for $1000 Similar to the Budget Line in consumer theory Referred to as the Iso-Cost Line when we are talking about production 19 Pages 106-107 Plotting the Iso-Cost Line Capital 10 Firm can afford 10 hours of capital at a rental rate of $100/hr with a budget of $1,000 Firm can afford 100 hour of labor at a wage rate of $10/hour for a budget of $1,000 Combination of Capital and Labor costing $1,000 Referred to as the $1,000 Iso-Cost Line 20 100 Labor Page 109 Plotting the Iso-Cost Line How can we define the equation of this iso-cost line? Given a $1000 total cost we have: $1000 = PK x Capital + PL x Labor → Capital = (1000÷PK) – (PL÷ PK) x Labor →The slope of an iso-cost in our example is given by: Slope = –PL ÷ PK (i.e., the negative of the ratio of the prices of the two inputs) 21 Page 109 Plotting the Iso-Cost Line Capital 2,000÷PK 20 Doubling of Cost Original Cost Line Note: Parallel cost lines given constant prices 10 500 ÷ PK 5 Halving of Cost Labor 50 22 500 ÷ PL 100 200 2000 ÷ PL Page 109 Plotting the Iso-Cost Line Capital $1,000 Iso-Cost Line Iso-Cost Slope = – PL ÷ PK 10 PL = $10 PL = $20 23 50 100 PL = $5 200 Labor Page 109 Plotting the Iso-Cost Line Capital 20 $1,000 Iso-Cost Line Iso-Cost Slope = – PL ÷ PK PK = $50 10 PK = $100 5 PK = $200 50 24 100 200 Labor Page 109 Least Cost Combination of Inputs 25 Least Cost Input Combination TVC are predefined Iso-Cost Lines Capital TVC*** > TVC** > TVC* Q* TVC*** A TVC** TVC* B Pt. C: Combination of inputs that cannot produce Q* Pt. A: Combination of inputs that have the highest of the two costs of producing Q* Pt. B: Least cost combination of inputs to produce Q* C Labor 26 Page 109 Least Cost Decision Rule The least cost combination of two inputs (i.e., labor and capital) to produce a certain output level Occurs where the iso-cost line is tangent to the isoquant Lowest possible cost for producing that level of output represented by that isoquant This tangency point implies the slope of the isoquant = the slope of that iso-cost curve at that combination of inputs 27 Page 111 Least Cost Decision Rule When the slope of the iso-cost = slope of the isoquant and the iso-cost is just tangent to the isoquant –MPPL ÷ MPPK Isoquant Slope = – (PL ÷ PK) Iso-cost Line Slope We can rearrange this equality to the following 28 Page 111 Least Cost Decision Rule MPPL MPPK PL Pk MPP per dollar spent on labor 29 = MPP per dollar spent on capital Page 111 Least Cost Decision Rule The above decision rule holds for all variable inputs • For example, with 5 inputs we would have the following MPP1 MPP2 MPP3 MPP4 MPP5 P1 P2 P3 P4 P5 MPP1 per $ spent on Input 1 30 = MPP2 per $ spent on Input 2 =…… = MPP5 per $ spent = on Input 5 Page 111 Least Cost Input Choice for 100 Units of Output Point G represents 7 hrs of capital and 60 hrs of labor Wage rate is $10/hr and rental rate is $100/hr → at G cost is $1,300 = ($100×7) + ($10×60) 7 60 31 Page 111 Least Cost Input Choice for 100 Units of Output G represents a total cost of $1,300 every input combination on the iso-cost line costs $1,300 With $10 wage rate → B* represent 130 units of labor: $1,300$10 = 130 7 60 130 Page 111 32 Least Cost Input Choice for 100 Units of Output Capital rental rate is $100/hr 13 → A* represents 13 hrs of capital, $1,300 $100 = 13 130 Page 111 33 What Happens if the Price of an Input Changes? 34 What Happens if Wage Rate Declines? Assume initial wage rate and cost of capital result in iso-cost line AB 35 Page 112 What Happens if Wage Rate Declines? Wage rate ↓ means the firm can now afford B* instead of B amount of labor if all costs allocated to labor 36 Page 112 What Happens if Wage Rate Declines? The new point of tangency occurs at H rather than G The firm would desire to use more labor and less capital as labor became relatively less expensive What is the minimum cost of producing 100 units of output? 37 Page 112 Least Cost Combination of Inputs and Output for a Specific Budget 38 What Inputs to Use for a Specific Budget? Capital M An iso-cost line for a specific budget N Labor 39 Page 113 What Inputs to Use for a Specific Budget? A set of isoquants for different output levels Page 113 40 What Inputs to Use for a Specific Budget? Firm can afford to produce 75 units of output using C3 units of capital and L3 units of labor Page 113 41 What Inputs to Use for a Specific Budget? The firm’s budget not large enough to produce more than 75 units 42 Page 113 What Inputs to Use for a Specific Budget? On any point on this isoquant the firm is not spending available budget here 43 Page 113 Economics of Business Expansion 44 Long-Run Input Use During the short run some costs are fixed and other costs are variable As you increase the planning horizon, more costs become variable Eventually over a long-enough time period all costs are variable 45 Page 114 Long-Run Input Use Cost/unit SACA SACB Fixed costs in short run ensure the U-Shaped SAC curves SACC A A* 3 different size firms A is the smallest, C the largest B C A firm wanting to minimize cost Output Operate at size A if production is in 0A range Operate at size B if production is in AB range 46 Page 114 The Planning Curve The long run average cost (LAC) curve Points of tangency with a series of short run average total cost (SAC) curves Tangency not usually at minimum of each SAC curve Cost/unit SACA SACB 47 SACC LAC sometimes referred to as Long Run Planning Curve LAC Output Page 114 Economies of Size Cost/unit Typical LAC curve Output What causes the LAC curve to decline, 48 become relatively flat and then increase? Due to what economists refer to as Page 114 economies of size Economies of Size Constant returns to size ↑(↓) in output is proportional to the ↑(↓) in input use i.e., double input use → doubling output Decreasing returns to size ↑ (↓)in output is less than proportional to the ↑(↓) in input use i.e., double input use → less than double output Increasing returns to size 49 ↑ (↓)in output is more than proportional to the ↑(↓) in input use i.e., double input use → more than double output Page 114 Economies of Size Decreasing returns to size → Firm’s LAC curve are increasing as firm is expanded Increasing returns to size → Firm’s LAC curve are decreasing as firm is expanded 50 Page 115 Economies of Size Reasons for increasing returns of size Dimensional in nature Double cheese vat size Eventually the gains are reduced Indivisibility of inputs Equipment available in fixed sizes As firm gets larger can use larger more efficient equipment Specialization of effort Labor as well as equipment Volume discounts on large purchases on productive inputs 51 Page 116 Economies of Size Decreasing returns of size LRC is ↑ → the LRC is tangent to the collection of SAC curves to the right of their minimum Cost/unit SACA SACB SACC SACD Output 52 Page 116 Economies of Size The minimum point on the LRC is the only point that is tangent to the minimum of a particular SAC C* is minimum point on Cost/unit SAC* SAC* and on LRC Only plant size and quantity output where this occurs LRC C* Q* 53 Output Page 116 The Planning Curve In the long run, the firm has time to expand or contract the size of their operation Each SAC curve for each size plant has associated short run marginal cost curve (MC) SACi = SMCi when SACi is at its minimum Cost/unit SMC1 SAC1 SMC4 SMC2 SAC2 SMC3 SAC3 Output 54 SAC4 Page 117 The Planning Curve Assume the market price for the product is P Assume the firm is of size i The firm maximizes profit by producing where P=MCi What can you say about the performance of these 4 firms? SMC1 SAC1 SMC4 SAC4 SMC2 P SAC2 SMC3 SAC3 Output 55 Page 117 The Planning Curve Firm 1 would lose money with output price = P Produce where P = SMC1 → Q* At Q*, P < SAC1 SMC1 SAC1 P Q* 56 Output Page 117 The Planning Curve Firms of sizes 2, 3 and 4 would make a positive profit when output price is P P > SAC at profit maximizing level P-SAC = per unit profit Per unit profit SMC4 SAC2 SMC2 SAC4 SMC3 P SAC3 Output Q2* 57 Q3 * Q4* Page 117 The Planning Curve Firm 2’s total profit Per unit profit x Q2* SMC4 SAC2 P SMC2 SAC4 SMC3 Firm 2’s Total Profit SAC3 Output Q2* 58 Q3 * Q4* Page 117 The Planning Curve Firm 3’s total profit Per unit profit x Q3* SMC4 SAC2 SMC2 SAC4 SMC3 P Firm 3’s Total Profit SAC3 Output Q2* 59 Q3 * Q4* Page 117 The Planning Curve Firm 4’s total profit Per unit profit x Q4* SMC4 SAC2 P SMC2 SAC4 SMC3 Firm 4’s Total Profit SAC3 Output Q2* 60 Q3 * Q4* Page 117 The Planning Curve Assume the product price falls to PLR Only Firm 3 will not lose money It only breaks even as PLR=SAC3 (=MC3) For other firms, the price is less than any point on the other SAC curves Firm 4 would have to reduce its size SMC1 SAC1 SMC4 SAC4 SMC2 P SAC2 SMC3 SAC3 PLR Output 61 Page 117 How to Expand Firm’s Capacity Optimal input combination for output=10 62 Page 118 How Can the Firm Expand Its Capacity? Two options: 1. Point B ? 63 Page 118 How Can the Firm Expand Its Capacity? Two options: 1. Point B? 2. Point C? Page 118 64 How Can the Firm Expand Its Capacity? Optimal input combination for output = 20 with budget represented by FG Optimal input combination for output=10 with budget DE Page 118 65 How Can the Firm Expand Its Capacity? This combination of inuts costs more to produce 20 units of output since budget HI exceeds budget FG 66 Page 118 Producing More than One Output Most agricultural operations produce more than one type of output For example a grain farm in Southern Wisconsin Produces wheat, oats, barley and some alfalfa hay Raises some cattle on the side Production of these outputs requires a set of inputs 67 Each output is competing for the use of limited inputs (e.g. labor, tractor time, etc) Producing More than One Output Lets first address the production decision from a technical perspective Similar to our examination of production of a single output via the isoquant 68 Producing More than One Output For a single output we defined an isoquant as the collection input combinations that has the same maximum output represented by that isoquant Lets now define the collection of output combinations that could be produced with a fixed supply of inputs 69 Producing More than One Output The collection of outputs technically feasible with a fixed amount of inputs is referred to as the production possibilities set The boundary of that set is referred to as the production possibilities frontier (PPF) 70 Producing More than One Output Output combinations within the frontier (boundary) are technically possible but inefficient Can produce more of at least one of the outputs Again remember that the amount of inputs available for production is assumed fixed 71 Producing More than One Output Output combinations on the frontier are technically efficient Can not produce more of at least one output unless less is produced of at least one of the other outputs Remember the assumption: The amount of inputs available for production is fixed 72 Producing More than One Output 73 Page 120 Points A → J are on the PPF Note axis labels What happens when firm changes output mix from B to E? 128 95 10 74 Page 120 K* Inefficient use of firm’s existing resources Level of output unattainable with with firm’s existing resources PPF represents maximum attainable products given fixed amount of inputs Page 120 75 Slope of the PPF The slope of the production possibilities curve is referred to as the Marginal Rate of Product Transformation (MRPT) In the above example, the MRPT is given by: Canned Fruit MRPT Canned Veg. Y2 Y2 In general we have: MRPT Y1 What sign will the MRPT possess? 76 PPF Y1 Page 119 Using slope definition MRPT = ∆Y2 ÷ ∆Y1 Slope between D and E is –1.30 = – 13 10 ↓ from 108 to 95 ↑ from 30 to 40 77 Page 120 95,000 - 108,000 -13,000 78 ÷ 40,000 - 30,000 10,000 = - 1.30 Page 148 Accounting for Product Prices 79 Economic Efficiency and Multiple Outputs Up to this point we have only considered technical efficiency, i.e., the PPF Lets now introduce prices (both output and input) to the model Enables us to discuss the concept of economic efficiency in the context of multiple outputs Page 122 80 Economic Efficiency and Multiple Outputs Lets start with introducing output prices Assume we have two outputs: canned fruits (CF) and canned vegetables (CV) PCF and PCV = the prices received for CV and CV, respectively What would be the combinations of CF and CV production that would generate $1 million in total revenue (TR)? Collection of these combinations generates an iso-revenue line 81 Page 122 Plotting the Iso-Revenue Line Assume PCF=$33.33/case, PCV=$25.00/case Cases of CF PCF = $33.33/case → 30,000 cases of CF generates revenue of $1 million 30,000 PCV = $25.00/case → 40,000 cases of CV generates revenue of $1 million $1 Mil Iso-Revenue Line 82 40,000 Cases of CV Page 122 Plotting the Iso-Revenue Line What is the equation that can be used to identify the R* iso-revenue line? Y2 R* PY2 Slope 83 We have 2 products (Y1, Y2) and associated product prices (PY1,PY2) The R* iso-revenue line is defined via: R* = PY1Y1 + PY2Y2 → PY2Y2 = R* – PY1Y1 → Y2 = (R*÷PY2) – (PY1÷PY2)Y1 PY1 PY2 * R PY1 Y1 General equation for the R* iso-revenue line Page 122 Plotting the Iso-Revenue Line Line AB is original iso-revenue line PCF= $33.33/case, PCV= $25.00/case Combination of outputs that generate the same amount of revenue Slope = $25.00 ÷ $33.33 = 0.75 PCV Slope PCF 84 Page 122 Plotting the Iso-Revenue Line Iso-revenue line would shift out to EF If the revenue target doubled or Output prices decrease by 50% The line would shift in to CD If revenue targets are halved or Output prices are doubled Note: Slope does not change PCV Slope PCF 85 Page 122 Plotting the Iso-Revenue Line Iso-revenue line would rotate: Out to line BC if PCF ↓ by 50% In to line BD if PCF doubled Note: Slope is changing PCV Slope PCF 86 Page 122 Plotting the Iso-Revenue Line Iso-revenue line would rotate Out to line AD if PCV ↓ by 50% In to line AC if PCV doubled Note: Slope is changing PCV Slope PCF 87 Page 122 Determining the Profit Maximizing Combination of Products 88 Profit Maximizing Combination of Products In the cost minimization problem where we produce one product The input combination that minimizes the cost of producing a given output level is where The slope of the isocost curve equals the slope of the isoquant → the isocost curve is just tangent to the isoquant Lets develop a similar decision rule but this time with Multiple outputs Fixed supply of inputs 89 Page 124 What is the profit (π) maximizing combination of fruit and veg. to can given current PCF and PCV values? Remember we have a fixed amount of inputs available Canned Fruit (1,000 Cases) 140 120 100 Determines location of the PPF → All costs are fixed → Maximizing revenue will maximize profit 80 60 40 20 20 90 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 124 Profit Maximizing Combination of Products Canned Fruit (1,000 Cases) 140 Lets place on this PPF the $1 Mil. 120 iso-revenue line, AB 100 80 60 40 A 20 B 20 40 60 80 100 120 140 Canned Veg. (1,000 Cases) 91 Page 124 Profit Maximizing Combination of Products The further from the origin Canned Fruit (1,000 Cases) 140 the iso-revenue line, the greater the level of revenue 120 100 R*1<R*2<R*3 Why are the iso-revenue lines parallel in this model? 80 60 R*2 40 20 R* 20 92 R*3 1 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 124 Profit Maximizing Combination of Products To find the maximum revenue Canned Fruit (1,000 Cases) 140 attainable given available inputs 120 100 80 60 R*2 40 20 R* 20 93 Lets find the iso-revenue line that is just tangent to the PPF At the tangency point it is physically possible to produce that combination of outputs given our fixed input base R*3 1 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 124 Profit Maximizing Combination of Products 140 Shifting line AB out in a parallel fashion holds both prices constant Canned Fruit (1,000 Cases) M 120 PCV At M MRPT = PCF 100 80 YCF PCV = YCV PCF 60 40 Slope of an PPF curve 20 20 94 40 60 80 100 Canned Veg. (1,000 Cases) 120 Slope of the Iso-cost line 140 Page 124 Profit Maximizing Combination of Products In summary: The profit maximizing combination of two products is found where the slope of the PPF is equal to the slope of the isorevenue line and on the highest iso revenue curve possible given the limited inputs 95 Page 124 Profit Maximizing Combination of Products Price ratio = -($25.00 ÷ $33.33) = - 0.75 125,000 cases of fruit 96 18,000 cases of veg. MRPT equals -0.75 Page 120 Doing the Math… Let’s assume PCF is $33.33 and PCV is $25.00 If point M represents 125,000 cases of fruit and 18,000 cases of vegetables, then total revenue at point M is: Revenue = 125,000 × $33.33 + 18,000 × $25.00 = $4,166,250 + $450,000 = $4,616,250 97 Doing the Math… At these same prices, if we instead produce 108,000 cases of fruit and and 30,000 cases of vegetables→ total revenue would fall Revenue = (108,000 × $33.33) + (30,000 × $25.00) = $3,599,640 + $750,000 = $4,349,640 • 98 $266,610 less than $4,616,250 earned at M Effects of a Change in the Price of One Product 99 Profit Maximizing Combination of Products PCF reduced by 50% M Canned Fruit (1,000 Cases) 140 120 Firm must sell twice as many cases of CF to earn a particular level of revenue 100 80 60 40 C This gives us a new isorevenue curve… line CB A 20 B 20 100 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 125 Profit Maximizing Combination of Products To determine the effects of this M Canned Fruit (1,000 Cases) 140 120 price change on the product mix Shift out the new iso-revenue curve Until it is just tangent to the PPF curve 100 80 60 40 C A 20 B 20 101 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 125 Profit Maximizing Combination of Products Canned Fruit (1,000 Cases) 140 As a result of a ↓ in PCF M 120 100 →Firm would shift from M to N To maximize profit → firm would ↓ production of CF and ↑ production of CV N 80 C 60 40 A 20 B 20 102 40 60 80 100 Canned Veg. (1,000 Cases) 120 140 Page 125 Summary #1 Concepts of iso-cost line and isoquants Marginal rate of technical substitution 103 (MRTS) Least cost combination of inputs for a specific output level Effects of change in input price Level of output and combination of inputs for a specific budget Key decision rule …seek point where MRTS = ratio of input prices, or where MPP per dollar spent on inputs are equal Summary #2 Concepts of iso-revenue line and the production possibilities frontier Marginal rate of product transformation (MRPT) Concept of profit maximizing combination of products Effects of change in product price Key decision rule – maximize profits where MRPT -ratio of the product prices 104 Chapter 8 focuses on market equilibrium conditions under perfect competition…. 105