Internal Performance Measurement and Transfer Pricing

advertisement

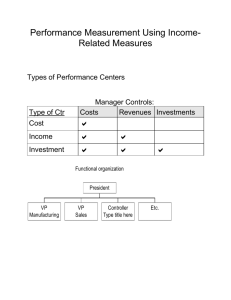

EMBA Presentation November 15,2012 INTERNAL PERFORMANCE MEASUREMENT AND TRANSFER PRICING Internal Performance Measurement Responsibility Centers Residual Income Return on Investment EVA Responsibility Centers Cost center Profit center Investment center Schematic Investment Center Profit Center Cost Center Cost Center Profit Center Cost Center Cost Center Summary of Performance Centers Type of Center Decision Rights Performance Measures Cost Input Mix Cost controls Profit Product Mix, Selling Prices, Input Mix Actual Profits, Budget Comparisons Investment Input Mix, Product Mix, Selling Prices, Capital Invested ROI, Residual Income, EVA Schematic of the ROI Method Sales Sales Turnover ROI Divided by Total Investment Multiplied by Earnings Return on Sales Divided by Sales ROI Example Sales Net Operating Income Total Investment $9,000,000 $ 720,000 $4,000,000 Sales Turnover $9,000,000 $4,000,000 = 2.25 Return on Sales $720,000 $9,000,000 = 8% ROI 2.25 x .08 = 18% Criticisms of ROI Managers may make decisions that increase the ROI in the short run Managers often inherit costs over which they have no control Managers may reject investment opportunities that are good for the organization, but negatively impact the segment Residual Income Focuses on the residual return after deducting the minimum return required by top management Residual Income = NOI – Average Operating Assets X Minimum Required Rate of Return Example of Residual Income Global Equities Corporation Analyis of ROI and Residual Income Sales Net Operating Income Average Operating Assets Europa American Division Division $ 3,000,000 $ 210,000 $ 1,000,000 $ 9,000,000 $ 720,000 $ 4,000,000 Return on Investment (ROI) 21% 18% Residual Income Approach: Assume Global Expects a 15% return on net operating assets Return on Average Operating Assets at 15% $ 150,000 $ 600,000 Net Operating Income $ 210,000 $ 720,000 Residual Income $ 60,000 $ 120,000 Greatest deficiency is that the method does not take into consideration size of the segment Criticisms of Residual Income Absolute number that ignores investment center size Does not measure risk factors Opportunity cost of capital is different between investment centers Calculation of EVA Adjusted EVA = Accounting – Earnings Weighted Cost of Capital X Total Capital Calculation of EVA Earnings • • • • • Earnings per GAAP Less cost of capital used by the center Plus R & D expenses deducted Add amortization of R & D Equals EVA Earnings Capital Formula for EVA Total Capital Invested Plus Capitalized R & D Costs Example Using EVA Operating Income plus R & D Expenses Less Amortization of R & D Expenses Adjusted Earning for EVA Invested Capital Plus Capitalized R & D EVA Capital EVA Rate $900,000 100,000 $800,000 $4,000,000 1,000,000 $5,000,000 16% Controllability Principle Westinghouse Nuclear Case Transfer Pricing Topics What is transfer pricing? Terms Delco example Transfer pricing methods Car dealership example Summary of transfer pricing methods International and tax ramifications A transfer price is the price one sub-unit charges another for a product or service supplied to it Terms Full cost – includes both fixed and variable components Variable cost – includes only the costs directly related to producing the product Idle capacity – plant capacity available for additional manufacturing without incurring more fixed costs Substitute products – competitive products are available in the open market a lower price Congruence Problems Management expects sub-units to act in a manner that maximizes firm-wide profits Management desires that product family members be used throughout the firm Unit managers operate in a manner that optimizes the profitability of their unit which is often reflected in their incentives Delco Example Delco Manufactures Batteries ? Chevrolet $40 After Market Outside market Full cost Variable cost $40 $30 $20 Delco has excess capacity Transfer Pricing Methods Market based Cost based Negotiated Dual Market Prices Lead to Optimal Decisions When: The market for the intermediate product is perfectly competitive Interdependence of subunits is minimal No additional costs in buying or selling in the external market compared to the internal Cost Based Transfer Prices Full cost – price includes both the fixed and variable component If excess capacity is used, there should be no additional fixed costs Fixed costs may be allocated between external and internal sales Full costing may be more appropriate where a firm uses ABC costing Variable cost – includes only the incremental cost Negotiated Prices Mutual agreement between sub-units May have no relationship to cost or market prices May be affected by a unit’s ability to negotiate Dual Pricing In this case, the selling division and the buying division do not pay or receive the same amount Seller gets full cost and buyer pays market Difference rolls to a corporate account May cause divisional tax calculation problems Selling unit has no incentive to control costs Car Dealer Example Departments: Service labor rate Body shop labor rate Parts mark-up New Vehicles, Used Vehicles, Service, Body Shop, and Parts Department New $40 $40 15% Used $40 $40 15% Body 15% Service Retail $65 $40 $65 15% 30% Summary of Methods Domestic Multinational Market based 26% 35% Cost based: Variable Full cost Other Total 3% 49% 1% 53% 0% 42% 1% 43% Negotiated 17% 14% 4% 8% 100% 100% Other TOTAL International and Tax Ramifications Large firms are global in nature Firms sell products between international subsidiaries or joint ventures Tax rates vary between countries International firms will transfer price to minimize total taxes paid Taxes Paid on Box of Contact Lenses in The Netherlands Transfer Price at 80 Euros Transfer Price at 110 Euros Taxes Paid in Netherlands: Revenue (Transfer Price) € 80 Variable Cost Taxable Income Tax Rate Dutch Taxes (50) €110 (50) € 30 € 60 30% 30% € 9 € 18 Taxes Paid in Australia Transfer Price at 80 Euros Transfer Price at 110 Euros Taxes Paid in Australia: Revenue (Australian Dollars) A$ 85 A$ 85 Transfer Price in Euros: 80 x .70 110 x .70 A$ (56) - - A$ (77) A$ 29 A$ 8 40% 40% Australian Taxes A$ 11.6 A$ 3.20 Converted to Euros at .70 Rate € 16.57 € 4.57 Taxable Income Tax Rate Comparison of Results Transfer Price at 80 Euros Transfer Price at 110 Euros Dutch Taxes € 9.00 € 18.00 Australian Taxes 16.57 4.57 € 25.57 € 22.57 Total Eastman Kodak Case Copyright, Frank Ilett, 2012