Managerial Economics & Business

Strategy

Chapter 7

The Nature of

Industry

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

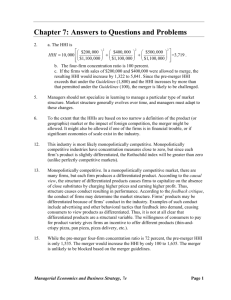

Industry Structure and Performance

Industries differ substantially in nature.

An effective manager is able to adapt to

the nature of the industry in which s/he

operates.

As the nature of industry changes so will

the manager’s optimal decisions.

7-2

Overview

I. Market Structure

– Measures of Industry Concentration

II. Conduct

– Pricing Behavior

– Integration and Merger Activity

III. Performance

– Structure-Conduct-Performance Paradigm

7-3

Industry Analysis

Market Structure –factors that affect managerial

decisions:

– Number and size of firms –as well as change in

a firm’s relative position can change over time.

Industry’s viability can change (auto, steel,

electronics).

– Industry concentration – are there many small

firms or a few large firms?

– Four-firm Concentration ratio – how much of

total output is produced by the four largest firms.

7-4

Industry Concentration

Four-Firm Concentration Ratio

– The sum of the market shares of the top four firms

in the defined industry. Letting Si denote sales for

firm i and ST denote total industry sales

C4 w1 w2 w3 w4 , where w1

Si

ST

– When an industry is composed of a large number of

small firms the FFCR will be close to zero. With four

or fewer firms in the industry the FFCR will be 1.

– With the FFCR close to zero the industry is not

concentrated.

7-5

Industry Concentration

Herfindahl-Hirschman Index (HHI)

– The sum of the squared market shares of firms in a

given industry, multiplied by 10,000:

– HHI = 10,000 S wi2, where wi = Si/ST.

– The squaring aspect of the HHI weights firms with high

market shares more heavily.

HHI = 10,000 monopoly

HHI = 0 PC

7-6

Example

There are five banks competing in a local

market. Each of the five banks have a 20

percent market share.

What is the four-firm concentration ratio?

C4 0.2 0.2 0.2 0.2 0.8

What is the HHI?

HHI 10,000 .2 .2 .2 .2 .2 2,000

2

2

2

2

2

7-7

Concentration in U.S. Industries

Significant concentration in computers, breweries,

automobiles, distilleries, and snack foods.

Less concentrated are concrete, jewelry, electronic

components, ladies apparel.

High FFCR generally have high HHI.

But there can be differences based on the HHI

including all firms in an industry, and its use of

squared market shares.

7-8

Limitations of Concentration Measures

Exclude foreign imports – tends to overstate true level

of industry concentration when many foreign firms serve

a market.

Based on data from the entire U.S. – in many industries

the relevant markets are local. Using national data tends

to understate the level of concentration.

Definition of the industry – how broad an industry is

defined.

Broadly defined industries would tend to have lower

concentration ratios – Beverages versus colas.

7-9

Industry Analysis

– Technological and cost conditions – differences

according to labor and capital intensity give rise to

different production techniques across industries.

Different techniques result in different costs.

– Demand conditions – low demand implies few firms

generally.

– Information available affects market conditions (airline

tickets - internet; used cars – Ebay?).

– Price elasticity of demand varies between industries

and many times between firms in an industry.

– The Rothschild Index

7-10

Measuring Demand and Market Conditions

The Rothschild Index (R) measures the elasticity of

industry demand for a product relative to that of an

individual firm:

R = ET / EF .

– ET = elasticity of demand for the total market.

– EF = elasticity of demand for the product of an individual firm.

– The Rothschild Index is a value between 0 and 1.

When an industry is composed of many firms, each

producing similar products, the Rothschild index will

be close to zero.

RI provides a measure of how sensitive an individual

firm’s demand is relative to the entire market.

7-11

Own-Price Elasticities of Demand and

Rothschild Indices

Industry

Food

Tobacco

Textiles

Apparel

Paper

Chemicals

Rubber

Elasticity

of Market

Demand

-1.0

-1.3

-1.5

-1.1

-1.5

-1.5

-1.8

Elasticity

of Firm’s

Demand

-3.8

-1.3

-4.7

-4.1

-1.7

-1.5

-2.3

Rothschild

Index

0.26

1.00

0.32

0.27

0.88

1.00

0.78

7-12

Industry Analysis

Ease of entry and exit – optimal decisions of firms in an

industry will depend, in part, on the ease of entry.

Barriers to entry – capital requirements; patents;

economies of scale

Conduct – behavior of firms tends to differ among

industries

– Pricing - firms in some industries can charge higher mark-ups

than in other industries.

– The Lerner Index – a measure of the difference

between price and marginal cost as a fraction of the

price of the product.

7-13

Conduct: Pricing Behavior

The Lerner Index

L = (P - MC) / P

– A measure of the difference

between price and marginal cost

as a fraction of the product’s

price.

– The index ranges from 0 to 1.

• When P = MC, the Lerner

Index is zero; the firm has

no market power.

• A Lerner Index closer to 1

indicates relatively weak

price competition; the firm

has market power.

7-14

Markup Factor

From the Lerner Index, the firm can determine the

factor by which it should price over MC. Rearranging

the Lerner Index

1

P

MC

1 L

The markup factor is 1/(1-L).

– When the Lerner Index is zero (L = 0), the markup factor is 1 and P =

MC.

– When the Lerner Index is 0.20 (L = 0.20), the markup factor is 1.25

and the firm charges a price that is 1.25 times marginal cost.

– The markup charged will vary depending on the nature of the

market in which the good is sold.

7-15

Lerner Indices & Markup Factors

Industry

Food

Tobacco

Textiles

Apparel

Paper

Chemicals

Petroleum

Lerner Index

0.26

0.76

0.21

0.24

0.58

0.67

0.59

Markup Factor

1.35

4.17

1.27

1.32

2.38

3.03

2.44

7-16

Integration and Merger Activity

Integration – uniting productive resources. Can occur

through merger or during the formation of a firm.

Mergers – attempt to reduce transactions costs, realize

economies of scale and scope, increase market

power, or gain easier access to capital markets.

Friendly versus hostile mergers

– Feared by managers in firms not maximizing profits or in some

way mis-managed.

Vertical Integration – various stages of production are

carried out within a single firm. Reduces transaction

costs associated with acquiring inputs.

7-17

Integration and Merger Activity

– Horizontal integration – merging production of a

similar product into a single firm. Done to realize

economies of scale or scope; enhance market power.

– Horizontal merger reduces competition and

increases market power.

– Social benefits of reduced costs must be weighed

against the social costs of more concentration.

7-18

DOJ/FTC Horizontal Merger Guidelines

Based on HHI = 10,000 S wi2, where

wi = Si /ST.

Merger may be challenged if

– HHI exceeds 1800, or would be after merger, and

– Merger increases the HHI by more than 100.

But...

– Recognizes efficiencies: “The primary benefit of mergers

to the economy is their efficiency potential...which can

result in lower prices to consumers...In the majority of

cases the Guidelines will allow firms to achieve

efficiencies through mergers without interference...”

7-19

DOJ/FTC Horizontal Merger Guidelines

DOJ and FTC permit mergers in high HHI industries

if:

there is significant foreign competition,

an emerging technology,

increased efficiencies,

one firm is having financial problems.

Conglomerate mergers - The integration of different product

lines into a single firm.

Economic rationale is not clear – loss of specialization w/o offsetting

synergies.

Possibly merging products with counter-cyclical revenue flows.

Dearth of management talent.

7-20

R&D and Advertising

Advertising – intensity varies over different industries

R&D – used to gain a technological advantage over

competitors by developing patentable products and

processes.

Optimal Advertising and R&D spending depends on

the characteristics of the industry in which the firm

operates.

7-21

Performance

Performance refers to the profits and social welfare

that result in a given industry.

Social Welfare = CS + PS = TS

– Dansby-Willig Performance Index - measure by

how much social welfare would improve if firms in

an industry expanded output in a socially efficient

manner.

– If the DW Index is zero there are no gains to TS if

firms increase output. TS is maximized given

industry demand and cost conditions.

– If DWI>0 the TS would increase if output

increased.

7-22

Dansby-Willig

Performance Index

Industry

Food

Textiles

Apparel

Paper

Chemicals

Petroleum

Rubber

Dansby-Willig Index

0.51

0.38

0.47

0.63

0.67

0.63

0.49

7-23

Approaches to Studying Industry

The Structure-Conduct-Performance (SCP)

Paradigm: Causal View

Market

Structure

Conduct

Performance

The Feedback Critique

– No one-way causal link.

– Conduct can affect market structure.

– Market performance can affect conduct

as well as market structure.

7-24

Relating the Five Forces to the SCP

Paradigm and the Feedback Critique

Entry

Entry Costs

Speed of Adjustment

Sunk Costs

Economies of Scale

Network Effects

Reputation

Switching Costs

Government Restraints

Power of

Input Suppliers

Power of

Buyers

Supplier Concentration

Price/Productivity of

Alternative Inputs

Relationship-Specific

Investments

Supplier Switching Costs

Government Restraints

Level, Growth,

and Sustainability

Of Industry Profits

Industry Rivalry

Concentration

Price, Quantity, Quality,

or Service Competition

Degree of Differentiation

Switching Costs

Timing of Decisions

Information

Government Restraints

Buyer Concentration

Price/Value of Substitute

Products or Services

Relationship-Specific

Investments

Customer Switching Costs

Government Restraints

Substitutes & Complements

Price/Value of Surrogate Products Network Effects

or Services

Government

Price/Value of Complementary

Restraints

Products or Services

7-25

Preview of Coming Attractions

Discussion of optimal managerial

decisions under various market structures,

including:

– Perfect competition

– Monopoly

– Monopolistic competition

– Oligopoly

7-26

Conclusion

Modern approach to studying industries involves

examining the interrelationship between structure,

conduct, and performance.

Industries dramatically vary with respect to

concentration levels.

– The four-firm concentration ratio and

Herfindahl-Hirschman index measure industry

concentration.

The Lerner index measures the degree to which

firms can markup price above marginal cost; it is a

measure of a firm’s market power.

Industry performance is measured by industry

profitability and social welfare.

7-27