slides pptx - School of Mathematics

advertisement

Modeling Related Failures in

Finance

Arkady Shemyakin

MFM Orientation, 2010

Outline

•

•

•

•

•

•

•

•

•

Relationships and Related Events

Related Failures: Insurance, Survival, Reliability

Failures in Finance

Probability Structure

Default Correlation (w/example)

Copula Models

Applications of Copulas

References

Conclusion

Relationships and Related Events

• Old, old story…

• Relationships that do not matter (hypothesis of

independence)

• Relationships that do matter

• How to model relationships?

• Random variables – height or weight, personal

income, stock prices

• Random variables –length of life or age at death

Related Failures

• Insurance (mortality structure on associated

human lives)

• Survival (biological species)

• Reliability (connected components in complex

engineering systems)

• Finance (?)

Insurance

• Associated human lives (e.g., husbands and

wives)

• Common lifestyles

• Common disasters (accidents)

• Broken-heart syndrome

• Exclusions!

Survival

• Biological species within certain environment

(e.g., life on an island)

• Common environmental concerns

• Predator/prey interactions

• Symbiosis

Reliability

• Interaction of components of a complex

engineering system (e.g., power grid)

• Links in a chain (series or parallel)

• High-load periods

• Climate and natural disasters

• Overloads

• Sayano-Shushenskaya HPS

Finance

• Bank failures, credit events, defaults on

mortgages

• Market situation

• Macroeconomic indicators

• Deficit of trust

• Chain reaction of failures

Probability Distributions

• Distribution function (d.f.; c.d.f)

F (t ) P X t

• Survival function

S (t ) P X t 1 F (t )

• Distribution density function (d.d.f.)

f ( z)

d

F (t )

dt

tz

Joint Distributions

• Joint distribution function

H (s, t ) P X s, Y t

• Joint survival function

K (s, t ) P X s, Y t )

• Joint density

d2

h( z, w)

H ( s, t )

dsdt

s z ,t w

Independence

• For any s, t

H (s, t ) F (s)G(t ) P( X s) P(Y t )

• For any s, t

K (s, t ) P( X s) P(Y t )

• For any s, t

h(s, t ) f (s) g (t )

• Joint functions are built from marginals

Pearson’s Moment Correlation

• Pearson’s moment correlation (correlation

coefficient) is defined as

Cov X , Y

EXY EX EY

X ,Y

XY

Var X Var (Y )

• It is a good measure of linear dependence,

strongly connected with the first two

moments, and is known not to capture nonlinear dependence

Sample Pearson’s Correlation

• Given a paired (matched) sample

x, y x1 , y1 ,..., xn , yn ,

the sample correlation coefficient is defined as

n

ˆ x, y

n

1 n

xi yi xi yi

n i 1 i 1

i 1

n 2 1 n 2 n 2 1 n 2

xi xi yi yi

i 1

i 1

n

n

i 1

i 1

Default Correlation

•

•

•

•

•

Time-to-default random variables

CDS (Credit Default Swaps)

CDO (Collateralized Debt Obligations)

Recent crisis

Problem: mathematical models failed to

accurately predict the risks

• Problems with default correlation

• Example: three-mortgage portfolio

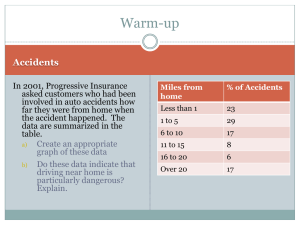

Example (Absolutely Unrealistic)

• We underwrite three identical mortgages, each

with $100K principal

• Term: 1 year

• Probability of default: 0.1 for each

• Annual payment is made in the beginning of the

year

• Interest rate of 11%

• Expected gain: $1,000 per mortgage per year

• Problem: relatively high risk of a big loss

Losses

• We can lose as much as over $250K while

making on the average $3K!

• Expected gain = $11,000 x 0.9 - $89,000 x 0.1

= $1,000

• Potential loss = $89,000

• We collect (three mortgages) the interest of

$33,000 = $ 30,000 + $3,000

• We bear the risk of losing the principal

3 x $89,000 = $267,000

Selling the Risk

•

•

•

•

•

•

Is it possible to hedge the risks (sell the risks)?

CDO structure: how many defaults?

Senior tranche (safe)

Mezzanine tranche (middle-of-the-road)

Equity tranche (risky)

Find the buyers (investors): those who will

receive our cash flows and accept

responsibility for possible defaults

Default Probabilities - Independence

• P(all three defaults) = P(ABC) = 0.1 x 0.1 x 0.1

= 0.001

• P(at least two defaults) = 0.027 + 0.001 =

=0.028

• P(at least one default) = 0.243 + 0.027 + 0.001

= 0.271

Investors’ Side - Independence

•

•

•

•

•

Assume independence of failures

Senior tranche: expected loss of $100

Mezzanine tranche: expected loss of $2,800

Equity tranche: expected loss of $27,100

Expected losses of all tranches add up to

$30,000

• For us: margin of $3,000 and no risk!

• We might have to split the margin

Diagram 1 (Independence)

Correlation

• Assume that there is no independence and we

expect pair-wise correlations (Pearson’s

moment correlations) between the individual

defaults at 0.5

• That corresponds to joint probability of two

defaults being 0.055

• Sadly, it says next to nothing about the joint

probability of three defaults

• Different scenarios are possible

Calculation of the Multiple Default

Probabilities

X ,Y

EXY EX EY

Var X Var (Y )

P ( AB ) P ( A) P ( B )

P ( A)(1 P ( A)) P ( B )(1 P ( B ))

P ( AB ) 0.1 0.1

0.5 P ( AB ) 0.055

0.1 0.9

P ( ABC ) ?

Diagram X - Correlation

Diagram 2 (Extreme Scenario 2)

Default Probabilities – Scenario 2

• P(all three defaults) = 0.01

• P(at least two defaults) = 0.145

• P(at least one default) = 0.145

Investors’ Side – Scenario 2

•

•

•

•

•

Assume default correlations of 0.5

Senior tranche: expected loss of $1,000

Mezzanine tranche: expected loss of $14,500

Equity tranche: expected loss of $14,500

Expected losses of all tranches add up to

$30,000

Diagram 3 (Extreme scenario 3)

Default Probabilities – Scenario 3

• P(all three defaults) = 0.055

• P(at least two defaults) = 0.055

• P(at least one default) = 0.19

Investors’ Side – Scenario 3

•

•

•

•

•

Assume default correlations equal to 0.5

Senior tranche: expected loss of $5,500

Mezzanine tranche: expected loss of $5,500

Equity tranche: expected loss of $19,000

Expected losses of all tranches add up to

$30,000

What do we conclude?

• Correlation between the default variables is

important in order to estimate expected losses

(i.e., to price) the tranches

• Results are sensitive to the value of the

correlation coefficient

• Knowing pair-wise correlation coefficients is not

enough to price the tranches in case of more than

2 assets

• It would be enough under assumption of

normality

Definition of Copula Function

• A function C : I 2 0,1 [0,1] I 0,1

is called a copula (copula function) if:

1. For any u, v I

C (u,0) C (0, v) 0

2. It is 2-monotone (quasi-monotone).

3. For any u, v I

C (u,1) u; C (1, v) v

Frechet Bounds

• For any copula C (u , v)

the following inequalities (Frechet bounds)

hold:

W (u, v) C (u, v) M (u, v),

W (u, v) max u v 1, 0 ,

M (u, v) min u, v

Maximum Copula

M (u, v) min{u, v}

Maximum Copula

M (u, v) min{u, v}

Minimum Copula

W (u, v) max u v 1,0

Minimum Copula

W (u, v) max u v 1,0

Product Copula

P(u, v) uv

Product Copula

P(u, v) uv

Sklar’s Theorem

• Theorem: 1. For any correctly defined joint

distribution function H ( x, y) with marginals

F ( x), G( y) , there exists such a copula function

that

H ( x, y) C F ( x), G( y)

2. If the marginals are absolutely continuous,

then this representation is unique.

Applications of Copulas

• Going beyond correlation

• Extreme co-movements of currency exchange

rates

• Mutual dependence of international markets

• Evaluation of portfolio risks

• Pricing CDOs

References

• Joe Nelsen; An Introduction to Copulas,

Springer

• Umberto Cherubini, Elisa Luciano, Walter

Vecchiato; Copula Methods in Finance, Wiley

• Attilio Meucci; Computational Methods in

Decision-making, Kluwer

• Robert Engle et al.

• Paul Embrechts et al.

Conclusions

• Work in progress – the world is in search for

better models (?)