Risk Management EABH & Swiss Re

advertisement

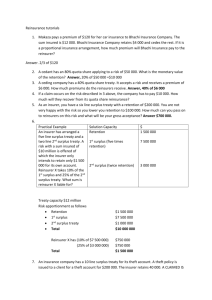

Risk Management EABH & Swiss Re Mathematics at Swiss Re in the 1960s Hans Bühlmann June 2013 1. Mathematics in insurance / Actuaries Actuaries of the first kind ~ 18th century Life insurance Individual Risk Theory each policy bottom up Cash Flow Accounting: EQUIVALENCE PRINCIPLE Present Value Matching interest rates mortality All this: In a Deterministic Model ! Law of Large Numbers 1. Mathematics in insurance / Actuaries Actuaries of the second kind ~ middle of 20th century All Branches of Insurance + Total of Insurance Company Collective Risk Theory total topdown Swiss Re decision in 1961 Witness of this pioneering period Risk management without calling it so 2 concrete examples to get insight into the then activity 2. Rating of Excess of Loss Reinsurance Treaties (XL-Treaties) History of XL-Treaty last five years For covered portfolio ceding company has earned premium T = 10mio Total claim Ceding company 120 000 100 000 20 000 80 000 80 000 - 235 000 100 000 135 000 97 000 97 000 - …. …. …. XL Treaty with limit 100 000 (retention) Reinsurer 550 000 100 000 450 000 320 000 100 000 220 000 165 000 100 000 65 000 2 350 000 1 015 000 1 335 000 B 2. Rating of Excess of Loss Reinsurance Treaties (XL-Treaties) B B% is called Burning Cost Burning Cost in percent : 13.35% of total premium T Burning Cost Rate What premium should we change for next years? First Idea Premium = B% . T next year Underwriter Premium = Actuary Premium = (B% + α F%) T next year 100 75 ______________________ B% . T next year 2. Rating of Excess of Loss Reinsurance Treaties (XL-Treaties) F% ~ fluctuation measure of data % e.g. standard deviation α ~ chosen such that total of all XL-treaties is producing a loss with small probability Generally: Actuary produces class of Premium Calculation Principles. Choice by consideration of total business of reinsurer => topdown 3. How to Choose the Retention Limit Also Swiss Re cannot run arbitrarily high engagements SR buys reinsurance on reinsurance business retrocession How should Swiss Re fix its retention under retrocession treaties? 3. How to Choose the Retention Limit Actuarial method (Bruno De Finetti 1940) a) Relative Retentions (Retention) Branchi ί = Cα ί αί ~ Profitability Branch ί Limit in XL MPL in proportional reinsurance Historical remark: H. Markowitz, 1952 3. How to Choose the Retention Limit b) Absolute retention Fix the constant C in a) ί) Choose operative capital buffer to absorb losses buffer which you are willing to loose buffer ? - such that the company can survive - such that the company can digest it on its balance sheet - full surplus 3. How to Choose the Retention Limit ίί) Choose acceptable probability of loosing the buffer - long term => Cramér-Lundberg formula: probability of ruin - short term : probability of default operative capital Ψ (u) = e-ku prob. ruin depends on riskportfolio retention limits on the constant C Conclusion • Probability of ruin enters into formula for C on logarithmic scale • Operative capital and profitability are the main drivers: C depends linearly on k and u Interesting for today • Questions of solvency • Attitude towards risk: - Security - Profitability