to view the attachment

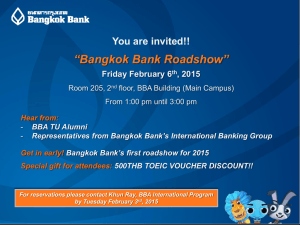

advertisement

ISLAMIC BANKING TERM PAPER PRESENTATION by Asmah Mohd Jaapar Hishamuddin Abdul Wahab Khusmuhammad Sulistya Rusgianto Yusif BBA HOME FINANCING: CASE STUDIES CIMB ISLAMIC HOME FINANCING-i AND FLEXI HOME FINANCING-i SEPT 2010 INCEIF OBJECTIVES Contract (‘Aqd) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah Objectives To understand the basic concept of CIMB Islamic Home Financing-i and Flexi Home Financing-i To determine sharī‘ah legitimacy of CIMB Islamic Home Financing-i and Flexi Home Financing-I using contract (‘aqd), legal documentation, financial reporting and Maqāṣid al-Sharī‘ah parameters YUSIF 2 2 Objectives CONTRACT (‘AQD) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah Bai’ Bithaman Ajil (BBA) (Deferred-payment Sale) Bai’ Bithaman Ajil is a contract of sale and purchase of an asset in which the payment of price is deferred and paid in installment within an agreed period of time. The selling price includes profit. The margin is up to 90% Financing all types of completed or under construction residential properties Required documents are PPA, PSA, Deed of Assignment (by way of security) KHUSMUHAMMAD 3 Objectives CONTRACT (‘AQD) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah (Cont.) Customer has executed a Sale and Purchase Agreement with the vendor Customer has the right to sell the property to bank by executing Property Purchase Agreement with the Bank Bank Resells the property to the customer by executing the Property Sale Agreement(Fixed or Floating rate) This falls under the concept of Bay Inah, where the bank buys directly from customer and resells the same property to same customer without incurring any risk KHUSMUHAMMAD 4 4 Objectives CONTRACT (‘AQD) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah CIMB Islamic Home Financing-i Home Financing-i, is fixed rate home financing for 3-years, 5-years 10 or 20 years A sample calculation for 20 years of house of 225000RM, at profit rate of 5.88% is as follows (Payment of monthly installment)=[Facility amount(1+profit rate)xnxr]/[1+(1+pr)xn-1] Monthly installment=[225000(1+5.88/12)x240x5.88/12]/[1+(1+5.66/12)x2401]=1,596RM The bank contract /selling price will be 1596.43x240=383,143RM The contract does not allow bank to adjust their profit rate and contracted price will remain fixed in 158,143RM KHUSMUHAMMAD 5 5 Objectives CONTRACT (‘AQD) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah CIMB Islamic Flexi Home Financing-i Variable rate home financing based floating rate features based on the movement of Base Financing Rate (BFR), with capped at an agreed ceiling rate, this is actually BBA financing with Ibra’ features, any shortfall will be treated as rebate given to client The bank sets ceiling price of 10.75% per annum whatever above this will be rebate to the customer The bank purchase is RM114,986 The bank selling price RM280,169, installment in 20 years Contracted profit rate/Ceiling rate 10.75% p.a Base financing rate on the time of offer latter is 6.5% The monthly payment amount is calculated based on the Effective Profit Rate which is the current Base Financing Rate - /+Spread per annum which 1-240 month, BFR-1.95% p.a. the amount = RM730.57 KHUSMUHAMMAD 6 6 Objectives CONTRACT (‘AQD) Legal Documentation Financial Reporting Maqāṣid al-Sharī‘ah Requirement of ‘Aqd/Contracts Agents of Contract - Customer - Bank Objective of Contract - BBA Property Financing Subject Matter and the price of Contract - Fixed/Floating Financing Rate- House financing Offer and Acceptance - Bank buys the house and resells the product by contracted profit rate installment - Customer accepts the selling price and monthly installment The whole arrangement of purchase and resale involves Bai-al-Inah concept KHUSMUHAMMAD 7 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Legal Documents for Home Financing Conventional Sale and Purchase Agreement (S&P) or Memorandum of Contract Loan Agreement Deed of Assignments/Charge Islamic banking Sales and Purchase Agreement (S&P) or Memorandum of Contract Property Purchase Agreement (PPA) Property Sale Agreement (PSA) Deed of Assignments/Charge SULISTYA RUSGIANTO 8 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Sale and Purchase Agreement The customer(s) purchase the property from the developer/vendor In this case, SPA in the form of the Memorandum of Contract (MoC) endorsed by the Auctioneer which indicate that the customer(s) is the successful bidder and the successful bid price is declared The customer(s) paid 10% down payment There is a transfer of ownership and title but has not been issued by the relevant authorities. SULISTYA RUSGIANTO 9 9 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Property Purchase Agreement The bank purchase the property from the customer(s) There is no title transfer, but beneficial ownership in and/or rights to the property only. The bank pay the purchase price (bid price – down payment) to the developer/vendor for benefit of the customer(s) SULISTYA RUSGIANTO 10 10 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Property Sale Agreement Agreement between the Bank as selling party and the customer as buyer Consists information on the rights and contractual obligation of the contracting parties, the property, the price, monthly payment, period of financing and other terms and conditions Attached with the Letter of Offer and Deed of Assignment/Charge The Bai’ al-’Inah concept is explained in this agreement and so, the BBA mode of payment which allow the customer to settle the bank’s selling price on deferred payment basis. ASMAH MOHD JAAPAR 11 11 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Default Definition 1) Failure to pay the monthly payment or any sum of money due and payable to the bank under the BBA facility 2) An act of bankruptcy under Bankruptcy Act 1983 has been committed 3) If Section 25 (1) of the Islamic Banking Act 1983 is triggered 4) Insanity or death of any of the customer(s) 5) Breach of any terms, conditions or approval contained in PSA and the Legal Docs. In the event of default, the customer(s) have to pay the whole bank’s selling price and all other sums payable under the BBA facility ASMAH MOHD JAAPAR 12 12 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Payment Installment based on the EPR=BFR-1.95% p.a. on daily rest throughout the facility period The installment is adjusted to reflect the changes of EPR based on the movement of BFR but shall not > CPR of 10.75% p.a. Automatic monthly ibra’ is given based on difference between EPR and CPR ASMAH MOHD JAAPAR 13 13 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Late Payment Ta’widh During the facility period: 1% p.a. on the overdue amount or a minimum of RM1 whichever is higher or any other method approved by BNM After the facility period: based on the bank’s current Islamic Interbank Money Market (IIMM) rate on the outstanding principal balance or any other method approved by BNM Ta’widh shall not be compounded on the principal amount ASMAH MOHD JAAPAR 14 14 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah Early Settlement/ Redemption of Facility During lock-in period (5 years) – Settlement/redemption is allow at the bank’s sole discretion and ibra’ may not be granted or granted at lower rate After the lock-in period – Ibra’ of any unearned profit over the bank’s selling price may be permitted Ibra’ computation shall be treated as final and binding Partial payment of the BBA facility is allowed through excess payment of the customer(s) by way of withdrawal of EPF or additional payment ASMAH MOHD JAAPAR 15 15 Objectives Contract (‘Aqd) LEGAL DOCUMENTATION Financial Reporting Maqāṣid al-Sharī‘ah GMTP The property must be covered with a TO on the Bank’s panel naming the Bank as beneficiary The GMTP contribution is either self-financed by the customer or the Bank For single applicant, the coverage is 100% For joint applicants, the coverage is about 50% each In the event GMTP is cancelled for whatsoever reason, the customer will be charge extra 1% of the profit rate ASMAH MOHD JAAPAR 16 16 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Financial Reporting Financial Reporting can be defined as a process of recording all business’ financial transactions and activities. The importance of the Financial Reports has been clearly emphasized from the Quranic Verse as follows: “…Never get bored with recording it, however small and large, up to its maturity date, for this is seen by Allah as closer to justice, more supportive to testimony and more resolving to doubt…” [Al-Baqara: 2, 82]. The true source of financial reporting will be based on Annual Report of CIMB Islamic Bank Bhd in year 2009 which in accordance with the requirements of the Companies Act 1965 (Malaysia), MASB Approved Accounting Standard and BNM Guidelines. For the purpose of testing the level of conformity with Shariah Injunction, we use Accounting, Auditing and Governance Standards For Islamic Financial Institutions (2008) published by AAOIFI (the Accounting and Auditing Organization for Islamic Financial Institutions) as yardstick HISHAMUDDIN ABDUL WAHAB 17 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Accounting Standards for Murabaha (BBA) AAOIFI FAS 1 Bank Negara GP8-i MASB FRS i12004 FAS 2 HISHAMUDDIN ABDUL WAHAB 18 18 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Problem of Inconsistency in Financial Reporting In the real Balance Sheet of CIMB Islamic Bank Bhd, all the entries have been recorded such Murabaha financing, cash, account receivable and profit realized from financing except for the asset purchase transaction. The inconsistency of financial reporting of CIMB Islamic Bank Bhd arises from BBA transactions - absence of the financial records of the “property buying” by the bank from the customer. It violates the Hadith “One must not sell what one does not own”. It makes buy-sell (bay al-enah) procedures only fictitious since no transaction recorded for asset buying HISHAMUDDIN ABDUL WAHAB 19 19 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Journal Entry for BBA (or Murabaha) (Shahul Hameed, 2009) No Transactions/ Events Dr Cr 1 Purchase of Asset by bank Equipment Cash/Creditor Murabaha 2 Murabaha (BBA) sale financing (cost + profit) 3 4 Installment receipt Recognition of profit as each installment received Equipment at cost of deferred profit with profit Cash Murabaha Financing Deferred profit Profit n Loss 5 Termination of contract A/c receivable Murabaha Financing 6 Rebate for early payment Deferred profit Murabaha Financing HISHAMUDDIN ABDUL WAHAB 20 20 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah General Presentation and Disclosure Relating to BBA Standard General Presentation and Disclosure In Balance sheet, on the asset side, BBA financing is pooled together with other types of financing into category of Financing, advances and other loans. No presentation for the asset purchased by bank before sell to customer. GP8-i In notes to financial statement, under category of Financing, advances and other loans, there’s specification for BBA by contract. From definition of paragraph 6, the standard defines BBA as : “Bai Bithaman Ajil (lit., deferred payment sale) - A form of financing in which an IFI finances a customer who wishes to acquire a given asset and who agrees to repay by instalments within an agreed period. The IFI will purchase the asset required by the customer and subsequently sells it to him at an agreed price inclusive of the IFI's profit margin.” Paragraph 10, the standard only mentions about requirement of information for financial statement such asset, liabilities, equity, income and expenses, changes in equity and cash flows. No specifications of items for assets except for paragraph 41 on Information to be presented on face of balance sheets FRS-i2004 “The assets of an IFI include cash balances and short-term funds, placements with other financial institutions, dealing and investment securities, and financing of customers...The financing of customers usually comprises financing extended to customers based on various Shariah principles. Other items include receivables, statutory deposits with BNM, and property, plant and equipment.” HISHAMUDDIN ABDUL WAHAB 21 21 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah (Cont.) Standard General Presentation and Disclosure Regarding to BBA, one close paragraph mention about it is in paragraph 27. The paragraph basically mentioning about the permissibility of offsetting certain items in assets and liabilities, and income and expenses. The paragraph 27 as below: FRS-i2004 (cont) 27. Offsetting of balances may be made in respect of unearned profit for murabahah, BBA and Ijarah financing against murabahah, BBA and rental receivables. In FAS (1), the asset purchased by bank is recorded in the inventory account. In para 37 FAS(1) of Statement of Financial Position, the Disclosure should be made on the face of financial statement including: FAS 1 “Inventories (including goods purchased for Murabaha customers prior to consummation of Murabaha agreement)” HISHAMUDDIN ABDUL WAHAB 22 22 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Extract of Annual Report CIMB Islamic Bank Bhd (2009) HISHAMUDDIN ABDUL WAHAB 23 23 Objectives Contract (‘Aqd) Legal Documentation FINANCIAL REPORTING Maqāṣid al-Sharī‘ah Extract of Annual Report CIMB Islamic Bank Bhd (2009) HISHAMUDDIN ABDUL WAHAB 24 24 Objectives Contract (‘Aqd) Legal Documentation Financial Reporting MAQĀṢID AL-SHARĪ‘AH Introduction to Maqāṣid Al-sharī‘ah Consist of the deeper meanings (ma‘ānī) and inner aspects of wisdom (ḥikam) considered by the Lawgiver (Shāri‘) in all or most of the areas and circumstances of legislation (aḥwāl al-tashrī‘) (Ibn Ashur, 2006). Either the realization of benefit (maṣlaḥah)or the repulsion of harm (mafsadah) or achieving both at the same time. (Ibn Ashur, 2006). Maqāṣid al-sharī‘ah: Necessities (ḍarūriyyāt): Preserves one’s faith, soul, wealth, mind, and offspring Needs (ḥājiyyāt) Luxuries (taḥsīniyyāt) YUSIF 25 Objectives Contract (‘Aqd) Legal Documentation Financial Reporting MAQĀṢID AL-SHARĪ‘AH Importance of Home in Islam Abu Musa reported AlLāh's Apostle (SAW) as saying: The house in which remembrance of AlLāh is made and the house in which AlLāh is not remembered are like the living and the dead (Sahih Muslim, Book 4, Hadith 1706) “And stay in your houses, and do not display yourselves like that of the times of ignorance…” [alAhzaab 33:33] YUSIF 26 26 Objectives Contract (‘Aqd) Legal Documentation Financial Reporting MAQĀṢID AL-SHARĪ‘AH CIMB Home Financing Repulsion of harm: No actual transfer of ownership (-) Involve property under construction (-) Realization of benefit: Preservation of faith, soul, wealth, mind, and offspring (+) YUSIF 27 27 وهللا س بحانه وتعاىل أعمل ابلصواب Thank You