Chapter 2

Profit’s Sensitivity to

Price

Conducting a Profit Sensitivity Analysis

to Identify volume Hurdles and the

Challenges Inherent in Economic Price

Optimization

Agenda

• How do price changes influence the ability to capture

customers?

• How sensitive are profits to price changes when we

include the influence of price changes to sales

volumes?

• When considering a price cut, what is the necessary

increase in sale volumes to improve the firm’s profits?

• When considering a price increase, what is the

allowable decrease in sale volumes that will leave the

firm more profitable?

• How does elasticity of demand enable executives to

optimize prices?

Profit Sensitivity Analysis

• If we know that the best price lies within a range, what

is the effect of a small change in price?

• Profit Equation

p = Q (P – V) – F

p – Profit

Q – Quantity Sold (Volume)

P – Price

V – Variable Costs

F – Fixed Costs

Profit Sensitivity Analysis

• Price Sensitivity Analysis analyzes the

sensitivity of profits to price changes

• Volume Hurdles are identified through the

profit sensitivity analysis. They define the

required changes in volume to justify a price

change.

Volume Hurdle

• Consider a Price Change

– How would volume need to change in order to improve profitability?

– Call this the Volume Hurdle

• Let the initial price and quantity be denoted by the subscript i, and the

final price and quantity be denoted by the subscript f

pi = Qi(Pi-V)-F

pf = Qf(Pf-V)-F

• Condition: any price change must improve profitability

pf > pi

• Use algebra to rearrange the equations and simplify to identify the volume

hurdle.

Volume Hurdle

%DQ ≥

– %DP

%CMi + %DP

Where

%DQ ≡

Qf – Qi

The change in volume must be

greater than this ratio for the

price change to yield higher

profits

Percent Change in Volume

Qi

%DP ≡

P f – Pi

Percent Change in Price

Pi

%CMi ≡

Pi – V i

Pi

Initial Contribution Margin as a

percentage of the original price

Example

• A retailer is selling T-shirt for $40 to his

customers which he purchase from the

wholesaler at a price of $30. Normally the

demand is 50 units per month. If the retailer

plans to increase the price by $50 per unit,

how much should be the allowable volume

drop?

Ans: -50%

Fixed Costs Don’t Matter, Variable Costs Do.

•

Notice Fixed Costs have no effect on

a marginal price change decision

– Your overhead is your problem, not

the customers. From a value

perspective, customers never care

about your cost structure. Only you

do. They only care about value –

how much value do they get for how

high a price.

– Fixed costs are key in the decision to

enter or stay in the industry. Once in

the industry, they make no difference

to marginal profitability decisions.

– Fixed costs more of an investment or

strategy issue than a pricing issue.

%DQ ≥

– %DP

%CMi + %DP

Volume Hurdle for a Price Cut

• Price cut, where %DP is negative, requires a

positive increase in volume to improve

profitability

– The amount of the required volume increase is

dependent on the size of the size of the

contribution margin.

– Large CM implies a small DQ is required.

– Small CM implies a larger DQ is required

• Strong implications with respect to tactical

price cuts

– Discounts

– Short term sales

– Creates a volume hurdle for the tactical price cut

to make sense to the firm

%DQ ≥

– %DP

%CMi + %DP

Volume Hurdle for a Price Hike

• Price Rise, where %DP is positive,

will allow for a reduction in

volume, up to a point.

– The amount of forfeited volume is

dependent on the contribution

margin.

– Small CM can handle a large DQ

decrease

– Large CM needs a smaller DQ

decrease

%DQ ≥

– %DP

%CMi + %DP

Profit Sensitivity towards Price Cuts

Retailer

Manufacturer

Broker

•

50% Contribution

Margin

•

25% Contribution

Margin

•

1% Contribution

Margin

•

15% Price Cut

•

5% Price Cut

•

0.1% Price Cut (10

bp)

•

43% Volume Growth

Required to Break

Even on the Decision

•

25% Volume Growth

Required to Break

Even on the Decision

•

11.1% Volume Growth

Required to Break

Even on the Decision

Profit Sensitivity towards Price Increases

Retailer

Manufacturer

Broker

•

50% Contribution

Margin

•

25% Contribution

Margin

•

1% Contribution

Margin

•

15% Price Rise

•

5% Price Rise

•

0.1% Price Rise (10

bp)

•

23% Volume Loss or

Less Decrease Would

Leave the Firm More

Profitable

•

14% Volume Loss or

Less Decrease Would

Leave the Firm More

Profitable

•

9.1% Volume Loss or

Less Decrease Would

Leave the Firm More

Profitable

Price Increases and Decreases have NonSymmetrical Effects on Profit

•

Price Cuts require Larger Changes in Volume than Price Rises to leave the firm equally

well off.

•

50% Contribution

Margin

•

50% Contribution

Margin

•

15% Price Rise

•

15% Price Cut

•

23% Volume Loss or

Less Decrease Would

Leave the Firm More

Profitable

•

43% Volume Growth

Required to Break

Even on the Decision

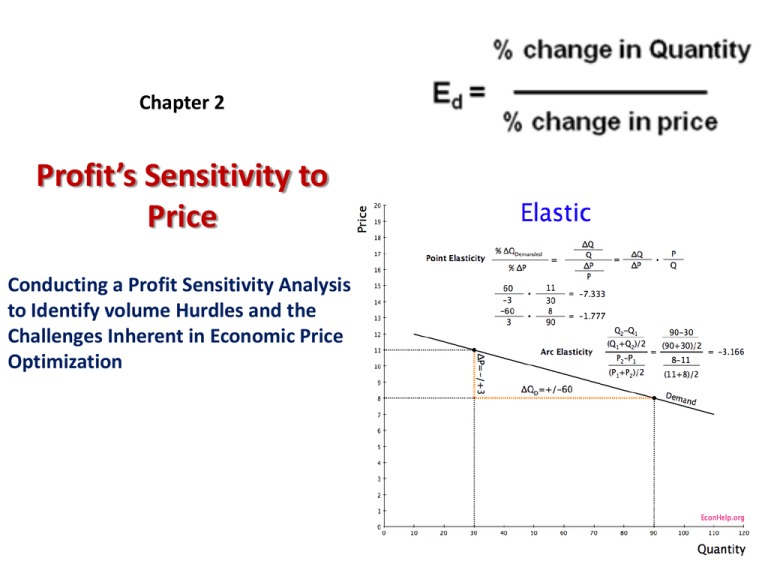

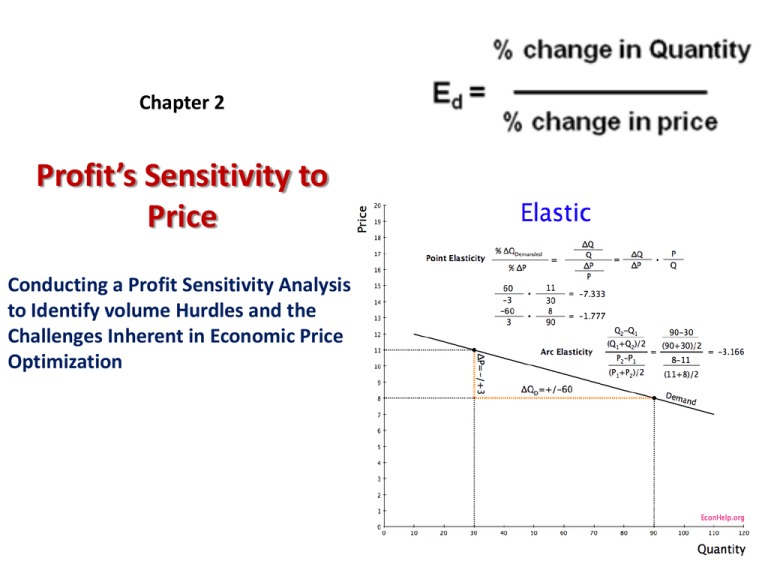

Price Elasticity of Demand

Price elasticity of demand measures the responsiveness of the quantity demanded

for a product or service to a change in the price of the product or service

Ed

Ed

ΔQ

ΔP

Q1, P1

(Q 1 Q 2) / Q 1

( P 1 P 2) / P 1

D Q / Q1

D P / P1

%DQ %DP

= price elasticity of demand

= quantity change in demand

= quantity change in demand

= original quantity demanded and price, respectively

Measured Elasticities

Category

Brand Choice

Category

Bacon

-1.25

-0.32

Margarine

-2.22

-0.12

Butter

-1.24

-0.74

Ice Cream

-1.89

-0.68

Paper Towels

-4.00

-0.74

Sugar

-4.03

-0.57

Liquid Detergents

-3.95

-1.70

Coffee

-1.65

-1.42

Soft Drinks

-2.66

-0.42

Bath Tissue

-3.85

-0.80

Potato Chips

-2.50

-0.88

Dryer Softeners

-4.08

-1.19

Yogurt

-1.57

-0.35

Highly Elastic Markets Favor Price Cuts

Elastic Demand Curve (e = -10) and

Volume Hurdle for Firm with a 25% Contribution Margin

15%

Percent Change in Price

Decreasing Profits 10%

5%

0%

Increasing Profits

-5%

-10%

-15%

-40%

-20%

0%

20%

40%

60%

80%

100%

120%

Percent Change in Volum e

• Elastic markets mean a small price change

induces a large volume change

– |e| > 1

– Most brands face elastic markets

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

Inelastic Markets Favor Price Increase

Inelastic Demand Curve (e = -0.5) and

Volume Hurdle for Firm with a 25% Contribution Margin

Percent Change in Price

Increasing Profits 15%

10%

5%

0%

-5%

-10%

-15%

-40%

Decreasing Profits

-20%

0%

20%

40%

60%

80%

100%

120%

Percent Change in Volum e

• Inelastic markets mean that a large price change is required to induce

a noticeable volume change

– |e| < 1

– Many industries face inelastic markets

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

Other elasticities in Pricing

• Income elasticity of demand

• Cross price elasticity of demand

Income Elasticity of Demand

• Income elasticity of demand: responsiveness of the quantity demanded

of a product or service to a change in personal income

EI

(D Q)

DI

(I)

Q

• If EI is negative, the product is an inferior good

Income goes up fewer units are demanded (switch to steak, less hamburger)

• If EI is positive, the product is a normal good

Demand increases as income increases

• If 0<EI<1, the product becomes less important in households’ consumption plan

• If EI >1, the product becomes more important as income increases.

Cross-Price Elasticity of Demand

• Cross price elasticity of demand: responsiveness of demand for a

product to a change in the price of another product

Ec

DQA

D PB

PB

QA

• If EC is negative, the two products are complementary

• If EC is positive, the two products are substitutes

Price Optimization

•

The above analysis implies that optimal pricing can be found, one where in

increase or decrease in price leads to less profit than otherwise would be

found.

– Assuming a constant elasticity of demand over a wide range of price, through

integral calculus we find the Optimal Price for elastic markets at:

Ve

P

1 e

– At the optimal price, the quantity sold is

e

P

Q Q i

Pi

– Where Qi and Pi the current demand and price

Optimal Price

Measure

Variable Cost

V

$5

Fixed Cost

F

$750,000

Elasticity of Demand

e

-1.8

Demand at $1

Qo

10,000,000

P*

$11.25

Under the conditions, find

Optimal Price

Key Challenge of Price Optimization

What is the relevant Elasticity of Demand?

• Always a “historic” number, not forward looking number.

– Dependent upon the economic conditions, competing alternatives, tastes of the

market, and other market factors, all of which are constantly changing.

– Can be influenced by the firm’s actions: Branding enables higher prices,

discounting can reset price expectations lower lowering the potential price

capture

• Non-measurable for revolutionary products

• Small versus large price changes may exhibit different a elasticity

• Upward versus downward price changes may exhibit different a elasticity

Summary

• A Profit Sensitivity Analysis should be used to identify Volume Hurdles

for tactical pricing actions (Discounts, Price Promotions, Specific Sales

Opportunities)

• Profit is asymmetrically sensitive to price cuts vs. price hikes

• Inelastic markets favor price increases

• Elastic Markets favor price decreases

• Given the elasticity of demand, one could identify “optimal prices”