Brand-bargainingx

advertisement

Michael Brand

Game Theory

=

The mathematics of

joint decision-making

Game Theory

=

The mathematics of

joint decision-making

Prisoner’s Dilemma

Stag Hunt

(1,1)

(0,5)

(5,0)

(3,3)

Player 1

Player

2

Player

2

Player 1

Battle of the Sexes

(2,3)

(0,0)

(1,1)

(1,0)

(2,2)

Player 1

Player

2

Player

2

*

(3,2)

(0,1)

Chicken

Player 1

(0,0)

(1,1)

(-9,-9)

(-1,1)

(1,-1)

(0,0)

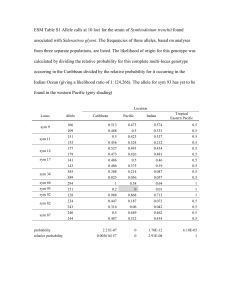

von Neumann and Morgenstern (1944)

(2,3)

ideal(S)

(3,2)

d

(0,0)

S

The utility

feasibility set is

• Convex

• Comprehensive

• Nontrivial

• Closed

• Bounded from

above

The disagreement

point

*

Nash (1950)

S

ψ(S,d) ∈ S ∪ {d}

• feasible

d

*

Nash (1950)

Weak Pareto Optimality (WPO)

Scale Invariance (INV)

Symmetry (SYM)

Invariance to Irrelevant Alternatives (IIA)

arg max

x S , x d

NBS

( xi d i )

i

IIA

SYM

INV

WPO

d

d

d

*

Nash (1950) + Nash (1953)

Weak Pareto Optimality (WPO)

Scale Invariance (INV)

Symmetry (SYM)

Monotonicity (MONO)

ideal(S)

d

*

Kalai, Smorodinsky (1975)

S

ψ(S,d) ∈ S ∪ {d}

• feasible

d

*

Nash (1950)

S

ψ(S,d) ⊆ S ∪ {d}

•

•

•

•

d

feasible

nonempty

closed

nontrivial

S

ψ(S)

⊆ S⊆ S ∪ {d}

ψ(S,d)

•

•

•

•

feasible

nonempty

closed

nontrivial

d

Harsanyi (1955), Myerson

(1981), Thompson (1981)

*

Individual Rationality

(IR)

Pareto Optimality (PO)

Linearity (LIN)

Upper Linearity (ULIN)

Concavity (CONC)

Individual Monotonicity

(IMONO)

etc...

Axioms

The egalitarian

solution

The dictatorial solution

The serial-dictatorial

solution

The Yu solutions

The Maschler-Perles

solution

etc...

Solutions

The alternating offers game

NBS

d

*

Rubinstein (1982)

Invariance to Irrelevant Alternatives (IIA)

◦ How can we know this, until we consider how the

feasibility set is explored? (Kalai+Smorodinsky)

Weak Pareto optimality (WPO)

◦ The same question applies.

◦ Commodity space may have a different topology.

Symmetry (SYM)

◦ Why, exactly, are we assuming this?

◦ Is life fair?

◦ Are all negotiations symmetric?

Axiom

Quality

Invariance to

Irrelevant Alternatives Thorough

(IIA)

Weak Pareto

Optimality (WPO) /

Benevolent

Pareto Optimality (PO)

Symmetry (SYM)

Impartial

INV claims that by rescaling to other vN-M

utility units, the solution cannot be altered.

It is considered to be a statement regarding

the inability to compare utility

interpersonally.

In fact, it is a stronger statement than this. It

is a claim that all arbitrators must necessarily

reach the same conclusion, because their

decisions must refrain from subjective

interpersonal assessment of utilities.

It is a claim that justice is objective.

To A or to B?

INV

d

Strawberry Shortcake

vs.

Lemon Tart

d

INV

d

d

The most we can require of an arbitrator is

that her method of interpersonal utility

comparisons is consistent.

◦ Or else, again, we are back at the “Strawberry

Shortcake vs. Lemon Tart” dilemma.

SYM now has to be reformulated.

◦ The arbitrator should now be required to be

impartial within her subject world view.

We assume the problem to be scaled into this

world view.

What is the role of d in arbitration?

Is the arbitration binding?

◦ If so: no role.

◦ If not: shouldn’t S reflect real outcomes, as

opposed to apparent outcomes?

This method of modeling actually gives more

modeling power.

(0,4,4)

(4,4,0)

(3,3,3)

(4,0,4)

Note: S no longer

comprehensive.

What division of the cake should John and

Jane decide on, if they are on their way to the

shop and still don’t know which cake is in

store?

CONC

LIN

ex-post efficiency vs. ex-ante efficiency

Axiom

Invariance to

Irrelevant Alternatives

(IIA)

Weak Pareto

Optimality (WPO) /

Pareto Optimality (PO)

Symmetry (SYM)

Concavity (CONC)

Quality

Thorough

Benevolent

Impartial

Uses foresight

WPO+SYM+IIA+CONC ⇔

◦ The Egalitarian Solution or The Utilitarian QuasiSolution (for a comprehensive problem domain)

Utilitaria n ( S ) arg max

x S

x

Egalitaria n ( S ) arg max

x S , i , j : x i x j

Edgeworth (1881),

Walras (1954)

i

i

Zeuthen (1930),

Harsanyi (1955)

x

i

i

Bentham (1907),

Rawls (1971)

Kalai (1977)

“The Veil of

Ignorance”

WPO+SYM+IIA+CONC ⇔

◦ The Egalitarian Solution or The Utilitarian QuasiSolution (for a comprehensive problem domain)

But only the Utilitarian Quasi-Solution ⇔

◦ Admitting non-comprehensive problems

◦ Strengthening WPO to PO

◦ Strengthening CONC to ULIN or to LIN

One of the tenets of the

modern legal system

NBS is a solution, but only when S is

guaranteed to be convex.

◦ Otherwise, it is a quasi-solution, and is known as

the “Nash Set”

The utilitarian quasi-solution is a quasisolution on general convex S. However, it is a

solution on strictly convex S.

A strictly convex S occurs when goods are

infinitely divisible and

◦ Players are risk avoiders; or

◦ Returns diminish

IIA implies that there is a social utility

function

PO implies that this function is monotone

increasing in each axis

LIN implies that it is convex

SYM implies that it maps all coordinate

permutations to the same value

◦ which, together with convexity, leads to being a

function on the sum of the coordinates.

Shapley (1969)’s “Guiding Principle”:

◦ ψ(S) = Efficient(S) ∩ Equitable(S)

IIA

SYM

ULIN

PO(S) ⊆ Efficient(S) ⊆ WPO(S)

The Utilitarian Quasi-Solution

*

On non-comprehensive domains

Now, we do need to look at the mechanics of

haggling.

The mechanics of Rubinstein’s alternating

offers game:

◦

◦

◦

◦

Infinite turns (or else the solution is dictatorial)

Infinite regression of refusals leads to d.

Time costs: <Si+1,di+1>=<(1-ε)Si+ε di,di>

When ε→0, the first offer is NBS and it is

immediately accepted.

<Si+1,di+1>=<(1-ε)Si+ε di,di>

Rubinstein: At each offer, there is a 1-ε

probability for negotiations to break down.

Why should negotiations ever break down for

rational players?

Why at a constant rate?

Is it realistic to assume that no amount of

refusals can ever reduce utility to less than a

fixed amount?

Man, I could

be at home

watching TV

right now...

900

800

400

200

300

700

100

600

I’d rather

be

sailing.

Let A be the vector designating for each

player the rate at which her utility is reduced

in terms of alternate time costs.

St+Δt={x-AΔt|x ∈ St}

We take Δt→0 and tmax→∞.

The result is in the utilitarian quasi-solution

arg max

x S

x

i

i

/ Ai

Note: The mechanics of the bargaining

process dictate the solution’s scaling, with no

need for interpersonal utility comparisons.

W.l.o.g., let us scale the problem to A=1.

We know we are on ∂S (the Pareto surface of S),

and because Δt→0 we know S changes slowly.

Let p(x)=the normal to ∂S at x (the natural rate of

utility exchange).

When backtracking over n turns, the leading offer

changes in direction <1/p1(x)-n/s,... , 1/pn(x)-n/s>,

where s=∑pi(x).

Applying the Cauchy-Schwarz inequality, we get

that ∑xi always increases, except when p(x)∝1.

Letting tmax→∞, we are guaranteed to reach a

point on the utilitarian quasi-solution.

We know this from experience.

We now know that it is rational behavior.

It is not accounted for by NBS (Or

Rubinstein’s alternating offers game).

questions?