Report Anthilia Orange A Share

advertisement

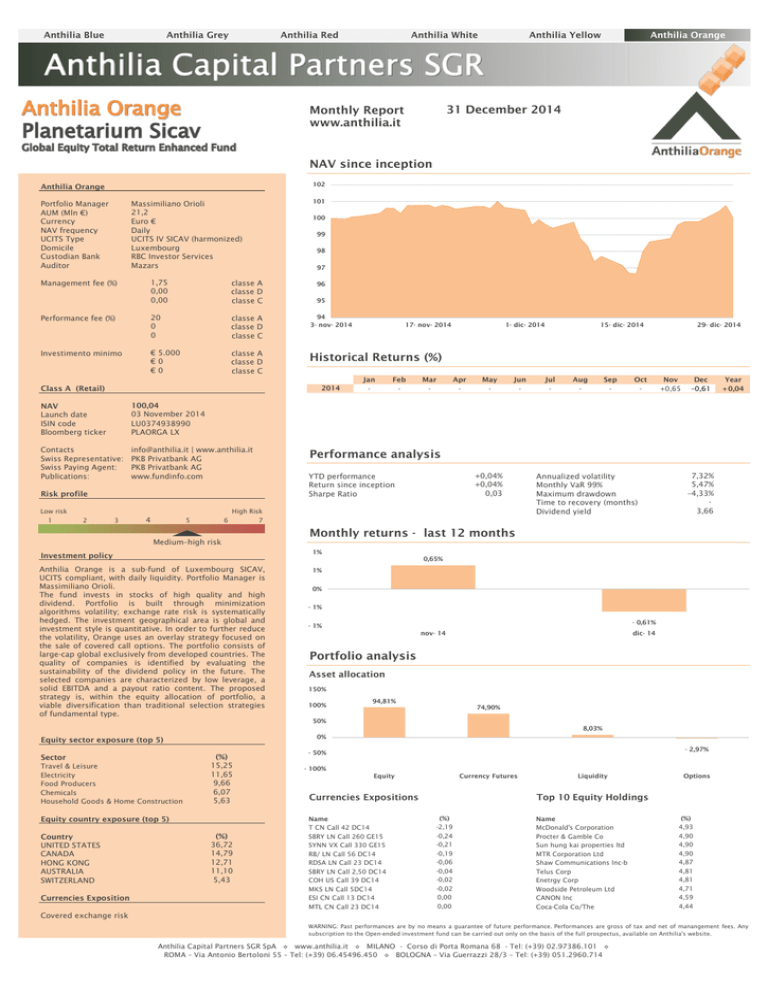

Anthilia Blue Anthilia Grey Anthilia Red Anthilia White Anthilia Yellow Anthilia Orange 31 December 2014 Monthly Report www.anthilia.it NAV since inception 102 Anthilia Orange Portfolio Manager AUM (Mln €) Currency NAV frequency UCITS Type Domicile Custodian Bank Auditor Massimiliano Orioli 21,2 Euro € Daily UCITS IV SICAV (harmonized) Luxembourg RBC Investor Services Mazars 101 100 99 98 97 Management fee (%) 1,75 0,00 0,00 classe A classe D classe C Performance fee (%) 20 0 0 classe A classe D classe C 94 3-nov-2014 Investimento minimo € 5.000 €0 €0 classe A classe D classe C Historical Returns (%) 96 95 1 2014 Class A (Retail) NAV Launch date ISIN code Bloomberg ticker 100,04 03 November 2014 LU0374938990 PLAORGA LX Contacts Swiss Representative: Swiss Paying Agent: Publications: info@anthilia.it | www.anthilia.it PKB Privatbank AG PKB Privatbank AG www.fundinfo.com 2 3 4 5 6 High Risk 7 Medium–high risk Sector 4 Apr - 5 May - 6 Jun - 7 Jul - 8 Aug - 9 Sep - 10 Oct - 29-dic-2014 11 Nov +0,65 12 Dec –0,61 Year +0,04 +0,04% +0,04% 0,03 0,78 –1,56% 0,57 YTD performance Return since inception Sharpe Ratio Market correlation Alpha Beta Monthly returns - last 12 months Annualized volatility Monthly VaR 99% Maximum drawdown Time to recovery (months) Dividend yield Last 4 quarters performance 7,32% 5,47% –4,33% 3,66 #N/D 0,65% 1% 0% -1% -0,61% -1% nov-14 dic-14 Portfolio analysis Asset allocation 150% 100% 94,81% 74,90% 50% 8,03% 0% Equity sector exposure (top 5) Travel & Leisure Electricity Food Producers Chemicals Household Goods & Home Construction 3 Mar - 15-dic-2014 Performance analysis 0 Anthilia Orange is a sub-fund of Luxembourg SICAV, UCITS compliant, with daily liquidity. Portfolio Manager is Massimiliano Orioli. The fund invests in stocks of high quality and high dividend. Portfolio is built through minimization algorithms volatility; exchange rate risk is systematically hedged. The investment geographical area is global and investment style is quantitative. In order to further reduce the volatility, Orange uses an overlay strategy focused on the sale of covered call options. The portfolio consists of large-cap global exclusively from developed countries. The quality of companies is identified by evaluating the sustainability of the dividend policy in the future. The selected companies are characterized by low leverage, a solid EBITDA and a payout ratio content. The proposed strategy is, within the equity allocation of portfolio, a viable diversification than traditional selection strategies of fundamental type. (%) 15,25 11,65 9,66 6,07 5,63 Equity country exposure (top 5) Currencies Exposition 2 Feb - 1% Investment policy Country UNITED STATES CANADA HONG KONG AUSTRALIA SWITZERLAND Jan - 1-dic-2014 2015 Risk profile Low risk 1 17-nov-2014 (%) 36,72 14,79 12,71 11,10 5,43 -2,97% -50% -100% Equity Currency Futures Currencies Expositions Name T CN Call 42 DC14 SBRY LN Call 260 GE15 SYNN VX Call 330 GE15 RB/ LN Call 56 DC14 RDSA LN Call 23 DC14 SBRY LN Call 2,50 DC14 COH US Call 39 DC14 MKS LN Call 5DC14 ESI CN Call 13 DC14 MTL CN Call 23 DC14 Liquidity Options Top 10 Equity Holdings (%) -2,19 -0,24 -0,21 -0,19 -0,06 -0,04 -0,02 -0,02 0,00 0,00 Name McDonald's Corporation Procter & Gamble Co Sun hung kai properties ltd MTR Corporation Ltd Shaw Communications Inc-b Telus Corp Enetrgy Corp Woodside Petroleum Ltd CANON Inc Coca-Cola Co/The (%) 4,93 4,90 4,90 4,90 4,87 4,81 4,81 4,71 4,59 4,44 Covered exchange risk WARNING: Past performances are by no means a guarantee of future performance. Performances are gross of tax and net of manangement fees. Any subscription to the Open-ended investment fund can be carried out only on the basis of the full prospectus, available on Anthilia's website. Anthilia Capital Partners SGR SpA ◊ www.anthilia.it ◊ MILANO - Corso di Porta Romana 68 - Tel: (+39) 02.97386.101 ◊ ROMA – Via Antonio Bertoloni 55 – Tel: (+39) 06.45496.450 ◊ BOLOGNA – Via Guerrazzi 28/3 – Tel: (+39) 051.2960.714