Daily Letter | 1

11 December 2014______

Canacol Energy Ltd.

Christopher Brown - Canaccord Genuity Corp. (Canada)

BUY

cjbrown@canaccordgenuity.com

Target: C$7.50

khedlin@canaccordgenuity.com

CNE : TSX : C$1.63

COMPANY STATISTICS:

Forecast Return %:

52-week Range:

Avg. Daily Vol. (000s):

Shares Out (M) basic:

Shares Out (M) fd:

Market Cap (M):

Current Net Debt (surplus) (M):

Current Enterprise Value (M):

360%

C$1.53 - 8.77

694

107.8

114.4

C$175.7

C$131.4

C$307.1

EARNINGS SUMMARY:

FYE Jun

Oil & NGL (b/d):

Natural Gas

(mmcf/d):

Total (boe/d):

EPS fd:

CFPS fd:

CF/boe:

EV/DACF:

NAV fd:

CAPEX (M):

2014A

7,660

2015E

11,941

2016E

15,170

17

18

56

10,437

14,982

24,489

US$0.11 US$0.34 US$0.95

US$0.85 US$1.00 US$1.87

US$22.99 US$23.72 US$25.28

10.3

3.1

1.4

C$9.25 C$10.40 C$11.10

US$141

US$185

US$144

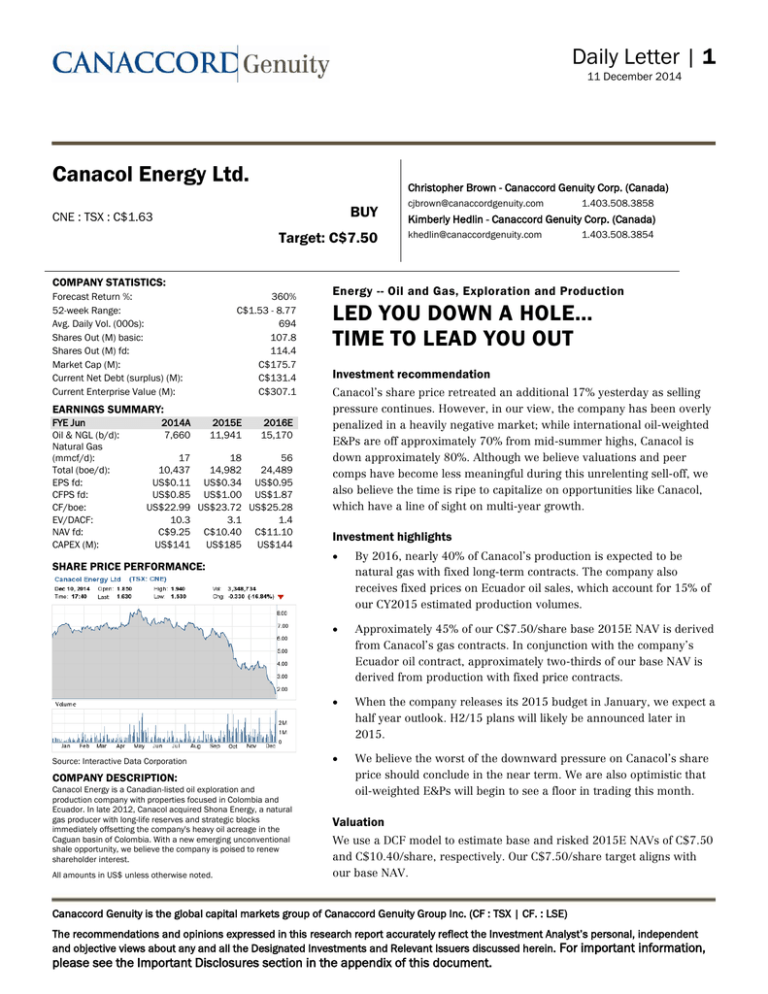

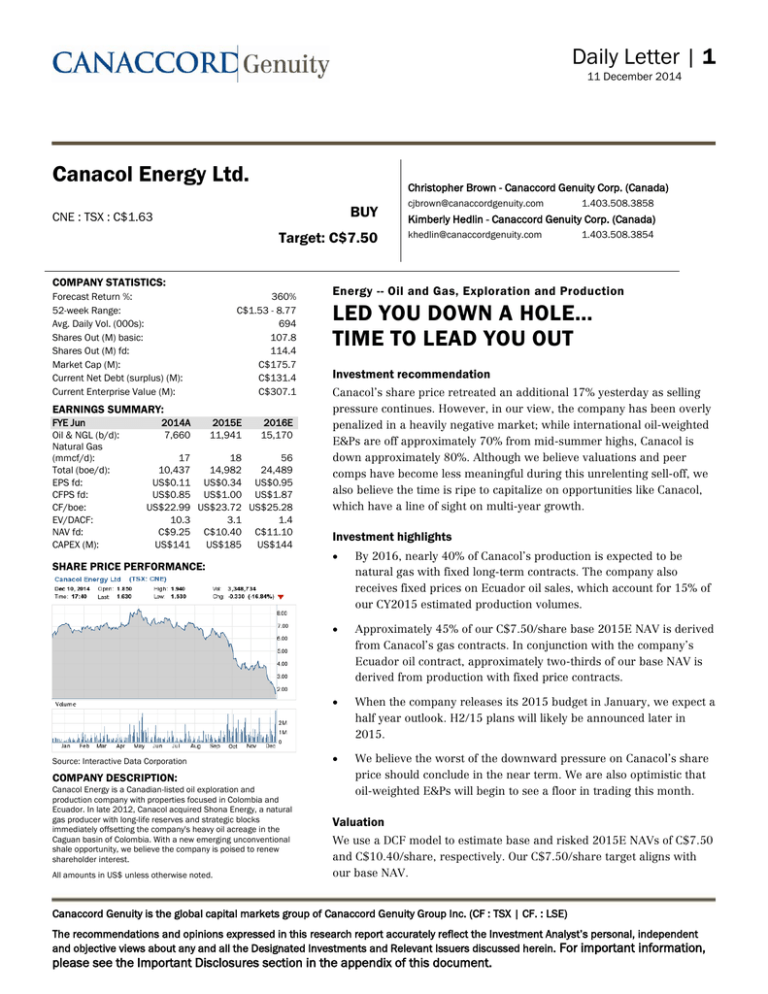

SHARE PRICE PERFORMANCE:

Source: Interactive Data Corporation

COMPANY DESCRIPTION:

Canacol Energy is a Canadian-listed oil exploration and

production company with properties focused in Colombia and

Ecuador. In late 2012, Canacol acquired Shona Energy, a natural

gas producer with long-life reserves and strategic blocks

immediately offsetting the company's heavy oil acreage in the

Caguan basin of Colombia. With a new emerging unconventional

shale opportunity, we believe the company is poised to renew

shareholder interest.

All amounts in US$ unless otherwise noted.

1.403.508.3858

Kimberly Hedlin - Canaccord Genuity Corp. (Canada)

1.403.508.3854

Energy -- Oil and Gas, Exploration and Production

LED YOU DOWN A HOLE…

TIME TO LEAD YOU OUT

Investment recommendation

Canacol’s share price retreated an additional 17% yesterday as selling

pressure continues. However, in our view, the company has been overly

penalized in a heavily negative market; while international oil-weighted

E&Ps are off approximately 70% from mid-summer highs, Canacol is

down approximately 80%. Although we believe valuations and peer

comps have become less meaningful during this unrelenting sell-off, we

also believe the time is ripe to capitalize on opportunities like Canacol,

which have a line of sight on multi-year growth.

Investment highlights

By 2016, nearly 40% of Canacol’s production is expected to be

natural gas with fixed long-term contracts. The company also

receives fixed prices on Ecuador oil sales, which account for 15% of

our CY2015 estimated production volumes.

Approximately 45% of our C$7.50/share base 2015E NAV is derived

from Canacol’s gas contracts. In conjunction with the company’s

Ecuador oil contract, approximately two-thirds of our base NAV is

derived from production with fixed price contracts.

When the company releases its 2015 budget in January, we expect a

half year outlook. H2/15 plans will likely be announced later in

2015.

We believe the worst of the downward pressure on Canacol’s share

price should conclude in the near term. We are also optimistic that

oil-weighted E&Ps will begin to see a floor in trading this month.

Valuation

We use a DCF model to estimate base and risked 2015E NAVs of C$7.50

and C$10.40/share, respectively. Our C$7.50/share target aligns with

our base NAV.

Canaccord Genuity is the global capital markets group of Canaccord Genuity Group Inc. (CF : TSX | CF. : LSE)

The recommendations and opinions expressed in this research report accurately reflect the Investment Analyst’s personal, independent

and objective views about any and all the Designated Investments and Relevant Issuers discussed herein. For important information,

please see the Important Disclosures section in the appendix of this document.

Daily Letter | 2

11 December 2014

NO ONE CAN CALL THE BOTTOM, BUT HERE WE ARE

Canacol’s share price retreated an additional 17% yesterday as selling pressure continues;

in our view, the company has been overly penalized in a heavily negative market. While

international oil-weighted E&Ps are off approximately 70% from mid-summer highs,

Canacol is down approximately 80%. Although we believe valuations and peer comps have

become less meaningful during this unrelenting sell-off, we also believe now is the time to

capitalize on opportunities with a line of sight on multi-year growth.

In our view, 2008 had a Darwinian impact on the surviving internationals today. Realizing

the limited options for equity financing, most companies have been trained to live within

their financial means for growth. While Canacol was successful at recently completing a

financing at a non-dilutive share price, the share price has subsequently fallen nearly 80%

since the financing. In our view, those with a long-term investment horizon on Canacol

should enjoy the benefits of a strong 2016 combined with a growing inventory of

exploration locations in both conventional and unconventional oil plays. Investors that are

suffering include those having to report month-to-month gains/losses and traders with

short-time horizons. Either way, we believe that the company is at or near an excellent

accumulation level particularly given its ability to decouple revenue streams from Brent in

2016.

The value of international gas…

Canacol’s gas contracts going forward should not be underestimated. If Brent prices

remain weak through 2015 and North American gas prices remain soft, there are few

options in the energy sector for commodity price upside other than internationals. Canacol

currently has 18 MMcf/d locked in at approximately $5/MMBtu with a 2% escalation factor.

In December 2015, the company is expected to initiate two new contracts of 35 MMcf/d at

~$5.40/MMBtu and 30 MMcf/d at $8.00/MMBtu. Management forecasts 2016 EBITDA of

$170 million associated with its 83 MMcf/d of contracted production. The company is also

pursuing incremental opportunities for upwards of 60 MMcf/d that would likely be

contracted at or above $8/MMBtu.

As we stated earlier, 45% of our C$7.50/share base 2015E NAV is associated with

Canacol’s gas contracts. In our view, investors are selling the shares, to some degree, due

to an over-emphasis on debt levels. However, it is our opinion that the market “can’t see

the forest for the trees” as the market ignores longer-term opportunities. We believe debt is

only an issue if the company cannot repay or renegotiate it, or if the repayment of nearterm debt impacts future growth. In our view, the company should be able to refinance

current debt and should be able to grow into 2016 with current sources of funding. As

such, we maintain that Canacol’s current share price provides a solid entry point for

investors going into 2015.

2015 outlook

As we stated in our, “Reduction in Guidance; Reducing Target”, publication November 13,

2014, “We believe soft Q1/F15 financials, along with reduced production guidance, will

weigh heavily on the stock through year end”. Now that we believe the worst of the share

price correction is behind us, we think there is a solid opportunity to accumulate the stock

at these levels.

Daily Letter | 3

11 December 2014

Based on our sensitivity analysis, the company could execute a self-funded $200 million

capex program in 2015 with Brent prices of $50/bbl. In this scenario, 2016 would be a

rebuilding year (in terms of the balance sheet). However, by this time ~40% of the

corporate production should be from long-term gas contracts.

We expect the company will likely provide a two-stage budget to remain dynamic in the

face of volatile Brent prices. As such, Canacol should be able to re-allocate funds

accordingly. The major unknown is where Brent prices will go in 2015. It is our belief that

Brent will be under pressure through Q1/15. However, as commodity traders begin to

speculate on a positive outcome from the OPEC meeting in June, futures contracts should

trend higher. This, combined with ongoing capital cutbacks from North American

producers, should put upward pressure on oil from the supply side. When oil prices

eventually turn around, we believe international oil producers should be well positioned to

capitalize on improved pricing through increased spending in H2/15 (versus the Majors,

which tend to be less dynamic in deploying capital programs).

VALUATION

We have made no changes to our DCF model or NAV estimate for 2015E. The company is

expected to release its updated 2015 capital program in January, which will impact both

our capital estimates as well as our production expectations. In the interim, we believe the

company can manage within its means with a capital budget under $200 million. As we

stated earlier, we believe that most international companies will give six-month capital

guidance with some optionality to increase H2/15 capital guidance depending on the status

of Brent pricing by mid-2015.

We note that even with a $50-55/bbl Brent price deck, we do not foresee liquidity issues

based on our current production projections. In our view, the expected boost in sales from

gas volumes (starting December 2015) should be a significant driver of cash flows going

forward. Given Canacol’s significant resource inventory, solid base development program,

and discounted valuation, we maintain our BUY recommendation.

Daily Letter | 4

11 December 2014

Figure 1: Fiscal 2015E NAV

2015E Net Asset Value

(US$ unless otherwise stated)

Resources

After Tax

10%

Disc.

(MM$)

62

After Tax

12%

Disc.

(MM$)

62

After Tax

15%

Disc.

(MM$)

62

LLA-23

Esperanza gas

Libertador & Atacapi (Ecuador)

Other (Colombia)

Serrania

Coati

+ Working Capital

- Debt

+ Corporate Items

Net Asset Value

260

341

160

31

49

4

37

(153)

35

764

219

308

153

32

43

4

37

(153)

35

678

199

275

137

26

36

3

37

(153)

35

595

7.50 $

6.65 $

5.85

104

104

104

83

211

1,059

66

173

917

48

129

772

10.40 $

9.00 $

7.55

2015E Base NAV (C$/sh)

$

Total Resources

Conventional upside

Unconventional upside

Upside Net Asset Value

2015E Risked NAV (C$/sh)

$

Assumptions:

Production (b/d)

Funds from Operations (US$ MM)

Capital expenditures (US$ MM)

Brent (US$/bbl)

F/D Shares O/S (MM)

Source: Company reports, Canaccord Genuity estimates

2014E

10,437

76

141

109

114

2015E

14,982

108

185

86

114

2016E

24,489

202

144

87

114

Daily Letter | 5

11 December 2014

The following section was taken from our November 13, 2014 publication titled

”Reduction in Guidance; Reducing Target”

LLA-23 – Likely drilling inventory into 2016

The company highlighted that, despite the downturn in global commodity prices, that LLA23 block remains highly profitable due to the high deliverability and its lower-cost

structure. The company intends to drill two development wells and additional exploration

wells before year end (Maltes-1 and Pastor-1).

The company is in the process of shooting 400 square kilometres of 3D seismic with a

target to firm up the 12 currently identified exploration leads shown in Figure 2. The

inventory of locations has the potential to provide drilling inventory into 2016.

Figure 2: LLA-23 prospect map

Source: Company reports

Daily Letter | 6

11 December 2014

SHALE – Up to 30 shale exploration wells expected through to the end of 2015

The company has benefited from conventional discoveries on its shale blocks via “free

looks” due to the deeper shale drilling on block VMM-2. The company plans to drill an

additional appraisal well into the shallow Lisama discovery prior to the end of 2014.

(subsequent to our November 13, 2014 publication, the company has decided not to drill)

On the VMM-3 block, the operator (Shell) spudded the Pico Plata-1 exploration well in early

October 2014. The well will target the La Luna shale formation. As shown in Figure 3,

there is a substantive number of shale locations planned into 2015 by various operators.

Canacol’s northern shale blocks have ConocoPhillips, Exxon and Shell as operators, with

the company being carried on 19 total locations in this region. The company’s independent

auditor has identified a net mean prospective shale resource of 185 million barrels with

estimated value of $1.3 billion (on the three northern blocks alone).

Figure 3: Shale proximity map

Source: Company reports

Daily Letter | 7

11 December 2014

Gas upside late 2015 – Canacol’s gas production should greatly reduce commodity

price volatility in 2016 and beyond

The company has successfully drilled the Corozo-1 gas exploration well and is awaiting a

production test. The Canandonga-1 exploration well is expected to be drilled next, likely

before year end. Management estimates that Canandonga could be as large as 67 Bcf on an

unrisked recoverable prospective resource basis.

In 2015, the company intends to follow with up to five appraisal/development locations in

order to deliver the 83 MMcf/d of contracted gas by the end of 2015. In our view, this

property should bring stability to the cash flow statement in future years as the company

has contracted the gas at various fixed prices (from $5 to $8/MMBtu) for up to five-year

terms. The company is currently pursuing an additional 60 MMcf/d of fixed contracts to

capitalize on the high gas prices that can currently be locked in for long-term contracts.

In the short term, Canacol also announced a price increase on current sales. Canacol

currently sells approximately 18 MMcf/d of gas from the Nelson Field to a local ferronickel

producer under a 10-year contract that expires in 2021. That contract was linked to the

Guajira price index, which changed effective October 29, 2014 from $3.97/MMBtu to

$5.08/MMBtu. This should benefit production netbacks starting this quarter.

Figure 4: Esperanza block

Source: Company reports

Daily Letter | 8

11 December 2014

TARGETING 35,000 BOE/D BY 2016

The company has ambitious plans to achieve 35,000 boe/d by 2016. With gas production

already contracted for 14,561 boe/d, the company needs to grow its oil production to

~20,400 b/d by 2016. The company indicated that its 13 existing fields currently contribute

43 million boe of 2P reserves with an NPV of $887 million shown in Figure 5.

Figure 5: Canacol long-term production estimates (November 12, 2014)

Source: Company reports

Daily Letter | 9

11 December 2014

APPENDIX I: FINANCIAL STATEMENTS

We outline our current financial projections for Canacol below (effective December 10,

2014).

Figure 6: Canacol’s income statement (US$000s)

June 30 YE

Oil and Gas Revenue

Royalties

Share of joint venture profit and other

Total Revenue

2013A

160,154

(12,488)

147,666

2014A

229,074

(21,287)

3,532

211,319

2015E

278,568

(27,142)

9,481

260,906

2016E

458,346

(41,783)

10,070

426,633

Operating

General and Administration

Depletion, Depreciation and Accretion

Stock Option Compensation

Other

Total Operating Expense

75,628

22,236

48,240

8,041

137,140

291,285

67,559

27,045

38,740

7,290

11,731

152,365

89,125

26,225

83,645

4,121

266

203,383

118,481

40,416

122,231

3,959

109

285,196

(16,211)

(523)

(2,818)

(19,552)

(9,656)

2,057

(19,402)

(27,001)

(21,548)

(2,485)

5,130

(18,903)

(21,072)

(21,072)

Income (Loss) Before Income Taxes

(163,171)

31,953

38,621

120,365

Current Income Tax

Future Income

Income Taxes

Non-controlling interest

Net Income

2,033

(44,592)

(42,559)

(120,612)

24,823

(2,807)

22,016

9,937

16,140

(14,411)

1,729

36,892

39,140

(21,537)

17,603

102,762

(1.61)

0.11

0.34

0.95

Finance Income (Expense)

Foreign Exchange Gain (Loss)

Other

Net Finance Income (Expense)

EPS - Fully Diluted, Continuing

Source: Company reports, Canaccord Genuity estimates

Daily Letter | 10

11 December 2014

Figure 7: Canacol’s cash flow statement (US$000s)

June 30 YE

Net Income

Depletion, depreciation and accretion

Deferred income

Impairment, loss (Gain) on acquisition

Stock-based compensation

Finance Costs

Deferred Income Tax

Unrealized (gain) loss on Commodity Contracts

Unrealized loss on financial Instruments

Unrealized (gain) loss on foreign Currency Translation

Other

Other (inc. E&A write off)

Cash From Operations

Changes in Non-Cash Operating Working Capital

Cash Flow from Discontinued Operations

Cash Flow From Operations

CFPS - Fully Diluted

2013A

(120,612)

48,240

3,731

1,000

8,041

16,211

(44,592)

1,184

(295)

(18,759)

157,007

51,156

(21,611)

29,545

2014A

9,937

38,740

7,290

9,656

(2,807)

24,288

(959)

(17,777)

10,963

75,799

2,145

77,944

2015E

36,892

83,645

4,121

9,104

(14,411)

(5,130)

3,383

176

108,299

22,930

131,229

2016E

102,762

122,231

3,959

4,496

(21,537)

109

201,949

(757)

201,192

0.68

0.85

1.00

1.87

Issue of common shares

Borrowing (Repayments)

Other Financing Activities

Cash From Financing Activities

(354)

102,043

(8,874)

92,815

120,405

74,045

(6,679)

187,771

434

6,000

(2,144)

4,290

(34,367)

(34,367)

Additions to intangible E & E assets

Additions to Petroleum properties

Divestitures/(Acquisitions) not assigned to PP&A or E&E

Additions to Other Assets

Changes in Restricted Cash

Change in non-cash Investing working capital

Other Investing Activities

Cash Flow From Investing Activities

(24,813)

(49,267)

(34,781)

(3,159)

2,861

8,300

(100,859)

(25,358)

(107,523)

(8,314)

(40,433)

27,352

(154,276)

(66,479)

(118,816)

(36,891)

13,434

207

(208,545)

(10,623)

(133,647)

(144,271)

Foreign Exchange Gain (Loss)

Increase/(Decrease) in Cash

Cash - Open

Cash - Close

Source: Company reports, Canaccord Genuity estimates

21,501

30,789

52,290

111,439

52,290

163,729

(73,026)

163,729

90,703

22,555

90,703

113,258

Daily Letter | 11

11 December 2014

Figure 8: Canacol’s balance sheet (US$000s)

Cash and Cash Equivalents

Restricted Cash

Accounts Receivable

Inventory

Deposits and Prepaid Expenses

Derivative Commodity Contracts

Other current assets

Current Assets

Exploration and Evaluation Assets

Property and Equipment

Other Assets

Total Assets

52,290

7,127

38,141

3,261

11,331

1,875

114,025

92,753

238,278

24,536

469,592

163,729

7,379

60,981

1,936

12,405

5,254

251,684

133,510

301,398

69,995

756,587

90,703

35,697

43,520

1,338

10,997

3,417

185,672

173,923

364,297

101,324

825,216

113,258

35,697

78,816

1,338

10,997

3,417

243,523

184,437

377,313

132,931

938,204

Accounts Payable and Accrued Liabilities

Current Portion of Long Term Debt

Other Short Term Liabilities

Current Liabilities

Asset Retirement Obligations

Long Term Debt

Deferred Tax

Convertible Debentures

Other Long-Term Liabilities

Total Liabilities

Share Capital

Contributed Surplus

Accumulated Other Comprehensive Income

Retained Earnings (Deficit)

Subtotal Equity (Shareholders Equity)

Total Liabilities and Equity

37,219

6,100

43,319

7,995

134,316

3,861

22,091

18,707

230,289

408,770

40,074

347

(209,888)

239,303

469,592

75,814

44,000

18,912

138,726

10,518

166,688

1,054

25,395

13,919

356,300

551,049

48,842

347

(199,951)

400,287

756,587

94,825

84,367

24,931

204,122

11,759

162,517

4,402

382,801

551,590

53,537

347

(163,059)

442,415

825,216

129,363

58,667

24,931

212,961

13,359

158,347

4,402

389,069

551,590

57,496

347

(60,297)

549,136

938,204

Source: Company reports, Canaccord Genuity estimates

Daily Letter | 12

11 December 2014

Investment risks

Investors need to be aware of the risks inherent in the oil and gas industry. Without

limitation, these risks include:

Trading liquidity risks.

Geological, engineering, regulatory and environmental risks related to the exploration for

and development of crude oil and natural gas resources.

Volatility in crude oil and natural gas prices that can materially affect financial

performance and the accuracy of estimates.

Access on favourable terms to oilfield services, equipment and labour.

Favourable access to external capital.

Country risk -- the majority of the company's producing and potential properties are

presently located in Colombia. The company's operations, financial results, and valuation

could be adversely affected by events beyond the company's control taken by the current

or future governments with respect to policy changes regarding taxation, regulation, and

other business environment changes.

Daily Letter | 13

11 December 2014

APPENDIX: IMPORTANT DISCLOSURES

Analyst Certification:

Compendium Report:

Site Visit:

Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby

certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring

analyst’s personal, independent and objective views about any and all of the designated investments or

relevant issuers discussed herein that are within such authoring analyst’s coverage universe and (ii) no part

of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific

recommendations or views expressed by the authoring analyst in the research.

Analysts employed outside the US are not registered as research analysts with FINRA. These analysts may

not be associated persons of Canaccord Genuity Inc. and therefore may not be subject to the NASD Rule 2711

and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading

securities held by a research analyst account.

If this report covers six or more subject companies, it is a compendium report and Canaccord Genuity and its

affiliated companies hereby direct the reader to the specific disclosures related to the subject companies

discussed in this report, which may be obtained at the following website (provided as a hyperlink if this

report is being read electronically) http://disclosures.canaccordgenuity.com/EN/Pages/default.aspx; or by

sending a request to Canaccord Genuity Corp. Research, Attn: Disclosures, P.O. Box 10337 Pacific Centre,

2200-609 Granville Street, Vancouver, BC, Canada V7Y 1H2; or by sending a request by email to

disclosures@canaccordgenuity.com. The reader may also obtain a copy of Canaccord Genuity’s policies and

procedures regarding the dissemination of research by following the steps outlined above.

An analyst has not visited Canacol's material operations.

Price Chart:*

Distribution of Ratings:

Coverage Universe

Global Stock Ratings

(as of 1 October 2014)

IB Clients

Rating

#

%

%

627

60.2%

36.7%

53

5.1%

54.7%

Hold

317

30.5%

13.9%

Sell

43

4.1%

2.3%

Buy

Speculative Buy

1041

100.0%

*Total includes stocks that are Under Review

Daily Letter | 14

11 December 2014

Canaccord Genuity

Ratings System:

BUY: The stock is expected to generate risk-adjusted returns of over 10% during the next 12 months.

HOLD: The stock is expected to generate risk-adjusted returns of 0-10% during the next 12 months.

SELL: The stock is expected to generate negative risk-adjusted returns during the next 12 months.

NOT RATED: Canaccord Genuity does not provide research coverage of the relevant issuer.

“Risk-adjusted return” refers to the expected return in relation to the amount of risk associated with the

designated investment or the relevant issuer.

Risk Qualifier:

SPECULATIVE: Stocks bear significantly higher risk that typically cannot be valued by normal fundamental

criteria. Investments in the stock may result in material loss.

Canaccord Genuity Research Disclosures as of 11 December 2014

Company

Canacol Energy Ltd.

1

2

Disclosure

1A, 2, 3, 7

The relevant issuer currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated

companies. During this period, Canaccord Genuity or its affiliated companies provided the following services

to the relevant issuer:

A. investment banking services.

B. non-investment banking securities-related services.

C. non-securities related services.

In the past 12 months, Canaccord Genuity or its affiliated companies have received compensation for

Corporate Finance/Investment Banking services from the relevant issuer.

3

In the past 12 months, Canaccord Genuity or any of its affiliated companies have been lead manager, co-lead

manager or co-manager of a public offering of securities of the relevant issuer or any publicly disclosed offer

of securities of the relevant issuer or in any related derivatives.

4

Canaccord Genuity acts as corporate broker for the relevant issuer and/or Canaccord Genuity or any of its

affiliated companies may have an agreement with the relevant issuer relating to the provision of Corporate

Finance/Investment Banking services.

Canaccord Genuity or one or more of its affiliated companies is a market maker or liquidity provider in the

securities of the relevant issuer or in any related derivatives.

In the past 12 months, Canaccord Genuity, its partners, affiliated companies, officers or directors, or any

authoring analyst involved in the preparation of this research has provided services to the relevant issuer for

remuneration, other than normal course investment advisory or trade execution services.

Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive

compensation for Corporate Finance/Investment Banking services from the relevant issuer in the next six

months.

The authoring analyst, a member of the authoring analyst’s household, or any individual directly involved in

the preparation of this research, has a long position in the shares or derivatives, or has any other financial

interest in the relevant issuer, the value of which increases as the value of the underlying equity increases.

The authoring analyst, a member of the authoring analyst’s household, or any individual directly involved in

the preparation of this research, has a short position in the shares or derivatives, or has any other financial

interest in the relevant issuer, the value of which increases as the value of the underlying equity decreases.

Those persons identified as the author(s) of this research, or any individual involved in the preparation of this

research, have purchased/received shares in the relevant issuer prior to a public offering of those shares, and

such person’s name and details are disclosed above.

A partner, director, officer, employee or agent of Canaccord Genuity or its affiliated companies, or a member

of his/her household, is an officer, or director, or serves as an advisor or board member of the relevant issuer

and/or one of its subsidiaries, and such person’s name is disclosed above.

As of the month end immediately preceding the date of publication of this research, or the prior month end if

publication is within 10 days following a month end, Canaccord Genuity or its affiliated companies, in the

aggregate, beneficially owned 1% or more of any class of the total issued share capital or other common

equity securities of the relevant issuer or held any other financial interests in the relevant issuer which are

significant in relation to the research (as disclosed above).

As of the month end immediately preceding the date of publication of this research, or the prior month end if

publication is within 10 days following a month end, the relevant issuer owned 1% or more of any class of the

total issued share capital in Canaccord Genuity or any of its affiliated companies.

Other specific disclosures as described above.

5

6

7

8

9

10

11

12

13

14

Daily Letter | 15

11 December 2014

“Canaccord Genuity” is the business name used by certain wholly owned subsidiaries of Canaccord Genuity

Group Inc., including Canaccord Genuity Inc., Canaccord Genuity Limited, Canaccord Genuity Corp., and

Canaccord Genuity (Australia) Limited, an affiliated company that is 50%-owned by Canaccord Genuity Group

Inc.

The authoring analysts who are responsible for the preparation of this research are employed by Canaccord

Genuity Corp. a Canadian broker-dealer with principal offices located in Vancouver, Calgary, Toronto,

Montreal, or Canaccord Genuity Inc., a US broker-dealer with principal offices located in New York, Boston,

San Francisco and Houston, or Canaccord Genuity Limited., a UK broker-dealer with principal offices located

in London (UK) and Dublin (Ireland), or Canaccord Genuity (Australia) Limited, an Australian broker-dealer

with principal offices located in Sydney and Melbourne.

The authoring analysts who are responsible for the preparation of this research have received (or will

receive) compensation based upon (among other factors) the Corporate Finance/Investment Banking

revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and

will not receive, compensation that is directly based upon or linked to one or more specific Corporate

Finance/Investment Banking activities, or to recommendations contained in the research.

Canaccord Genuity and its affiliated companies may have a Corporate Finance/Investment Banking or other

relationship with the issuer that is the subject of this research and may trade in any of the designated

investments mentioned herein either for their own account or the accounts of their customers, in good faith

or in the normal course of market making. Accordingly, Canaccord Genuity or their affiliated companies,

principals or employees (other than the authoring analyst(s) who prepared this research) may at any time

have a long or short position in any such designated investments, related designated investments or in

options, futures or other derivative instruments based thereon.

Some regulators require that a firm must establish, implement and make available a policy for managing

conflicts of interest arising as a result of publication or distribution of research. This research has been

prepared in accordance with Canaccord Genuity’s policy on managing conflicts of interest, and information

barriers or firewalls have been used where appropriate. Canaccord Genuity’s policy is available upon request.

The information contained in this research has been compiled by Canaccord Genuity from sources believed to

be reliable, but (with the exception of the information about Canaccord Genuity) no representation or

warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as

to its fairness, accuracy, completeness or correctness. Canaccord Genuity has not independently verified the

facts, assumptions, and estimates contained herein. All estimates, opinions and other information contained

in this research constitute Canaccord Genuity’s judgement as of the date of this research, are subject to

change without notice and are provided in good faith but without legal responsibility or liability.

Canaccord Genuity’s salespeople, traders, and other professionals may provide oral or written market

commentary or trading strategies to our clients and our proprietary trading desk that reflect opinions that are

contrary to the opinions expressed in this research. Canaccord Genuity’s affiliates, principal trading desk,

and investing businesses may make investment decisions that are inconsistent with the recommendations or

views expressed in this research.

This research is provided for information purposes only and does not constitute an offer or solicitation to buy

or sell any designated investments discussed herein in any jurisdiction where such offer or solicitation would

be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale

in some jurisdictions. This research is not, and under no circumstances should be construed as, a solicitation

to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally

permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is

prepared for general circulation to clients and does not have regard to the investment objectives, financial

situation or particular needs of any particular person. Investors should obtain advice based on their own

individual circumstances before making an investment decision. To the fullest extent permitted by law, none

of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any

direct or consequential loss arising from or relating to any use of the information contained in this research.

For Canadian Residents:

This research has been approved by Canaccord Genuity Corp., which accepts sole responsibility for this

research and its dissemination in Canada. Canadian clients wishing to effect transactions in any designated

investment discussed should do so through a qualified salesperson of Canaccord Genuity Corp. in their

particular province or territory.

For United States

Residents:

Canaccord Genuity Inc., a US registered broker-dealer, accepts responsibility for this research and its

dissemination in the United States. This research is intended for distribution in the United States only to

certain US institutional investors. US clients wishing to effect transactions in any designated investment

discussed should do so through a qualified salesperson of Canaccord Genuity Inc. Analysts employed outside

the US, as specifically indicated elsewhere in this report, are not registered as research analysts with FINRA.

These analysts may not be associated persons of Canaccord Genuity Inc. and therefore may not be subject to

the NASD Rule 2711 and NYSE Rule 472 restrictions on communications with a subject company, public

appearances and trading securities held by a research analyst account.

Daily Letter | 16

11 December 2014

For United Kingdom and

European Residents:

This research is distributed in the United Kingdom and elsewhere Europe, as third party research by

Canaccord Genuity Limited, which is authorized and regulated by the Financial Conduct Authority. This

research is for distribution only to persons who are Eligible Counterparties or Professional Clients only and is

exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the

communication of invitations or inducements to engage in investment activity on the grounds that it is being

distributed in the United Kingdom only to persons of a kind described in Article 19(5) (Investment

Professionals) and 49(2) (High Net Worth companies, unincorporated associations etc) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be

distributed or passed on, directly or indirectly, to any other class of persons. This material is not for

distribution in the United Kingdom or elsewhere in Europe to retail clients, as defined under the rules of the

Financial Conduct Authority.

For Jersey, Guernsey

and Isle of Man

Residents:

This research is sent to you by Canaccord Genuity Wealth (International) Limited (CGWI) for information

purposes and is not to be construed as a solicitation or an offer to purchase or sell investments or related

financial instruments. This research has been produced by an affiliate of CGWI for circulation to its

institutional clients and also CGWI. Its contents have been approved by CGWI and we are providing it to you

on the basis that we believe it to be of interest to you. This statement should be read in conjunction with your

client agreement, CGWI's current terms of business and the other disclosures and disclaimers contained

within this research. If you are in any doubt, you should consult your financial adviser.

CGWI is licensed and regulated by the Guernsey Financial Services Commission, the Jersey Financial Services

Commission and the Isle of Man Financial Supervision Commission. CGWI is registered in Guernsey and is a

wholly owned subsidiary of Canaccord Genuity Group Inc.

For Australian

Residents:

This research is distributed in Australia by Canaccord Genuity (Australia) Limited ABN 19 075 071 466

holder of AFS Licence No 234666. To the extent that this research contains any advice, this is limited to

general advice only. Recipients should take into account their own personal circumstances before making an

investment decision. Clients wishing to effect any transactions in any financial products discussed in the

research should do so through a qualified representative of Canaccord Genuity (Australia) Limited. Canaccord

Genuity Wealth Management is a division of Canaccord Genuity (Australia) Limited.

For Singapore

Residents:

This research is distributed pursuant to 32C of the Financial Advisers under an arrangement between each of

the Canaccord Genuity entities that publish research and Canaccord Genuity Singapore Pte. Ltd who are an

exempt financial adviser under section 23(1)(d) of the Financial Advisers Act. This research is only intended

for persons who fall within the definition of accredited investor, expert investor or institutional investor as

defined under section 4A of the Securities and Futures Act It is not intended to be distributed or passed on,

directly or indirectly, to any other class of persons. Recipients of this report can contact Canaccord Genuity

Singapore Pte. Ltd. (Contact Person: Tom Gunnersen’s tel # is +852 3919 2561) in respect of any matters

arising from, or in connection with, the [analyses or report].

For Hong Kong

Residents:

This research is distributed in Hong Kong by Canaccord Genuity (Hong Kong) Limited who is licensed by the

Securities and Futures Commission. This research is only intended for persons who fall within the definition

of professional investor as defined in the Securities and Futures Ordinance. It is not intended to be

distributed or passed on, directly or indirectly, to any other class of persons. Recipients of this report can

contact Canaccord Genuity (Hong Kong). Ltd. (Contact Person: Tom Gunnersen’s tel # is +852 3919 2561) in

respect of any matters arising from, or in connection with, the research.

Additional information is available on request.

Copyright © Canaccord Genuity Corp. 2014. – Member IIROC/Canadian Investor Protection Fund

Copyright © Canaccord Genuity Limited 2014. – Member LSE, authorized and regulated by the Financial

Conduct Authority.

Copyright © Canaccord Genuity Inc. 2014. – Member FINRA/SIPC

Copyright © Canaccord Genuity (Australia) Limited 2014. – Participant of ASX Group, Chi-x Australia and of

the NSX. Authorized and regulated by ASIC.

All rights reserved. All material presented in this document, unless specifically indicated otherwise, is under

copyright to Canaccord Genuity Corp., Canaccord Genuity Limited, Canaccord Genuity Inc. or Canaccord

Genuity Group Inc. None of the material, nor its content, nor any copy of it, may be altered in any way, or

transmitted to or distributed to any other party, without the prior express written permission of the entities

listed above.