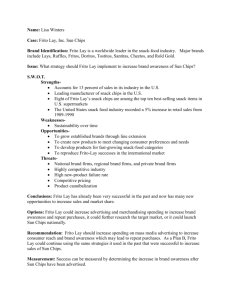

Frito Lay Case

advertisement

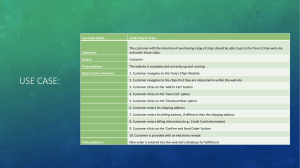

Frito-Lay, Inc. Sun Chips Multigrain Snacks Ryan Brogan, John Campanioni, Patrick Hildebrandt, Tracy Lai, Ashlea Morrell, and Kate Piskorowski Snack Chip Category $37 billion in snack food retail sales- 5% increase from 1989 Snack chip retail sales of $9.8 billion (26.7% of snack food sales)-also 5% increase Growth in snack chip category comes from increased per capita consumption In 1990 consumption was 14 pounds per person Three types of competitors National brand firms Regional brand firms Private Brands Snack Chip Category Highly competitive on price Chip manufacturers rely on technology to react quickly to competitors new product introductions Rely on media advertising, consumer promotions, and trade allowances New product failure rate is high Most products are new flavors for already existing chips Frito-Lay, Inc Division of PepsiCo, Inc National brand firm manufacturer and marketer of snack chips Well-known brands- Lays, Ruffles, Fritos, Chee-tos, Rold Gold, 13% of US snack food sales Leading manufacturer of snack chips-half of retail sales U.S. sales of $3.5 billion in 1990 8 of the chips are among the top ten best-selling chips Every step in process-agriculture to stacking shelves Risks and Challenges of Marketing Sun Chips Requires a new manufacturing process and introduces a new chip categoryhuge capital investment Requires a huge marketing investmentnew brand name Sun Chips name had a negative past Past Problems In 1970s introduced Prontos- failure with low sales and manufacturing problems Unfocused copy, confusing name , and too small of target market Frito-Lay has to enter the market at the right time and before the competition When is the right time? Efforts to develop another multigrain product didn’t occur until late 1980s. Need committed and focused advertising, a catchy and clear name, and a broader target market Assumptions The test market is reflective of the entire population The cannibalization rate for the test market will be used for the national market Pretest Results “Healthier product” Prior to use not an “everyday snack” After trying product, “everyday snack” Positive attitudes and perceptions of brand name Pretest indicates first-year sales of $113 million Focus on natural and wild onion flavors Statement of Problem To continue with the test market of Sun Chips or to introduce it nationally Manufacturing/marketing costs Manufacturing difficulties-still a new manufacturing process What new additions will be added to the product line. I.E. flavor extension, 15 oz. Package size Brand Comparison Nationally O’Grady’s had achieved 100 million in first year sales Sun chips sales for 10 months is $82,096,000 and after a year about $98,516,000 sales. It is comparable to the bench mark of O’Grady’s Chips. Since we are creating a new segment of the market we would want to be the first to enter it to capture customers early. Test Results For The Test Market Quantitative analysis Possible Alternatives Continue the test market with 15-ounce package Continue the test market with a flavor extension Introduce product nationally with same strategy as test market Brand Extension National Comparison Flavor extension achieved $110,328,000 in sales and achieved a gross profit after cannibalization of aprox $14,144,000 15 oz Package achieved $101,469,000 in sales and achieved a gross profit after cannibalization of aprox $13,075,000 Test Results Test Results for the Other product extensions Quantitative analysis Recommendation Because of the $98,516,000 in first year sales it is a good idea to launch the Natural and French Onion Combination. Initial analysis of the flavor extension states that we may have sales of $110,328,044 by launching the product nationally. Therefore we feel that it would be best to test market the mild cheddar extension since it may prove to be lucrative.