Diapositiva 1

advertisement

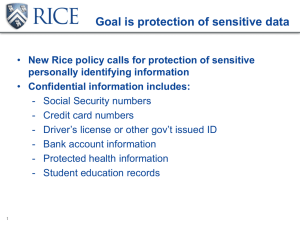

Corporate Presentation November, 2010 INDEX 1. Introduction 2. Rice Business 3. Pasta Business 4. Conclusion 5. Annex I. Main Figures 6. Annex II. Product Samples 1 INTRODUCTION Who is Ebro? Ebro is an international brand-based food group with a market capitalization of €2.26 billion, turnover of €1.75 billion and net profit of €176.4 m at the end of 2009. Over the last ten years we have made several changes, transforming our company from a sugar company in 2000 (with a financial participation in Herba since 1989) to our present structure: In 2000, we merged with Puleva (branded dairy leader in Spain). In 2001, we fully incorporated Herba (European rice leader). Between 2001 and 2004 we bought up 7 small and medium-sized leading branded rice companies in Europe. In 2004, we acquired Riviana (branded rice leader in USA). In 2005, we acquired Panzani (branded rice and pasta leader in France). In 2006, we acquired New World Pasta and Minute Rice (leading branded pasta and rice companies in USA and Canada). In 2007, we acquired Birkel (leading branded pasta company in Germany). In 2009, we divested our Sugar Division. In 2010, we divested Puleva. In this period we have invested €1.7 billion, made divestments of €1.87 billon, with no capital increase and maintaining a healthy pay out for our shareholders. Nowadays, after the sale of Puleva, we are debt free. Ebro Nowadays We are world leaders in the branded rice sector and the second branded pasta manufacturer worldwide. Ebro subsidiaries are distributed over 23 countries in Europe, America, Asia, Northern Africa and we have a portfolio of over 60 brands. Our stock is quoted in the Madrid Stock Exchange Market (Ibex 35 company). The Hernandez family is the reference shareholder since 2003. All together, with other members of the Board (essentially other Spanish families), control 44.6% of the equity. The rest is freely floated in the market. Being our products strongly related with raw materials our relationship with rice and durum wheat farmers has always been very strong and we consider this as a very valuable asset. Our balance sheet is very strong. Nowadays we are debt free and we have a strong cash flow generation. We have the clear ambition of reinforcing our international leadership in our core businesses. Breakdown of Ebitda EBITDA by Geographical Zone 1H10 EBITDA by Divisions 1H10 North America 51% Rice 41% Rest of Europe 41% Spain Iberia 7% Rest of World 1% Pasta 59% Ebro Presence 2 RICE BUSINESS The Rice Business The history of our Rice Division tracks back to a business started by the Hernandez Family in Spain in 1950. After its full integration in Ebro Foods in 2001, we have taken over 10 rice businesses throughout the world: Denmark, Hungary, Finland, Germany, UK, USA, Canada, Egypt, Thailand and India most of them branded companies but as well sourcing capacity (silos and mills). Two key milestones for us were the acquisition on Riviana Foods in 2004 (374 MUSD) and Minute Rice in 2006 (280 MUSD). That development allowed us to become US leader in rice. That added to our pasta activity created a 1,0 BUSD sales group in US and Canada. Nowadays we are the largest rice processor in the world with leading brands in most countries in Europe, USA and Canada. We have a strong expertise in raw materials. One of our strengths is having a strong foothold in the largest rice production regions in the world, with a strong infrastructure and a flexible balance sheet. We are using our brands to open up new sectors, including convenience foods, pasta, purées, porridges and new products. Management raw materials, production and packaging, technologies and brands are vital for our project. Rice Market Shares COUNTRY MARKET SHARE VOLUMEN Spain 24,0% Portugal 16,0% Germany 20,0% Belgium 31,7% P. Rico 23,0% USA 24,0% Canada (Instant Rice) 65,0% France 23,0% Rice Brands Rice Raw Material Purchases In Europe: We purchase 500.000 tm/annum of rice. All purchases are made to farmers and cooperatives. In North America: We purchase 200.000 tm/annum of paddy rice. We purchase 200.000 tm/annum of milled rice. The bulk of our purchasing is from Arkansas and Memphis therefore our facilities are located in that regions. We procure paddy rice directly from growers as well as from drying and storage operations throughout Arkansas. We purchase milled rice from a preferred group of vendors that meet our quality requirements. Other sources: We purchase on paddy basis other 500.000 Mt/annum from origins as Uruguay, Guyana, Thailand, Egypt and fragrant rice from India, Pakistan and Thailand. Rice Factories Spain Our factories in Spain have a: Milling capacity of: 500.000 mt/annum. Parboiling capacity: 210.000 mt/annum. Storage capacity: 182.000 mt. The facilities are located in: San Juan – Seville: Rice Mill, Parboiled Rice, Quick Rice, Ready Made Dishes and Packing. Isla Mayor - Seville: Rice Mill. Coria - Seville: Rice Mill. Jerez: Microwave and Packing facilities. Silla - Valencia: Rice Mill and Packing Facilities. L´Aldea - Tarragona: Rice Mill and Flour Mill. Tortosa - Tarragona: Packing facilities. Rice Factories Spain L´Aldea Tarragona Tortosa - Tarragona San Juan - Sevilla Silla - Valencia Isla Mayor-Sevilla Jerez - Jerez Coria - Sevilla Rice Factories EU. Our factories in the European Union have: Milling capacity of: 400.000 mt/annum. Storing capacity of: 80.000 mt/annum. The facilities are located in: Cambridge, UK: Rice Mills. Liverpool, UK: Rice Mills and Flour Mill. Orbaek, Denmark: and IQF Rice and Pasta. Antwerp, Belgium: Rice Mill, Flour Mill and Packing facilities. Hamburg, Germany: Rice Mill and Packing facilities. Vercelli, Italy: Rice Mill. Coruche, Portugal: Rice Mill and Packing facilities. Rice Factories EU. Antwerp Liverpool Danmark Hamburg Cambridge Vercelli Coruche Rice Factories USA. Our plants in US are located in: Carlisle, AR. Parboil and Crisping: Capacity for Parboil and Milling operation 80.000 mt/annum. Capacity for Crisping and Packaging 1.800 mt/annum. Brinkley, AR. Instant Rice Processing and Milling: Capacity for Instant Rice Processing and Packaging 26.000 mt/annum. Capacity for Rice Milling 47.000 mt/annum. Clearbrook, MN. Parboiling, Roasting, and packaging of Wild Rice: Capacity for Parboiling/Roasting of green Wild Rice 25.700 mt/annum. Memphis, TN. Next slide. Rice Factories USA. Memphis Rice Factory Construction on the estimated 110 MAUD Ebro’s., rice processing and packaging plant in Memphis will be finished by 1Q11 but is already starting to work. It will add a 400,000-square-foot state-of-the-art plant that will include an on-site warehousing and distribution center. The new facility will be located on 31 acres lands property of the Group. It will have instant rice processing and packaging of instant and milled rice: Capacity for instant rice processing and packaging 91.500 mt/annum. 8 processing lines and 9 packaging lines. Milled Rice packaging capacity 152.500 mt/annum. 11 packaging lines. Other Rice Affiliates We are also placed in: Egypt: Herba Egypt Milling capacity of: 100.000 mt/annum. Storage capacity: 20.000 mt Morocco: Mundiriz Milling capacity of: 60.000 mt/annum. Parboiling capacity: 18.000 mt/annum. Storage capacity: 25.000 mt Thailand: Herba Bangkok Processing and packing capacity of: 100.000 mt/annum. Storage capacity: 20.000 mt Uruguay: Joint Venture with Casarone 20.000 ha of rice rotating with wheat. Production 40.000 mt/annum of paddy rice. 180.000 mt/annum of rice milled and parboiled. Other Rice Affiliates Uruguay Herba Bangkok 3 PASTA BUSINESS The Pasta Business Our first step in the Pasta business was the acquisition of Panzani in 2005 (€639 m). Panzani was the leading dry pasta, fresh pasta, rice and sauces branded leader in France. It brought to our group an expertise in pasta marketing and R+I+D, along with a specialized management team that allowed us to transfer all these knowledge to other countries. Panzani was the perfect platform to develop a pasta business, offering know-how and product innovation, allowing those new products to be introduced on markets on which we were already present. In 2006 we bought New World Pasta (“NWP”), the pasta branded leader in USA and Canada, it was a company that was getting out of Chapter 11, clearly underinvested in R+D and A&P. We integrated NWP with our rice businesses in North America generating important synergies. In 2008 we acquired Birkel, the branded pasta leader in Germany. Our strategy in pasta is focused in: Convenience, e.g.: microwave products, quick cook, etc. Health, e.g.: pasta enriched with vegetables, whole grain pasta, high fiber white pasta, etc. Taste/Ethnics, e.g. Fresh pasta, fresh sauces, Halal, etc. The Pasta Division Market Shares Pasta COUNTRY MARKET SHARE VOLUMEN Germany 11,2% Belgium 13,7% Cezch Republic 12,5% USA 25,8% Canada 39,4% France 40,8% Sauce COUNTRY France MARKET SHARE 33,6% Fresh Pasta COUNTRY France MARKET SHARE 30,5% The Pasta Division Main Brands Pasta Raw Material Purchases In Europe: We purchase 582.000 tm/annum of durum wheat. 524.600 tm/ annum come from France. 57.400 tm/annum come from North America. 100% of French durum wheat purchase is done to cooperatives. In France the 60% of the purchases are made through three years contract where the price is fixed at the average price of the market. The North American 100% durum wheat purchases for Europe are made from brokers. In North America: We purchase 280.000 tm/annum of durum wheat. 196.000 tm/annum come from the Northern Tier (Dakotas). 28.000 tm/annum come form the desert (California). 56.000 tm/annum come from Canada (Saskatchewan and Alberta). All purchases from the Northern Tier are made on the open market, in the desert we contract acres with farmers, and in Canada is through the Canadian Wheat Board. Pasta Factories EU. Our facilities in EU are located in: France: Three mills: Gennevilliers (Paris): with a capacity of 130.000 tm/annum. Littoral (Marseille): with a capacity of 65.000 tm/annum. Saint Just (Marseille): with a capacity of 130.000 tm/annum. Two plants of dry pasta: Nanterre (Paris): with a capacity of 87.000 tm/annum. La Montre (Marseille): with a capacity of 76.000 tm/annum. Two plants of fresh pasta: Saint Genis Laval (Lyon): with a capacity of 20.000 tn/annum. Lorette (Lyon): with a capacity of 16.000 tn/ annum. A plant of cous cous Vitrolles: with a capacity of 50.000 tn/annum. Germany: Two plants of dry pasta: Mannheim: with a capacity of 66.000 tm/annum. Waren: with a capacity of 14.000 tm/annum. Pasta Factories France Pasta Factories Germany Pasta Factories USA. and Canada We have four pasta factories between US and Canada. Three in US: Winchester, Virginia: this factory has a milling capacity of: 90.000 tm/annum. St. Louis, Missouri: this factory has a milling capacity of 81.000 tm/annum. Fresno, California: this factory has a milling capacity of 34.200 tm/annum. One in Canada: Montreal, Quebec: this factory has a milling capacity of 50.400 tm/annum. Pasta Factories USA. And Canada 4 CONCLUSION Conclusion We are a Food Group specialized in products highly related with their raw materials, rice and durum wheat. Originally we started as a sugar and dairy company and nowadays we are focused in rice and pasta therefore our relationship with our raw material providers is very important. We maintain strong and long lasting relations with the local farmers; we understand that the relationship between farmers and industrials is a long term one, based on cooperation and respect. We purchase around 2 million tones of rice a year and some 1 million tones of durum wheat what shows the magnitudes we are used to trade. We have a clear and strong commitment to develop ourselves as a world leading group in meal solutions based on rice and pasta and therefore we highly invest in R+D and marketing. We want to upgrade our portfolio with more value added products. We are a Group with high speed of adaptation to the environment and specificities of each country. We have developed a skill of integration, always respecting the local cultures of each business and local management. 5 ANNEX I. MAIN FIGURES RICE Main Figures- Rice Business 9M08 647.763 17.430 89.592 9M09 654.925 21.166 85.600 9M10 602.055 20.699 87.779 EBITDA Margin 13,8% 13,1% 14,6% EBIT Operating profit 74.026 73.805 69.901 63.190 70.488 73.185 18,6 19,4 19,9 Thous EUR Sales Advertising EBITDA ROCE Thous EUR Sales EBITDA 2008 890.969 20.214 126.560 EBIT Operating profit 105.724 104.365 Advertising EBITDA Margin ROCE 14,2% 19,0 10/09 CAGR 10/08 -8,1% -3,6% -2,2% 9,0% 2,5% -1,0% 11,6% 2,7% 0,8% -2,4% 15,8% -0,4% 2,6% 3,4% 2009 E2010 E10/09 CAGR E10/08 836.147 801.815 -4,1% -5,1% 24.175 26.731 10,6% 15,0% 118.561 122.498 3,3% -1,6% 14,2% 15,3% 7,7% 3,7% 97.575 99.128 1,6% -3,2% 82.157 106.795 30,0% 1,2% 19,7 19,5 -1,0% 1,3% Main Figures- Pasta Business Thous EUR Sales Advertising EBITDA EBITDA Margin EBIT Operating profit ROCE 9M08 713.065 9M09 692.308 9M10 669.379 10/09 CAGR 10/08 -3,3% -3,1% 34.538 37.431 43.153 15,3% 11,8% 67.208 94.807 117.651 9,4% 13,7% 17,6% 45.257 36.381 73.818 71.767 97.569 91.254 12,6 21,6 29,3 24,1% 28,3% 32,2% 27,2% 35,6% 32,3% 36,6% 46,8% 58,4% 52,5% Thous EUR Sales 2008 993.696 2009 E2010 E10/09 CAGR E10/08 928.077 905.394 -2,4% -4,5% 56.661 16,2% 9,5% EBITDA 105.993 137.057 157.205 75.581 65.312 108.831 130.935 104.066 122.236 14,7% 17,6% 20,3% 17,5% 25,9% 21,8% 27,6% 31,6% 36,8% 40,5% Advertising EBITDA Margin EBIT Operating profit ROCE 47.273 10,7% 14,8 48.781 14,8% 23,2 17,4% 29,2 Main Figures- Consolidated Thous EUR 9M08 9M09 9M10 Sales 1,333,597 1,342,483 1,253,850 53,986 61,482 64,774 148,762 171,259 197,586 11.2% 12.8% 15.8% 108,360 128,969 69,519 46,997 92,698 131,665 117,977 99,176 67,008 134,701 157,520 142,443 135,283 265,702 346,065 13.2 17.8 21.5 Advertising EBITDA EBITDA margin EBIT Operating profit Profit before tax Discontinued operations Net Profit ROCE Thous EUR Sales Advertising 2008 2009 E2010 1.874.475 1.765.397 1.684.898 70.219 75.750 84.930 EBITDA 224.074 243.824 271.229 EBIT Operating profit Profit before tax Discontinued operations Net Profit 169.216 165.606 72.354 82.049 130.637 190.666 175.041 124.436 79.543 176.539 217.940 205.754 199.780 265.702 387.552 EBITDA margin ROCE 12,0% 14,5 13,8% 18,5 16,1% n.a. 10/09 -6.6% 5.4% 15.4% 23.5% 19.6% 20.7% 36.4% 296.5% 156.9% 20.8% CAGR 10/08 -3.0% 9.5% 15.2% 18.9% 20.6% 5.1% 39.5% 137.8% 93.2% 27.6% E10/09 CAGR E10/08 -4,6% 12,1% 11,2% 16,6% 14,3% 17,5% 60,5% 234,0% 119,5% -5,2% 10,0% 10,0% 16,0% 13,5% 11,5% 66,2% 80,0% 72,2% Main Figures- Balance Sheet After the sale of the Dairy Division (€630m) that took place in September we are debt free. Thous EUR Net Debt Average Debt Equity Leverage ND Leverage AD x EBITDA (ND) x EBITDA (AD) 30 Sep 08 31 Dec 08 30 Sep 09 31 Dec 09 30 Sep 10 E31 Dec 10 1,233,271 1,055,853 545,272 556,800 716,725 508,386 1,189,193 1,203,131 1,228,326 1,280,322 1,500,321 103.7% 101.4% 87.8% 100.4% 4.7 44.4% 62.8% 43.5% 56.0% 2.3 -5.6% 33.9% 1,205,893 1,208,078 5.4 770,943 2.9 -84,306 70,160 n.d 1,544,867 4.5% 46.4% 0.3 n.a. E10/09 -115.5% -34.1% 22.1% -112.7% -46.0% CAGR E10/08 -74.2% -23.0% 13.3% -77.3% -32.0%