CVX & OXY

advertisement

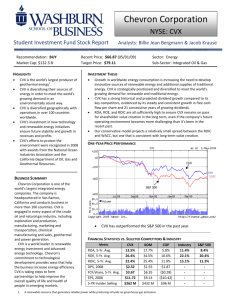

Recommendation: Buy Chevron and Occidental Petroleum (CVX & OXY) Integrated: Chevron • 2nd largest US traded oil company by market cap. • $198B in 2010 revenue, $19B net income • 2.763B in net oil equivalent production • 58,000 employees and 4,000 service station employees Chevron: Strong Financials FCF Mgn 3Yr Avg Total Debt/Total Equity Sum (Lower is better) Ticker Mkt. Cap. Div. Yield 5Yr. Div. Growth FCF Yield WACC ROIC P/B P/E 3Yr Avg ROE XOM 360B 4th 4th 4th 1st 7th 6th 1st 1st 2nd 30 CVX 190B 2nd 3rd 3rd 2nd 6th 2nd 2nd 2nd 1st 23 COP 88B 1st 1st 2nd 5th 4th 4th 6th 3rd 8th 34 HES 18B 6th 7th 6th 7th 1st 3rd 5th 6th 6th 47 Chevron: Strong Financials Measure CVX Top 4 Mkt. Cap. Avg. Dividend Yield 3.38% 2.73% 5Yr Net Div. Growth 9.11% 7.41% FCF Yield 7.11% 4.48% 14.64% 10.34% P/B 1.62 1.53 P/E 8.24 8.87 P/E 5yr Avg. minus Current P/E 1.09 2.20 19.53% 13.73% 3.27 2.74 9.89% 20.56% WACC ROIC 3Yr Avg. ROE FCF Mgn. 3Yr Avg. Total Debt/Total Equity CVX: Dividend History CVX Dividend (CAGR: 8.19%) 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 CVX: Replacement Ratio CVX SWOT Analysis Strengths Very large, well established Moderate Beta of 0.98 Strong financials; good track record in most aspects Weaknesses 2010 Replacement ratio < 1, but 10 year avg. = 1.01 Price correlated to Brent while Brent-WTI spread at highs Opportunities Reserve growth through acreage acquisitions Oil consumption increases abroad Threats Tax increases Environmental concerns Global economic weakness CVX Investment Information Prev Close: 94.66 1y Target Est: 108 52wk Range: 80.41 - 109.94 Avg Vol (3m): 10,954,200 Market Cap: 189.6B P/E (ttm): 8.33 EPS (ttm): 11.45 Div & Yield: 3.12 (3.38%) Forward P/E: 7.24 E & P: Occidental Petroleum • Largest US traded E&P by market cap: 61.57B, nearly 2x as large as next largest Anadarko at 32.8B • Highest dividend yield (2.45%) in top 6 US E&P, 2nd in top 16 • 3.36B barrels of oil equivalent (BOE) proven reserves as of 2010 end. • 19B in 2010 net sales, 4.53B net income • Has outperformed S&P last 12 years (though currently trailing S&P YTD) Occidental: Strong Financials Measure OXY Top 4 Mkt. Cap. Avg. Dividend Yield 2.45% 1.24% 5Yr Net Div. Growth 18.29 9.15 FCF Yield 2.52% 0.00% WACC ROIC 12.63% 9% P/B 1.75 1.39 P/E 10.49 14.14 P/E 5yr Avg. minus Current P/E 4.98 7.45 15.11% 7.49% 23.47 8.54 12.08% 34.43% 3Yr Avg. ROE FCF Mgn. 3Yr Avg. Total Debt/Total Equity Occidental: Reserve Growth OXY Proved Reserves (CAGR: 4.35%) 3500 3400 3300 3200 3100 3000 2900 2800 2700 2600 2500 2006 2007 2008 2009 2010 Occidental: Dividend Growth Occidental: Sales Growth Occidental: Correlation to Oil (Timing) SWOT Analysis Strengths Largest US E&P Strong reserve, sales, and dividend growth Strong financials compared to peers Weaknesses New CEO in 2011 (unproven but promoted from COO) Opportunities May be currently underpriced Continuing oil shale acquisitions and international plays Threats Tax increases Environmental concerns Global economic weakness OXY Investment Information Prev Close: 75.72 1y Target Est: 113 52wk Range: 66.36 - 117.89 Avg Vol (3m): 5,976,330 Market Cap: 61.54B P/E (ttm): 10.49 EPS (ttm): 7.08 Div & Yield: 1.84 (2.60%) Forward P/E: 8.47 Investment Theses • Chevron is a large cap integrated financially outperforming its peers. A respectable dividend with a history of growth protects against the downside while a moderate beta and solid correlation to oil prices should cause it to also do well in an up market. • Occidental Petroleum is a large cap E&P with international production diversification and is a financial standout among its peers. A beta slightly over one paired with an acceptable dividend give it an upside and downside protection. Now appears to be a good time to buy considering the tight correlation to oil and the discount to said correlation. Portfolio Placement / Recommendation $/SH. SH. # TOTAL $ WT. BETA WT. STD. BETA DEV. WT. STD. TTM DIV. DIV. $ YIELD WT. YIELD DESCRIPTION AMLP 15.3 350 5355 0.1276 0.80 0.10 0.02 0.003 0.99 0.06 0.01 Pipeline ETF CVX 94.61 100 9461 0.2254 0.77 0.17 0.06 0.013 3.00 0.03 0.01 Oil Integrated FEN 26.16 200 5232 0.1247 0.92 0.11 0.05 0.006 1.85 0.07 0.01 Pipeline CEF OXY 78.56 100 7856 0.1872 1.02 0.19 0.11 0.021 1.76 0.02 0.00 Oil E&P PXJ 17.47 400 6988 0.1665 1.34 0.22 0.10 0.016 0.08 0.00 0.00 Oil Services Fund VPU 70.74 100 7074 0.1686 0.61 0.10 0.03 0.005 2.69 0.04 0.01 US Utility Fund YIELD 3.56% TOTAL WT. AVG. $41,966 $10.36 BETA 0.91 STD. DEV. 0.064 Portfolio Placement / Recommendation BUY 100 shares of CVX at Limit Price of $95.00 ($9,500, 2% of portfolio) Holding Period/Exit Strategy: 2+ years; reassess thesis at least every three months. BUY 100 shares of OXY at Limit Price of $80.00 ($8,000, 1.75% of portfolio) Holding Period/Exit Strategy: 2+ years; reassess thesis at least every three months. Portfolio Placement / Recommendation Sector : Energy Projected Holdings: AMLP, FEN, CVX, PXJ, OXY Target Sector Allocation: 8.54%, ~$38,860 Projected Sector Allocation: 7.62% , ~$34,660 Remaining Allocation: 1.92%, $4,200