Netgear (NTGR)

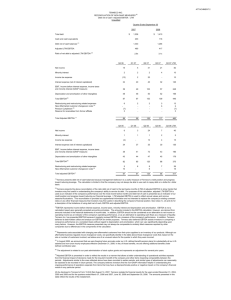

advertisement

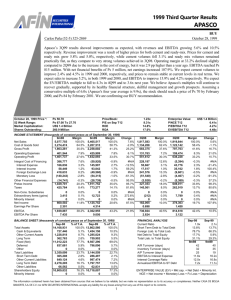

Netgear (NTGR) Bharath Chandrashekhar Daniel Kleeman Shalini Sivarajah Presented: April 10, 2014 Agenda • • • • • • • • • • Company Profile Business Model SWOT Analysis Macroeconomic Overview Stock Performance Porter’s Analysis Comps Analysis Financial Analysis Valuation Recommendation Company Profile • Netgear is a global networking company, engaged in providing a range of networking products to consumers, businesses and service providers • The company operates in US, EMEA (Europe, Middle-East and Africa) and Asia • Incorporated: January 1996 • HQ: San Jose, CA • IPO: July 2003, raised $98m • Market Cap: $1.2bn • Current Share Price(4/8/14): $33.45 Business Model • Outsource manufacturing, warehousing and distribution • Focus mainly on sales & marketing and R&D • Distribution is mainly through traditional retailers, online retailers, wholesale distributors, DMR and VARs • Three business segments: ▫ Retail ▫ Commercial ▫ Service Provider • Little to no debt • 150 issued United States and 80 foreign patents that expire between 2014 and 2030 • Approximately 125 pending United States and foreign patent applications Business Segmentation Business Segments Retail • • • • • • • • WiFi Internet Routers WiFi Network Adapters WiFi Range Extenders Network Powerline Products Home Monitoring Cameras Multimedia Streaming Devices Home Use Network Storage Switches and Access Points Mobile Broadband Routers DSL and Cable Gateways Commercial • • • • Unified Network Storage Systems WiFi Networking Products Network Management Tools Network Security Service Provider • • • • • • • • • • Mobile Broadband Devices WiFi Routers DOCSIS 3.0 Gateways xDSL and Fiber Gateways Powerline and MoCA Adapters WiFi Adapters Storage Switches Home Security Network Security Retail Networking Retail Share Source: Analyst Day 2013 Presentation Wifi Range Extender DSL Modem Router USB Mini Adapter Wifi Router Commercial Switches Backup Storage Wifi Networking Router Service Provider Business Segments $600 000 25,00% 22,00% $500 000 20,00% 21,40% $400 000 17,20% 15,00% 14,40% $300 000 9,40% 10,00% 8,90% $200 000 5,00% $100 000 $- 0,00% Retail 2012 Net Revenue Commercial 2013 Net Revenue 2012 Contribution Margin Service Provider 2013 Contribution Margin Geographic Segments Revenue Breakdown 2012 2013 12,20% 10,60% 36,00% 53,40% 30,10% Americas 57,70% EMEA APAC SWOT Analysis STRENGTHS WEAKNESSES -Continuous R&D focus -Low debt -Exposed to Foreign Exchange Rate Risk -Increased cost of production in China SWOT Analysis OPPORTUNITIES THREATS -EMEA after consolidation (one of the best distribution networks in Europe) -Aircard acquisition implementation -New Technology by competitors -Imports from China Macroeconomic Overview • Key Drivers ▫ ▫ ▫ ▫ Demand from wired Telecommunications operators Number of broadband connections Corporate profit Aggregate private investments- expected to increase by 5.1% in the above period Stock Performance NASD NTGR Source: Yahoo Finance 14 Porter’s 5 Forces Bargaining Power of Buyers HIGH Threat of New Entrants MEDIUM Bargaining Power of Suppliers Industry Landscape /Competition MEDIUMHIGH MEDIUM Threat of Substitutes LOW Competitive Space Comparable Companies NetGear (NASDAQ:NTGR) Benchmarking Analysis – Financial Statistics and Ratios, Page 2 ($ in millions, except per share data) Return on Investment LTM Leverage Ratios ROIC (%) ROE (%) ROA (%) Debt / Tot. Cap. (%) Debt / Net Debt / EBITDA EBITDA (x) (x) LTM Coverage Ratios EBITDA / EBITDA EBIT / Int. Exp. - Cpx/ Int. Int. Exp. (x) (x) (x) Company Ticker NetGear NTGR 15% 7% 5% 1% 0.1x -1.1x 0.0x 0.0x 0.0x ASUSTeK Cisco D-Link ASUS CSCO DLINK 42% 53% 11% 18% 62% 11% 7% 10% 3% 6% 44% 12% 0.3x 1.0x 1.5x -3.1x 0.4x -4.1x 63.6x 23.2x 9.5x 57.0x 21.2x 6.3x 56.3x 19.2x 6.3x 35% 47% 30% 21% 7% 10% 21% 3% 0.92 0.17 -2.28 -0.95 32.11 43.41 28.19 39.12 27.26 37.74 Mean Median Valuation – Comparable Companies NetGear (NASDAQ:NTGR) Comparable Companies Analysis ($ in millions, except per share data) Enterprise Value / Company Weight NetGear ASUSTeK Cisco D-Link 30% 30% 40% Ticker Equity Value Enterprise Value NTGR Company NTGR Company NTGR LTM Sales LTM EBITDA LTM EBIT Total EBITDA Debt / Margin EBITDA Price / LTM EPS NTGR $1,301 $1,164 0.8x 9.3x 12.5x 9% 0.1.x 23.2x ASUS CSCO DLINK $7,805 123,417 434 $5,937 129,036 383 0.4x 2.7x 0.4x 8.0x 9.5x 19.2x 9.0x 11.5x 28.9x 5% 28% 2% 0.3.x 1.0.x 1.5.x 11.0x 12.4x 19.6x 1.1x 0.4x 1.1x 12.2x 9.5x 12.9x 16.5x 11.5x 17.7x 12% 5% 0.9x 1.0x 14.3x 12.4x 14.8x Mean Median Weighted Company LTM P/E 14.8x EPS Stock Price 1.44 $ EV/EBITDA EBITDA 12.9x EV/EBIT 17.7x 125.84 $ EBIT 92.98 $ 21.32 EV 1,627.48 EV 1,649.22 MVE Stock Price $ 1,764.19 $ MVE 45.37 Stock Price $ 1,785.93 $ 45.93 Financial Analysis Current Ratio Quick Ratio Cash Ratio Liquidity Ratios 2009 2010 2.73 2.62 2.27 2.12 0.88 0.50 2011 2.70 2.17 0.68 Profitability Ratios 2009 2010 2011 Operating Profit Margin 4.74% 10.11% 10.52% Net Margin 1.36% 5.64% 7.74% ROA 1.47% 6.52% 9.41% ROE (Book Value) 2.25% 10.17% 14.30% 2012 2013 3.31 2.67 2.64 1.92 0.57 0.48 2012 10.16% 6.80% 8.36% 11.47% 2013 6.79% 4.03% 5.05% 7.14% A/R Turnover Days Sales Outstanding Inventory Turnover Fixed Asset Turnover Total Asset Turnover Activity Ratios 2009 2010 4.22 3.98 86.57 91.74 7.58 7.08 6.39 6.23 1.08 1.16 2011 4.52 80.76 7.21 6.58 1.22 2012 4.97 73.47 7.27 6.56 1.23 2013 5.14 71.02 6.10 5.44 1.25 DuPont Analysis 2009 2010 2011 2012 2013 Tax Burden 28.66% 55.81% 73.56% 66.94% 59.38% Interest Burden 100.00% 100.00% 100.00% 100.00% 100.00% Operating Profit Margin 4.74% 10.11% 10.52% 10.16% 6.79% Asset Turnover 1.08 1.16 1.22 1.23 1.25 Leverage 1.53 1.56 1.52 1.37 1.41 ROE 2.25% 10.17% 14.30% 11.47% 7.14% Business Performance Share of Revenue By Segment 100% 90% 27.37% 20.18% 80% 31.14% 36.10% 40.04% 70% 60% 31.54% 30.58% 28.06% 50% 24.21% 22.73% 40% 30% 20% 42.05% 48.28% 40.79% 39.69% 37.23% 2011 2012 2013 10% 0% 2009 2010 Retail Commercial Service Annual Growth Rate by Segment 2010 2011 2012 Retail 50.83% 10.63% 4.77% Commercial 35.53% 16.48% -7.09% Service -3.13% 102.05% 24.85% Total Revenue 31.38% 30.93% 7.70% 2013 1.02% 1.08% 19.44% 7.68% Revenue Analysis ($ in thousands) Retail as a % of Total Revenue growth rate 2014 535,420.2 Revenue Assumptions 2015 2016 2017 567,545.4 578,896.3 613,630.1 2018 656,584.2 34.59% 34.09% 33.91% 32.01% 30.87% 5.00% 6.00% 2.00% 6.00% 7.00% Commercial as a % of Total Revenue growth rate 326,824.1 343,165.3 336,301.9 353,117.0 377,835.2 21.12% 20.61% 19.70% 18.42% 17.76% 5.00% 5.00% -2.00% 5.00% 7.00% Service as a % of Total Revenue growth rate 685,560.0 754,116.0 791,821.8 950,186.2 1,092,714.1 44.29% 45.30% 46.39% 49.57% 51.37% 25.00% 10.00% 5.00% 20.00% 15.00% 1,547,804.3 1,664,826.7 1,707,020.1 1,916,933.3 2,127,133.5 13.01% 7.56% 2.53% 12.30% 10.97% Total Net Revenue growth rate Valuation – Discount Rate Weighted Average Cost of Capital Share Price $ 34.04 Fully Diluted Shares Outstanding 38,885 Market Value of Equity 1,323,653 CAPM Risk-Free Rate Market Risk Premium 5-Year Beta 3.50% 5.00% 2.23 Total Debt CAPM Cost of Equity 14.63% Weight of Equity Weight of Debt 100.00% 0.00% Cost of Debt Size weighted interest rate CAPM Cost of Equity NTGR Realized Return - 5 year Cost of Equity 0.00% 14.63% 40.00% 11.69% 60.00% 12.86% Tax Rate 40.00% WACC 12.86% Discount Rate WACC Business Risk Premium Discount Rate 12.86% 1.50% 14.36% Valuation – DCF NTGR Discounted Cash Flow Analysis 2014 2015 2016 Net Income 60,179 89,701 88,820 Plus: Depreciation 34,497 36,049 38,212 Less: Capital Expenditures (21,299) (23,429) (24,366) Changes in Net Working Capital Less: Increases in A/R (35,338) (47,792) (34,466) Less: Increases in Inventory (23,193) 14,573 (22,977) Plus: Increases in A/P 17,032 (15,025) 37,094 Free Cash Flow 31,878 54,077 82,316 Present Value 27,875 41,347 55,035 as a % of value 4.11% 6.10% 8.12% Discount Rate Terminal Growth Rate 14.36% 3.00% Enterprise Value Less: Debt Market Capitalization 678,035 678,035 Share Price $ 17.44 $ 17.44 2.6% 2.8% 3.0% 3.2% 3.4% 2017 2018 Terminal 77,555 86,060 39,740 41,727 (29,239) (33,625) (56,815) (5,803) (31,487) (10,259) 9,308 28,503 9,062 106,603 5,298 54,494 0.78% 8.04% Sensitivity Analysis 13.0% 13.5% 14.0% 14.5% $ 19.59 $ 18.55 $ 17.59 $ 16.73 $ 19.91 $ 18.83 $ 17.85 $ 16.96 $ 20.24 $ 19.12 $ 18.11 $ 17.19 $ 20.58 $ 19.43 $ 18.39 $ 17.44 $ 20.94 $ 19.75 $ 18.67 $ 17.69 966,346 493,987 72.86% 15.0% $ 15.93 $ 16.14 $ 16.35 $ 16.57 $ 16.80 Recommendation • • • • Current Price – $34.04 DCF Value – $17.44 Comps Value – $20.54 - $34.34 Recommendation: No change, keep on watch list