GASB Update #3

advertisement

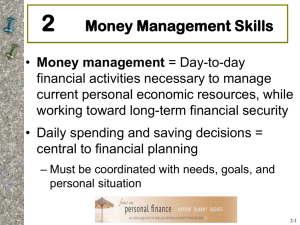

1 2013 Statement Statement Statement Statement 60 61 62 63 – – – – Service Concession Arrangements Reporting Entity Codification of AICPA and FASB Deferrals Presentation 2014 Statement 65 – Assets and Liabilities – Reclassification and Recognition Statement 66 – Technical Corrections Statement 67 – Financial Reporting for Pension Plans 2015 Statement 68 – Accounting and Financial Reporting for Pensions Statement 69 – Government Combinations and Disposals of Government Operations 2 3 Objective of Statement Incorporate into GASB’s authoritative literature (pre Nov 1989) which does not conflict with or contradict GASB pronouncements: 1. FASB Statements and Interpretations 2. Accounting Principles Board Opinions (APBs) 3. Accounting Research Bulletins of the AICPA Committee on Accounting Procedure(ARBs) 4 Statement 62 eliminated the election contained in paragraph 7 of GASB Statement No. 20, Accounting and Financial Reporting for Proprietary Funds and Other Governmental Entities That Use Proprietary Fund Accounting, as amended, for enterprise funds and business-type activities to apply post November 30, 1989, FASB pronouncements. MUST CONSIDER 1. Disclosure reference to pre-1989 use of FASB standards to be removed 2. All references to FASB should be removed (unless a specific adoption to a FASB ASC is elected) 3. Disclosure should be made to the adoption of this standard also if prior period adjustment occurred 4. Communicated to Those Charged With Governance (Optional if it does not materially affect statements?) 5. Auditor’s Report as Emphasis of Matter if adoption materially effects financial statements. 5 How the Changes in This Statement will Improve Financial Reporting “The requirements in this Statement will improve financial reporting by contributing to the GASB's efforts to codify all sources of generally accepted accounting principles for state and local governments so that they derive from a single source. This effort brings the authoritative accounting and financial reporting literature together in one place, with that guidance modified as necessary to appropriately recognize the governmental environment and the needs of governmental financial statement users. “ 6 Organization of This Statement • By Topic-each topic contains provisions derived from FASB and AICPA pronouncements that address the subject matter. • Some language has been changed to be more specific • i.e. “Business-Type or Governmental Activities” • The order in which the topics are presented corresponds to the order of the primary locations within the GASB Codification of Governmental Accounting and Financial Reporting Standards, where the topics are codified. 7 -Accounting Changes adopted to conform • Applied retroactively by restating prior periods • If restatement not practical-the cumulative effect reported as a restatement of beginning net asset, fund balances, or fund equity • The F/S should disclose the nature of any restatement and its effect 8 Since FASB introduced its codification, its original pronouncements are nonauthoritative • Action-No longer reference FASB (unless exception) GASB 34, p. 17 required application of preNovember 30, 1989 FASB statements, etc. • Action-No longer need to elect to apply post 11.30.1989. can apply when it does not conflict with GASB guidance 9 Capitalization of interest costs (FAS 34, 62) Statement of net position classification (ARB 43, APB 12, FAS 6) Special and extraordinary items (APB 30) Comparative financial statements (APB 30) Related Parties (FAS 57) Prior-period adjustments (FAS 16, APB 9) Accounting changes and error corrections (APB 20, FIN 20) Extinguishment of debt (APB 36, FAS 76) Troubled debt restructuring (FAS 15) 10 Inventory (ARB 43) Contingencies (FAS 5, FIN 14) Leases (FAS 13,22,98, FIN 23,26,27) Regulated operations (FAS 71, 90, 101) 11 An amendment of GASB Statements 10 and 62 • Amends GASB 10 to comply with GASB No. 54 and No. 34 regarding fund type classifications • Amends GASB 62 modifying guidance on accounting for 1. Operating lease payments that vary from a straight-line basis 2. The difference between the initial investment (purchase price) and the principal amount of a purchased loans 3. Servicing fees related to mortgage loans that are sold Changes clarify how to apply: • GASB 13-Accounting for Operating Leases with Scheduled • • Rent Increases GASB 48-Sales and Pledges of Receivables and Future Revenues and Intra-Entity Transfers of Assets and Future Revenues Effective periods beginning after December 15, 2012. 12 13 Background Concept Statement 4 and 5 (June 2007) identifies 5 elements that make up a statement of financial position: Assets Liabilities Deferred outflows of resources Deferred inflows of resources Net position This differs from the composition currently required by Statement 34, which requires the presentation of assets, liabilities, and net assets in a statement of financial position 14 Definitions Assets Resources with present service capacity that the gov’t controls Liabilities Present obligations to sacrifice resources Deferred outflows of resources A consumption of net assets applicable to a future reporting period has a positive effect on net position, similar to assets Deferred inflows of resources An acquisition of net assets applicable to a future reporting period has a negative effect on net position, similar to liabilities Net position The residual of all elements presented = assets + deferred outflows – liabilities – deferred inflows 15 Reporting Requirements Report these new classifications in the following manner: deferred outflows in a separate section following assets deferred inflows in a separate section following liabilities May subtotal deferred outflows with assets and deferred inflows with liabilities Net Position components resemble net asset components under Statement 34 but include the effects of deferred outflows and inflows Net investment in capital assets Restricted Unrestricted 16 Formatting Requirements Economic Resources Measurement Focus Preferred: assets + deferred outflows – liabilities – deferred inflows = net position The traditional balance sheet is still acceptable: assets + deferred outflows = liabilities + deferred inflows + net position Current Resources Measurement Focus Required: assets + deferred outflows = liabilities + deferred inflows + fund balance 17 18 19 20 Concept Statement No. 4 Elements of Financial Statements and GASB 63 limited recognition of deferred inflows and outflows to balances examined through GASB due process, previously only GASB No. 53 Accounting and Financial Reporting for Derivative Instruments & No. 60 Accounting and Financial Reporting for Service Concession Arrangements. The objective of this statement is reexamine existing guidance on balances through due process: properly classify certain items that were previously reported as assets and liabilities as deferred outflows/inflows of resources or recognize certain items that were previously reported as assets and liabilities as outflows of resources (expenses or 21 expenditures) or inflows of resources (revenues) Deferred Inflows Grants earned in advance of meeting timing requirements (availability criteria) Deferred amounts from refunding of debt (credits) Proceeds from sales of future revenues Deferred gain from sale-leaseback “Regulatory” credits Unavailable revenue related to the application of modified accrual accounting Deferred Outflows Grants incurred in advance of timing requirement Deferred amount from refunding of debt (debits) Cost of acquire rights to future revenues (intra-entity) Deferred loss from sale-leaseback transaction 22 Outflows of Resources (Expenditures or Expenses) Debt issuance costs (other than insurance) Initial costs incurred by lessor in an operating lease Acquisition costs for risk pools Loan Origination costs Inflows of Resources (Revenues) Loan origination fees Commitment fees (after exercise or expiration) 23 Classification has not changed for: ◦ Prepayments ◦ Resources advanced to another government in relation to a government-mandated nonexchange transaction or a voluntary nonexchange transaction when eligibility requirements other than time requirements have not been met ◦ The purchase of future revenues from a government outside the financial reporting entity ◦ Circumstances in which a pension plan’s net position exceeds the total pension liability 24 Classification has not changed for ◦ Resources received in advance in relation to a derived tax revenue nonexchange transaction ◦ Resources received in advance in relation to a government-mandated nonexchange transaction or a voluntary nonexchange transaction when eligibility requirements other than time requirements have not been met ◦ Resources received in advance of an exchange transaction ◦ Refunds imposed by a regulator 25 Revenues and other governmental fund financial resources should be recognized n the accounting period in which they become both measureable and available Revenue-measureable and available When an asset in recorded in governmental fund financial statements, but the revenue is not available, the government should report a deferred inflow of resources until such time as the revenue becomes available Revenue-not available 26 Other Changes The term deferred revenues should no longer be used: Could be confused with deferred inflows/outflows No guidance on a replacement term Recommend use of advance as the accounting for the availability and earned criteria are now distinct There have been no changes to the Major Fund criteria except the following: Deferred outflows should be combined with assets Deferred inflows should be combined with liabilities 27 Effective September 30, 2014 (Years beginning after 12/15/2012) Early application is encouraged Required to be applied retroactively for all periods presented 28 29