MONYX FUND - Monyx Financial Group

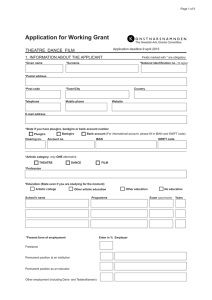

advertisement