Ppt

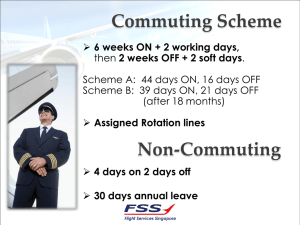

advertisement

Aggregate Production Planning (APP) Aggregate Production Planning (APP) Matches market demand to company resources Plans production 6 months to 12 months in advance Expresses demand, resources, and capacity in general terms Develops a strategy for economically meeting demand Establishes a companywide game plan for allocating resources Inputs and Outputs to Aggregate Production Planning Capacity Constraints Demand Forecasts Size of Workforce Strategic Objectives Aggregate Production Planning Production per month (in units or $) Inventory Levels Company Policies Financial Constraints Units or dollars subcontracted, backordered, or lost Strategies for Meeting Demand 1. Use inventory to absorb fluctuations in demand (level production) 2. Hire and fire workers to match demand (chase demand) 3. Maintain resources for high demand levels 4. Increase or decrease working hours (over & undertime) 5. Subcontract work to other firms 6. Use part-time workers 7. Provide the service or product at a later time period (backordering) Strategy Details Level production - produce at constant rate & use inventory as needed to meet demand Chase demand - change workforce levels so that production matches demand Maintaining resources for high demand levels ensures high levels of customer service Overtime & undertime - common when demand fluctuations are not extreme Strategy Details Subcontracting - useful if supplier meets quality & time requirements Part-time workers - feasible for unskilled jobs or if labor pool exists Backordering - only works if customer is willing to wait for product/services Level Production Demand Production Units Time Chase Demand Demand Units Production Time APP Example The Bavarian Candy Company (BCC) makes a variety of candies in three factories worldwide. Its line of chocolate candies exhibits a highly seasonal pattern with peaks in winter months and valleys during the summer months. Given the costs and quarterly sales forecasts, determine whether a level production or chase demand production strategy would be more economically meet the demand for chocolate candies. APP Using Pure Strategies Quarter Spring Summer Fall Winter Sales Forecast (kg) 80,000 50,000 120,000 150,000 Hiring cost = $100 per worker Firing cost = $500 per worker Inventory carrying cost = $0.50 per kilogram per quarter Production per employee = 1,000 kilograms per quarter Beginning work force = 100 workers Level Production Strategy Quarter Spring Summer Fall Winter Sales Forecast 80,000 50,000 120,000 150,000 400,000 Production Plan 100,000 100,000 100,000 100,000 Inventory 20,000 70,000 50,000 0 140,000 Cost = 140,000 kilograms x $0.50 per kilogram = $70,000 Chase Demand Strategy Quarter Spring Summer Fall Winter Sales Forecast 80,000 50,000 120,000 150,000 Production Workers Plan Needed 80,000 80 50,000 50 120,000 120 150,000 150 Workers Hired 70 30 100 Workers Fired 20 30 50 Cost = (100 workers hired x $100) + (50 workers fired x $500) = $10,000 + 25,000 = $35,000 LP Formulation Define Ht = # hired for period t Ft = # fired for period t It = inventory at end of period t Pt = Production in period t Wt = Workforce in period t Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4) + $0.50 (I1 + I2 + I3 + I4) Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4)+ $0.50 (I1 + I2 + I3 + I4) Subject to P1 - I1 = 80,000 I1 + P2 - I2 = 50,000 I2 + P3 - I3 = 120,000 I3 + P4 - I4 = 150,000 (1) (2) (3) (4) Demand constraints Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4)+ $0.50 (I1 + I2 + I3 + I4) Subject to P1 - I1 = 80,000 (1) Demand I1 + P2 - I2 = 50,000 (2) constraints I2 + P3 - I3 = 120,000 (3) I3 + P4 - I4 = 150,000 (4) P1 - 1,000 W1 = 0 P2 - 1,000 W2 = 0 P3 - 1,000 W3 = 0 P4 - 1,000 W4 = 0 (5) (6) (7) (8) Production constraints Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4)+ $0.50 (I1 + I2 + I3 + I4) Subject to P1 - I1 = 80,000 (1) Demand I1 + P2 - I2 = 50,000 (2) constraints I2 + P3 - I3 = 120,000 (3) I3 + P4 - I4 = 150,000 (4) P1 - 1,000 W1 = 0 (5) Production P2 - 1,000 W2 = 0 (6) constraints P3 - 1,000 W3 = 0 (7) P4 - 1,000 W4 = 0 (8) W1 - H1 + F1 = 100 W 2 - W 1 - H 2 + F2 = 0 W 3 - W 2 - H 3 + F3 = 0 W 4 - W 3 - H 4 + F4 = 0 (9) (10) (11) (12) Work force constraints Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4)+ $0.50 (I1 + I2 + I3 + I4) Subject to P1 - I1 = 80,000 I1 + P2 - I2 = 50,000 I2 + P3 - I3 = 120,000 I3 + P4 - I4 = 150,000 P1 - 1,000 W1 = 0 P2 - 1,000 W2 = 0 P3 - 1,000 W3 = 0 P4 - 1,000 W4 = 0 W1 - H1 + F1 = 100 W2 - W1 - H2 + F2 = 0 W3 - W2 - H3 + F3 = 0 W4 - W3 - H4 + F4 = 0 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) Demand constraints Production constraints Work force constraints LP Solution: Z = $32,000 H1= 0, F1= 20, I1= 0, P1=80000; H2= 0, F2= 0, I2= 30000, P2=80000; H3= 10, F3= 0, I3= 0, P3=90000; H4= 60, F4= 0, I4= 0, P4=150000; Summary: APP By Linear Programming Min Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4)+ $0.50 (I1 + I2 + I3 + I4) Subject to P1 - I1 = 80,000 I1 + P2 - I2 = 50,000 I2 + P3 - I3 = 120,000 I3 + P4 - I4 = 150,000 P1 - 1,000 W1 = 0 P2 - 1,000 W2 = 0 P3 - 1,000 W3 = 0 P4 - 1,000 W4 = 0 W1 - H1 + F1 = 100 W2 - W1 - H2 + F2 = 0 W3 - W2 - H3 + F3 = 0 W4 - W3 - H4 + F4 = 0 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) Demand constraints Production constraints where Ht = # hired for period t Ft = # fired for period t It = inventory at end of period t LP Solution: Z = $32,000 H1= 0, F1= 20, I1= 0, P1=80000; H2= 0, F2= 0, I2= 30000, Work force P =80000; 2 constraints H3= 10, F3= 0, I3= 0, P3=90000; H4= 60, F4= 0, I4= 0, P4=150000; APP By The Transportation Method Quarter 1 2 3 4 Expected Demand 900 1500 1600 3000 Regular Capacity 1000 1200 1300 1300 Overtime Subcontract Capacity Capacity 100 500 150 500 200 500 200 500 Regular production cost per unit = $20 Overtime production cost per unit = $25 Subcontracting cost per unit = $28 Inventory carrying cost per unit per period = $3 Beginning inventory = 300 units Initial Setup of the Transportation Tableau Period of Production Period of 1 Use Beginning Inventory 300 20 1 Regular 2 3 4 Un- Capa used -city 23 26 29 1000 Overtime 25 28 31 34 100 Subcontract 28 31 34 37 500 20 23 26 1200 Overtime 25 28 31 150 Subcontract 28 31 34 500 20 23 1300 Overtime 25 28 200 Subcontract 28 31 500 20 1300 Overtime 25 200 Subcontract 28 500 2 Regular 3 Regular 4 Regular Demand 900 1500 1600 3000 Solution: Step 1 Period of Production Period of 1 Use Beginning Inventory 300 20 1 Regular 600 25 Overtime 2 3 4 Un- Capa used -city 23 26 29 1000 28 31 34 100 31 34 37 500 20 23 26 1200 Overtime 25 28 31 150 Subcontract 28 31 34 500 20 23 1300 Overtime 25 28 200 Subcontract 28 31 500 20 1300 Overtime 25 200 Subcontract 28 500 28 Subcontract 2 Regular 3 Regular 4 Regular Demand 900 1500 1600 3000 Solution: Step 2 Period of Production Period of 1 2 Use Beginning Inventory 300 20 23 1 Regular 600 300 25 28 Overtime 28 Subcontract 2 Regular 3 4 Un- Capa used -city 26 29 1000 31 34 100 31 34 37 500 20 23 26 1200 1200 Overtime 25 28 31 150 Subcontract 28 31 34 500 20 23 1300 Overtime 25 28 200 Subcontract 28 31 500 20 1300 Overtime 25 200 Subcontract 28 500 3 Regular 4 Regular Demand 900 1500 1600 3000 Final Transportation Tableau Period of Production Period of 1 2 3 4 Un- Capa Use used -city Beginning Inventory 300 20 23 26 29 1 Regular 0 1000 600 300 100 ----25 28 31 34 Overtime 0 100 100 28 31 34 37 Subcontract 500 500 20 2 Regular 1200 ----- Overtime 25 Subcontract 28 26 ----- 28 31 150 31 34 250 20 3 Regular 23 25 0 500 20 0 1300 25 0 200 28 0 500 200 Subcontract 900 250 500 31 1300 Overtime 150 200 500 4 Regular 0 0 28 28 Subcontract 1200 1300 ----- 200 0 0 1300 ----- Overtime Demand 23 500 1500 1600 3000 Production Plan Period 1 2 3 4 Demand 900 1500 1600 3000 Total Strategy Variable Reg Prodn Overtime Sub End Inv 1000 100 0 500 1200 150 250 600 1300 200 500 1000 1300 200 500 0 7000 4800 650 1250 2100 Regular Production Cost = (4,800 * $20)=$96,000 Overtime Production Cost = (650 * $25)= $16,250 Subcontracting Cost = (1,250 * $28) = $35,000 Inventory Cost = (2,100 * $3) = $ 6,300 The Total Cost of the Plan = $153,550 Linear Programming Formulation Let: Dt = units required in period t, (t = 1,…,T) m = number of sources of product in any period Pit = capacity, in units of product, of source i in period t, (i = 1,…,m) Xit = planned quantity to be obtained from source i in period t cit = variable cost per unit from source i in period t ht = cost to store a unit from period t to period t+1 It = inventory level at the end of period t, after satisfying the requirement in period t Minimize z T t 1 m [ cit Xit htIt ] i 1 ST Xit Pit, (i 1,..., m; t 1,..., T ) It It 1 m Xit Dt , ( t 1,..., T ) i 1 Xit 0, (i 1,..., m; t 1,..., T ) It 0, ( t 1,..., T ) Minimize z 20( XR1 XR 2 XR 3 XR 4 ) 25( XO1 XO 2 XO 3 XO 4 ) 28( XS 1 XS 2 XS 3 XS 4 ) 3( I 1 I 2 I 3 I 4 ) ST XR1 1000, XR 2 1200, XR 3 1300, XR 4 1300; XO1 100, XO 2 150, XO 3 200, XO 4 200; XS 1 500, XS 2 500, XS 3 500, XS 4 500; XR1 XO1 XS 1 I 1 600, XR 2 XO 2 XS 2 I 2 I 1 1500, XR 3 XO 3 XS 3 I 3 I 2 1600, XR 4 XO 4 XS 4 I 4 I 3 3000; Optimal Value (Z) = $153,550 XR1 XR2 XR3 XR4 XO1 XO2 XO3 XO4 XS1 XS2 XS3 XS4 = 1000 = 1200 = 1300 = 1300 =0 = 150 = 200 = 200 =0 = 350 = 500 = 500 Strategies for Managing Demand Shift demand into other periods incentives, sales promotions, advertising campaigns Offer product or services with countercyclical demand patterns create demand for idle resources Aggregate Planning for Services 1. Most services can’t be inventoried 2. Demand for services is difficult to predict 3. Capacity is also difficult to predict 4. Service capacity must be provided at the appropriate place and time 5. Labor is usually the most constraining resource for services Services Example The central terminal at the Deutsche Cargo receives airfreight from aircraft arriving from all over Europe and redistributes it to aircraft for shipment to all European destinations. The company guarantees overnight shipment of all parcels, so enough personnel must be available to process all cargo as it arrives. The company now has 24 employees working in the terminal. The forecasted demand for warehouse workers for the next 7 months is 24, 26, 30, 28, 28, 24, and 24. It costs $2,000 to hire and $3,500 to lay off each worker. If overtime is used to supply labor beyond the present work force, it will cost the equivalent of $2,600 more for each additional worker. Should the company use a level capacity with overtime or a matching demand plan for the next six month? The Level Capacity with Overtime Plan (1) (2) (3) Month 1 Number of Workers Forecasted 24 Overtime Labor Cost [(2)-24]*$2,600 0 2 26 $5,200 3 30 15,600 4 28 10,400 5 28 10,400 6 24 0 The Matching Demand Plan (1) Month (2) Number of Workers Required 0 1 2 3 4 5 6 7 24 24 26 30 28 28 24 24 (3) Number of Workers Hired (4) Number of Workers Laid Off 0 2 4 0 (5) Cost of Hired Workers [(3)*$2,000] (6) Cost of Laid-Off Workers [(4)*$3,500] 0 $4,000 8,000 2 0 4 0 $7,000 0 14,000 The cost of the Level Capacity with Overtime = $ 41,600 The total cost of the Matching Demand plan = $12,000 + $21,000 = $33,000 Hence, since the cost of matching demand plan is less than the level capacity plan with overtime and would be the preferred plan Aggregate Planning Example 1 A manufacturer produces a line of household products fabricated from sheet metal. To illustrate his production planning problem, suppose that he makes only four products and that his production system consists of five production centers: stamping, drilling, assembly, finishing (painting and printing), and packaging. For a given month, he must decide how much of each product to manufacture, and to aid in this decision, he has assembled the data shown in Tables 1 and 2. Furthermore, he knows that only 2000 square feet of the type of sheet metal used for products 2 and 4 will be available during the month. Product 2 requires 2.0 square feet per unit and product 4 uses 1.2 square feet per unit. TABLE 1 Production Data for Example 1 PRODUCTION RATES IN HOURS PER UNIT DEPARTMENT Production PRODUCT 1 PRODUCT 2 PRODUCT 3 PRODUCT 4 Hours Available Stamping 0.03 0.15 0.05 0.10 400 Drilling 0.06 0.12 ----- 0.10 400 Assembly 0.05 0.10 0.05 0.12 500 Finishing 0.04 0.20 0.03 0.12 450 Packaging 0.02 0.06 0.02 0.05 400 TABLE 2 Product Data for Example 1 NET SELLING PRODUCT PRICE/UNIT 1 2 3 4 $10 25 16 20 VARIABLE COST/UNIT $6 15 11 14 SALES POTENTIAL MINIMUM MAXIMUM 1000 ----500 100 6000 500 3000 1000 A Linear Program of Example 1: Define xi be the number of units of Product i to be produced per month, i = 1, 2, 3, and 4. Maximize 4 x 1 10 x 2 5 x 3 6 x 4 ST 0.03 x 1 0.15 x 2 0.05 x 3 0.10 x 4 400 0.06 x 1 0.12 x 2 0.10 x 4 400 0.05 x 1 0.10 x 2 0.05 x 3 0.12 x 4 500 0.04 x 1 0.20 x 2 0.03 x 3 0.12 x 4 450 0.02 x 1 0.06 x 2 0.02 x 3 0.05 x 4 400 2.0 x 2 1.2 x 4 2000 x 1 1000 x 1 6000 x 2 500 x 3 500 x 3 3000 x 4 100 x 4 1000 Solution of Example 1 using LINGO Software Package (get a free copy of this package from the web site at www.lindo.com): Objective value: 42600.00 Variable X1 X2 X3 X4 Value 5500.000 500.0000 3000.000 100.0000 Reduced Cost 0.0000000 0.0000000 0.0000000 0.0000000 Row PROFIT STAMPING DRILLING ASSEMBLY FINISHING PACKAGING SHEETMETAL MINPROD1 MAXPROD1 MAXPROD2 MINPROD3 MAXPROD3 MINPROD4 MAXPROD4 Slack or Surplus 42600.00 0.0000000 0.0000000 13.00000 28.00000 195.0000 880.0000 4500.000 500.0000 0.0000000 2500.000 0.0000000 0.0000000 900.0000 Dual Price 1.0000000 0.0000000 66.66666 0.0000000 0.0000000 0.0000000 0.0000000 0.0000000 0.0000000 2.0000000 0.0000000 5.000000 -0.6666667 0.0000000 Ranges in which the basis is unchanged: Objective Coefficient Ranges Variable X1 X2 X3 X4 Current Allowable Coefficient Increase 4.000000 INFINITY 10.00000 INFINITY 5.000000 INFINITY 6.000000 INFINITY Allowable Decrease INFINITY INFINITY INFINITY INFINITY Righthand Side Ranges: Row STAMPING DRILLING ASSEMBLY FINISHING PACKAGING SHEETMETAL MINPROD1 MAXPROD1 MAXPROD2 MINPROD3 MAXPROD3 MINPROD4 MAXPROD4 Current RHS 400.0000 400.0000 500.0000 450.0000 400.0000 2000.000 1000.000 6000.000 500.0000 500.0000 3000.000 100.0000 1000.000 Allowable Increase INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY INFINITY Allowable Decrease 100.0000 3000.000 500.0000 5500.000 0.0 13.00000 28.00000 195.0000 880.0000 4500.000 500.0000 2500.000 900.0000