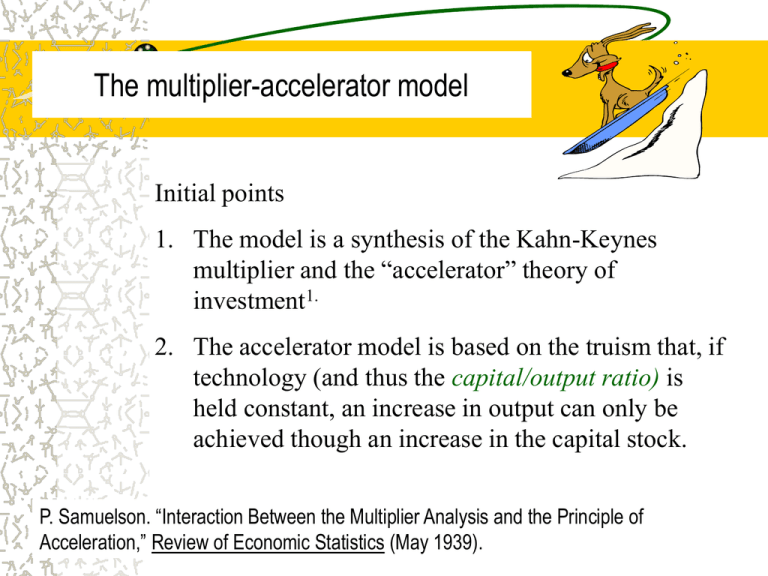

The multiplier-accelerator model

advertisement

The multiplier-accelerator model Initial points 1. The model is a synthesis of the Kahn-Keynes multiplier and the “accelerator” theory of investment1. 2. The accelerator model is based on the truism that, if technology (and thus the capital/output ratio) is held constant, an increase in output can only be achieved though an increase in the capital stock. P. Samuelson. “Interaction Between the Multiplier Analysis and the Principle of Acceleration,” Review of Economic Statistics (May 1939). The accelerator •Firms need a given quantity of capital to produce the current level of output. If the level of output changes, they will need more capital. How much more? Change in capital = accelerator change in output (10.1) •But firms can only increase their capital stock by (positive) net investment. How much? Net investment = accelerator change in output (10.2) •It is also true that: Accelerator = Change in Capital/Change in Output Capital/Output ratio •If we do not allow for productivity boosting technical change, then the capital output ratio is held constant. •If fact, this is what we are assuming—no technical change. Example of the accelerator principle • We assume that = 3a . That is, it takes 3 dollars worth of capital to manufacture $1 worth of shoes. •Hence if the demand for shoes increased by say, $10, there would be a need for $30 in additional capital—or equivalently, $30 in net investment. aSherman & Kolk claim this is a reasonable figure since estimates show that GDP is typically equal to 1/3 the value of the capital stock. Time period 1 Demand Change in Demand for Shoes for Shoes $100 1 to 2 2 $110 4 $60 $390 $5 $135 $15 $405 $0 $135 5 to 6 6 $330 $130 4 to 5 5 $30 $20 3 to 4 $0 $405 -5 $130 Change in Shoe Machinery $300 $10 2 to 3 3 Shoe Machinery -$15 $390 Formalizing the model If the economy is in equilibrium, Then output supplied (Y) is equal to aggregate demand (AD). Assuming a closed economy without government, we have: Yt = Ct + It (1) Formalizing the model •The consumption function is given by1: Ct C cYt 1 (2) •We assume that investment in the current period (It) is equal to some fraction () of change in output in the previous period (or lagged output): It (Yt 1 Yt 2) (3) We assume that C depends on lagged, rather than current, income. Also note that for our simplified economy, Y = YD. 1 Insert (2) and (3) into (1) to obtain: Yt C (c v)Yt 1 Yt 2 (4) To get a homogenous equation, we ignore the constant C To get a standardized form, let A = c + . Also, Let B = . Thus we can write: Yt At 1 Bt 2 0 (5) Note for the mathematically inclined: equation (5) is a 2nd order (homogenous) difference equation. It can be shown that: 1. There will be cyclical fluctuations in the time path of national income (Yt) if A2 < 4B. 2. If B = 1 (and presuming that A2 < 4B), then cycles are constant in amplitude. 3. If B < 1 (and presuming that A2 < 4B), then cycles are damped—that is, amplitude is a decreasing function of time. 4. If B > 1 (and presuming that A2 < 4B), then cycles are explosive—that is, amplitude is a increasing function of time. 5. There will be no cyclical fluctuations if A2 > 4B. Example of the Multiplier-Accelerator Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 C $996 996 992 985 975 964 953 942 933 927 928 928 936 945 957 969 978 987 992 Y Net I $996 $1,000 1000 $4 996 0 988 -4 977 -8 965 -11 952 -12 940 -13 930 -12 923 -10 920 -7 925 -3 933 5 944 8 956 11 969 12 982 13 991 13 996 9 1000 8 Assumptions: (1) Y is $996 in period 1 and $1000 in period 2; (2) C = 96 + .9Yt - 1; and (3) = 1 Multiplier-Accel erator Model Assumptions: (1) Y is $996 in period 1 and $1000 in period 2; (2) C = 996 + .9Yt -- 1; and (3) = B = 1 Data in Billions 1020 1000 980 960 940 920 900 1 3 5 7 9 11 13 Time Period 15 17 19 21 Damped oscillations B < 1 and A2 > 4B Time period Explosive oscillations B > 1 and A2 > 4B Time period Qualifications/limitations •This model is based on a crude theory of investment. There is no role for “expected profits” or “animal spirits.” •The time lag between a change in output and a change in (net) investment can be significant—the investment process (planning, finance, procurement, manufacturing, installation, training) is often lengthy. •J. Hicks pointed out that, for the economy as a whole, there is a limit to disinvestment (negative net investment). At the aggregate level, the limit to capital reduction in a given period is the wear and tear due to depreciation.