Chapter5 lc

advertisement

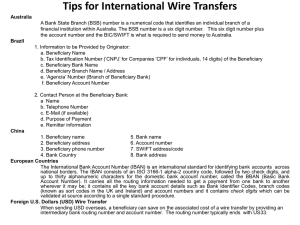

International Settlement L/O/G/O Chapter five Letter of credit • • • • The concept and characteristics of a L/C Contents of a L/C Parties to a L/C Procedures of a documentary credit operation • Types of credit • Examination of a L/C The concept of a L/C • A L/c is a written undertaking by the issuing bank to the beneficiary, under which the bank will pay a sum certain in money to the beneficiary if the beneficiary of the L/C provides the bank with specified documents within a prescribed time period, which all comply with the terms and conditions of the credit. UCP500 Art.2 an arrangement, however named or described, whereby a bank(the issuing bank) acting at the request and on the instructions of a customer (the applicant) or on its own behalf, 1)is to make a payment to the order of a third party(the beneficiary), or is to accept and pay bills of exchange(drawn by the beneficiary); or 2)authorizes another bank to effect such payment, or to accept and pay such bills of exchange; or 3) authorizes another bank to negotiate, against stipulated documents, provided that the terms and conditions of the credit are complied with. Characteristics of a L/C • • • • A written undertaking on the part of the issuing bank Independent of the sales contract Exclusively dealing with documents High level of protection and security to both buyers and sellers • Abide byUCP500, Uniform Customs and Practice for Documentary Credits, ICC Publication No.500 1929/74, 1933/82,1951/151,1962/222,1974/290,1983/400, 1993/500, 2006/600 全文共49条,包括:总则与定义、信用证的格式与通知、 责任与义务、单据、杂项规定、可转让信用证和款项让渡 七个部分。 UCP 600 2007 Revision • the ICC Banking Commission on 25 October, 2006 approved UCP 600, and it enters into force on July 1, 2007 and contains substantive changes to the existing rules • New Provisions a leaner set of rules, with 39 articles rather than 49 articles of UCP 500; a new section of “Definitions,” containing terms such as “honour” and “negotiation”; a replacement of the term “reasonable time” with a definite number of days for examining and determining compliance of documents; a new provision concerning addresses of the beneficiary and the applicant; an expanded discussion of “original documents”; re-drafted transport articles aimed at resolving confusion over the identification of carriers and agents. The new UCP 600 also contains within the text the 12 Articles of the eUCP, ICC’s supplement to the UCP governing presentation of documents in electronic or part-electronic form. Contents of a L/C • • • • • • • • • Items on the credit itself Basic parties Items on draft Settlement conditions兑付的方式 Items on goods,shipping documents , transport and insurance L/C amount and currency Additional conditions Reimbursement of the paying, accepting and negotiating bank The notation of the credit subject to UCP500 Parties to a L/C • 开证申请人(Applicant/buyer) Liable for payment to the issuing bank provided no discrepancy between documents and the credit; right to examine the documents and refuse payment; any requirement of the applicant should be satisfied by certain documents and clearly indicated when making credit application Issuing application form • 开证行(Issuing bank/the buyer’s bank) By issuing a credit the issuing bank undertakes full responsibility for payment 受益人(Beneficiary/seller) The right to examine a credit upon receipt of it according to the sales contract; whether be paid or not solely depends on the fulfillment of terms and conditions of the credit. applicant Sales contract applicant beneficiary L/C issuing bank 通知行(Advising bank) Accurately transmit the terms of credit and check the apparent authenticity of the credit 保兑行(Confirming bank) Undertake the same obligations assumed by the issuing bank; Responsible for a credit independently and pay without recourse 议付行(Negotiating bank) In a negotiation credit, purchases the drafts and documents; Claim -ing bank When dishonored by the issuing bank, it has the right of recourse to the beneficiary; Obtain the reimbursement from the issuing bank 付款行(Paying/accepting bank) Designated by issuing bank to effect payment or acceptance, in most cases to be the advising bank; Once it has made payment to the beneficiary, it will lose the right of recourse to the beneficiary; Entitled to obtain reimbursement from the issuing bank 偿付行(Reimbursing bank) A bank named in credit from which the paying bank, accepting bank or negotiating bank may request cover after paying or negotiating the documents. the reimbursing bank shall not examine the documents 开证申请书 是申请人对开证行详尽的开证指示,有两部分即对开 证行的开证申请和对开证行的声明和保证。 申明赎单付款前货物所有权归银行; 开证行及其代理行只付单据表面是否合格之责; 开证行对单据传递中的差错不负责; “不可抗力”不负责; 保证到期付款赎单; 保证支付各项费用; 开证行有权随时追加押金 Procedures of a L/C 1)contract Seller/ beneficiary 9)pick up Shipping goods company 5) Buyer/ applicant 6)payment 4)advise L/c 5)examine and prepare documents 2)application and 8)examine cash deposits documents and ask the buyer to redeem 3)opens a L/C Advising bank designated bank 7)Forwards documents and claiming reimbursement Issuing bank 进口人申请开证:选择开证行,谈妥保证金比例,填写开证申请书, 备妥有关文件; 开证行开立L/C,并交通知行:开证行审核申请人、业务的贸易背 景和开证申请书,选择开证方式,选择通知行; 通知行通知受益人:核验L/C真伪,审核信用证(完整性、政策性 条款、可否撤销、是否生效、索汇路线和方式、信用证责任条款、 费用问题等)缮制通知面函; 受益人交单议付:受益人审证(与合同一致性、信用证条款的可接 受性、价格条款、“三期”、货物控制权等)发货,缮制单据,交 单议付; 议付行议付单据索偿 开证行审单并付款:审单原则、偿付或拒付、偿付行偿付(偿付授 权书) 申请人付款、放单 出口信用证 进口信用证 Types of a L/C • 按用途及是否随附单据,分为光票信用证和单信用证 • 按性质分为可撤销信用证和不可撤销信用证(irrevocable L/C) • 按信用证是否有另一银行加以保证兑付,分为保兑信用证 (confirmed L/C)和不保兑信用证 缄默保兑silent confirmation • 根据受益人对信用证的权利是否可转让,可分为可转让信用证 (transferable L/C)和不可转让信用证 • 背对背信用证(back to back L/C) • 循环信用证(revolving L/C) • 按信用证的兑付方式,可分为预支信用证、即期付款信用证、延 期付款信用证、承兑信用证和议付信用证 • 对开(reciprocal L/C)信用证和伊士克罗(escrow L/C)信用 证 Types of a L/C According to whether it can be revoked or not • Revocable credit May be amended or cancelled or revoked by the issuing bank without the beneficiary’s consent or even without prior notice ; The issuing bank is bound to notice nominated bank not to accept the documents delivered by the beneficiary and reimburse the nominated bank which has made payment/accept/negotiation prior to the receipt of notice of cancellation or amendment. • Irrevocable credit Definite undertaking Confirmed L/c According to the adding of confirmation Confirmed irrevocable credit gives the beneficiary a double assurance of payment According to the UCP500,confirmation can be only added at the request of the issuing bank. Used when the seller does not have confidence that the issuing bank can effectively guarantee payment . &Silent confirmation Based on a separate arrangement between the beneficiary and the “confirming” bank The bank will not be considered the confirming bank by the issuing bank and acquiring no right of claiming reimbursement from the issuing bank. Sight payment credit According to the mode of availability Sight payment credit--available by sight payment to beneficiary with a named bank The paying bank may be the issuing bank, the advising bank, or a third bank; With or without draft; Payment without recourse; Usually marked in L//C as : “this credit is to expire on or before(date) at place and is available with issuing bank or advising bank/other bank by payment at sight against the beneficiary’s draft at sight drawn on nominated paying bank and the documents detailed herein” • Straight credit Two party involved only—the issuing bank and beneficiary Draft and documents are honored by issuing bank ,L/C expires at the counter of the issuing bank and advised to beneficiary by the issuing bank directly. Acceptance credit and deferred credit ----Available by acceptance with a named drawee bank, be it the issuing bank or other nominated bank. the accepted draft can be discounted by the beneficiary; &buyer’s acceptance credit买方承兑信用证、假远期信用证 ----according to the contract,payment to the seller at sight; time draft discounting charges and acceptance commission are for the buyer’s account ----available by deferred payment with a nominated bank at a fixed time after the date of the B/L or after the presentation of documents. Usually without a draft Negotiation credit • Negotiation means the giving value for draft and /or documents • Negotiating bank becomes holder in due course of a draft • Types: Restricted negotiation credit Free negotiation credit • Draft : for negotiation at sight,no necessary for negotiation at certain days sight,necessary &discounting Comparison of the five kinds Sight l/c Deferre Acceptan d l/c ce l/c Restricted Free negotiatio negotiatio n n draft With/ without with without Sightwithout Time-with Sightwithout Time-with Tenor of draft sight time Sight/time Sight/time drawee Paying bank Accepting Issuing bank bank Time of payment sight deferre d Due date Sight minus interest Sight minus interest Restricte d or free R R R R F Right of recourse Without Without Without With with Issuing bank Transferable L/C A credit under which the beneficiary (first beneficiary) may request the bank authorized to pay, incur a deferred payment undertaking,accept or negotiate(the “transferring bank”), or in the case of a freely negotiable credit, the bank specifically authorised in the credit as a transferring bank, to make the credit available in whole or in part to one or more other beneficiary(second beneficiary) application: enables a middleman who is receiving payment from a buyer to transfer his claim under the credit to his own supplier. funtion: provides a bank undertaking to manufacturer and will not tie up the funds of middleman; simplifies the payment procedures; keeps the commercial secrets Seller/first beneficiary 4)request to transfer L/C Buyer/applicant 3)advice of L/C 9)pay the balance Transferring bank 1)application Advising bank 2)documentary L/c 7)remitting documents 8)payment 5)advice of transferred L/C 9)payment 6)presentation of documents manufacturer Issuing bank The issuing bank must expressly designate “transferable”; the transferable credit can only be transferred once Contents of request to transfer: 1)whether some clauses being changed or not是否变更信用证条款 Unit price and the amount of credit can be reduced The expire date,final shipment date and the final date for presentation can be shortened the percentage of insurance cover may be increased The name and address of the first beneficiary can be substitute for that of the original buyer 2)retainment of beneficiary’s right on amendment保留修改权利 Partial transfer and total transfer:related with partial shipment; Transfer with substitution of invoice and draft; Payment will be effected by the transferring bank only when cover has been received under the original transferable credit ; Back to back L/C The beneficiary of an irrevocable credit(primary credit) may use the credit as security to open a separate credit(back-to-back credit /subsidiary credit). back-to-back credit transferable credit Buyer/Original applicant Real supplier New beneficiary Issuing bank Advising bank Advising bank Issuing bank Original beneficiary /new applicant Buyer/Original applicant Issuing bank Advising bank /transferring bank Manufacturer Real supplier First beneficiary Back to back &transferable Credit 背对背L/C使两个独立的信用证,有两个开证行分别对自己 的受益人负责,而可转让信用证是一笔信用证业务的延伸, 开证行只有一个,同时对两个受益人负责; 背对信用证的开立并非原始信用证申请人和开证行的意旨, 而可转让L/C的开出则是在开证行和开证申请人允许下; 背对背L/C中的中间商可自选新证的开证行,而可转让L/C 中间商不能自选转让行; 在存在多个中间商时,中间商可依次开立背对背L/C,而可 转让L/C只能转让一次; 背对背L/C比可转让L/C对实际供货商更有保障,而可转让 L/C在转开时,会加入限制性的条款,如只有开证行付款后, 才对实际供货商付款。 Revolving L/C • The amount of the credit can be renewed or reinstated without specific amendments to the credit • 适用于需要在较长时间内分批供货的贸易合同,如包销或专卖,以 避免资金占压和重复的办理手续 • 循环条款,说明循环方法、循环次数和总金额 按时间循环 “This is a monthly revolving credit which is available for up to the amount of USD15000 per month, and the full credit amount will be automatically renewed on the 1st day of each succeeding calendar month. Our maximum liability under this revolving credit does not exceed USD90000 being aggregate value of six months. ” 按金额循环 “This credit is revolving for three shipments only.Each shipment should be effected at one month interval. The amount of each shipment is not exceeding USD50000. The total value of this revolving credit does not exceed USD150000.” 上次未用完金额能否移到下期使用: cumulative revolving 积累循环 non-cumulative revolving非积累循环 金额恢复方式: automatic revolving periodic revolving (semi-automatic revolving) notice revolving (non-automatic revolving) Anticipatory L/C • It is a credit with a special clause added that authorizes the advising bank or any other nominated banks to make advances to the beneficiary before the submission of document. • Issued at the request of the applicant • Places the burden of final repayment on the applicant who could be liable for repayment of advances and all costs if the beneficiary failed to present the documents required under the credit. • Application • &T/T 对开信用证(Reciprocal L/C) 是以交易双方互为开证申请人和受益人、金额大致相等的信 用证。对开信用证广泛用于易货贸易、来料加工贸易、补偿贸易 等。 对开信用证中,第一份信用证的开证申请人就是第二份信用 证的受益人;反之,第二份信用证的开证申请人就是第一份信用 证的受益人。第二份信用证也被称作回头证。第一份信用证的通 知行一般就是第二份信用证的开证行。 注意: 1、规定两证的生效时间很重要 2、我国的来料加工贸易中,对原料、配件的进口一般开远 期L/C,对成品的出口要求对方开即期付款的L/C。远期汇票的期 限与加工周期吻合。 伊士克罗信用证(Escrow L/C) 是指在对销贸易中,一国开立的L/C中规定,该信用证下申 请人所付的款项,将以受益人的名义存放开证银行,用于支付受 益人从开证行所在国的进口货款,也称为有条件支付。开证行为 受益人开立的帐户叫“P.I.E”账户。 特点: 1、“付款”只是以受益人的名义存在P.I.E账户中,不能支 取现金,类似与记帐贸易; 2、平衡进出口贸易收支; 3、实际的交易方涉及三方,而不像对开L/C中仅涉及两方。 goods Importer A 6)pay and redeem 1)applidocuments cation goods Exporter B/ Exporter N Applicant of N(importer) 3)advise 4)docu 1)application 3)documents -ments 2)advise Issuing bank C 7)credit B’s account P.I.E account of B 2)advise Advising bank 5)Asking Advising bank/ C to pay Issuing bank of B 4)documents 5)documents 7)payment from B’s account 备用信用证 Standby L/C • Concept and characteristics • Contents of a standby L/C • Types • Comparison with commercial L/C and L/G Concept and characteristics • Standby letter of credit means an issuer on behalf of an applicant that represents an obligation to the beneficiary, pursuant to a complying presentation: • to repay money borrowed by, advanced to, for the account of the applicant; or • to make payment on account of any indebtedness undertaken by the applicant;or • to make payment on account of any default by the applicant in the performance of an obligation. • Irrevocable form • independent • documentary • Standby Documents required under a standby L/C: • 索款要求 demand for payment 可以是汇 票或其它指示、命令或付款要求 • 违约或其它提款事由的声明 Statement of Default or Other Drawing Event • 适用规则 • 《国际备用证惯例 》ISP98, International Standby Practices, ICC Publication No.590 Basic contents 保 到 对 金 不 证 期 单 额 可 文 日 据 、 撤 句 的 使 销 要 用 的 求 的 性 货 质 币 • • • • • • • • • • 表 明 适 用 的 惯 例 受 址开 开 开 益 证 证 证 人 申 日 行 的 请 期 的 名 人 名 称 的 称 、 名 地 称 址 、 地 Types • • • • • • • • 履约备用证 Performance Standby 预付款备用证Advance Payment Standby 投标备用证 Bid Bond/Tender Bond Standby 反担保备用证 Counter Standby 融资备用证 Financial Standby 直接付款备用证 Direct Pay Standby 保险备用证 Insurance Standby 商业备用证 Commercial Standby Comparison with a commercial L/C • similarities: based on bank credit; independence; payable by required documents. • differences: UCP600 & ISP98; different documents required:the beneficiary only presents a document stating that the applicant has not fulfilled his obligations towards the beneficiary; 作用和用途不同; 议付的做法不同:备用证的开证行尽量避免授权第三者议付 业务处理不同:备用证是备而不用,而跟单信用证是进出口交 易中必用的结算工具 Examination of L/C 受益人审证: 依据:买卖合同;收证时的政策法令;有无我方办不到 或影响安全收汇和增加费用开支的地方 内容: 信用证的性质和是否生效; 货物描述; 信用证的金额; 货物的数量重量; 价格条件; 装运港和目的港; 装期、交单期和有效期; 分批装运; 单据要求 装期、交单期和有效期: 双到期(装效同期)--无装运期视有效期为 装运期; 最迟交单期--提单日期后21天内; 修改中只展装期未展效期,可理解为装效同展, 只展效期未展装期,不能认为装效同展 Protection and risks 从出口商的角度 • • • 伪造信用证 信用证的软条款识别: L/C开出后暂不生效,另加生效条款 需凭开证申请人或其代理出具某些单据议付 有关货物运输的限制 似是而非的条款 “提单径寄开证申请人”条款 从进口商的角度 提货担保中的风险;成组化运输的风险;提单的真伪 从银行的角度 提单径寄开证申请人;提货担保 Trapped clause For example: Shipment can only be effected upon receipt of applicant’s shipping instruction through L/C opening bank nominated the name of carrying vessel by means of subsequent credit amendment. Cargo receipt issued and signed by authorized signatures of the applicant, whose signature must be in conformity with our records,, certifying that the goods have been received in good order, showing the quantity, value of goods, date of delivery and letter of credit number. Documents must be negotiated within 15 days from B/L date. 案例: 某制造商缔结了一项安特卫普船边交货(FAS)为贸 易术语的提供重型机械的合同,由不可撤销的保兑跟单 信用证付款,证中规定须提供商业发票及买方签发的已 在安特卫普提货的证明。 货物及时备妥装运,但到达安特卫普后买方却不提 货,由于卖方未收到买方的证明,无法根据信用证收到 货款。经过长达一年的交涉,卖方虽然得到赔偿但仍遭 受巨大损失。 第六节 常见不符点及其处理 不符点(Discrepancy)是指信用证项下受益人所提交的单据表面 出现的一处或多处不符合信用证的条款或条件的错误。当单据出现不 符点后,信用证的开证行就可以免除付款的责任。 • 出口商无法更改的错误 • 出单人疏忽造成的差错 • 技术错误: 对票据抬头的理解错误,如L/C规定 INVOICE MADE OUT IN THE NAME OF …; 检验证日期迟于提单日; 有关提单的规定; 短溢装问题; 保单的日期迟于提单日。 单据不符的通知及处理方法 不符点单据的通知: • 银行应在不迟于收到单据后的7个工作日内,发出拒收 单据的通知,并一次说明全部不符点 处理办法: • 将单据退给受益人更改,在有效期内再交单 • 受益人授权寄单行电告开证行不符点,请开证行授权 付款、承兑、议付 • 在受益人同意下办理保留追索权的付款、承兑或议付 • 凭担保(Indemnity)付款、承兑或议付 • 寄单托收 案例: 我某出口企业收到国外开来不可撤销信用 证1份,由设在我国境内的某外资银行通知并加 以保兑。我出口企业在货物装运后,正拟将有关 单据交银行议付时,忽接该外资银行通知,由于 开证银行已宣布破产,该行不承担对该信用证的 议付或付款责任,但可接受我出口公司委托向买 方直接收取货款的业务。对此,你认为我方应如 何处理为好?