notes

advertisement

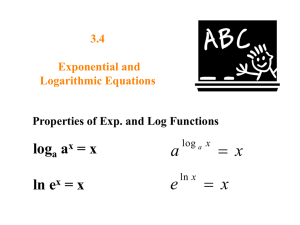

Chapter 4 Exponential and Logarithmic Functions (指数函数和对数函数) In this Chapter, we will encounter some important concepts Exponential Functions(指数函数) Logarithmic Functions(对数函数) Differentiation of Logarithmic and Exponential Functions 1 Section 4.1 Exponential Functions Exponential function(指数函数): If b is a positive number other than 1 (b>0, b≠1), there is a unique function called the exponential function with base b that is defined by f(x)=bx for every real number x NOTE: Such function can be used to describe exponential and logistic growth and a variety of other important quantities. 2 Definition of b n for Rational Values of n (and b>0) Integer powers: If n is a positive integer, bn b b b n facters Fractional powers: If n and m are positive integers, b where m n/m b m n b m n b denotes the positive mth root. Negative powers: b n 1 n b 0 b 1 Zero power: 3 Example 1 Solution: 4 Figure below shows graphs of various members of the x family of exponential functions y b b p ( x ) x NOTE: Students often confuse the power function x f ( x ) b with the exponential function 5 6 7 Definition: The natural exponential function is Where n 10 100 2.59374 2.70481 1000 2.71692 10,000 2.711815 100,000 2.71827 8 Continuous Compounding of Interest(连续利息) If P is the initial investment (the principal) and r is the interest rate (expressed as a decimal), the balance B after the interest is added will be B=P+Pr=P(1+r) dollars 9 10 11 12 Example 2 Suppose $1,000 is invested at an annual interest rate of 6%. Compute the balance after 10 years if the interest is compounded a. Quarterly b. Monthly c. Daily d. Continuously Solution: a. To compute the balance after 10 years if the interest is compounded quarterly, using the formula r B(t ) p1 k kt with t=10, p=1,000, r=0.06, and k=4: 40 0.06 B(10) 1,0001 $1,814.02 4 to be continued 13 b. This time, take t=10, p=1,000, r=0.06, and k=12 to get 120 0.06 B(10) 1,0001 12 $1,819.40 c. Take t=10, p=1,000, r=0.06, and k=365 to obtain 0.06 B(10) 1,0001 365 3, 650 $1,822.03 d. For continuously compounded interest use the formula B(t ) pert with t=10, p=1,000, and r=0.06: B(10) 1,000e0.6 $1,822.12 This value, $1,822.12, is an upper bound for the possible balance. No matter how often interest is compounded, $1,000 invested at an annual interest rate of 6% can not grow to more than $1,822.12 in 10 years. 14 Present Value (现值) & Future Value Present Value is the interest accumulation process in reverse. Rather than adding interest to a principal to determine a sum, it is in effect subtracted from a sum to determine a principal. The present value P of future value F with interest rate r per conversion period for n period is given by the formula is the present value interest factor (PVIFn) (or discount factor) of n periods. 15 Present Value (现值) & Future Value i = annualized interest rate, t = number of years m = compound periods per year If the interest rate is i*100% per year and the interest is compounded continuously for t years, then the present value P for a given amount of future value F can be calculated from where exp(−it) is the continuous PVIF. 16 Present value of $1.00 when interest (i=5%) is compounded quarterly for a year 17 Example 3 Sue is about to enter college. When she graduates 4 years from now, she wants to take a trip to Europe that she estimates will cost $5,000. How much should she invest now at 7% to have enough for the trip if interest is compounded: a. Quarterly b. Continuously Solution: The required future value is F=$5,000 in t=4 years with r=0.07. a. If the compounding is quarterly, then k=4 and the present value is to be continued 18 0.07 P 5,0001 4 4 ( 4 ) $3,788.08 b. For continuous compounding, the present value is P 5,000e0.07 ( 4) $3,778.92 Thus, Sue would have to invest about $9 more if interest is compounded quarterly than if the compounding is continuous. 19 Example4 The present value of a future expense. Suppose that you plan to buy a luxury car four years from now and that car will cost $55,000 at that time. If your bank’s savings deposit interest rate is 5% per year, what is the amount that you have to deposit now (present value) in your savings account in order to grow enough interest and with the principal to buy your dream car in the future? Assume the interest is compounded: (a) annually; (b) quarterly; (c) weekly; or (d) continuously, for a year. (e) Show your results in a table of PV calculation with separate FV, PVIF, and PV columns. 20 Answer: (a) annually P = $55,000(1 + 0.05)−4 = $45,248.64; (b) quarterly P = $55,000(1 + 0.05/4)−4∗4 = $45,086.05; (c) weekly P = $55,000(1 + 0.05/52)−52∗4 = $45,034.52; (d) continuously P = $55, 000e−0.05∗4 = $45,030.19; (e) 21 Pricing the Cash Flows of a Bond Application of present value 22 23 24 Coupon Bond valuation equation Price of a bond is equal to the sum of present values of future coupons plus that of the redemption value. For a typical bond that promises to pay a fixed coupon payment of C/2 every six months and repay the par amount FV (face value) at maturity, current price P is: where r /2 is the appropriate semiannual yield rate and n is the remaining life of the bond measured in the unit of the coupon payment period (six months). 25 v=1/(1+i) Present value of annuity 26 Example: How to value a coupon bond? 1 Suppose a bond has a face value of $1000, will pay semi-annual interest at the (coupon) rate of 5%, and will be due 10 years after issue. This means that the owner of one such bond will receive $25 (=1000*5%/2) every six months for a total of 20 payments, together with a payment of $1000 10 years after the date of issue. 27 Example: How to value a coupon bond? 2 If the purchaser wishes to receive a 6% return, compounded semiannually, then the present value at issue is A purchaser content with a return of 4% compounded semi-annually would value the bond at Price of a bond is equal to the present value of future coupons plus that of the redemption value. 28 29 Sensitivity of Bond Prices to Interest Rate Movements 30 idV Bond price elasticity = Vdi 31 Discounted Cash-flow Valuation: A share of preferred stock is like a perpetual bond, and has no maturity. It receives a pre-specified regular dividend. Present value of preferred stock = 32 指数增长和指数下降 33 Section 4.2 Logarithmic Functions(对数函数) 34 35 Example 4 Use logarithm rules to rewrite each of the following expressions in terms of log5 2 and log . 53 5 log a. b. log5 8 c. log5 36 5 3 Solution: a. 5 log5 log5 5 log5 3 3 1 log5 3 quot ientrule since log5 5 1 b. log5 8 log5 23 3 log5 2 c. power rule log5 36 log5 (2 232 ) log5 2 2 log5 32 2log5 2 2 log5 3 product rule power rule 36 37 38 Example 5 Solution: 39 Exponential & Logarithmic functions: important limits Lim (x0) (exp(x) – 1 ) / x = 1 Or exp(x) 1 + x as x0 , and Lim (x0) ln(1+x) / x = 1 From these, we can prove d/dx ( exp(x) ) = exp(x) , d/dx ( ln(x) ) = 1/x 40 Section 4.3 Differentiation of Logarithmic and Exponential Function Example 6 Solution: 41 Example 7 42 Solution: 43 Differentiate both sides of the equation 44 Example 8 Solution: 45 46 Example 9 Solution: 47 Taking the derivatives of some complicated functions can be simplified by using logarithms. This is called logarithmic differentiation. Example 10 Solution: to be continued 48 49 Example 11 Differentiate each of these function a. y 2x b. y log3 x Solution: a. To differentiate follows: y 2 x , we use logarithmic differentiation as to be continued 50 b. 51 52 53 The relative rate of change of a quantity Q(x) can be computed by finding the derivative of lnQ. d Q '( x ) (ln Q) dx Q( x) 54 Example 12 Solution: to be continued 55 56 Summary Exponential Functions, Basic Properties of Exponential Functions, The Natural Exponential Base e. Compound Interest, Continuously Compounded Interest, Present Value. Exponential Growth and Decay. Logarithmic Functions, The Natural Logarithm. Differentiation of logarithmic and Exponential Functions. Optimal holding time. 57 Trigonometric functions: a very important limit From this we can prove: 58 Derivatives of trigonometric functions Using the previous results we can derive d/dx sin(x) = cos(x) d/dx cos(x) = - sin(x) d/dx tan(x) = ? d/dx sec(x) = ? 59 Hyperbolic functions sinh (x) = ( exp(x) – exp(-x) )/ 2 cosh (x) = ( exp(x) + exp(-x) )/ 2 d/dx sinh(x) = cosh(x) d/dx cosh(x) = sinh(x) 60 Indeterminate forms Expressions of the form 0/0, ∞/∞, 0 ×∞, ∞−∞, 0^∞ and ∞^0 are called indeterminate forms. 61 L’Hospital’s Rule – for indeterminate forms If f’(x) and g’(x) exist, and if g’(x) is nonzero, then we have the following result, known as L’Hospital’s rule: 62 Examples: 63