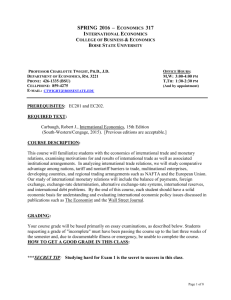

Tariffs

advertisement

Tariffs

Why restrict trade?

Benefits of free trade come in the long

term, and are usually spread widely across

society

Costs of free trade are felt rapidly and are

usually concentrated in specific sectors of

the economy (usually import-competing

industries and scarce factors)

Carbaugh, Chap. 4

1

Tariffs

Defining tariffs

A tariff is a tax (duty) levied on products (final

goods, intermediates or raw materials) as they

move between nations

Import tariff - levied on imports

Export tariff - levied on exported goods as they leave

the country

Protective tariff - designed to insulate domestic

producers from competition

Revenue tariff - intended to raise funds for the

government budget (no longer important in industrial

countries)

Carbaugh, Chap. 4

2

Tariffs

Types of tariff

Specific tariff – a fixed monetary fee per unit.

Ad valorem tariff

A percentage of the value of the product (like a

sales tax) - FOB vs. CIF

Compound tariff

A combination of the above, often levied on

finished goods whose components are also

subject to tariff if imported separately

Carbaugh, Chap. 4

3

Tariffs

Selected US tariffs

Product

Duty Rate

Brooms

32 cents each

Fishing reels

24 cents each

Wrist watches (without

jewels)

29 cents each

Ball bearings

2.4% ad valorem

Electrical motors

6.7% ad valorem

Bicycles

5.5% ad valorem

Wool blankets

1.8 cents/kg + 6% ad valorem

Electricity meters

16 cents each + 1.5% ad valorem

Auto transmission shafts

25 cents each + 3.9% ad valorem

Source: U.S. International Trade Commission, Tariff Schedules of the United States (Washington, DC: U.S. Government

Printing Office, 2004); http://www.usitc.gov/t affairs.htm.

Carbaugh, Chap. 4

4

Tariffs

Effective rate of protection

The impact of a tariff often differs from its stated

nominal tariff rate

The effective tariff rate measures the total

increase in domestic production that the tariff

makes possible, compared to free trade

Measures the degree to which domestic producers can

be less efficient compared to foreign producers.

Domestic producers may use imported inputs

which are subject to tariffs, so calculation of the

effective tariff rate is not simple

Carbaugh, Chap. 4

5

Effective rate of protection

te = (tnom – ti*a)/(1 – a)

a = value imports/value final good

ti = tariff rate on imported inputs

te = Dvalue added/(original value added)

The higher ti (tariff on imported inputs), the

lower the effective tariff since domestic

producers pay more for their inputs.

If imported inputs have low duties and final

goods have high duties then the effective tariff

rate is high; called tariff escalation.

Carbaugh, Chap. 4

6

Example

Free trade price $100, inputs $80; ti = 0%.

Free Trade: Domestic

Foreign

Components $ 80

$ 80

Value added $ 20

$ 20

Price

$100

$100

Carbaugh, Chap. 4

7

Ad valorem final good tariff = 10%; Price = $110

Tariff:

Domestic

Foreign

Components

$ 80

$ 80

Value added

$ 30

$ 20

Tariff

------$ 10

Price

$110

$110

te = Dvalue added/value added = ($30 - $20)/$20 =

0.5 or 50% effective tariff rate.

te = (tnom – ti*a)/(1 – a) = {0.1 – (0)*(0.80)}/(1 – 0.80)

= 0.1/0.2 = 0.5 = 50% effective tariff rate.

Carbaugh, Chap. 4

8

Tariff on inputs: ti = 10%

Tariff:

Domestic

Foreign

Components

$ 88

$ 80

Value added

$ 22

$ 20

Tariff

------$ 10

Price

$110

$110

te = Dvalue added/value added = ($22 - $20)/$20 =

0.1 or 10% effective tariff rate.

te = (tnom – ti*a)/(1 – a) = {0.1 – (0.10)*(0.80)}/(1 –

0.80) = 0.02/0.2 = 0.10 = 10% effective tariff rate.

Carbaugh, Chap. 4

9

Tariffs

Nominal & effective tariff rates

Product

United States

Japan

European Union

Nominal

rate (%)

Effective

rate (%)

Nominal

rate (%)

Effective

rate (%)

Nominal

rate (%)

Effective

rate (%)

1.8%

1.9%

18.4%

21.4%

4.8%

4.1%

Food, beverages,

tobacco

4.7

10.6

25.4

50.3

10.1

17.8

Textiles

9.2

18.0

3.3

2.4

7.2

8.8

Wearing apparel

22.7

43.3

13.8

42.2

13.4

19.3

Leather products

4.2

5.0

3.0

–14.8

2.0

–2.2

Footwear

8.8

15.4

15.7

50.0

11.6

20.1

Wood products

1.6

1.7

0.3

–30.6

2.5

1.7

Furniture and fixtures

4.1

5.5

5.1

10.3

5.6

11.3

Paper and paper

products

0.2

-0.9

2.1

1.8

5.4

8.3

Printing and publishing

0.7

0.9

0.1

–1.5

2.1

-1.0

Agriculture, forestry, fish

*Following the completion of the Tokyo Round of Multilateral Trade Negotiations in 1979.

Source: Alan Deardorff and Robert Stern, “The Effects of the Tokyo Round on the Structure of Protection,” in R. Baldwin and A. Krueger, The

Structure and Evolution of Recent U.S. Trade Policy (Chicago: University of Chicago Press, 1984), 368–377.

Carbaugh, Chap. 4

10

Tariff effects

Who pays for import restrictions?

Domestic consumers face increased costs

Low income consumers are especially hurt by

tariffs on low-cost imports

Overall the economy suffers DWL due to

production and consumption effects

Export industries face higher costs for inputs

Cost of living increases

Other nations may retaliate, further

restricting trade

Carbaugh, Chap. 4

11

Reasons for tariffs

Arguments for trade restrictions

Job protection

Protect against cheap foreign labor

Fairness in trade - level playing field

Protect domestic standard of living

Equalization of production costs

Infant-industry protection

Political and social reasons

Carbaugh, Chap. 4

12

Reasons for tariffs

Politics of protectionism

“Supply” of protectionism (trade policy)

depends on:

the cost to society of restricting trade

the political importance of the importcompeting industries

Magnitude of the adjustment costs from free

trade

Public sympathy for those sectors hurt by free

trade

Carbaugh, Chap. 4

13

Reasons for tariffs

Politics of protectionism

“Demand” for protectionism depends on:

The amount of the import-competing industry’s

comparative disadvantage

The level of import penetration

The level of concentration in the affected sector

The degree of export dependence in the sector

Carbaugh, Chap. 4

14

Types of non-tariff barriers

Import quotas

Quotas are a restriction on the quantity of a

good that may be imported in any one

period (usually below free-trade levels)

Global quotas restrict the total quantity of

an import, regardless of origin

Selective quotas restrict the quantity of a

good coming from a particular country

Carbaugh, Chap. 4

15

Types of non-tariff barriers

Tariff-rate quota

The tariff-rate quota is a two-tiered tariff

A specified number of goods (up to the quota

limit) may be imported at one (lower) tariff rate,

while imports in excess of the quota face a

higher tariff rate

Carbaugh, Chap. 4

16

Types of non-tariff barriers

Domestic content requirements

Rules that require a certain percentage of a

product’s total value to be produced

domestically

Often has the effect of forcing lower-priced

imports to include higher-cost domestic

components or be assembled in a highercost domestic market

Carbaugh, Chap. 4

17

Types of non-tariff barriers

Domestic content: trade & welfare effects

Carbaugh, Chap. 4

18

Types of non-tariff barriers

Subsidies

Domestic subsidy

Payments made to import-competing

producers to raise the price they receive above

the market price

Export subsidy

Payments and incentives offered to export

producers intended to raise the volume of

exports

Carbaugh, Chap. 4

19

Types of non-tariff barriers

Dumping

The practice of selling a product at a lower

price in export markets than at home (or

exporting at prices below production cost)

Sporadic dumping - to clear unwanted

inventories or cope with excess capacity

Predatory dumping - to undermine foreign

competitors

Persistent dumping - reaping greater profits by

engaging in price discrimination

Carbaugh, Chap. 4

20

Types of non-tariff barriers

Other NTBs

Government procurement policies

Social regulations (health, environmental

and safety rules can also restrict trade)

Sea transport and freight restrictions

Carbaugh, Chap. 4

21

Case for Free Trade

Not based on claim that everyone is better

off with free trade

Modern case against free trade is based

on:

The infant industry argument,

The terms of trade argument,

Arguments concerning income redistribution

Carbaugh, Chap. 4

22

Case for Free Trade

Consumption Efficiency

Production Efficiency

Compensation Principle: TAA for displaced

workers

Introduces competition into imperfectly

competitive markets

Helps country avoid tit-for-tat retaliation

Reduces interest group lobbying

Carbaugh, Chap. 4

23

Case Against Selected Protectionism

1) Potential reactions by others in response

to a country's protection,

2) Superior policies to raise economic

efficiency relative to a trade policy,

3) Information deficiencies which can inhibit

the implementation of appropriate policies,

4) Problems created by lobbying within

democratic political systems.

Carbaugh, Chap. 4

24