Slides to the speech

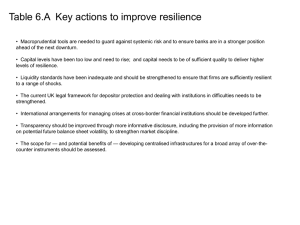

advertisement

Basel III – regulations for safer banking Swedish Bankers’ Association Stefan Ingves, 10 November 2011 The banks are important to the economy A motorway junction for the economy Important, but risk of serious external effects Financial crises have significant economic costs Crises have permanent negative effects on growth… …and, in a financial crisis, the bill for the taxpayers is considerable Conceptual sketch Public sector net debt in the United Kingdom, 2001-2013 GDP GDP level Trend Crisis Post-crisis trend Time Sources: The Riksbank, Independent Committee on Banking Banks need a substantial amount of equity Capital adequacy requirements in Basel III and Basel II 2% 1.5% 9.5% Contracyclical buffer 0-2.5% 8% 7% 2.5% 4.5% Conservation buffer 4% 4% 2% Minimum requirement 2% 2% CET 1 Additional Tier 1 Basel III Tier 2 CET 1 Additional Tier 1 Basel II Tier 2 Basel III sets up clear measures for liquidity Liquidity in the short term Liquidity Coverage Ratio High quality liquid assets Net cash outflow over the coming 30 calender days > 100% Liquidity in the long term Net Stable Funding Ratio Available stable funding Need for stable funding > 100% Systemically-important banks need special regulation Almost 30 global systemicallyimportant banks (G-SIB) Package for special resilience Framework for crisis management Extra buffer of Common Equity Tier 1 equal to 1-2.5 per cent of RWA More intensive supervision Indicators of systemic importance • Cross-jurisdictional activity • Size • Interconnectedness • Substitutability On the way – D-SIB • Complexity Features of the Swedish banking market Concentration Size and international operations Implicit state guarantees Market funding and funding in foreign currencies Liquidity Risk weighting The Swedish banking system is concentrated Sources: OECD and World Bank Swedish banks are large and internationally dependent Bank assets in relation to GDP, June 2010 Sources: The ECB, the Swiss National Bank and the Riksbank Implicit state guarantees Five-year CDS for Danske Bank and Nordea 2010-2011, basis points 300 250 200 Nordea Danske Bank 150 100 50 0 2010-01-01 2010-06-01 2010-11-01 2011-04-01 2011-09-01 Source: Bloomberg Large share of market funding in foreign currency The major Swedish banks’ market funding via Swedish parent companies and subsidiaries, 1998-2011 (quarter 1), SEK billions 3 000 2 500 2 000 1 500 1 000 500 0 98 99 00 01 02 03 04 05 Foreign currency 06 07 08 09 10 11 12 SEK Sources: Statistics Sweden and the Riksbank Weaker liquidity position than others in Europe Survival period in the Riksbank’s stressed scenario, months, December 2010 2,5 Stable funding as share of illiquid assets, December 2010 100% 90% 2,0 80% 70% 1,5 60% 50% 1,0 40% 30% 0,5 20% 10% 0,0 Swedbank Nordea Handelsbanken 0% SEB Mean, European banks SEB Handelsbanken Nordea Swedbank Mean, European banks Sources: Liquidatum and the Riksbank Swedish banks have low risk weightings Risk weighting on mortgages according to Basel II, per cent 60 50 40 30 20 10 Slovakia Latvia Hungary Spain Lithuania Estonia Italy Germany Netherlands Greece Norway Denmark Finland Belgium Sweden 0 Sources: National central banks and the Riksbank, FSR 2011:1 Sweden has had bad experiences of low capital adequacy Source: The Riksbank Resilience is needed in uncertain times Example: Rough estimate of loss aversion in 35 major European banks Loan losses and provisions 2007-2010 SEK 350 billion Common Equity Tier 1 2010 SEK 780 billion Example: Similarly large loan losses in the next few years 350 780 45 per cent of Common Equity Tier 1 Source: The Riksbank Other countries with large banking industries have more stringent regulations than Basel III Bank assets in relation to GDP, June 2010 Commission of Experts • • • Progressive capital requirements 10 per cent equity 9 per cent contingent convertibles Independent Commission on Banking • • • Structural separation of retail and investment banking Extra capital buffer for retail banks Capital and bail-in bonds to total 17-20 per cent The Riksbank sees a need for regulation in several areas Capital adequacy requirements Short-term liquidity and reserve requirements Risk weightings Need to go beyond requirements of Basel III • Leverage ratio measure Need to be met on per-currency basis • ESRB recommendations Need for a floor The Riksbank will clarify its recommendations soon The Financial Stability Report 2011:2 will be published on 29 November