11_common_resources_and_production_costs

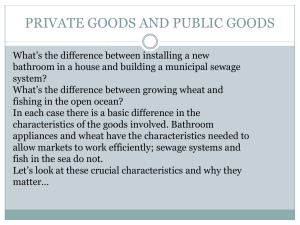

advertisement

Principles of Microeconomics 11. Public Goods and Common Resources* Juan Pablo Chauvin August 10, 2011 * Slide content principally sourced from N. Gregory Mankiw “Principles of Economics” Premium PowePoint Contents 1. Review of previous lecture 2. An Investment proposition 3. Classifying different types of goods 4. Public Goods 5. Common Pool resources 6. Introduction to Production Costs 1. Review Externalities • The uncompensated impact of one person’s actions on the well-being of a bystander. • Can be negative • Making social costs higher than private costs • Leads to an over-production of the good (with respect to the optimal quantity) • … or positive • Making social value greater than private value • Leads to an under-production of the good (with respect to the optimal quantity) Policy responses to externalities • Command-and-control policies (regulation) • Market-based policies • Corrective taxes (pigouvian taxes) or subsidies • Taxes that induce private decision makers to take into account the social costs generated by a negative externality • Subsidies that induce private decision makers to take into account the social benefits generated by a positive externality • Tradable pollution permits • Firms with lower costs of reducing pollution can sell their permits to firms with higher costs of reducing pollution. • Market-based policies (theoretically) can achieve the same goals as regulations, but more efficiently Refer to the figure below. The socially optimal level of output is Price Social Cost Supply (Private Cost) P0 P1 P2 P3 P4 Demand (social value) Q1 Q2 1. Q1. 2. Q2. 3. Q3. 4. Q4. Q3 Q4 Quantity Refer to the figure below. Which of the following would improve economic efficiency in the market? Price Social Cost Supply (Private Cost) P0 P1 P2 P3 P4 Demand (social value) Q1 Q2 Q3 Q4 Quantity 1. a tax equal to P1 - P3 2. a tax equal to P0 - P4 3. a subsidy equal to P1 - P3 4. a subsidy equal to P0 - P4 2. An investment proposition An investment proposal: THE CCU • Welcome to the CCU! (“Class Credit Union”) – your place to invest! • All the students of the class collectively own the CCU. • This is your lucky day! We bring you an investment opportunity! An investment proposal: THE CCU • You currently own 800 “brownie points” (BP) • You can invest any amount from 100 to 800 BP (in increments of 100) with the CCU • You can also decide not to invest at all and keep your 800 BP • Your individual investment will go to a common class investment pool • The CCU will pay a return of 10% (one extra BP for every 10 BP that the class invest) at the end of this exercise • Then, the full amount (capital plus interests) will be redistributed equally to all the students in this class. • Note that everybody will receive an equal share from the investment fund final balance, regardless of whether they invested or not! How much will you deposit to the Class Credit Union? A - Nothing F – 500 dollars B – 100 dollars G – 600 dollars C – 200 dollars H – 700 dollars D – 300 dollars I – 800 dollars E – 400 dollars Given your recent experience, How much will you now deposit to the Class Credit Union? A - Nothing F – 500 dollars B – 100 dollars G – 600 dollars C – 200 dollars H – 700 dollars D – 300 dollars I – 800 dollars E – 400 dollars 3. Classifying different types of goods Important Characteristics of Goods • A good is excludable if a person can be prevented from using it. • Excludable: fish tacos, wireless internet access • Not excludable: FM radio signals, national defense • A good is rival in consumption if one person’s use of it diminishes others’ use. • Rival: fish tacos • Not rival: An MP3 file of Ben Harper’s latest single The Different Kinds of Goods Rival Not Rival Excludable Not excludable Private goods e.g. food Common resources e.g. fish in the ocean Natural monopolies Public goods e.g. cable TV e.g. national defense STUDENTS’ TURN Categorizing roads • A road is which of the four kinds of goods? • Hint: The answer depends on whether the road is congested or not, and whether it’s a toll road or not. Consider the 4 different cases that arise from this observation. Answers • Rival in consumption? Only if congested. • Excludable? Only if a toll road. Four possibilities: Uncongested non-toll road: public good Uncongested toll road: natural monopoly Congested non-toll road: common resource Congested toll road: private good 4. Public Goods Public Goods • Are goods that are nonexcludable and non-rival • Some important public goods are: • National defense • Knowledge created through basic research • Fighting poverty • Public goods are difficult for private markets to provide because of the free-rider problem. The free-riding problem • Free rider: a person who receives the benefit of a good but avoids paying for it • If good is not excludable, people have incentive to be free riders, because firms cannot prevent non-payers from consuming the good. • Result: The good is not produced, even if buyers collectively value the good higher than the cost of providing it. Cost-benefit analysis • If the benefit of a public good exceeds the cost of providing it, government should provide the good and pay for it with a tax. • Problem: Measuring the benefit is usually difficult. • Cost-benefit analysis: a study that compares the costs and benefits of providing a public good • Cost-benefit analyses are imprecise, so the efficient provision of public goods is more difficult than that of private goods. 5. Common Pool Resources Common Resources • Like public goods, common resources are not excludable. • Cannot prevent free riders from using • Little incentive for firms to provide • Role for government: seeing that they are provided • Additional problem with common resources: rival in consumption • Each person’s use reduces others’ ability to use • Role for government: ensuring they are not overused • Some important Common Resources are: • Clean air and water • Congested roads • Fish, whales, and other wildlife The Tragedy of the Commons • A parable that illustrates why common resources get used more than is socially desirable. • Setting: a medieval town where sheep graze on common land. • As the population grows, the number of sheep grows. • The amount of land is fixed, the grass begins to disappear from overgrazing. • The private incentives (using the land for free) outweigh the social incentives (using it carefully). • Result: People can no longer raise sheep. The Tragedy of the Commons and externalities • The tragedy is due to an externality: Allowing one’s flock to graze on the common land reduces its quality for other families. • People neglect this external cost, resulting in overuse of the land. STUDENT’S TURN Policy options for common resources • With your knowledge about externalities, you can help the people of this town! • What could the townspeople (or their government) have done to prevent the tragedy? • Try to think of two or three options. Answers • Impose a corrective tax on the use of the land to “internalize the externality.” • Regulate use of the land (the “command-and-control” approach). • Auction off permits allowing use of the land. • Divide the land, sell lots to individual families; each family will have incentive not to overgraze its own land. 6. Introduction to Production Costs Let’s take a step back… • We have started discussing situations in which the market outcomes may not be the most efficient for society as a whole • Externalities • Public Goods • Common Pool Resources • Another very important case is that of Monopolies. • In order to analyze Monopolies, we need to have a deeper understanding of how firms make decisions. • Let’s take a step back to explore what is behind the Supply Curve! Total Revenue, Total Cost, Profit • We assume that the firm’s goal is to maximize profit. Profit = Total revenue – Total cost the amount a firm receives from the sale of its output the market value of the inputs a firm uses in production Costs: Explicit vs. Implicit • Explicit costs require an outlay of money, e.g., paying wages to workers. • Implicit costs do not require a cash outlay, e.g., the opportunity cost of the owner’s time. • Remember one of the Principles of Economics: The cost of something is what you give up to get it. • This is true whether the costs are implicit or explicit. Both matter for firms’ decisions. Explicit vs. Implicit Costs: An Example You need $100,000 to start your business. The interest rate is 5%. • Case 1: borrow $100,000 • explicit cost = $5000 interest on loan • Case 2: use $40,000 of your savings, borrow the other $60,000 • explicit cost = $3000 (5%) interest on the loan • implicit cost = $2000 (5%) foregone interest you could have earned on your $40,000. In both cases, total (exp + imp) costs are $5000 Economic Profit vs. Accounting Profit • Accounting profit = total revenue minus total explicit costs • Economic profit = total revenue minus total costs (including explicit and implicit costs) • Accounting profit ignores implicit costs, so it’s higher than economic profit. The Production Function • A production function shows the relationship between the quantity of inputs used to produce a good and the quantity of output of that good. • It can be represented by a table, equation, or graph. • Example: • Farmer Golib grows Cotton. • He has 5 acres of land. • He can hire as many workers as he wants. • To build Golib’s Production Function we need to determine how many additional bags of cotton he would produce each time he hires one additional worker for his farm. EXAMPLE: Farmer Golib’s Production Function Q (no. of (bags of workers) cotton) 3,000 Quantity of output L 2,500 0 0 1 1000 2 1800 3 2400 500 4 2800 0 5 3000 2,000 1,500 1,000 0 1 2 3 4 No. of workers 5 Marginal Product • If Golib hires one more worker, his output rises by the marginal product of labor. • The marginal product of any input is the increase in output arising from an additional unit of that input, holding all other inputs constant. • Notation: ∆ (delta) = “change in…” Examples: ∆Q = change in output, ∆L = change in labor • Marginal product of labor (MPL) = ∆Q ∆L EXAMPLE: Farmer Golib’s Total & Marginal Product L Q (no. of (bags workers) of cotton) ∆L = 1 ∆L = 1 ∆L = 1 ∆L = 1 ∆L = 1 0 0 1 1000 2 1800 3 2400 4 2800 5 3000 MPL ∆Q = 1000 1000 ∆Q = 800 800 ∆Q = 600 600 ∆Q = 400 400 ∆Q = 200 200 MPL = Slope of Prod Function L Q MPL 3,000 0 0 1 1000 2 1800 3 2400 4 2800 5 3000 1000 800 600 400 200 Quantity of output MPL (no. of (bags workers) of cotton) equals the slope of the 2,500 production function. 2,000 Notice that MPL diminishes 1,500 as L increases. 1,000 This explains why the 500 production function gets flatter 0 as L0increases. 1 2 3 4 No. of workers 5 Why MPL Is Important • Recall one of the Principles of Economics: Rational people think at the margin. • When Farmer Golib hires an extra worker, • his costs rise by the wage he pays the worker • his output rises by MPL • Comparing them helps Golib decide whether he would benefit from hiring the worker.