File

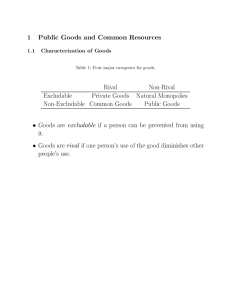

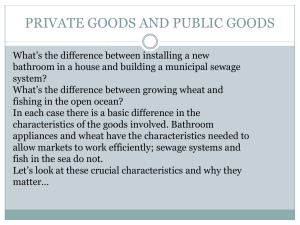

advertisement

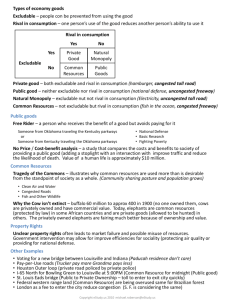

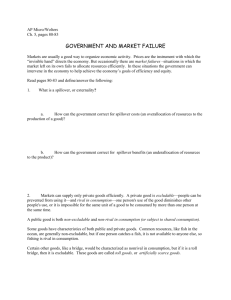

Public Goods & Resources (11) Mr. Barnett AP Microeconomics University High School Introduction We consume many goods without paying: parks, national defense, clean air & water. When goods have no prices, the market forces that normally allocate resources are absent. The private market may fail to provide the socially efficient quantity of such goods. One of the Ten Principles from Chapter 1: Governments can sometimes improve market outcomes. Private vs Public A good is excludable if a person can be prevented from using it. Excludable: fish tacos, wireless Internet access Not excludable: FM radio signals, national defense A good is rival in consumption if one person’s use of it diminishes others’ use. Rival: fish tacos Not rival: An MP3 file of Kanye West’s latest single Private vs Public Pure public goods are nonrival, nonexcludable, and nondivisible Free-Riders Since non-excludable, people enjoy good without payment Private market produces less of the good or service than is socially optimal (buyers collectively value the good higher than the cost of providing it). Four Classifications Private – Rival & Excludable Common Resources – Rival but NOT Excludable Quasi-Public/Collective/Club Goods – NOT Rival & Excludable Public Goods – NOT Rival & NOT Excludable Question A road is which of the four kinds of goods? Hint: The answer depends on whether the road is congested or not, and whether it’s a toll road or not. Consider the different cases. Answer Rival in consumption? Only if congested. Excludable? Only if a toll road. Four possibilities: Uncongested non-toll road: public good Uncongested toll road: club / quasi-public/collective good Congested non-toll road: common resource Congested toll road: private good Cost-Benefit Analysis The difficult job of cost–benefit analysis Government Decide what public goods to provide What quantities Cost–benefit analysis Compare the costs and benefits to society of providing a public good Doesn’t have any price signals to observe Government findings Rough approximations at best How much is a life worth? Cost: $10,000 – new traffic light Benefit: increased safety Risk of a fatal traffic accident Drops from 1.6% to 1.1 % Obstacle Measure costs and benefits in the same units Put a dollar value on a human life? Priceless = infinite dollar value 9 How much is a life worth? Implicit dollar value of a human life Courts - award damages in wrongfuldeath suits Total amount of money a person would have earned if he or she had lived Ignores other opportunity costs of losing one’s life Risks that people are voluntarily willing to take and how much they must be paid for taking them Value of human life = $10 million 10 How much is a life worth? Cost-benefit analysis Traffic light Reduces risk of fatality by 0.5 percentage points Expected benefit = 0.005 × $10 million = $50,000 Cost ($10,000) < Benefit ($50,000) Approve the traffic light 11 Common Resources Like public goods, common resources are not excludable. Cannot prevent free riders from using Little incentive for firms to provide Role for govt: seeing that they are provided Additional problem with common resources: rival in consumption Each person’s use reduces others’ ability to use Role for govt: ensuring they are not overused The Tragedy of the Commons A parable that illustrates why common resources get used more than is socially desirable. Setting: medieval town where sheep graze on common land. As the population grows, the # of sheep grows. The amount of land is fixed, the grass begins to disappear from overgrazing. The private incentives (using the land for free) outweigh the social incentives (using it carefully). Result: People can no longer raise sheep. The Tragedy of the Commons The tragedy is due to an externality: Allowing one’s flock to graze on the common land reduces its quality for other families. People neglect this external cost, resulting in overuse of the land. ACTIVE LEARNING 2 Policy options for common resources What could the townspeople (or their government) have done to prevent the tragedy? Try to think of two or three options. ACTIVE LEARNING Answers 2 Impose a corrective tax on the use of the land to “internalize the externality.” Example: hunting & fishing licenses, entrance fees for congested national parks Regulate use of the land (the “command-andcontrol” approach). Auction off permits allowing use of the land. Divide the land, sell lots to individual families; each family will have incentive not to overgraze its own land. Common Resources Some important common resources Fish, whales, and other wildlife Oceans – least regulated common resource Needs international cooperation Difficult to enforce an agreement Fishing and hunting licenses Limits on fishing and hunting seasons Limits on size of fish Limits on quantity of animals killed 17 Why the cow is not extinct Animals with commercial value that are threatened with extinction Buffalo North America Hunting in 19th century Elephants African countries Hunting today 18 Why the cow is not extinct The cow Commercial value Species continues to thrive Cows - private good Ranches - privately owned Rancher - great effort to maintain the cattle population on his ranch Reaps the benefit 19 Why the cow is not extinct Elephant - common resource Poachers - numerous Strong incentive to kill elephants Government Illegal to kill elephants and sell ivory Hard to enforce laws Decreasing population of elephants Elephants – private good People can kill elephants on their own property Landowners - incentive to preserve the species Elephant populations have started to rise 20 Public Bads Opposite of public goods Non-Rival & Nonexcludable Provides disutility and dissatisfaction – reduces economic welfare when consumed Public waste & pollution are examples Efficiency issues CONCLUSION Public goods tend to be under-provided, while common resources tend to be over-consumed. These problems arise because property rights are not well-established: Nobody owns the air, so no one can charge polluters. Result: too much pollution. Nobody can charge people who benefit from national defense. Result: too little defense. The gov’t can potentially solve these problems (MARKET FAILURES) with appropriate policies.