Dell Case Key Issues

advertisement

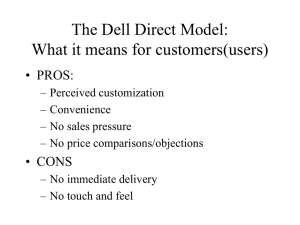

Dell Case Key Issues Matching Dell • Industry Dynamics – How to attain advantage – How to protect advantage 2-2 Industry Dynamics • 5 Forces Model – Gauges the degree of competitive rivalry in industry. – Bargaining Power of Suppliers. – Bargaining Power of Customer. – Threat of new entry. – Threat of substitutes. – Intensity of Rivalry. 2-3 Bargaining Power of Suppliers • Proprietary Standards from Microsoft and Intel - Extract profits • Other inputs are commodities • Thus Bargaining Power of Suppliers is Very High 2-4 Bargaining Power of Customers • Standardized product means its easy to switch brands • Resellers and retailers have grip on channels. • Corp. users buy direct based on price since little differentiation • Over BP of customers is high and rising. 2-5 Threat of new entry. • Increasing with rise of internet and direct channel. • Main barrier is capital needed for manuf. facility. • Only real barrier are economies of scale. • Threat is fairly high. 2-6 Threat of substitutes. • Within product category, few direct substitutes. 2-7 Intensity of Rivalry. • Rivalry is very high due to: • Lack of differentiation. – Reliability and Service are only diff’s. • Price is similar for all competitors – If prices are similar, this is a signal of rivalry. • Do prices go down or up? – Tend to fall. 2-8 Dell’s Advantages/Disadv. • Direct to order – Efficient (best cost position) – Effective (for some customers - best) • Focus! – Not distracted by other channels – Maybe not competent in other channels? • Service – By from Dell, deal w/ Dell. 2-9 IBM’s Advantages/Disadv. • • • • Direct Salesforce. Well regarded laptop. Costs are higher Few non-corporate customers 2-10 Compaq Adv/Disadv. • Cost position is good • Retail relationships • Poor quality • Poor reputation 2-11 HP Adv/Disadv. • Quality reputation • Higher cost • Resellers 2-12 Gateway Adv/Disadv. • Price – lower • Service • Image? 2-13 Example of Unit Price and Cost Analysis 1998 numbers Dell Compaq Unit Price 1996 1932 Unit COGS 1555 1325 0 135 195 309 44 124 1794 1893 202 39 12327 31169 Gross Margin 2722 9786 Margin % Rev 22.1% 31.4% Channel Markup 0.0% 7.0% SGA 1202 4978 SGA % Rev 9.8% 16.0% Cost of inventory 273 2,005 Days of Inventory 10 34 2% 6% Channel Markup/Unit Unit SGA Inv. Carry Costs Cost of unit Profit Rev Cost of Inv % of Rev Notes 1-Gross Margin Inv / (Rev-Gross Marg)*365 2-14 For all firms 1998 numbers Unit Price Unit COGS Channel Markup/Unit Unit SGA Inv. Carry Costs Cost of unit Profit Rev Gross Margin Margin % Rev Channel Markup SGA SGA % Rev Cost of inventory Days of Inventory Cost of Inv % of Rev Dell 1996 1555 0 195 44 1794 202 Compaq 1932 1325 135 309 124 1893 39 IBM 1959 921 0 400 125 1445 514 HP 2129 1451 149 353 284 2237 -108 Gateway 1762 1406 0 242 39 1687 75 12327 2722 22.1% 0.0% 1202 9.8% 273 31169 9786 31.4% 7.0% 4978 16.0% 2,005 81667 43282 53.0% 0.0% 16662 20.4% 5,200 47061 14989 31.9% 7.0% 7793 16.6% 6,284 7648 1546 20.2% 0.0% 1052 13.8% 168 10 2% 34 6% 49 6% 72 13% 10 2% Note: IBM numbers are likely inflated by Mainframe and service being included. 2-15 2-16