10.1 insurance documents

advertisement

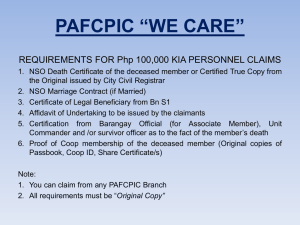

Chapter 10 Insurance & Other Documents Learning target: 1. What is insurance coverage? 2. What are insurance documents and their classifications? 3. What are other documents required in special cases? 10.1 insurance documents In international trade, the transportation of goods from the seller to the buyer by air, by land, or by sea is realized generally over a long distance and has to go through the procedures of loading, unloading, and storing. During this process, it is quite possible that the goods will encounter various kinds of perils or risks and sometimes suffer losses. In order to protect the goods against possible losses of such perils, the buyer or seller before the transportation of the goods must usually take out insurance with an insurance company on the goods. International cargo transportation insurance refers to the fact that the insured covers insurance for the shipment with the insurer, i.e., the insurance company before shipment. Insurance for maritime shipping is the paramount adopted in international trade. The insured pays insurance premium to the insurance company on the basis of insurance amount, insurance cover as well as insurance premium rate, and obtains the insurance policy. The insurer shall compensate the insured for the losses of, and damage to the goods, if any, during the transportation within the scope of insurance cover. The insured pays insurance premium to the insurance company on the basis of insurance amount, insurance cover as well as insurance premium rate, and obtains the insurance policy. The insurer shall compensate the insured for the losses of, and damage to the goods, if any, during the transportation within the scope of insurance cover. Perils Perils refer to risks which occur at sea, or at the place where the ocean and land, or the ocean and the inland river, or the ocean and the lighter are connected. Perils are mainly divided into two kinds, i.e., general perils of the sea and extraneous risks. General perils of the sea include natural calamities and fortuitous accidents. Natural calamities are caused by the forces resulting from the changes of natures, e.g., vile weather, thunder, lightning, Tsunami, earthquake, flood, etc.. Fortuitous accidents include accidents resulting from unexpected causes, the carrying conveyance being grounded, stranded, or in collision with floating ice or other objects, as well as fire or explosion. Extraneous risks include theft, fresh or rain water damage, shortage, leakage, breakage, sweating and heating, intermixture and contamination, odor, hook damage, breakage of packing, rusting, etc. Another extraneous risk occurs due to political and social agitation, such as wars, strikes, cargo rejection and failure to deliver. 2)Ocean Losses and expenses sustained Ocean losses refer to the direct or indirect losses of the insured subject matter during the voyage owing to the perils of the sea. Losses can be divided into two kinds: total losses and partial losses. Total losses imply all goods insured are lost or turn to no worth. Total losses include actual total losses and constructive total losses. Actual Total Loss: The insured subject matter is totally and irretrievable lost; Constructive Total Loss It is estimated that the actual total loss of cargo is inevitable or the cost of salvage or recovery could have exceeded that the value of the cargo. Partial loss implies some of the goods are lost or the goods are damaged by still remain some values. Partial loss includes general average and particular average. ①General average refers to a certain special sacrifice and extra expense intentionally incurred for the general interests of the shipowner, the insurer, and the owners of the various cargoes aboard the ship. For example, a ship may have run aground and all efforts to refloat it have failed. In order to save the ship from breaking up, the master may decide to jettison part of the cargoes to lighten the ship. This loss is borne by all the parties concerned mentioned above in proportion. The following conditions of general average must be provided with: The carrying vessel must really run up against the risk that threatens the safety of the ship and the cargoes. The sacrifice of general average must be a willing and intentional action. The sacrifice of general average and the expense outlaid must be reasonable. The purpose of the sacrifice and expense incurred is only restricted to the general safety of the vessel and cargoes. Losses should be the direct result of the general average. ②Particular average: it means that a particular cargo is damaged by any cause and the degree of damage does not reach a total loss, i.e., only a partial loss, which shall be borne by the owner of this individual consignment or the insurer related. 10.1.2 Insurance Coverage The Insurance Coverage Includes Basic Insurance and Additional Insurance. Basic risks:Basic insurance is also called main insurance which may be underwritten independently and taken as the basic insurance by insurer. It is classified into three conditions, i.e., Free From Particular Average (F.P.A.), with Particular Average (W.A/W.P.A.) and All Risks. Where the goods insured hereunder sustain loss or damage, the People’s Insurance Company shall undertake to indemnify there-for according to the Insured Condition specified in the Policy and the Provisions of the clauses. ①Free form particular average (F.P.A). F.P.A. means that the insurer is free from being claimed for any particular average losses. It only provides coverage for the total loss and general average. F.P.A. provides the least coverage. ②With particular average (W.P.A. or W.A.): it provides coverage for the F.P.A. plus particular average. ③All risks: Aside from the risks covered under the F.P.A. and W.A. conditions as above, this insurance also covers all risks of losses or damage to the insured goods whether partial or total, arising from external causes in the course of transit. 2) Additional risks are generated for the purpose to cover risks from external elements. Additional risks can not be covered independently; they shall be underwritten depending on one kind of the basic risks. General additional risks; Theft, Pilferage and Non-Delivery; Fresh Water and Rain Damage; Shortage; Intermixture and Contamination; Leakage; Clash and Breakage; Odor; Sweating and Heating; Hook damage; Loss or Damage Caused by Breakage of Packing; Rust. ②Special additional risks Failure to delivery; On deck risk; Aflatoxin risk; Survey in customs risk; Survey at jetty risk; Strike, riot and civil commotion(SRCC); War risk; Contingency insurance “cover seller’s interest only” 10.1.3 Definition, function and classification of insurance document 10.1.3.1 Insurance Document An insurance document is a contract of indemnity between the insurer and the insured stipulating the premium, the amount insured, risks to be covered, and procedures to establish a claim and other terms and conditions applicable, thereby indemnifying or making compensation to the latter by the former in the event that a covered loss occurs. Functions ① a certificate of international freight transport insurance contract; ② a certificate of indemnity or compensation claimed by the insured. 10.1.3.3 Classifications ⑴Insurance Policy. The insurance policy is a formal written contract between the insurer and the insured, with all terms and conditions included in its front cover and provisions of rights and responsibilities of both parties in its reverse cover. The insurance policy is the most widely used insurance document. ⑵Open Policy. This type of policy is of great importance for export business, it is a convenient method for insuring the goods where a number of consignments of similar export goods are intended to be covered. An open policy covers these shipments, as soon as they are made, under the previous arrangement between the insured and the insurance company. The particulars of these shipments should be supplied to the insurance company later on in the form of shipment advices to get insurance certificate. Certificate. The insurance certificate is the one mentioned above under open policy and the insurance certificate said in UCP600 and ISBP681. The insurance certificate has the same legal validity as the insurance policy. ⑷Insurance Declaration. The insurance declaration is one of the insurance documents under open policy, which is filled in by the insured in printed form fixed for submission to the insurer. The insurance declaration particulars are similar with the shipment advice in content. ⑶Insurance ⑸Cover Note. The cover note is an informal insurance policy issued by the insurer before shipment particulars are available to satisfy. Until the shipment details are provided to the insurance company, can the insured not take formal insurance policy. 10.1.4 Insurance policy includes the contents as the insured, marks, quantity, description of goods, amount insured, total amount insured, premium and rate, per conveyance S.S., Slg.on or abt, From…to….conditions, claim payable at, insurance survey agent, place and date of issue and authorized signature. Here below are the contents of an insurance policy for reference. 10.1.5 Essentials of Insurance Documents Review (1) Kind of insurance documents should be regulated by L/C. (2) Insurance premium. The insurance premium should be what L/C specifies. In case of no such regulation in L/C, the generally accepted premium should be 110% CIF value. The amount in lowercase and capital words should be unanimous. The amount insured often remains an integer by omitting all decimals while adding one digit to the whole amount regardless of whatsoever the decimal is. 10.2 Other Documents 10.2.1 Inspection Certificate 10.2.1.1 Definition An inspection certificate is a document to certify the goods traded to ensure conditions as quality and quantity. The institution carrying out inspection can be either official authorized or private. The inspection certificate can be taken for the following purpose: Firstly, a certificate for delivery of goods between the importer and the exporter; Secondly, a document in settlement; Thirdly, a document for export declaration and import clearance and reference for evaluating of certain commodities; Lastly, a certificate of indemnity and compensation. 10.2.1.2 Classifications Inspection certificates are various. The following kinds are the most commonly used: Inspection Certificate of Quality, Inspection Certificate of Weight/ Quality, Veterinary Inspection Certificate, Sanitary Inspection Certificate/ Inspection Certificate of Health, Disinfection Inspection Certificate, Inspection Certificate of Fumigation, Inspection Certificate for Raw Silk Classification and Conditioned Weight, Inspection Certificate of Analysis, Society General de Surveillance S. A., BV Certificate (Bureaus Verita). Summary This chapter discusses insurance documents and other documents in international trade. In particular, the insurance documents specify the liabilities and risks for contracting parties and thus constitute an important part in this concern. In the process of international trade, once one party buys the insurance, the insurance documents will become one of the important documents in international settlement. Similarly, other documents could be applied accordingly in case they are be adopted by each party. These documents, although unnecessary, they should hinder the trade process without being taken properly. Key Words Free From Particular Average (F.P.A.) 平安险 With particular average (W.P.A. or W.A.) 水渍险 General additional risks 一般附加险 Special additional risks 特殊附加险 Actual Total Loss: 际全损 constructive total losses 推定全损 insurance document 保险单据 实 insurance policy 保险单 Open Policy 预约保单 insurance certificate. 保险凭证 insurance declaration. 保险声明 cover note 暂保单 Certificate of Origin (C/O) 原产地证书 inspection certificate 检验证书