Presentation of Mr Huseyin Zafer

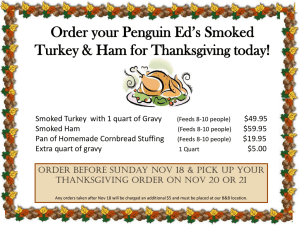

advertisement

CENTRAL BANK OF THE

REPUBLIC OF TURKEY

Hüseyin Zafer

Executive Director

May 2011

1

Contents

I. General Outlook in the Turkish Economy

II. Post-Crisis Challenges

III.New Policy Mix as the Response

IV.Outcomes of the New Policy

2

I. General Outlook in the Turkish Economy

3

Strong Rebound in Economic Activity in 2010

GDP Growth

(%)

10

8

6

8,9

4

2

6,8

3,0

4,5

5,0

5,5

0,7

0

-2

-4,8

-4

-6

07

01

0

0

2

2

02

93

0

9

2

1

08

20

09

20

10

20

p

11

0

2

p

12

0

2

p

13

0

2

Source: TURKSTAT, SPO

4

Unemployment is Still High but Recovering

Non-Agricultural Employment and

GDP Growth

Unemployment ratio

(%, Seasonally Adjusted)

15

14,8

14

10,0

1200

8,0

1000

6,0

800

13

4,0

600

12

2,0

400

0,0

11

10,6

200

-2,0

GDP Grow th (%)

-4,0

Change in Non-agricultural

Employment (000 person,

rhs)

10

9

01.05

05.05

09.05

01.06

05.06

09.06

01.07

05.07

09.07

01.08

05.08

09.08

01.09

05.09

09.09

01.10

05.10

09.10

01.11

-6,0

2005

2006

2007

2008

0

-200

2009

2010

Source: TURKSTAT

Last observations: January 2011

5

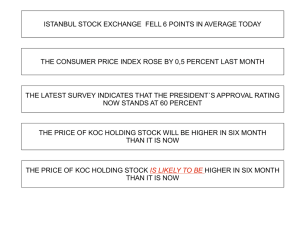

Disinflation Continues

Inflation Realizations

(%, red dots are the year-end inflation targets)

80

70

60

50

40

30

20

10

5,5

5

5

2011

2012

2013

0

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Source: TURKSTAT

6

And so Does the Historically-Low Lending Rates..

Lending Rates

(%, weighted averages for the categories)

80

70

Personal Finance

60

Vehicle

Housing

50

Commercial

CBT Policy Rate

40

30

20

10

01-11

07-10

01-10

07-09

01-09

07-08

01-08

07-07

01-07

07-06

01-06

07-05

01-05

07-04

01-04

07-03

01-03

07-02

01-02

0

Source: CBRT

7

Highest Decline in CDS Spreads Despite Highest Interest

Rate Cut

1600

CDS Premia of Selected Countries

CDS Premia of Selected Countries

(January 1, 2008=0, April 22, 2011)

(January 1, 2008 - April 22, 2011)

1200

CDS (bps)

1400

Turkey

1000

Greece

Portugal

Turkey

Spain

Ireland

Italy

Belgium

1200

1000

800

600

Czech R.

Poland

Hungary

800

Bulgaria

Romania

600

400

Russia

400

200

200

0

Turkey

-200

Source: CBRT

02.11

10.10

06.10

01.10

09.09

05.09

01.09

09.08

05.08

01.08

02.11

10.10

06.10

01.10

09.09

05.09

01.09

09.08

05.08

01.08

0

8

II. Post-Crisis Challenges

9

Background

Advanced Economies

Low Growth rates

&

Very Low Interest Rates

+

Capital Inflows

to Emerging

Markets

Credit Growth

&

Risk of

Overheating

Emerging Markets

Strong Growth Prospects

&

High Interest Rates

Risk of future

instability!

10

Capital Inflows

Capital Inflows

(USD billion)

FDI

50

Portfolio Investments and Deposits

40

Private Sector Credit*

30

20

10

0

-10

-20

* After controlling for the effect of

change in Decree No. 32

01.11

10.10

07.10

04.10

01.10

10.09

07.09

04.09

01.09

10.08

07.08

04.08

01.08

-30

Source: TURKSTAT, CBT

11

… Supporting the Strong Growth in Credits

Loan Growth

(%, year-on-year change)

60

50

40

30

20

10

0

-10

SME

Total

Individual

Corporate/Commercial

02.11

12.10

10.10

08.10

06.10

04.10

02.10

12.09

10.09

08.09

06.09

04.09

02.09

12.08

10.08

08.08

06.08

04.08

02.08

-20

Source: BRSA

Last observation: February 2011

12

… which is Higher than the EU Countries

Change in Bank Credit

(%, year-on-year, 2010)

40

31.6

33.9

30

20.4

Portugal

Denmark

Belgium

France

Austria

8.4

8.5

Italy

2.5

5.4

U.K

1.0

3.9

0.0

0.7

4.1

Germany

10

Finland

20

-1.7

-0.9

-0.7

Luxembourg

Spain

Netherlands

0

-10

-20

-22.6

Turkey

Greece

Sweden

Ireland

-30

Source: ECB Statistical Data Warehouse

13

3

0

-2

-5

Portugal

Greece

Australia 1

Lithuania

Slovenia

Spain

Italy

Poland

France

Norway

Slovak Republic

Sweden

Latvia

Ireland

Netherlands

Hungary

Romania

Czech Republic

Bulgaria

Switzerland

Turkey (Feb'11)

Russian

Turkey ('10)

Estonia

Latvia

Romania

Greece

Hungary

Netherlands

Slovenia

France

Italy

Estonia

Sweden

Switzerland

Portugal

Slovak Republic

Spain

Russia

Poland

Norway

Bulgaria

Lithuania

Czech

Turkey (Feb'11)

Turkey (2010)

Outstanding Outlook in the Banking Sector

Return on Assets

Capital Adequacy Ratio

(%)

(%)

25

2

1

20

15

-1

10

-3

5

-4

0

Source: IMF

Latest Data Available varies btw 2009-2010

14

16

8

14

7

12

10

8

6

0

02.08

04.08

06.08

08.08

10.08

12.08

02.09

04.09

06.09

08.09

10.09

12.09

02.10

04.10

06.10

08.10

10.10

12.10

02.11

Switzerland

Norway

Australia 1

Netherlands

Turkey (Feb'11)

Portugal

Turkey (10)

Poland

France

Spain

Slovak Republic

Estonia

Czech Republic

Slovenia

Lithuania

Bulgaria

Greece

Hungary

Russian Federation2

Italy

Romania

Ireland

Latvia

…with Comparatively Very Low NPL Ratios

NPL Ratios of Selected Countries

NPL Ratios in Turkey

(%)

(%)

SME

Corporate

6

Total

Individual

5

4

4

2

3

2

Source: IMF, BRSA

Latest Data Available varies btw 2009-2010

15

Strong Balance Sheet of Households

Household Liabilities to GDP Ratios

Household FX Positions

(%)

Turkey

Romania

Slovakia

Slovenia

Czech Rep

Bulgaria

Belgium

Hungary

Litvania

Italy

Poland

Greece

Latvia

Austria

France

Estonia

Finland

EU27

Germany

The Netherlands

UK

Sweden

Luxembourg

Portugal

Spain

Ireland

Denmark

15.4

2009

Sep. 2010

Households FX Assets*

67,597

69,338

Households FX

Liabilities*

2,172

1,572

FX Position*

65,425

67,766

GDP*

616,753

734,723

FX Position/GDP (%)

+10.6

+9.2

* (USD million)

0

20

40

60

80

100

120

140

160

Source: Eurostat, CBRT

Last observations:Sep. 2010

16

…and Non-Financial Sector

Non Financial Companies (NFC) FX

Positions

Bank Loans to Non Financial Companies

(% of GDP)

Poland

Romania

Czech Republic

Slovakia

Turkey

Hungary

Finland

Belgium

Lithuania

Germany

United Kingdom

Greece

France

Bulgaria

EU27

Estonia

Latvia

Italy

Austria

Sweden

Netherlands

Slovenia

Denmark

Portugal

Spain

Malta

Ireland

Cyprus

Luxembourg

September

2010

28

NFC FX Assets*

83,860

NFC FX Liabilities*

173,128

FX Position*

-89,268

FX Position/GDP (%)**

-12.7

•(USD million).

** Note that the short FX position for short term

liabilities are less than 1% of GDP (USD 458 mio).

Banking Sector FX position is balanced.

0

20

40

60

80

100

120

140

160

180

Source: Eurostat, CBRT

Last observations:Sep.2010

17

… and of Public Sector

Budget Deficit Forecast for 2011

Public Debt Forecast for 2011

(% of GDP)

(% of GDP)

Hungary

Sweden

Estonia

Luxembourg

Finland

Germany

Bulgaria

Turkey*

Malta

Austria

Denmark

Czech Rep.

Netherlands

Belgium

Italy

Romania

Cyprus

Slovenia

Slovak Rep.

Latvia

Portugal

Poland

France

Lithuania

Spain

Greece

UK

Ireland

-11

Estonia

Luxembourg

Bulgaria

Maastricht

Criterium

Maastricht

Criterium

Austria

Sweden

Romania

Turkey*

-2.8

40.6

Czech Republic

Slovenia

Latvia

Lithuania

Slovak Republic

Denmark

Finland

Poland

Cyprus

Spain

Netherlands

Malta

Hungary

Germany

UK

France

Portugal

Belgium

Ireland

Italy

Greece

-9

-7

-5

-3

-1

1

3

*: Turkey’s budget deficit figure is MTP (2011-2013 projection) for central govenment. IMF

WEO April 2011 budget deficit forecast for Turkey is 1.7% and better than what was envisaged

in Turkey’s MTP as 2.1% for general government.

0

20

40

60

80

100

120

140

160

*: Turkey’s debt figure is MTP (2011-2013) projection. IMF WEO April 2011 public debt

forecast for Turkey is 39.4%.

Source: MoF, Treasury, MTP (2011-2013)

Targets, IMF WEO April 2011

18

Stronger Import Demand Partly Fuelled by Credit Growth...

The quantity indices depict the stronger import demand growth compared to export growth.

Higher growth in import demand resulted in increasing foreign trade deficit.

Export, Import & Foreign Trade Balance

(12-month MA, USD Billion)

Export and Import Quantity Indices

(3-month MA)

200

Export Quantity Index

190

Import Quantity Index

180

20

Export

18

Import

14

160

12

150

10

140

8

130

6

120

4

110

-6

Net Export (rhs)

16

170

-7

-5

-4

-3

-2

-1

2

Source: TURKSTAT

Oca.11

Eyl.10

May.10

Oca.10

Eyl.09

May.09

Oca.09

Eyl.08

May.08

Oca.08

Eyl.07

May.07

Oca.07

Eyl.06

May.06

Oca.06

Eyl.05

0

May.05

0

Oca.05

Oca.11

Eyl.10

May.10

Oca.10

Eyl.09

May.09

Oca.09

Eyl.08

May.08

Oca.08

Eyl.07

May.07

Oca.07

Eyl.06

May.06

Oca.06

Eyl.05

May.05

Oca.05

100

19

... Leading to a Deterioration in the Current Account…

Current Account Balance/GDP

(%)

8,0

Ratio to

GDP

6,0

CAB / GDP

4,0

2007

2008

2009

201

0

2011*

CAB

-5.3

-6.8

-2.2

-6.6

-7.7

CAB Excl.

Energy

-1.3

-0.2

1.9

-2.0

-2.6

CAB (excl. Energy)/ GDP

2,0

0,0

* As of February 2011, last 12

months.

-2,0

-4,0

-6,0

-8,0

0110

0109

0108

0107

0106

0105

0104

0103

0102

0101

0100

-10,0

Source: TURKSTAT, CBRT

20

…Although “Current Account Imbalances” is a Global Issue.

30

Current Account Balance in Some Countries

25

(2010 IMF Forecasts, ratio to GDP, percent)

20

15

10

5

0

-5

Source. IMF, CBRT

Greece

Turkey (2011)

Turkey (2010)

Spain

Italy

Poland

United States

India

India

United Kingdom

Brazil

France

Indonesia

Korea

Japan

Thailand

China

Saudi Arabia

Taiwan

Malaysia

-15

Czech Rep.

-10

21

III. New Policy Mix as the Response

22

The Three Phases of the Monetary Policy since the Collapse

of Lehman Brothers

• Phase-1: Full liquidity support (after the collapse of Lehman

Brothers, September 2008)

• Phase-2: Exit Strategy (April 2010)

• Phase-3: New Policy Mix (since November 2010)

-

A lower policy rate,

-

Wider interest rate corridor and

-

Higher reserve requirements

23

RRR and the Policy Rate being the Main Monetary Tools

Tools in the order of priority

For Financial Stability:

For Price Stability:

1.

2.

3.

1.

2.

3.

Required Reserve Ratios

TRY Liquidity Management

Short-Term Interest Rates

Short-Term Interest Rates

TRY Liquidity Management

Required Reserve Ratios

24

The New Policy Framework of Two Targets and Two

Instruments

25

Lower Policy Rate and Wider Corridor

Policy Rate and Interest Rate Corridor

(%)

25

20

Interest Rate Corridor

15

10

5

Policy Rate

0

01.08 04.08 07.08 10.08 01.09 04.09 07.09 10.09 01.10 04.10 07.10 10.10 01.11 04.11

26

Higher Reserve Requirements

Reserve Requirements Balances

(%)

18

Longer Than 1 Year

16

6-12 Months

14

3-6 Months

1-3 Months

12

Up to 1 Month

10

Demand Deposit

8

6

4

2

0

Nov 2010

Step 1 (Dec 2010)

Step 2 (Jan 2011)

Step 3 (Apr 2011)

Step 4 (Apr 2011)

Source: CBRT

27

Reserve Requirements – An International Comparison

Current Reserve Requirement Ratios

(%)

25

20.5

20

20

15

13.5

11.8

10.0

10

8

6

4

5

3.5

Poland

Russia

India

Indonesia

Peru

Turkey (FX)

Turkey (TRY)

Brazil

China

0

Source: Central Banks, CBRT

28

Measures Taken by other Turkish Authorities.

1. Fiscal discipline

2. No FX loans to households

3. Domestic currency bond market

4. Loan/value restrictions

5. Tax hikes on certain consumer loans

6. Restrictions on credit card borrowing

29

IV. Outcomes of the New Policy

30

1. Tightening Liquidity

Reserve Requirements Balances

(billion TRY)

70

The new reserve requirements will be effective as of Apr 29, 2011

(approx. 1.5 billion TRY and 1.4 billion USD)

60

50

40

TRY Required

Reserves

30

20

10

FX Required

Reserves

03.11

01.11

11.10

09.10

07.10

05.10

03.10

01.10

11.09

09.09

07.09

05.09

03.09

01.09

0

Source: CBRT

31

2. Desired Level of Volatility in Money Markets

Overnight Interest Rates

(%)

Swap Rates

(%)

Source: CBRT

32

3. Impact on Currency

TRY and Other EM Currencies

Against USD ( 4 Jan 2010= 1)

33

4. Steeper Yield Curve and Inflation Expectations under

Control

Yield Curve*

Inflation Expectations

(%)

(%.)

*Calculated from the compunded returns on

bonds quoted in ISE by using ENS method.

Source: CBRT

34

CENTRAL BANK OF THE

REPUBLIC OF TURKEY

Hüseyin Zafer

Executive Director

May 2011

35

Reserve Slides

Monetary Policy Outlook

36

Baseline Scenario – Inflation Report (April 28, 2011)

The net impact is on the tightening side.

20-25% annual credit growth is targeted at the end of 2011

Risks both on the downside and on the upside

37

Inflation and Output Gap Forecasts

Output Gap Forecast

Inflation Forecasts

(%)

(%)

9

0

8

-1

7

6

6.9

-2

6.4

6.5

5.2

-3

5

5.5

5

5

5

-4

4

-5

3

Inflation Forecasts

Inflation Targets

Uncertainty Band

-6

2

Source: CBRT, April 2011 Inflation Report

12.13

09.13

06.13

03.13

12.12

09.12

06.12

03.12

12.11

09.11

06.11

03.11

12.10

-7

09.10

2013

06.10

2012

03.10

2011

12.09

2010

38

Risk Scenarios

Scenario 1

• In case global economic problems intensify and contribute to stronger capital flows, a

policy mix of low policy rate, high RRR and wider interest rate corridor may be

implemented for a long period. If this scenario leads to weaker domestic demand, it may

require an easing in all instruments.

Scenario 2

• If the global economy faces a faster-than-expected recovery, global inflation may

increase and thus trigger a tightening in the monetary policies of developed economies.

• Materialization of such a scenario would mean higher global interest rates and demanddriven domestic inflation, and thus necessitate a tightening by using both policy rates

and reserve requirements.

Scenario 3

• The increases in commodity prices, if they persist, exert risks regarding general pricing

behavior, given the strong pace of domestic demand.

• Should such a risk materialize and hamper the attainment of the medium-term inflation

targets, there may be stronger tightening than envisaged in the baseline scenario.

• Higher commodity prices may worsen the current account balance.

• Therefore, the policy mix may vary depending on the developments regarding external

demand, capital flows, and the outlook for credit growth.

39