Letters of Credit

advertisement

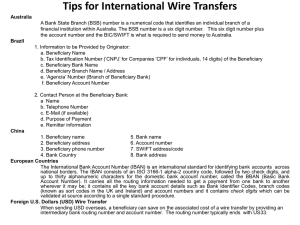

LETTER OF CREDIT 1 LETTER OF CREDIT /DOCUMENTARY CREDIT Letter of Credit is an undertaking issued by a Bank (Issuing Bank), on behalf of the buyer (the importer), to the seller (exporter) to pay for goods and services provided that the seller presents documents which comply with the terms and conditions of the Letter of Credit 2 LETTER OF CREDIT UCPDC – 600 Edition effective from 1st July 2007 Documentary Credit means any arrangement that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation. 3 Complying presentation a presentation that is in accordance with • the terms and conditions of the credit, • the applicable provisions of these rules (UCP 600) and • international standard banking practice. Honour a. to pay at sight if the credit is available by sight payment. b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. c. to accept a bill of exchange ("draft") drawn by the beneficiary and pay at maturity if the credit is available by acceptance. 4 LETTER OF CREDIT • Three main contracts underlying LC - Sale Contract between Buyer & Seller - Application-cum-Guarantee between Applicant(Buyer) and Issuing Bank - LC itself (contract between Issuing Bank and Beneficiary/Seller) ( LC independent of other two contracts) 5 Mechanics of Documentary Credit CONTRACT IMPORTER GOODS GOODS DOCS DOCS EXPORTER Letter of Credit Advising bank DOCUMENTS DOCUMENTS PAYMENT Reimbursing Bank Negotiating Bank/ Confirming Bank PAYMENT 6 Parties to Letter of Credit • • • • • • • Opener/Buyer Issuing Bank Advising Bank Beneficiary/Seller Nominated Bank/Negotiating Bank Confirming Bank Reimbursing Bank 7 Types of credit Security to beneficiary Confirmed Mode of settlement Payment/ deferred payment Acceptance Negotiation Involving middlemen Transferable Back to back Involving advances Red Clause Credit Green Clause Credit Involving repeated transactions Revolving Stand by 9 Transferable Credits • Credit has to be opened as transferable • The beneficiary is normally a trader or agent • He transfers credit to his supplier - second beneficiary. • Transferred by a bank at the request of first beneficiary • Second beneficiary can supply goods and negotiate documents as if he had received the credit. • He may pay commission to first beneficiary for the order • There can be more than one second beneficiary. • No third beneficiary is permitted. 10 Transferable Credits • The following parameters may be changed while transferring a credit – Amount of credit, unit price and quantity of goods – Date of expiry, last date of shipment and last date of negotiation can be brought forward – % of insurance cover may be increased. • First beneficiary has the right to substitute documents negotiated by second beneficiary. 11 Back to Back Credits • Exporter receives a credit from his buyer ( Selling credit) • He has to procure goods from other suppliers • He opens a credit for purchase of the goods ( buying credit) • Second credit is said to be back to back to the first one. • Bill proceeds of the export LC (Selling LC) will be used to meet liabilities under the second (Buying LC) • Amount of back to back credit will be lower. • Usance period of the back to back credit should be equal to or more than that of the export credit. • Bank still at risk if the customer fails to export • No concession in margin and security norms. 12 Revolving Credits • Credit is opened to cover a series of regular transactions over a longer period • Beneficiary will submit a series of documents • Maximum value of each document will be fixed and is the revolving limit • LC amount is the maximum value of documents that can be handled under the credit. • The credit may be reinstated automatically or after payment of earlier bill. • It can be opened as cumulative or non cumulative. 13 Standby Letters of Credit • Credit is issued for a particular amount and for a particular period • Trade takes place on running account basis. • Beneficiary does not submit documents to bank. • If there is a default, he can claim funds from opening bank giving a certificate of default • No quibbling over discrepancies and documents • Opening bank will pay on demand • Works like a bank guarantee • UCPDC is applicable if so declared in the credit 14 LC Regulations • • • • Foreign Trade Policy requirements. FEMA requirements. Credit norms of Central Bank. UCPDC 600 Provisions. • Bank’s Internal Credit Policies/ procedures. • Public notices issued by DGFT • Uniform Rules for bank-to-bank reimbursements 525 • Incoterms 2010 15 Bank’s Obligation & Responsibilities • Issuing Bank (opening bank) ( UCP Article 7) -the prime obligator -to ensure credit-worthiness and trust-worthiness of the applicant - Once credit is opened, the bank is placing itself as a substitute for the buyer. 16 Bank’s Obligation & Responsibilities • Advising Bank has the obligation to authenticate the credit once it is received and passing it promptly on to the beneficiary ( Art.9). • Confirming Bank takes over the responsibilities of the issuing bank as far as the beneficiary is concerned though it has got recourse to the Issuing Bank (Art 8). 17 Bank’s Obligation & Responsibilities Negotiating Bank • to examine docs. Within 5 banking days after receipt of the documents at their counters(Art 14b). • to ensure compliance of credit terms ( on the basis of documents alone) as well as consistency of docs with each other. 18 Protection to Banks • Banks are not responsible : for the genuineness or contents of any documents submitted (Art. 34) For losses etc. arising from transmission problems (Art. 35) Force Majeure ( Art. 36) For the failings of their correspondent Banks (Art. 37) 19 Protection to Banks • Issuing Bank is responsible for all Bank charges and other costs at home or abroad even if they are supposed to be paid by other party (Art. 37 c). • Applicant is responsible for any adverse consequences of foreign laws (Art. 37d). 20 LETTER OF CREDIT Appraisal / Assessment • satisfactory track record. • dealings with only one bank. • Liabilities of the applicant to the Bank and third parties. • Means by which the applicant is expected to meet his commitment once the bills arrive. • Margin he should deposit. 21 Appraisal Issues.. • Limit to be commensurate with turnover and CC limits. • Should be for genuine trade/ manufacturing activity. • Usance period of the LC should ordinarily have relation to the working capital cycle. • Level of inventory carried should be commensurate with industry norms / past trends. 22 Appraisal Issues…. • LCs for purchase of machinery / capital goods should be backed by borrower’s own funds or a term loan sanctioned for the purpose. • Wherever warranted, in addition to margin, where prescribed, we may also retain a lien on the undrawn portion of the CC limit for the value of bills to be received under the LC. 23 Appraisal Issues • Sister concerns: – Where the opener and beneficiary are sister concerns, LCs should not normally be necessary. – Take care of kite-flying operations. – Standing of the beneficiary. • D/A facilities to applicants of undoubted standing and where security available is much more than the value of LC. 24 Appraisal Issues • While computing purchase of imported material on LC basis take net of import duty. • Assess limits for usance and sight LC separately. • Usance period should not exceed the production cycle excepting in the case of bulk imports. • Keep in mind the accepted projections regarding Sundry Creditor levels. • Margins & security depending on track record. • Cash budget monitoring to track availability of funds. 25 Appraisal Issues…. Revolving LCs: – To be valid for not more than 1 year – The limit should be a sub-limit. – The LC value should be restored for further negotiation only after the advice of retirement of the previous bill has been received from the issuing bank by the beneficiary bank. 26 ASSESSMENT OF LC LIMIT • While assessing Letter of Credit Limit, the following points need to be noted: Purchases of RM on LC basis should be net of Import Duty; LC amount should cover FOB, CIF or C&F value of goods- should not include customs duty and other charges payable in India. Payment of these charges should be taken care of by the main working capital(CC) A/C of Applicant. Transit time should be treated as ‘Nil’ if usance period starts from shipment date. 27 Other issues Arriving at D.P: – Ensure that the stocks covered by bills which have been received under LCs opened by us, and not yet retired, are not included for computing the D.P. in CC account. Devolvement of LCs: – In case of irregularity in CC account do not open further LCs. – Take adequate margins and step up in case of it becoming a habit – in worse cases stop further issues. – Mark lien on DP so that usance bills are properly retired on due date. 28 Treatment of stocks covered by Usance LC Lien should be earmarked against advance value of stocks for the outstanding usance LC bills. This ensures provision of margins on the stocks covered by usance LCs right from the time the stocks are bought on credit backed by the Bank’s commitment. Thus, it ensures that the margin is available well before the CC a/c is debited for the matured LC bill. 29 Treatment of stocks covered by Usance LC In some cases it is quite possible that the units may not be in a position to provide margins right from the time of purchases against LCs. In such cases, based on merits, earmarking of lien for the value of usance LC bills outstanding may be permitted against the aggregate ‘market value’ of stocks (including the LC stocks) instead of against the ‘advance value’ of securities. 30 Precautions The limits for demand LCs and usance LCs should be assessed separately with ample justifications. The usance period should not, generally, exceed the production cycle. In case of bulk imports, establishment of LCs for longer usance period may be considered selectively. When liability under LC is met by creating an irregularity in the Cash Credit account, the relative LC limit should not be released for opening further LCs till the account is adjusted. Frequent Devolvement's: Warning signal! 31 Assessment of LC Limit • We assume that: - Annual consumption of material to be purchased under LC ……… C (Rs..) - Lead time from opening LC to shipment: L (months) - Transit time: T (months) - Credit (usance) period available: U (months) 32 Assessment of LC Limit • L+ T+ U = Purchase Cycle: P (months) • LC Limit = P x C/12 Say, lead time, i.e. time from order placement to shipment = 10 days Transit period = 20 days Usance period from arrival of goods= 3m Total Purchase Cycle = 4m Monthly consumption of material = Rs 100 lacs LC Limit(4 x 100) = Rs 400 lacs 33 ASSESSMENT OF LC LIMIT : M/s XYZ COMPANY LIMITED LETTER OF CREDIT LIMIT OF Rs. 20 CRORES (Rs. in crores) Total purchase of Raw Materials (RM) Purchase of RM under LC 172.64 69.41 Average monthly purchase of RM [A] 5.78 Average usance period [B] 3 months Lead time & transit period [C] 1 month Total of [B] & [C] [D] 4 months Requirement of LC Limit [A] x [D] 23.12 LC Limit recommended 20.00 34 Assessment of LC Limit • Let us assume as follows: (Rs in lacs) i) Annual purchase of RM: 3200 ii) RM purchase under LC(50%): 1600 iii) Purchase under demand LC: 800 iv) Purchase under usance LC: 800 35 Assessment of Demand LC Limit • Time gap from opening till shipment: 1 m • Transit period from date of shipment till date of retirement: 0.5 m • Demand LC Limit: 800 x 1.5/12 = Rs 100 lacs 36 Assessment of Usance LC Limit • Lead Time, i.e from opening LC till shipment: 1 month • Transit Period, i.e. from date of shipment till date of receipt of documents by importer: 0.5 months • Average usance period: 2 months • Usance LC Limit: 800x3.5/12= Rs 233 lacs 37