Slide Show - taxreformproposal.org

advertisement

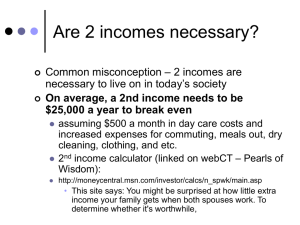

Richard A Demers Minneapolis, MN April 1, 2014 Why is income tax reform needed? What are the goals of this Citizen’s Proposal? What income should be taxed? Transferring income among individuals Taxing asset transactions Taxing income by formula Income taxes and the national budget? Household examples 2 Neither fair nor just Too many ways to avoid and evade taxes Too complicated, intrusive and expensive It harms the national economy ◦ Too much interference ◦ Drag on the national economy It fails to adequately fund the government ◦ Annual deficits ◦ Ever increasing federal debt 3 Raise enough money for government operations in a way that is fair, just, simple and efficient Eliminate tax biases in favor of some people and businesses at the expense of everyone else Automatically link taxation with spending Take control of the details of income taxation out of the hands of politicians who don’t really know what they are doing anyway 4 It is not the goal of this proposal to Reduce taxes Redistribute wealth Reduce the size of government Reduce government spending 5 Yes, if we incorporate good ideas from many sources Libertarian Conservative Taxation should intrude as little as possible in our lives and economy. People should have some say in how their taxes are spent. Income shouldn’t be taxed more than once - dividends, gifts, estates. Rely as much as possible on the national economy, not government, to meet society’s needs. Liberal We are a community and not just individuals. We should help people who help themselves to get ahead. Taxes should be progressive and affect everyone to the same extent. 6 Every person, every business and every non-profit – no exceptions As individuals - infants to corporations Eliminate Single vs. Married distinctions Eliminate personal vs. business vs. nonprofit distinctions If businesses want to be treated as individuals for other purposes, they should be taxed as individuals. 7 Tax all Income – no exceptions Individuals, Wages, tips, bonuses, awards, realized options, interest, dividends, pensions, Social Security payments, welfare payments, insurance and annuity payouts, jury awards, alimony, lottery and gambling winnings, etc. Capital gains taxed as income only if not reinvested Gifts and estates not considered income Businesses, Net, pre-tax business income Non-profits Same as service businesses 8 No deductions, credits, allowances, exclusions or rebates to anyone or any organization for any purpose "We are all in the tax game together, and what is a privilege to one group of people ends up being a penalty to everyone else through higher tax rates.“ Taxing Ourselves: A Citizen's Guide to the Debate Over Taxes by Joel Slemrod and Jon Bakija, 2008, p. 89. 9 Social Security and Medicare are currently financed through wage taxes Social Security wage taxes not progressive ◦ Only on wages below a cutoff ◦ Greatly increases the tax burden of low income people Social Security is not an annuity ◦ The so called SS Trust Fund is a bookkeeping gimmick Social Security and Medicare benefits should be financed by the entire nation through income taxes 10 Any amount of pre-tax income can be transferred to any other individual or organization where it is taxed as part of the receiver’s income. Family transfers among members Windfall transfers to IRAs Corporate transfers to stockholders as dividends Transfers to non-profits as contributions Limitations on transfers All income transfers become part of online public record 11 The income of a household can be transferred among its members so each is taxed at the lower rate of a progressive tax. Tax Rate Household Member Income 12 One-time income from inheritances, insurance payouts, lottery winnings, bonuses, high income years, etc Income can be transferred to flexible IRA type accounts Taxed as income on withdrawal 13 After-expense, pre-tax income can be transferred ◦ To stockholders as dividends ◦ To subsidiaries to enhance their capitalization ◦ To non-profits Eliminates double taxation of profits and dividends Eliminates unfairness of different tax rates for wage vs. investment income Strong incentive for businesses to pay better dividends and to support non-profits 14 Non-profits viewed as service businesses No distinctions made among non-profits ◦ charitable, religious, political, cultural, etc Net income taxed after operational ◦ Property costs, salaries, supplies, etc Non-profits can be viewed as transfer agents when income received is transferred directly to beneficiaries 15 Objective: Help citizens become rich in assets and part of the so called “ownership society” ◦ Assets: anything that generates a monetary return ◦ Examples: real estate, stocks, bonds, mutual funds, savings accounts, farms, real estate, businesses, etc Assets can be freely converted from one form to another with no tax consequences Assets can be freely transferred from one individual to another with no tax consequences 16 When sold and any part of the proceeds are taken as income ◦ This makes this proposal a consumption tax. Losses are the investors responsibility, not the government’s 17 Gift taxes eliminated Estate taxes eliminated The special treatment of Capital Gains and Losses is eliminated All asset transfers part of online public record 18 No quid pro quo transfers No reciprocal transfers from whom the donor can extract an advantage ◦ Money ◦ Assets ◦ Influence Violations to be prosecuted as tax fraud 19 Why taxes? How high should taxes be? Should individuals have a say in how their taxes are spent by the government? ◦ To pay for essential governmental services ◦ Which services are essential is not part of this proposal ◦ Should not be to encourage or discourage any activity ◦ As high as necessary to pay for budgeted spending ◦ Tax-cutting without cutting spending is foolish ◦ New spending without new revenues is foolish ◦ Yes, to the extent that they are willing to transfer income and assets to organizations that can otherwise provide required services 20 Why not a flat tax? ◦ Inherently regressive ◦ Does not affect everyone to the same extent Why should taxes be progressive? ◦ High income individuals receive disproportionately more value from living in a modern society ◦ As an incentive for individuals to transfer income to non-profits Example: privatize NASA and get to MARS sooner 21 Simple way to determine taxes at all income levels ◦ Calculated per individual, not household ◦ The same formula used for individuals and businesses ◦ From incomes of $0 to $1 Trillion-12 orders of magnitude If your income is $x, your income tax is f(x) = $y. 22 tax = k × (basic rate × income) – offset Basic rate depends on income offset depends on earned wages k depends on ◦ 0% at $0 and 100% at $1 Trillion ◦ All taxes are on individuals ◦ No special rates for single vs. family vs. business vs. non-profits ◦ Similar to existing Earned Income Tax Credit ◦ National spending budget ◦ Population in each income range. ◦ Calculated repeatedly until the generated tax revenue equals budgeted spending. Actual tax rate = tax / income 23 Basic rate= xlog(income) - 1 1 = x12 - 1 2 = x12 x = the 12th root of 2 x = 1.059463 Basic rate = (1.059463log(income) - 1) 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1.E+00 1.E+01 1.E+02 1.E+03 1.E+04 1.E+05 1.E+06 Basic tax rate 1.E+07 1.E+08 1.E+09 1.E+10 1.E+11 1.E+12 Individual Income 24 Depends on earned wages ◦ ◦ ◦ ◦ Similar to current Earned Income Tax Credit Calculated per individual, not per family Encourages all citizens to work for their living No offset for those able to pay taxes Offset Phase-in limit = $3,000 Plateau limit = $4,000 Plateau = $2,000 Other income limit = $4,000 Phase-out limit = $100,000 Wages 25 Ideal tax = 1 × (basic rate × income) – offset Ideal rate = ideal tax / income Ideal tax rate as % of individual income Ideal Tax Rate 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% -30% -40% -50% -60% -70% -80% -90% -100% 1.E+00 1.E+01 1.E+02 1.E+03 1.E+04 1.E+05 Basic tax rate 1.E+06 1.E+07 1.E+08 1.E+09 1.E+10 Ideal Tax Rate 1.E+11 1.E+12 Total individual income • Ignores spending budget • Ignores population distribution 26 Dollars Households and Household Income Households 1.E+13 1.E+11 1.E+09 1.E+07 1.E+05 1.E+03 1.E+01 1.E-01 1.E+03 1.E+04 1.E+05 1.E+06 1.E+07 1.E+08 Households Total household income 1.E+09 1.E+10 Income Most tax revenue from households with a modest income Revenue from high income households also required 27 Goal: Determine if proposal is reasonable Revenue target is sum of ◦ 2011 individual income tax ◦ 2011 employee FICA and Medicare wage taxes Limited to personal income ◦ Population distribution from IRS tables Business, gift, estate and non-profit income not part of model because income distribution not available Allocates household income equally to all members 28 Individual Tax Revenue Individual, estate and trust income tax Employee FICA + Medicare wage taxes Total individual tax revenue Estate and Gift Tax Revenue Gift tax Estate tax Total Estate and Gift Tax revenue Organizational Tax Revenue Corporate income tax Employer FICA + Medicare wage taxes Tax-exempt unrelated business income tax Total organization tax revenue Revenue Target of 2011 Spreadsheet Model $1,175,989,528,000 $481,552,411,000 $1,657,541,939,000 $6,572,384,000 $2,506,991,000 $9,079,375,000 $242,435,939,000 $481,552,411,000 $412,183,000 $242,848,122,000 $1,657,541,939,000 29 tax = k × (basic rate × income) – offset where k = 0.692 Individual Tax Rate Individual Tax Rate 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% -30% -40% -50% -60% $1,000 $10,000 Basic Tax Rate $100,000 $1,000,000 $10,000,000 Proposed individual tax rate $100,000,000 $1,000,000,000 Individdual Income+ FICA + Medicare • Assumes equal allocation of household income • Includes FICA and Medicare financing • Model does not include business income 30 $100,000,000,000 $10,000,000,000 $1,000,000,000 $100,000,000 $10,000 $100,000 $1,000,000 $10,000,000 $100,000,000 $1,000,000,000 $10,000,000,000 Proposed tax revenue 2011 combined tax revenue Negative values cannot be shown on a log chart. 31 Dad earns $x per year Mom earns $y per year Their two children have no income The family transfers 10% to charities, their church, their political party and cultural nonprofits For tax purposes, they allocate the rest equally (25%) to each person 32 Household income % of income transferred out Taxable household income $10,000 10% $9,000 $20,000 10% $18,000 $30,000 10% $27,000 $50,000 10% $45,000 $100,000 10% $90,000 $250,000 10% $225,000 $1,000,000 10% $900,000 % of taxable household income per person Each person's taxable income log(each person's taxable income) Basic tax rate 25% $2,250 3.352182518 21.3646369% 25% $4,500 3.653212514 23.4933971% 25% $6,750 3.829303773 24.7559095% 25% $11,250 4.051152522 26.3648770% 25% $22,500 4.352182518 28.5813424% 25% $56,250 4.750122527 31.5711276% 25% $225,000 5.352182518 36.2271747% Basic tax rate * income Phase in offset Plateau offset Phase out offset offset Each person's tax Each person's tax rate $481 $1,500.00 $0.00 $0.00 $1,500.00 -$1,083.72 -48.17% $1,057 $0.00 $0.00 $1,989.58 $1,989.58 -$1,074.06 -23.87% $1,671 $0.00 $0.00 $1,942.71 $1,942.71 -$495.62 -7.34% $2,966 $0.00 $0.00 $1,848.96 $1,848.96 $719.61 6.40% $6,431 $0.00 $0.00 $1,614.58 $1,614.58 $3,954.42 17.58% $17,759 $0.00 $0.00 $911.46 $911.46 $14,467.44 25.72% $81,511 $0.00 $0.00 $0.00 $0.00 $70,587.79 31.37% Household tax Household tax rate Household take-home income -$4,335 -48.17% $13,335 -$4,296 -23.87% $22,296 -$1,982 -7.34% $28,982 $2,878 6.40% $42,122 $15,818 17.58% $74,182 $57,870 25.72% $167,130 $282,351 31.37% $617,649 Household tax rate 60.00% 40.00% 20.00% 0.00% -20.00% -40.00% -60.00% $10,000 $100,000 $1,000,000 $10,000,000 $100,000,000 $1,000,000,000 Household tax rate 33 Tax all income Eliminate all loopholes Allow income and assets to be transferred without tax consequences All taxes are on individual persons and businesses Tax all income using a single progressive formula that spans 12 orders of magnitude Make all income, transfer and tax information available online and transparent 34 A much more complete model is needed! This is a work in progress, a stake in the ground. Please throw rocks at it. 35 taxreformproposal.org Tax proposal home page with links to: Tax proposal essay Early comments Spreadsheet model This slide show About the author 36