Alternative Development Plan for Central Chile*s Ports

advertisement

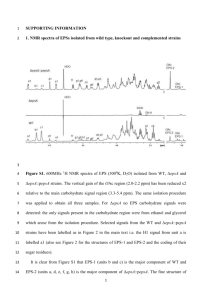

“SOÑAR VALPARAÍSO” ALTERNATIVE DEVELOPMENT PLAN FOR CHILE’S REGION V PORTS ASAF ASHAR NATIONAL PORTS & WATERWAYS INT., USA www.asafashar.com April 2012 Presentation Agenda • • • • • • • • Traffic Forecast Demand Scenarios Fleet Forecast EPSA/EPV Plan Supply Options Alternative Plan Capacity of Plans Capability of Plans Comparison Cost of Plans Summary & Conclusions Past Traffic Developments 1,800,000 Containerization (Reefer, Containerization Copper, Forest Products) 1,600,000 60% 55% 50% Growing Import & Asia 45% 1,400,000 40% 1,200,000 14.5% 35% 30% 1,000,000 9.5% 800,000 25% 20% 15% 600,000 10% 400,000 5% 0% 200,000 -5% - -10% TEUs Change (%) Forecast Scenarios Only to 2017 when Outer Harbor needed 4.0 mil. 4,500,000 4,000,000 3,500,000 177% 3,000,000 2.2 mil. 2,500,000 2,000,000 1,500,000 1,000,000 500,000 - 6% 15% Actual World’s Economic Forecast Increasing Volatility Slowing Recovery IHS Global Insight; Wilbur Smith; Ashar Larger Newer Ships more Fuel Efficient Present and Future Ships Dimensions LOA x Beam x Draft (m) Arrangement Under-BelowAcross (rows) Category Name Operator Capacity (TEUs) Sub Panamax Cap San Antonio HSD 3,700 252 x 32.2 x 12.5 8 -6 - 13 Panamax - Max Zim Savannah Zim 5,000 295 x 32.3 x 13.5 8 -6 - 13 Post Panamax I Monte Class III HSD 6,300 300 x 40 x 13.5 9 - 5 - 16 Post Panamax II Sovereign Maersk Maersk 8,000 347 x 42.8 x 14.5 9 - 6 - 18 Post Panamax III New Panamax (NPX) --- 12,500 366 x 49 x 15.2 10 - 6 - 19/20 Post Panamax III MSC Daniela MSC 13,800 366 x 51.3 x 15 10 – 6 - 20 Post Panamax III Emma Maersk Maersk 14,500 396 x 56.4 x 15.5 10 – 6 - 22 Post Panamax III Triple E 18,000 165,000 400 x 59 x 15.5 10 – 8 - 23 Fleet Composition by Line 38% Growing Consolidation (Super Alliances), Larger Ships, Larger Terminals Alphaliner 2012; Ashar Presentation Agenda • • • • • • • • Traffic Forecast Demand Scenarios Fleet Forecast EPSA/EPV Plan Supply Options Alternative Plan Capacity of Plans Capability of Plans Comparison Cost of Plans Summary & Conclusions Comparison of Development Plans • Capacity – Forecast Scenarios (TEUs) • Capability – Future Ships (Depth, Turning Basin, Berth Length, Yard Area) • Efficiency – Scale Economies; Automation; Land Access; Logistic • Competition • (Environmental Concerns) Alternative Plans • EPSA/EPV Plan – – Short Term: Minor Extension of Present Terminals – Mid Term: New Terminals in San Antonio (Puerto Central) and Valparaiso (Terminal 2) • Alternative Plan (AA & PW) – – Short Term: Meaningful Expansion of Present Terminals – Long Term: Outer Terminal • Cost Comparison – Only Basic Infrastructure – Per Capacity Unit ($/ TEU) • Only Containers Competition • Valparaiso and San Antonio serve the same Hinterland – No Captive Cargo • Similar Services & Prices – Line Switching for $10/Box – Both STI & TPS Low Price $120/Box • Tight Price Control by EPSA/EPV • Small Risk of Collusion • 3 Terminals = Sufficient Number of Competitors Automated Modern Terminal 600 x 600 m = 32 ha; 16 ha / 300-m Berth 8 STS (65 MT, no tandem); 32 ASC (8 wide, 1-over-5); 20 Shuttle Strads TTI; Ashar2012 Middle Harbor Terminal Long Beach (1) 2 Terminals; 80 ha; 1.3 M TEUs; 16,250 TEUs/ha POLB; Ashar2012 1 Terminals; 120 ha; 3.3 M TEUs; 27,500 TEUs/ha (+70%); $1.2 billion; 40-year Lease Berth’s Scale Economies 0.60 0.55 Wait ing Time / Service Time 0.50 0.45 0.40 0.35 3 X (0.68 – 0.58) = 0.3; 3rd Berth = 1.3 More Combinations of Ship Length 1,200 = 240 x 5; 900 = 240 x 3 Fixed Facilities: Gate, Administration, Maintenance n=2 n=3 0.30 0.1 0.25 0.20 0.15 0.10 0.05 0.00 0.4 0.425 0.45 0.475 0.5 0.525 0.55 0.575 0.6 0.625 0.65 0.675 0.7 0.725 0.75 0.775 Berth Utilization (E2/E2/n) UNCTAD; Ashar 2009 San Antonio Harbor Lagoon Puerto Central Bulk Original EPSA Plan Deep Shallow Lagoon 2011 EPSA Plan -- STI Ampliación a incorporar por canje a STI Área Total: 31 ha (40 ha) Frente lineal: 746 m (900 m) Calado: 15 m Área de respaldo a canjear a STI Área Inundada a canjear a STI 16 Ha Puerto Central Ampliación Frente 17 17 2011 EPSA Plan – Puerto Central Área Total: 35.7ha Frente lineal: 945 m (700 + 245) + 250 = 1,195m Profudidal : 15 m Ship-side Yard: 12 ha; 4 ha / Berth Odd-Shape Area; Traffic? STI Sea Protection: 2% to 5% Downtime 14 ha 945 m 18 18 Original EPV Plan -- TPS 740 m << 900, 945 m of SA Terminals Área Total: 13 ha Frente lineal: 740 m Profudidal: 14.5 m 6.5 ha/Berth 19 Original EPV Plan (1) Terminal 1 TPS (628 m, 16 ha) Terminal 2 Original EPV Plan (2) 30 - 40 m Depth in Front! Limited Protection: 5 - 15% Downtown 6 – 7 ha / Berth; Remote Gate? Logistics? Constrained Land Access; Rail? EPV 2012 Bidding Only 1 Container Berth? Only 2 Berths Sea Protection; Land Access ? Expanded STI, San Antonio 2007: 1.55 million TEUs +9 ha; 43 ha 2012: 2.2 million TEUs l 769m (-15 m) +430m; 1,200m; 49 ha Ashar 2009 Expanded TPS, Valparaiso 2007: 1.45 million TEUs 2012: 1.87 million TEUs 2012: 6 ha / Berth +516m; 1,130m +7 ha; 23 ha 610 m; 16 ha Ashar 2009 Port Moin, APMT Phase I: 600 m / 40 ha / -16 m / 1.3 M TEUs; Final: 1,500 m / 80 ha / -18 m/ 6 M TEUs Bid 8/2010; Award 3/2011; Phase I: 8/2016; 33 Years; 80% of Trade; Exclusivity; Price Control APMT 2011; Google; Ashar 2012 Colombo South Harbor 3 x 1,200 m (3 x 400m) ; 18m (23m); 600 ha; 7.2 M TEUS (0.8 M TEUs/Berth) 6.8 km Breakwater; $1.6 billion; 75% Transshipment; Indian Direct? Future Port Ashar; Sri Lanka Port Authority Present Port Rotterdam’s Maasvlakte 2 Present Port Future Port Open-Sea Reclamation; 240 M cu m; 11 km Seawall; 1,000 ha 3 Terminals: Euromax, APMT and ECT/HPH, each 1,200 m; 1.2 mil TEU/Berth Outer Harbor 400 x 500 m Modules 600 m Diameter Outer Harbor Development Options General & Bulk Logistic Park Ashar/Woodbury 2009 http://www.lyd.com/lyd/control s/neochannels/neo_ch4358/depl oy/presentacion2.pdf Presentation Agenda • • • • • • • • Traffic Forecast Demand Scenarios Fleet Forecast EPSA/EPV Plan Supply Options Alternative Plan Capacity of Plans Capability of Plans Comparison Cost of Plans Summary & Conclusions Capacity vs. Forecast Year Capacity -- Existing Capacity -Plan Alternative Plan Forecast -- 6% Growth Forecast -- 15% Growth 2010 2,425,000 2,425,000 1,500,000 1,500,000 2012 2,999,000 4,050,000 1,685,400 1,983,750 2014 5,649,000 4,380,000 1,893,715 2,623,509 2017 5,649,000 5,908,571 2,255,445 3,990,030 6,000,000 6,000,000 Cap. Existing Plan 5,000,000 5,000,000 Cap. Alternative Plan 6% Growth 4,000,000 4,000,000 15% Growth 3,000,000 3,000,000 2,000,000 2,000,000 1,000,000 1,000,000 - 2010 2012 2014 2017 Ashar 2009 Infrastructure Unit Costs Construction Element Unit Cost per Unit ($, US) Berths (Muelles) Linear Meter 121,000 Structural Steel Ton 2,200 Sheet Pile Placement Linear Meter 1,900 Excavation Cubic Meter 25 Dredging Cubic Meter 6.5 Hydraulic Fill Cubic Meter 9 Quarry Run or Select Fill Cubic Meter 25 Dewatering Hydraulic Fill Hectare 10,000 Dynamic Compaction Hectare 24,000 Finish Grading Hectare 12,500 Woodbury 2009 Cost Comparison Capacity (TEUs) Infrastructure Cost Unit Cost Plan 2012 2017 ($) Differ. ($/TEU) Differ. EPSA/EPV Plan 2,999,000 5,649,000 412,979,944 100% 128.1 100% Alternative Plan 4,050,000 5,908,571 326,893,709 79% 93.8 73% EPSA/EPV Alternative 1,051,000 259,571 86,086,236 21% 34.3 27% Ashar 2009 Summary & Conclusion • EPSA/EPV Plans – Small Terminals, Odd Shape, No Rail, Difficult Land Access, No Support Facilities, Problems in Navigations, Difficulties in Serving Future PostPanamax • Alternative Plan – New Spacious Harbor, Large Terminals, Accommodates Traffic to 2035 and beyond • Expansion of Present Terminals – Relatively Easy and Cost Effective, Retains Competition (Tariff Control) • Savings -- Alternative Saves $86 million, or 27% of Infrastructural Cost • Other Cargoes -- Outer Harbor has sufficient space for Non-Container Cargoes “SOÑAR VALPARAÍSO” Gracias ASAF ASHAR NATIONAL PORTS & WATERWAYS INT., USA www.asafashar.com April 2012